Is Wholesaling Real Estate Legal In Canada? A 2025 Guide For Investors

Mar 28, 2025

Wholesaling real estate is a fantastic investment strategy that allows you to enter the market with minimal risk and capital, which begs the question: Is wholesaling real estate legal in Canada? We are here to assure you that wholesaling is not only legal in Canada, but it is a great investment strategy.

Knowing how to wholesale legally in Canada is crucial for long-term success. Those who understand the rules and follow provincial regulations can benefit immensely from this approach. In this guide, we’ll walk you through everything you need to know about the legal side of wholesaling in Canada, ensuring you’re well-prepared to navigate the market confidently and profitably.

- What Do You Need To Know About Wholesaling In Canada?

- What Is Wholesaling Real Estate?

- Can You Do Wholesaling In Canada?

- Is Wholesaling Real Estate Legal In Canada?

- Do You Need A License To Wholesale Real Estate In Canada?

- How To Do Wholesale Real Estate In Canada Legally?

- What Are The Benefits Of Wholesaling Real Estate In Canada?

- How To Buy A Wholesale Deal In Canada?

- Is Wholesaling Real Estate Legal In Ontario?

- Wholesale Real Estate Ontario Contract

- Final Thoughts

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

*Before we begin our guide on whether wholesaling real estate is legal in Canada, we invite you to view our video on How To Wholesale Real Estate Step by Step (IN 21 DAYS OR LESS)!

Host and CEO of Real Estate Skills, Alex Martinez, provides a comprehensive, step-by-step guide for beginners to start wholesaling real estate!

What Do You Need To Know About Wholesaling In Canada?

Over the past four years, home prices in Canada skyrocketed, following a trend seen in many parts of the world. Years of rapid appreciation, combined with recent interest rate hikes, have caused the real estate market to plateau. While prices are still increasing, they’re doing so at a much slower pace, with some experts even predicting potential drops in certain areas.

For real estate wholesalers, this shift presents an exciting opportunity. As the market stabilizes or possibly declines, motivated sellers may become more common, allowing wholesalers to secure deals at a discount. Additionally, with many buyers waiting on the sidelines due to rising interest rates, wholesalers who know how to operate legally in Canada can step in and meet investor demand.

Yes, wholesaling real estate is legal in Canada, and those who understand the rules are in a prime position to benefit from the current market conditions. Following provincial regulations and working within the legal framework will allow you to take advantage of market shifts and build a profitable wholesaling business in this evolving landscape.

A Quick Look Around Canada:

Year-over-year growth in the Canadian real estate market (according to the Canadian Real Estate Association):

- British Columbia: -1.6%

- Alberta: +11.1%

- Saskatchewan: +6.1%

- Manitoba: +1.5%

- Ontario: -1.2%

- Montreal: +3.3%

- Quebec: +4.4%

- New Brunswick: +6.1%

- Newfoundland & Labrador: +3.7%

Most investors know these growth rates are not only unprecedented but also not sustainable. Likely, the current real estate market will slowly shift to a more balanced position, which means there will be more listings and, thus, more opportunities for investors.

What Is Wholesaling Real Estate?

Wholesaling real estate offers a short-term technique or strategy for investors. From its most simplistic perspective, a real estate wholesaler is a mediator or middleman who connects buyers and sellers. Wholesalers market the only asset they can legally sell without a real estate license – their right to purchase a property at mutually agreed-upon terms.

A real estate wholesaler looks for a well-priced (i.e., below market value) property. These are often found on real estate websites like Zillow or Redfin. Motivated sellers benefit from a wholesaler’s service because a distressed property (like a foreclosure) is easier to sell as-is to a wholesaler than a retail client.

This wholesale investment choice can be a condo, one-family, investment property, or rental property, to name a few. More often than not, the price has been reduced because the seller needs a quick sale or some sort of correctable obsolescence or repairs are needed. For example, a seller may need to unload a property due to financial challenges, family emergencies, or health issues.

The real estate wholesaler then executes a real estate purchase contract with the buyer that details the transaction’s terms. This executed contract grants the buyer the exclusive right (also known as equitable interest) to buy the property through the Doctrine of Equitable Conversion.

This same principle transfers the seller’s interest to personal property while maintaining possession until closing.

Before closing the original real estate purchase agreement, the wholesaler assigns his "equitable right to purchase the subject property" to a different end buyer, often a cash buyer. It is not unusual for a wholesaler to have a buyer lined up before an offer is made on an investment property. This offers a guarantee that the investment properties sell quickly. The difference between the purchase price of the first and second contracts is the wholesaling fee or gross profit.

To be effective, a real estate wholesaler in Canada must complete two simultaneous tasks:

- Create and update a curated list of buyers.

- Locate properties that meet the wholesale investment model.

A cash buyer’s list can include another real estate investor looking to flip or hold the property long-term for appreciation and rental income.

When all is said and done, real estate wholesaling Canada investors can be proud of is not some pipe dream; it's a viable exit strategy with plenty of benefits—as long as it's done legally and by the book.

Can You Do Wholesaling In Canada?

Wholesaling in Canada is legal; however, a wrong decision may create legal problems for those who are unprepared or inexperienced real estate wholesalers. The primary factor that allows a real estate wholesaler to work within Canadian law is the fact they are selling/marketing their "equitable interest," not the property itself.

Selling/marketing the real property would require a real estate license which means becoming a real estate agent or realtor.

On the other hand, selling or marketing your equitable interest is completely within the law. Although it may seem like a distinction without a difference, the difference is quite critical to staying within Canada’s legal limits.

As a wholesaler, you are marketing a property for yourself, not as a representative of another, which requires a license.

Canadian Real Estate License Laws By Province

Education and other requirements for real estate licensing vary by province in Canada.

- Ontario: The Real Estate and Business Brokers Act 2002

- Quebec: The Real Estate Brokerage Act

- Nova Scotia: The Real Estate Trading Act & Regulations

- New Brunswick: The New Brunswick Real Estate Agents Act & Regulations

- Manitoba: The Real Estate Services Act

- British Columbia: The Real Estate Service Act

- Prince Edward Island: The Real Estate Trading Act

- Saskatchewan: The Real Estate Act, Regulations & By-laws

- Alberta: The Real Estate Act

- Newfoundland/Labrador: The Real Estate Trading Act

Is Wholesaling Real Estate Legal In Canada?

Real estate wholesaling is not illegal if the wholesaler understands the legal limits set forth by Canadian law. Implied in the previous sentence is the requirement that you, as a wholesaler, understand the law and the legal implications for potentially violating it.

However, note that wholesalers in Canada are advised to take an ethical approach (including transparency) to ensure there are no surprises for unsuspecting homeowners who are selling their homes.

As a wholesaler, it is prudent to disclose to end or potential buyers that you are not the current owner and are only selling the right to buy the property, as delineated in the executed purchase and sale agreement.

Do You Need A License To Wholesale Real Estate In Canada?

With so many laws and regulations regarding real estate and licensing, many would wonder if it is legal to wholesale real estate in Canada. Fortunately, if done strategically and within Canadian legal limits, wholesaling is legal and, at times, quite lucrative.

Many wholesalers eventually choose to earn a real estate license that specializes in locating properties and negotiating these wholesale properties for potential cash buyers. These are the real estate oversight agencies and associations for each province in Canada –

- Ontario (Toronto): The Real Estate Council Of Ontario

- Quebec: The OACIQ

- Nova Scotia: The Nova Scotia Real Estate Commission

- New Brunswick: The New Brunswick Financial and Consumer Services Commission – Real Estate License

- Manitoba: The Manitoba Security Commission

- British Columbia: The British Columbia Financial Services Authority

- Prince Edward Island: Consumer, Corporate & Financial Services

- Saskatchewan: The Financial & Consumer Affairs Authority of Saskatchewan

- Alberta: The Real Estate Council

- Newfoundland/Labrador: Digital Government and Service – Real Estate Regulation

How To Wholesale Real Estate In Canada Legally?

It is possible to wholesale real estate Canada residents want to sell legally. In fact, there are several ways to complete a wholesale transaction in Canada, and the most popular are discussed below:

The Buy & Assign Exit Strategy

With a fully executed contract, the wholesaler has the legal option to market/sell their "right to buy the property" to another buyer. Wholesalers can use an Assignment of Contract to accomplish this task.

An Assignment is a legal instrument that transfers the wholesaler’s rights (aka, as the original buyer or assignor) to the new buyer (aka, the assignee).

The assignee is often a cash buyer who may regularly work with the wholesaler.

The Double Close Exit Strategy

Another closing strategy that Canadian real estate wholesalers use is the Double Close. As its name suggests, the double close includes two closings – usually performed back-to-back.

The wholesaler purchases the subject property as the principal buyer in the first closing. However, the real estate wholesaler is the seller in the second transaction.

The difference in the contracted price in each contract is the wholesaler’s gross revenue. That said, a double close includes twice the closing costs. This additional cost offers protection to the wholesaler as there is no question that a real estate license is not a requirement.

The Joint Venture (JV) Wholesaling Strategy

If you’ve been wondering, “is wholesaling real estate legal in Canada?”, the answer is yes — but only when done within certain legal boundaries. One of the most common and compliant ways to wholesale real estate in Canada is through a joint venture (JV) agreement.

In a JV deal, two or more parties come together to partner on a real estate transaction. As a wholesaler, you can legally find a deal, structure the opportunity, and then partner with an investor who provides the capital or closes on the property. Rather than assigning a contract — which may be restricted in some provinces without a real estate license — you enter into a legal partnership where each party contributes value and shares in the profits.

Joint venture wholesaling agreements are widely accepted across Canada and are especially useful for new investors who want to legally profit from real estate without violating licensing laws. If you're trying to find out is wholesaling real estate legal in Canada, JV partnerships are a proven way to stay compliant while still earning income from sourcing deals.

As always, it's wise to consult with a real estate lawyer to properly draft your JV agreement and ensure it meets all provincial requirements. When structured correctly, joint ventures are not only legal — they’re one of the most effective ways to grow your real estate business in Canada.

Wholetailing Strategy

Wholetailing combines two investment strategies – wholesaling and flipping.

Wholetailing goes a step beyond simple wholesaling because the investor purchases the property instead of assigning the right to purchase to another end buyer. Wholetailing a real estate deal is not considered a true flip because there are only a few modifications and repairs to be made as an enhancement to the property’s market value. Conversely, flippers would perform significant renovations.

Another difference is this strategy is that the end buyer of a wholetailing deal can be a retail buyer and not another investor.

This is because the wholetailer chooses to update and modify the property to be able to market it to a wider investor pool and likely generate a larger profit (from a higher price) than simply wholesaling deals.

What Are The Benefits Of Wholesaling Real Estate In Canada?

Is wholesaling real estate legal in Canada? Yes, it is, and those who navigate the exit strategy within the confines of the law can expect several benefits.

There Is No Need For A Large Cash Investment or Perfect Credit

The primary reason to consider wholesaling real estate is the fact that it doesn’t require a large cash investment. Additionally, there is no credit review or ongoing mortgage payments as the property is sold quickly.

This investment strategy for Canadian investors does not require you to save a significant cash investment.

It Is A Short-Term Investment

Wholesaling, by its very nature, offers a quick turnaround. The part of the process that takes the most time is researching and finding investment properties that meet your investment criteria.

Wholesaling real estate offers a return on your investment without waiting for a renovation to be complete or the receipt of future rental income.

Wholesaling Real Estate Offers An On-Ramp For Beginners

Wholesaling houses in Canada, at its basics, is a simple process. It offers new investors the opportunity to enter the market without solid credit or large amounts of capital, learn the art of real estate investing, build a list of buyers, and evaluate a viable real estate wholesale deal.

Its Offers Relatively Low-Risk Investments In Terms Of Real Estate Strategies

Prudent investors prefer low-risk investments, which are not always visible for beginners to identify. Wholesaling offers a short-term, low-risk investment as only a small cash investment (with the provision of an earnest money deposit in escrow) is required.

Most wholesalers also have established relationships with lenders in case they need to access funding.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment. Attend our FREE training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How To Buy A Wholesale Deal In Canada?

The end buyer in a wholesale deal is typically an investor who plans to hold the property for rental income or further renovate to raise the purchase price for the next buyer.

If you are interested in becoming a cash buyer, who takes out the wholesaler, note these important considerations –

- The end buyer saves time (and, therefore, money) because the wholesaler does much of the legwork by sorting through potential properties.

- Wholesalers are on the clock as there is a legally binding contract with a closing deadline. As such, when negotiating, remember that wholesalers are highly motivated property owners (aka sellers).

- Buying a property from an unlicensed individual creates a bit of risk as there would be no governing oversight body to help should the deal become problematic. Due diligence offers the best defense against this potential risk.

Is Wholesaling Real Estate Legal In Ontario?

Yes, it is legal to wholesale real estate in Ontario without a real estate license if the transaction stays within the legal lanes of Canadian law. The Ontario law that defines the legal boundaries of real estate licensing is The Real Estate and Business Brokers Act (2002).

Specifically, Ontario law states that no person shall trade in real estate (as a broker or salesperson) unless appropriately licensed and registered.

The salient point in this law is that the asset being sold is "real property", which differs from the asset a wholesaler is marketing – the right to purchase the property according to the terms of the executed contract. As a result, real estate wholesalers must be diligent in their efforts to market their equitable rights, not the property, as if they were owners.

The salient point in this law is that the asset being sold is "real property", which differs from the asset a wholesaler is marketing – the right to purchase the property according to the terms of the executed contract. As a result, real estate wholesalers must be diligent in their efforts to market their equitable rights, not the property, as if they were owners.

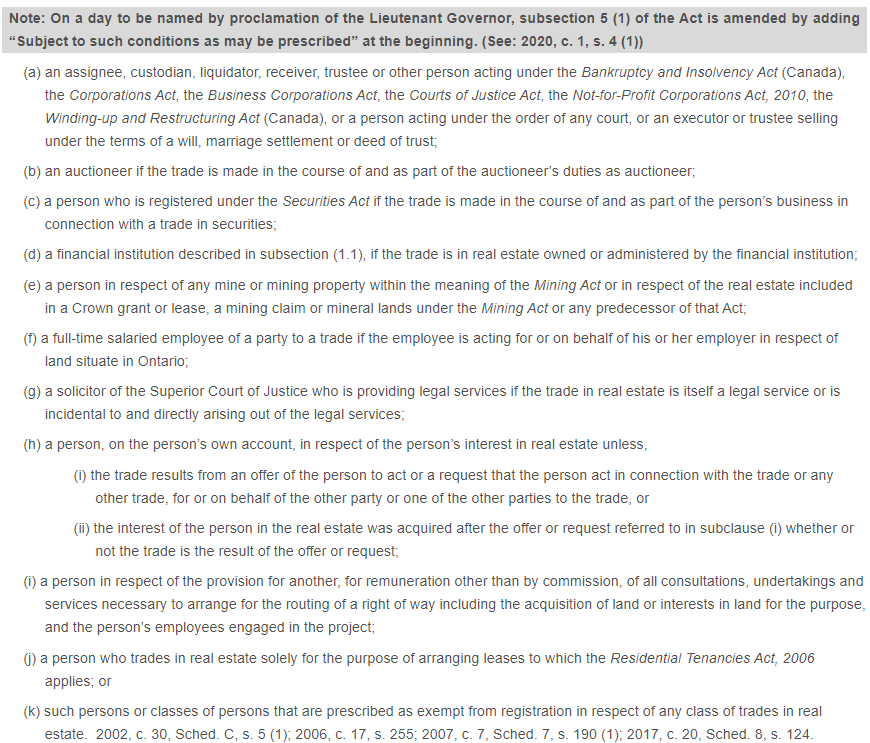

However, Ontario real estate law offers these exemptions, noted Subsection 5(1 a-k), and shown below.

A wholesaler should make sure that the wholesale contract does not expressly prohibit assignments or be heavily conditioned with approval from the seller required to assign your equitable interest. Without an explicit clause prohibiting assignments, a wholesaler may assign their rights to another end buyer.

Wholesaling real estate requires an investor to have a working knowledge of the local real estate market and its customs.

This would include knowledge of what actions require a license in Ontario, as well as state real estate laws. In addition, wholesalers must only market or sell their equitable ownership if they avoid those actions requiring an Ontario real estate license.

Wholesale Real Estate Ontario Contract

A Canadian real estate wholesale deal typically uses two legal instruments – a Purchase Agreement and an Assignment of Contract.

If you are unfamiliar with these documents, it is prudent to speak with a real estate attorney who can offer the appropriate legal advice for your wholesale real estate deal.

The Real Estate Contract or Purchase Agreement

The wholesale real estate contract used for Ontario real estate includes a tremendous amount of information that details the terms for each party.

At the very least, a contract will include:

- The Names & Contact Information Of All Relevant Parties: This would include the wholesaler, as the buyer, plus the seller. Lawyer and real estate broker names may also be included, if applicable.

- The Description Of The Subject Property: The street address & the legal description of the property.

- The Condition Of Premises: This section delineates the property’s physical state, including existing damage and necessary repairs, if applicable.

- The Purchase Price And Financing Terms: The agreed-upon price and financing terms are recorded along with where deposits will be held.

- The Deed Type: What type of deed is being used to pass the title?

- The Closing Date: This is the day when the paperwork is executed and the title changes hands in accordance with the contract terms.

In addition, a contract may also include additional clauses and relevant contingencies, as follows:

- The Financing Contingency: This allows for the cancellation of the real estate transaction if a buyer cannot secure the necessary financing. This is not applicable to cash buyers.

- The Inspection Contingency: This allows for the cancellation of the transaction if the buyers are dissatisfied with the home inspection report.

- The Marketable Title Option: This allows for the cancellation of the transaction if the buyer can’t obtain title insurance through a title company.

- The Buyer And Seller Default Clauses: This clause outlines what happens if either contract party defaults.

- The Risk Of Loss And Damage Clause: This clause protects the buyer if the subject property sustains damage while under contract but not yet closed.

- The Adjustments Clause: This clause may include modifications for property taxes or utilities. The specifics depend on the location of the property.

- The Statement Regarding Lead-Based Paint: This disclosure requires all parties to acknowledge that there is no lead-based paint on the property.

- The Addenda: Offers space for additional contingencies, if applicable. Caution – sellers or their representatives may use this section to require any assignments to be approved by the seller.

The Assignment Of Contract

A wholesaler uses an Assignment of Real Estate Purchase and Sale Agreement to legally transfer their equitable interest (granted in one contract) to another buyer if the contract does not specifically prohibit this action.

The assignment contract stipulates the name of the new buyer who is assuming the equitable interest until closing.

The Assignment of Real Estate Contract includes a copy of the original purchase and sale agreement. This assignment provides the new buyer with the transaction’s details – including conditions, pricing, and stipulations if they apply.

The Assignment of Real Estate Contract also includes -

- The wholesaler’s payment terms.

- The date of the assignment.

- The date the assignment was executed.

The new buyer will generally provide a small earnest money deposit, with the balance received at or after closing.

Final Thoughts

So, is wholesaling real estate legal in Canada? If you've made it this far, you know that, yes, wholesaling real estate is legal in Canada, but it’s important to follow the specific regulations in your province. While you don’t need a real estate license in most cases, you do need to ensure full transparency with all parties and adhere to local laws regarding contract assignments. For those who operate within the legal framework, wholesaling presents a great opportunity to profit in the Canadian real estate market while keeping risks and upfront costs low. Whether you are real estate wholesaling Alberta properties or wholesaling real estate in Ontario, there is a path to success; you just need the right systems.

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.