Real Estate Wholesaling vs Flipping Houses: The (Ultimate) Guide

Aug 30, 2022Real estate investing is a wide-ranging field that encompasses many different strategies and techniques.

Two of the most common strategies that often face comparison are wholesaling and house flipping. Wholesalers and house flippers work together to scout distressed or under-valued properties and renovate them to sell at the current market price.

Both are lucrative practices with high earning potential, but the exact roles and responsibilities vary slightly. Here is a look at real estate wholesaling vs flipping houses; the ultimate guide.

- What Is Real Estate Wholesaling?

- What Is Flipping Houses?

- Real Estate Wholesaling vs Flipping Houses

- Is Wholesaling Real Estate Better Than Flipping?

- Is Wholesaling Real Estate The Same Thing As Flipping?

- Real Estate Wholesaling: Pros And Cons

- Real Estate Flipping: Pros And Cons

- Who Should Consider Wholesaling?

- Who Should Consider Flipping Houses?

- Final Thoughts

What Is Real Estate Wholesaling?

Wholesaling houses is the practice of finding a property that can be bought at a discount, entering into a contract with the buyer to purchase the property, and then selling that contract to another real estate investor for a markup. This strategy allows the wholesaler to pocket the difference between the original purchase price and the price the investor is ultimately willing to pay without ever having to purchase the property or put up any of their own money.

Wholesaling is a great way to earn sizeable wholesale fees and profits without needing a license, credit, or money in the bank. It takes a good understanding of the local market, people skills, and a large network to wholesale real estate successfully. But it's something almost anyone can do if they have some spare time and patience with the process. Here are the general steps involved in wholesaling real estate.

Step 1: Scout Properties

The first step is to go out and look at properties. You can do this by driving around your neighborhood and looking for abandoned or distressed homes, posting bandit signs, or checking public records for foreclosures, bankruptcies, and other signs of a potential short sale.

You'll have to develop a strategy that works for you, but the key is to look for homes that can be bought at a significant discount because the owner is a motivated seller. Motivated sellers are those looking to sell a home quickly and at a discount, either because they are going through financial problems or a disruptive life event, such as a divorce or job relocation.

Step 2: Make An Offer

Once you find a motivated seller willing to let go of their home at a fair price, you'll want to make an offer as soon as possible to avoid losing the sale. So, you'll need to research and determine a price point that will allow you to make as much profit as possible yet still attract potential buyers. Many house flippers use the 70% rule, which means they won't want to pay more than 70% of the after-repair value (ARV) for a distressed property.

ARV refers to the amount the newly renovated home will fetch on the current market. So, you'll want to make an offer that is below 70% of what a similar home in the area is worth when renovated to market standards. For instance, you find a run-down house that would be worth $200,000 in good condition.

If the seller is willing to let it go for $130,000, you could turn around and sell the contract to a house flipper for $140,000 and pocket the extra $10,000. So, crunch the numbers to find a price point that makes sense.

Step 3: Get The Property In Contract

Once the seller accepts your offer, you'll have to get it under contract - otherwise, you could easily get cut out of the deal. Make sure that you inform the seller that you are not the one who will be rehabbing the property. Otherwise, they may be confused by the paperwork.

You will then sign a wholesale contract with the seller, giving you the right to purchase the property at your offering price and assign ownership to a new buyer for a different price.

Step 4: Find A Buyer Willing To Contract

Next, you will assign the rights to the property over to a new buyer who agrees to purchase the home at the new price. This new buyer is typically another investor willing to let you keep an assignment fee for helping them find a deal. It helps to have a solid buyers list before making an offer, so you can find someone as soon as possible.

You can find investors by attending local real estate events, calling realtors, posting signs, or messaging prospects on social media. As long as you secure a good deal on the property, you should be able to find someone willing to take it off your hands.

Step 5: Close On The Sale

Once the contracts are signed and the ownership is transferred to the new buyer, you can collect your check and move on to the next deal. The house flipper will take it from there and begin the rehabbing process.

The whole process usually moves pretty quickly, and you can often find a property and close on the sale in 30 days or less, which makes real estate wholesaling a low-risk investment strategy that is great for beginners.

What Is Flipping Houses?

Flipping houses refers to purchasing a property at a lower price than the market value, renovating it, and selling it to prospective buyers at a markup. Unlike wholesalers, house flippers sometimes use their own money or credit to purchase properties and assume ownership while they are renovating.

While flipping houses don't require formal schooling or a full-time commitment to mastering, it can be a complicated process that will last anywhere from a few months to a year or more. Here are the basic steps involved in house flipping.

Step 1: Find A Property To Flip

The first step is to find a motivated seller looking to let go of their home at a discount. Flippers can use the same methods as wholesalers to find motivated seller leads, or they can work directly with a wholesaler to locate deals. Use the 70% rule to find properties with a high ARV and low purchase price.

To calculate ARV, look at the listing prices of other comparable properties in the neighborhood and take an average of any that matches your ultimate vision for the home. You can also enlist the help of a real estate agent to help you pull comps and determine a rough ARV.

Step 2: Obtain Financing And Submit An Offer

Once you find a property available at a good price point, you will want to make an offer. You will then temporarily assume ownership of that property while you work on the renovation. House flippers often use hard money lenders to finance their deals because a traditional mortgage lender doesn't offer favorable terms to real estate investors.

Hard money lenders are short-term loans secured by an asset (usually the property itself). They typically feature higher interest rates than a traditional mortgage but offer attractive features to investors, such as shorter repayment periods and faster closing. So make sure to have the financing lined up before making an offer.

Step 3: Renovate The Property

As soon as you close on the purchase, you should begin the renovation process. Most house flippers work with a contractor and a team of construction professionals, but if you have the experience, you may decide to do the work yourself. You should have a clear timeline and construction plan ready before you start.

The more time you spend renovating, the more expenses you'll incur. So make sure you have a clear plan and construction schedule to keep everything running smoothly.

Here's a "before" photo of a house we flipped in Florida. This distressed property needs a full renovation!

Here's the "after" photo of the house and Ryan Zomorodi, Co-Founder & COO at Real Estate Skills. He was pleased when it sold in less than a week at full price!

Step 4: Market the Property To Homeowners Or Tenants

When the renovations are complete, you can begin marketing the property to homeowners. The goal is to get a higher price than the purchase price and repair costs combined, so you can pocket the difference. Many house flippers use realtors to market properties, so they can focus on finishing any last-minute renovations or planning their next deal. But as the owner, it's your choice whether or not you want to pay a sales commission.

You can sell the property to a homeowner who will use it as their primary residence or keep it as an investment property and collect income from tenants. The latter is a more complicated strategy but can provide you with long-term cash flow, whereas the former will result in a one-time, lump-sum payment.

Step 5: Close On The Sale

If you decide to sell to a homebuyer, all that's left to do is sign the contracts and collect your profits. The buyer will likely want to perform their due diligence and schedule an inspection and appraisal to ensure the work is up to par and the valuation is accurate. Then, they will bring their down payment and pay any additional closing costs at the contract signing.

Once the title is transferred, you will receive your money. If everything goes smoothly, you will collect the difference between whatever you put in and the final purchase price, which can be anywhere from $50,000 to $100,000 in profits or more!

Real Estate Wholesaling vs Flipping Houses

There are key differences in the responsibilities, risks, profits, and timeline of wholesaling real estate vs flipping houses.

Responsibilities

Wholesalers are solely responsible for finding deals and getting properties under contract for a discount. After that, it's up to the rehabber to handle all the other heavy lifting.

House flippers are responsible for finding deals, purchasing the property, hiring contractors and subcontractors, overseeing construction, responding to any problems or delays, working with realtors to find buyers and any other tasks that pop up along the way. As a result, flipping properties is a longer, more in-depth process and often requires more experience.

Read Also: Red Flags Before Hiring a Contractor | Real Estate Skills

Risks

Wholesaling also carries less risk than flipping homes. As long as your income is not dependent on finding wholesale deals, there is minimal risk to this type of real estate investing strategy. You may face rejection and must be patient to make money wholesaling. But as long as you build your buyers list and find a good deal, you shouldn't have any problems. Plus, there are often contingencies in the wholesale contract that allow you to back out of the sale under certain conditions - for instance, if you can't find a buyer. So be sure to have an attorney help you draft the paperwork.

Flipping houses is a bit riskier because you may be using your own money and credit to finance the deal, plus more variables can impact your bottom line. Construction delays, untrustworthy contractors, inflated building costs, and many other problems can arise that could threaten your investment.

Plus, there's no guarantee that you'll find a buyer willing to make an offer at the price you need once you complete the construction. There's always a risk that you'll get stuck with the property and all the responsibilities that come with it, so you'll need a clear plan and a thorough understanding of the housing market to succeed.

Profits and Timeline

But because flipping homes is riskier, it also offers a larger profit than wholesaling. The typical wholesale assignment fee is around $5,000 to $10,000, but with effort and experience, some wholesalers make up to $40,000 per deal. Location and the local real estate market conditions will also impact earning potential.

House flippers, on the other hand, can make anything from $20,000 to $100,000 per flip or more if all goes well. But there is always the risk of losing money on the deal. Plus, it usually takes several months or even years to recoup your investment with a fix and flip, whereas wholesalers can get paid in as little as 30 days or less.

Read Also: Flipping Houses Salary: How Much Do House Flippers Make?

Is Wholesaling Real Estate Better Than Flipping?

Both real estate investing strategies offer benefits, but wholesaling offers unique advantages that are often more attractive to a broader group. Anyone with a few hours of spare time can become a real estate wholesaler and start learning about the business from the ground up.

It doesn't require a long-term commitment, and you can make sizeable checks without risking your own money or credit. As a result, wholesaling is a smart strategy for almost anyone interested in the real estate business who wants to start working immediately. But, for those with experience and time on their hands, flipping houses offers more earning potential and can be suitable for those who enjoy the renovation process.

Is Wholesaling Real Estate The Same Thing As Flipping?

No, they are not the same thing but involve different aspects of the same business. A wholesaler essentially works on behalf of the fixer to find properties. Wholesaling is often referred to as flipping contracts because you employ the same financial strategy by purchasing a contract and selling it to someone else at a markup.

But wholesaling real estate involves honing in on just the process of scouting properties, whereas flippers are responsible for purchasing, renovating, and selling the property to a homebuyer.

Real Estate Wholesaling: Pros And Cons

While it's not all black and white, here are some of the benefits and drawbacks to real estate wholesaling:

Pros

- Great for new investors who want to learn the business

- Low-risk real estate investing strategy

- No formal educational degree or licensing requirements

- Easy to find wholesale properties and buyers

- Potential to earn large assignment fees without risking your own money or assets

Cons

- Income is not always predictable

- You may face a lot of rejection

- Motivated sellers may be emotional or difficult during the sales process

- Must study local property laws to ensure you operate legally

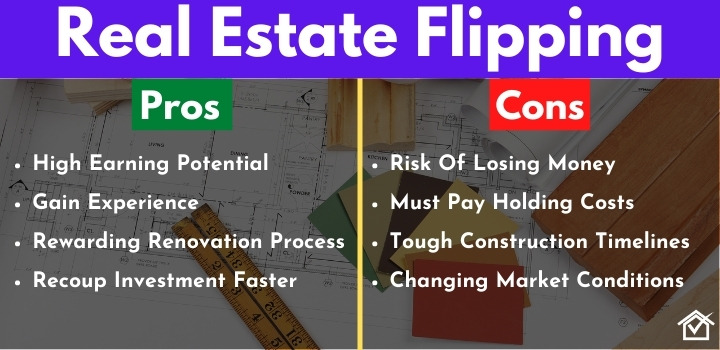

Real Estate Flipping: Pros And Cons

These are several advantages and disadvantages of flipping houses:

Pros

- High earning potential

- Gain experience managing a construction project

- It can be a rewarding process to renovate old and outdated homes.

- Recoup your investment faster than buying a rental property

Cons

- Risk of losing money

- Must pay holding costs such as taxes, insurance, loan interest, utilities, etc.

- Construction timelines can be tough to predict and execute.

- Market conditions may change and threaten your investment.

Who Should Consider Wholesaling?

Wholesaling real estate is great for new investors and those who want to make quick cash while learning about real estate in their spare time. Due to the unpredictable nature of the business, it isn't best for those looking to replace a full-time job.

But it's perfect for those who want to start doing real estate deals as soon as possible and don't have the time or interest in managing an entire construction project. It's also perfect for seasoned investors who want to create a new revenue stream that offers low-time commitments and an easy exit strategy.

Who Should Consider Flipping Houses?

Flipping houses is a better strategy for those interested in the construction process, who want the potential to make higher profits. It's suitable for those who have the time and resources on their hands and want to take a more hands-on role in their real estate investing journey.

While it does carry its risks, flipping houses can also be a rewarding experience with the potential for large profits and can be done while working another full-time job. So, while it may be a bit more complex, it's a solid strategy for those who are up for the challenge.

Final Thoughts

You can undoubtedly say that there are numerous benefits to choosing different investment strategies. Wholesaling real estate is a low-risk investment strategy where you can also learn how the industry works as a beginner. While flipping houses may take a while before you can see your return on investment you can still definitely expect to earn much higher profits than wholesaling.

But even seasoned investors choose to use both strategies to scale their real estate business to ensure a higher return on investment.

If you are new in the industry or even a seasoned real estate investor looking to improve and work your strategies in real estate investing you can check out our brand-new training and consistently wholesale deals or learn the strategies you need in flipping houses!