Tax On Rental Income: How Much To Pay & More

Oct 06, 2022Owning rental property as a real estate investing strategy is one of the best ways to build long-term income and wealth. Of course, like all things in life, rental real estate income is taxable, but most tax laws in the United States favor rental property owners with tax breaks and other advantages for those who rent their properties.

Before purchasing an investment property for rental income, you need to know how to calculate ROI on rental property. ROI stands for return-on-investment and should be the primary factor in deciding whether you purchase a property for rental income or not. Understanding ROI is especially crucial if you're exploring how to buy a rental property with no money, as maximizing returns becomes key when leveraging creative financing strategies.

Calculating the ROI on a potential rental property is by dividing the net profit by the total investment.

Next, take that number and multiply it by 100.

The higher the number, the better the ROI, meaning the more income you’ll make over time.

Understanding what counts as rental income, how rental income is taxed, strategies to minimize the tax liabilities on your rental income, and how to report and calculate your taxes are crucial for maximizing your rental income earning potential.

Suppose you’re considering starting a real estate business and looking at rental properties as a source of income.

In that case, you need to understand how to calculate the ROI for your potential rental and what types of tax on the rental income you may be responsible for as a taxpayer.

- What Is Rental Income?

- How Rental Income Tax Works

- How To Avoid Or Reduce Paying Tax On Rental Income

- What Can Be Deducted From Rental Income?

- How To Report Rental Income On Your Tax Returns

- How To Calculate Rental Income And Expenses

- Software For Tracking Taxes On Rental Income

What Is Rental Income?

Rental income is any type of money you receive for the tenant's use of your property in the form of rent. Any property rented for more than 15 days a year is considered a rental property.

Maximizing your net income requires you to understand the tax on rental income and the sources of income that you’re required to claim with the IRS.

There are a variety of types of rental income that include:

- Advance rent

- Security deposits

- Payment for termination of lease

- Expenses paid by a tenant

- Trader for services

If you’re wondering how much tax you pay on rental income, it’s a simple calculation. However, for every dollar in the rental income, you receive from these sources, you’ll be responsible for reporting and paying taxes.

One thing to know is that these income sources need to be documented and included as part of your ROI calculation.

How Rental Income Tax Works

Rental income tax works the same as ordinary income. Any net rental income you receive is taxable, similar to ordinary income. All income you earn through a rental property must be reported, and the Federal Tax on rental income rate is calculated the same as ordinary income.

To calculate the rental income tax rate, follow the same valuation formula as ordinary income, which is:

Net Rental Income x % Tax Bracket = Rental Income Tax

As an owner of a rental property, you’re considered by the renter to be their landlord. Therefore, the amount you’ll be required to pay on your landlord taxes will be lower if you know how to take advantage of the various benefits and breaks the tax code provides for landlords.

Read Also: Wholesaling Real Estate Taxes: (Ultimate) Guide For Investors

How To Avoid Or Reduce Paying Tax On Rental Income

There’s not a perfect formula that answers the question of how to avoid paying tax on rental income as you’ll be required to report and possibly pay some tax on the income earned.

The goal, however, is to utilize the tax advantages that benefit landlords and minimize your tax obligations. Understanding the new rental property rules and the type of rental income will help you navigate the tax code to your maximum benefit.

You can receive a couple of significant tax breaks on your rental income if you know how to navigate the tax code.

1031 Exchange

A 1031 exchange benefits homeowners and allows you to defer capital gains tax by transferring the profit to purchasing a similar priced (like-kind) property.

To take advantage of 1031, you’ll need to transfer the proceeds to a new property within 45 days of selling your previous one, and you must close on that new property within 180 days.

Convert A Rental Property To A Primary Residence

If you’re looking to sell your rental property, you may want to consider living in it first.

For example, suppose you live in a property for 2 years during a time frame that is 5 years. In that case, the property is considered a primary residence, and proceeds from the sale of the home can receive tax breaks of up to $250,000 for single filers and up to $500,000 for married couples filing jointly.

Related: Taxes On Flipping Houses: The (Ultimate) Guide

What Can Be Deducted From Rental Income?

Any rental expenses considered “ordinary and necessary” for the use and maintenance of your rental property may be deductible expenses with one significant difference.

Costs of improvements like restoration, betterment, or adaptations for different uses can not be deducted. However, these costs of improvements can be recovered through depreciation.

Types of allowable deductions:

- Mortgage interest

- Property tax

- Repairs

- Utilities

- Homeowners Insurance

- Advertising

- Maintenance and cleaning

- Homeowner association (HOA) or condo fees

- Insurance costs

- Legal and professional fees

- Landscaping fees

One point on depreciation is that depreciation is a deduction that occurs over a more extended period of time and is set by a timetable from the IRS.

Types of deductions that fall under depreciation include:

- Structural additions and renovations

- Insulation, heating, and air conditioning

- Flooring

- Furniture

- Landscaping

Understanding the types of tax deductions and tax breaks available to be applied to the tax on rental income is essential before you file your tax returns.

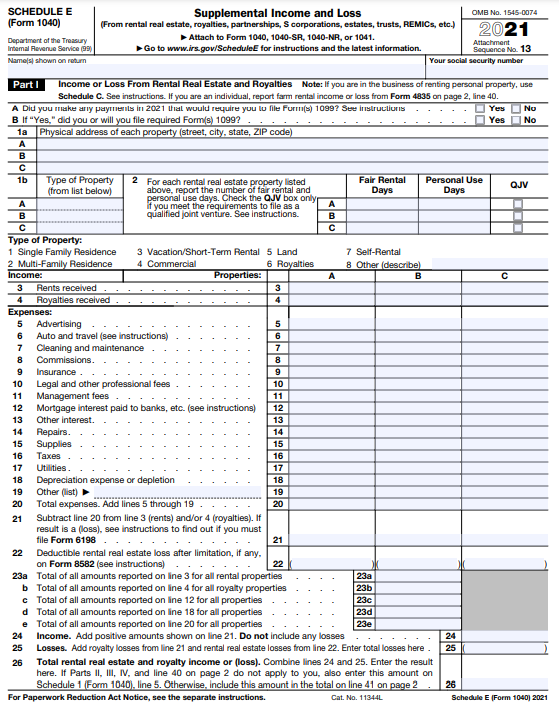

How To Report Rental Income On Your Tax Returns

When it comes time to do your taxes and report the income you earned through rental properties, you need to know what forms to file and the proper way to list income, expenses, and depreciation costs.

There are two tax forms associated with filing your Federal tax on rental income.

The first form is to file a Form 1040, or 1040-SR for seniors. Once you complete this form, you will use Schedule E, Part I, for the remaining tax on rental income disclosures.

To file your taxes with rental income, you’ll need:

- Schedule E, Part I (also known as supplemental income and loss)

Read Also: Tax Benefits Of Real Estate Investing: Save More, Earn More

How To Calculate Rental Income And Expenses

To calculate how much real estate taxes you pay on rental income, you must fill out the 1040 and Schedule E forms with the IRS first.

- Understand that you will be responsible for declaring:

- Any rent payments

- Advanced rent payments (first, last month, for example)

- Any supplemental fees to rent agreement such as pet fees or parking fees

- One-time fees such as canceling a lease penalty

- Any expenses paid by the tenant (instead of the landlord) that are in place of rent–think landscaping, for example

- Any amount of the security deposit not returned to the tenant

To calculate your income from rental properties, take all your earned income, and subtract it from all your expenses. That total is the taxable income you may owe before calculating depreciation costs.

Software For Tracking Taxes On Rental Income

![]()

Keeping an inventory and tracking all income, expenses, and possible depreciation costs can be challenging, so using tax software designed to track rental property income is a great idea.

The benefit of utilizing revenue intelligence software for your rental income is that come tax season, all your income and expenses are in one easy-to-find place.

At the same time, it seamlessly calculates your depreciation costs. In addition, this software will make your tax filing more manageable and compliant, lowering your potential for audits.

How Real Estate Skills Can Help You Get The Most Out Of Your Rental Income, Even With Taxes

Finding ways to maximize your rental income also includes using the tax code as an advantage for your real estate business.

From Wholesaling rental properties to ordinary rental property income, it can be challenging to know all the taxes on rental income and the proper ways to file it. At Real Estate Skills, we’ve designed our program to assist you in maximizing your earning potential.

If you need information on maximizing your investment, check out Real Estate Skills real estate resources for tips and tricks on boosting your income and managing your tax liabilities.