Investing In Real Estate With Self Directed IRA | Real Estate Skills

May 07, 2022Everyone focuses on making more money. There is nothing wrong with it, but if they shift their attitude just a little bit and focus on how they can keep the money too, people will have better financial stability.

Taxes, mismanaged investments, inflation, and market movements are some of the common reasons why people cannot hold onto their money.

If you want to preserve wealth, you must consider real estate as one of the biggest tools to pass on wealth through generations.

As a real estate investor, you can own a physical asset, receive rental income, and create a stable source of retirement income if you plan carefully.

Certain tax-reducing strategies, such as contributing a portion of your income to a 401(k) or a Self Directed IRA (SDIRA) can allow you to save for retirement with the flexibility of investing in more than just stocks and bonds.

Let’s learn more about it.

- What Is A Self Directed IRA?

- Self-Directed IRA Real Estate Pros And Cons

- Self-Directed IRA Real Estate Rules

- The Self-Directed Roth IRA Advantage

- Legal Considerations Of Self-Directed IRA

- Final Thoughts

What Is A Self Directed IRA?

A self directed IRA or SDIRA is a qualified retirement plan which offers people more control over the investment choices available to them in their retirement accounts.

Check out this short video that talks about self directed IRA.

Retirement accounts allow income earners, employees, and business owners, to contribute a portion of their income to an account, and use that as a tax deduction. In other words, every dollar you contribute to a tax-advantaged retirement account is a dollar that you won't need to pay taxes on in that current financial year.

For example, if you made $100,000 of income and your effective tax bracket is 25%, then you may owe $25,000 in taxes.

However, if you contributed $15,000 to your retirement account before paying taxes, then it reduces your taxable income to $85,000. So you reduce your tax bill from $20,000 to $21,250.

That's an extra $3,750 to put to work and invest in your retirement!

Most mainstream, retirement accounts like the traditional IRA and 401(k) are geared towards investing in stocks, bonds, mutual funds, and common investments that other people manage for them.

With a self directed IRA or a self directed 401(k) the investor may direct those funds to more actively managed investments like real estate. For savvy real estate investors, like those in our Pro Wholesaler VIP Program, this becomes quite interesting.

Various types of investments available in an SDIRA include:

- Real Estate

- Mortgage Notes

- Wholesaling Real Estate

- Private Placements

- Tax Liens

- Tax Deeds

- Cryptocurrency (Bitcoin, Ether, etc.)

- Stock Market & Mutual Funds

- Precious Metals (Gold, Silver, etc.)

- Private Equity Deals

- REITs

With all of those available, other alternative investments such as life insurance, collectibles, antiques, and art are not allowed through the SDIRA.

If you want to generate sustainable wealth through investing in real estate, you must start as early as possible. At the same time, find alternative ways to preserve your wealth.

Some of the real estate investing options using a self-directed IRA include residential properties, commercial properties, apartment complexes, LLCs, trust deeds, mortgage notes, foreign real estate investments, agricultural land, REO properties, and raw land. There are various other advantages of a Self-directed IRA.

Self-directed retirement accounts are a great investment option in real estate that will give you tax benefits. They are also known as Real Estate IRAs, mainly due to their ability to invest in real estate and various assets related to real estate.

Read Also: Do You Need An LLC To Wholesale Real Estate?

Self-Directed IRA Real Estate Pros And Cons

Pros

As a real estate investor, you can buy houses and get tax-deferred growth of your assets until distribution through a self-directed IRA.

If you want to go through a regular house flipping transaction, you would usually purchase a house at a below-market rate, do all the repair work and sell it for a profit within a year.

After putting in all that hard work, which will take a considerably long time to get done, your profits will be subjected to taxation.

The IRS calls it short-term capital gains and for all the assets that are held less than a year, the taxation rates could be as high as 35%, even though the maximum taxation subsides to 15% or less for assets held for a year or longer.

However, if you purchase real estate through a self-directed IRA, then the entire process will remain the same except that you don’t have to pay taxes until distribution. This means that you can engage in multiple house purchasing transactions and defer your tax bills until your retirement. In fact, you can fund more purchases from the profit generated by your previous transactions.

Cons

The caveat is that you won't be able to pull those profits out of your retirement account without a penalty until you're 59 1/2 years old. That means you must keep the profits in the account and continue to reinvest them, albeit tax-free.

Some of the freedom that comes with owning property is lost because you must adhere to the self-directed IRA rules.

This wouldn't be the best strategy to focus on if you're making your living off of house flipping and real estate investing since you can't use the cash flow or profits for your lifestyle without jumping through hoops.

Though, it has the potential to set you up for a massive retirement nest egg!

Another disadvantage of the SDIRA for real estate is that you cannot finance properties that you purchase with your IRA without paying Unrelated Business Income Tax (UBIT).

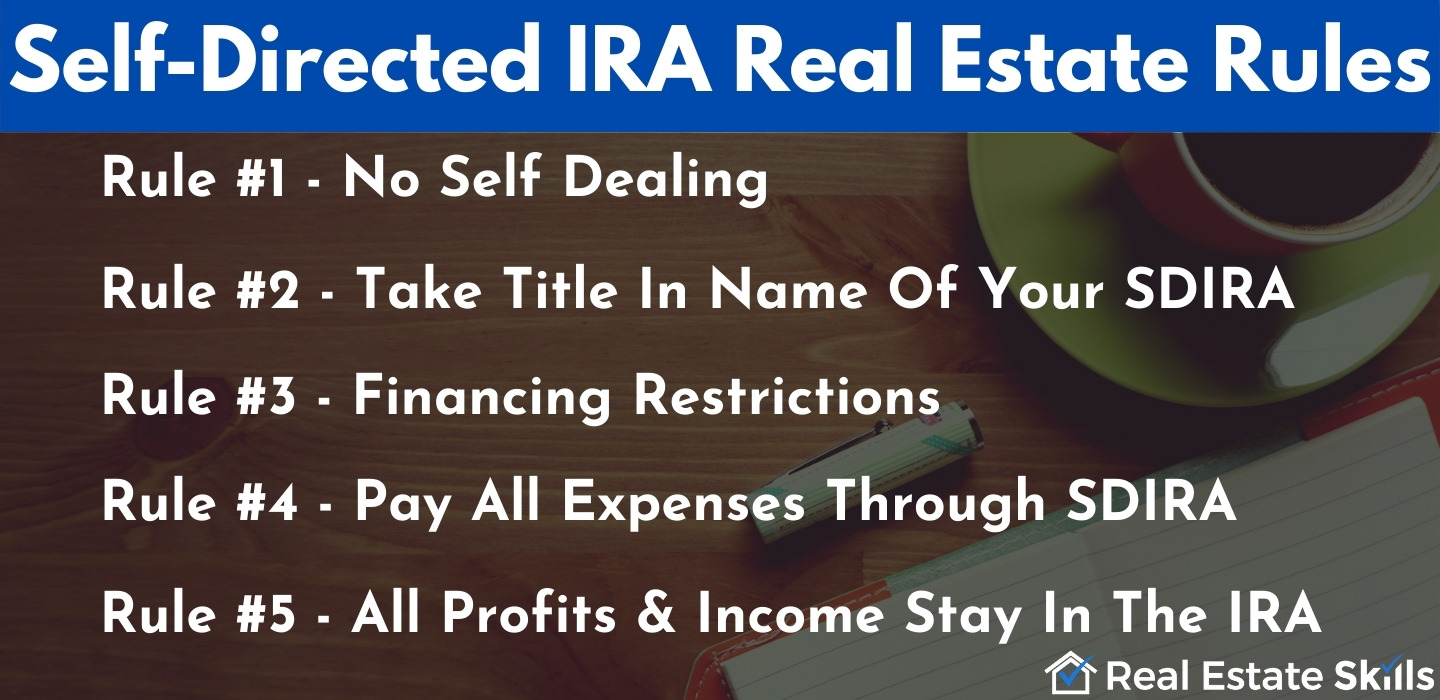

Self-Directed IRA Real Estate Rules

As you know by now, there are certain rules to follow when investing in real estate with a self-directed IRA. Here are some guidelines to help you understand exactly what sort of restrictions these accounts have for real estate investors.

Rule #1 - No Self Dealing

Simply put, your SDIRA cannot conduct business with you personally. This means your IRA cannot purchase a property that you own, nor can you sell a property to your IRA. This applies to you and any other disqualified person, as it would be considered a prohibited transaction.

Rule #2 - Take Title In The Name Of Your SDIRA

You personally cannot buy the property. Your SDIRA must be the purchaser and owner of the property. Like an LLC or corporation, your self-directed retirement account is a separate legal entity. Therefore, if can legally own assets, such as real estate.

Rule #3 - Financing Restrictions

As mentioned, if you purchase a property using debt, then the investment is required to pay UBIT taxes. For this reason, many SDIRA investors utilize all-cash purchases for real estate investments.

Rule #4 - Pay All Expenses Through The SDIRA

Any expenses incurred by the real estate project owned by the retirement account must be paid from the IRA.

Rule #5 - All Profits and Income Stay In The IRA

When you realize income from your real estate investments within your IRA, the earnings must always return to your retirements account. If you take early withdrawals, they may be subject to penalties and taxes.

The Self-Directed Roth IRA Advantage

Apart from the various benefits offered by a self-directed IRA, you can also have a Roth IRA account option.

Under the Roth self-directed IRA, you can pay taxes upfront and receive tax-free distributions when you retire.

Moreover, if you do a real estate transaction within a Roth self-directed IRA account, there won’t be any taxation. This allows you to enjoy the returns entirely, however, a few exceptions may be applicable.

Before you get started, there are a few things you need to consider. Take a look:

- Figure out whether real estate investing with your IRA funds is right for you.

- Consider the structure and diversify your portfolio for your self-directed IRA.

- Choose a self-directed IRA custodian and set up an account.

- Know the contribution limits and transfer your IRA funds to your self-directed IRA account.

- Understand how ROTH IRA tax benefits can accelerate your wealth.

- Know the contribution limits

Legal Considerations Of Self-Directed IRA

You will have to follow a unique set of legal considerations, some of which include:

- The owner of the SD IRA plan cannot use the property for personal benefit or for another prohibited transaction.

- You will lose depreciation deductions for the properties owned under a self-directed retirement account, unlike regular real estate ownership.

- You are not allowed to do business with the IRA. This includes using your construction or marketing services for the sale or repair of your property. Often called self-dealing transactions, it holds true for your spouses, ascendants, and descendants

- You cannot offer a personal guarantee as your self-directed IRA can use only non-recourse financing for a purchase. In case of a default, the lender will hold no claim other than the property itself.

- A self-directed retirement account allows investors to use their retirement funds for real estate investing and add alternative assets to their retirement plans.

Final Thoughts

Investing in real estate through a self-directed IRA is certainly an appealing opportunity for high-income real estate investors and entrepreneurs. It's also quite interesting for those who do not currently invest in real estate but want to diversify away from traditionally sold investments such as shares of mutual funds, the stock market, and corporate bonds.

As the markets soar to new heights, companies trade at record-breaking valuations, and the world continues to face uncertainty, many investors seek to take control over their future.

When it comes to investing, most people hand their financial future over to a financial advisor working at one of the big financial institutions who provides textbook investment advice, such as encouraging diversification

Real estate investing, whether or not in a retirement savings account, provides more certainty of income and future stability while giving the investor control over the outcome of their investments. You, too, can become the CEO of your own real estate investing business and fund it through your pre-tax dollars.

Of course, the best investment you can make is in your own education. Learn how to profit in the real estate investing business before getting the ball rolling. That way, you'll maximize every investment dollar and achieve unparalleled returns when the opportunity strikes.