Mashvisor Review: Pricing, Competitors, & Promo Code (2023)

Aug 11, 2022Technology has changed how we do most of our daily activities. The dream of doing many things with just a click of a button is now a reality. This reality is felt across all niches, including the real estate industry.

Without technology, real estate investors, buyers, agents, and other professionals would have no efficient way to carry out research. Imagine having to collect market and property data manually, compiling the data on a spreadsheet, then computing the different neighborhood-level and property-level numbers. This would take you days and sometimes weeks. Also, imagine the kind of inaccuracy a simple error would cause.

As you can see, real estate software solutions make realtors’ lives easier. One of these solutions is Mashvisor. In this Mashvisor review, we’re going to be looking at what Mashvisor is, what it has to offer, and how it compares to some of its main competitors.

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

What Is Mashvisor?

Mashvisor is a real estate data analytics platform that uses AI and machine learning algorithms to help investors, sellers, and agents access profitable investment opportunities in a few minutes.

The unique thing about Mashvisor is that it provides you with data analytics for both traditional and Airbnb properties to help you select the ideal rental strategy for your financial and investment goals.

The Mashvisor platform has various tools integrated together to help you find everything you’re looking for under one roof. If you’re looking for a platform where you can search for lucrative properties, analyze them by calculating the expenses as well as the expected rental income, and also compare the properties with other listings, then Mashvisor is what you’re searching for.

On top of that, Mashvisor reviews will also tell you that it’s possible to find and analyze off-market properties on the platform. Many off-market property investors will tell you how hard it is to access property owners’ data. Mashvisor solves this as you can use the Mashboard to reach out to property owners directly on the platform.

When it comes to the data, Mashvisor’s analytics is predictive. Predictive analytics are meant to give you future projections or property performance forecasts based on historical trends and comparative data.

Try it for yourself & use our link for your FREE 7-Day Trial of Mashvisor and 20% off for life!

How Does Mashvisor Work?

All tools and features on Mashvisor are created to work together and complement each other. The tools can help you in different ways in your real estate investment journey. Some tools may be more useful when searching for a profitable property, while others will help you more when you want to make an offer.

That said, in the next section of this Mashvisor review let’s look at the various features to help you understand how Mashvisor works:

Search Function

The first thing any user sees when they go to the Mashvisor website is the search page. According to most Mashvisor reviews, the search functionality is one of the most useful features on the platform. Why?

While it may look similar to other real estate platforms, the Mashvisor search page offers various filtering criteria specially designed for real estate investors. You can kick off your search for profitable investment properties by searching the location, and by entering the city, neighborhood, zip code, or street address.

Once you’ve searched the location, the tool brings you a list of MLS listings, alongside bank-owned properties, foreclosures, and short sales listed on Auction.com.

Mashvisor will compute and show you all the crucial metrics with regard to each property. These numbers include:

- Listing property price

- Square footage

- Number of bedrooms and bathrooms

- Traditional cash on cash return

- Airbnb cash on cash return

- Traditional cap rate

- Airbnb cap rate

No investor wants to spend the whole day looking at listings they’re not interested in. This search page allows you to customize your property search to only see property listings that match your search criteria. You can use the above metrics to filter the listings or your preferred rental strategy.

For example, let’s say you want to find an investment property to start an Airbnb business within a certain price range and with the best cash-on-cash return. You simply have to set the appropriate search filters, and the algorithm will generate the results for you.

On top of the most crucial numbers listed above, you can also use the following metrics to filter through the listings:

- Property type (single-family houses, multi-family homes, condos, apartments, townhouses, or others)

- Year built (property age)

- Property status (foreclosure, for sale, pending, or sold)

- Potential rental income

These metrics will help you weed out all the unwanted listings and only see properties with the best return on investment based on these numbers.

Heatmap Tool

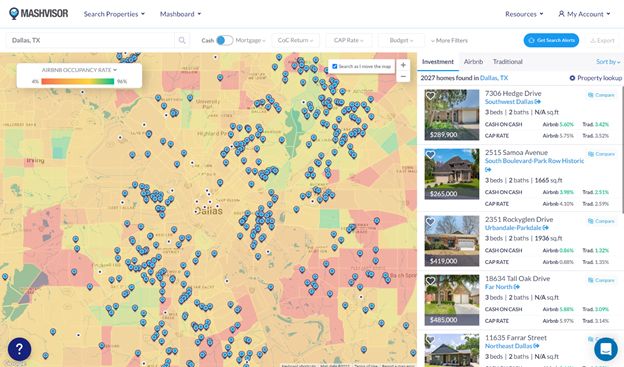

Another tool that Mashvisor review articles highlight is the Heatmap located on the left side of the search page. Initially, it may look like an ordinary map that only shows you any available investment properties for sale and the neighborhoods they’re located in.

However, you can activate it into a Heatmap by clicking on the house icon at the top left and selecting one of the filters. Here is a list of the filters you can select:

- Property listing price

- Traditional rental income

- Traditional cash on cash return

- Airbnb rental income

- Airbnb cash on cash return

- Airbnb occupancy rate

Once you’ve selected the filters, the heatmap tool gives you a color-coded insight into the selected location. Green represents areas with high values, while a red represents low values. For example, if you want to invest in a neighborhood with low property prices but high returns, look for neighborhoods where the property price is red, but rental income, occupancy rate, and cash on cash return are green.

The tool’s main aim is to help you see how a city’s neighborhoods are performing based on your selected criteria so that you can only search for properties in profitable neighborhoods.

We can call the heatmap tool a neighborhood analysis tool. The real estate heat map allows you to see how a certain neighborhood is performing compared to others within the selected city. As a real estate investor, you know how important the location you invest in is.

Read Also: 7 Best Markets To Wholesale Real Estate

Property Finder

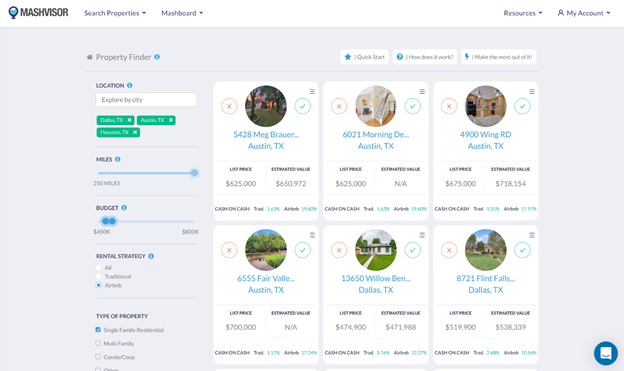

If you already have a few profitable locations in mind, the Property Finder will help you find the best properties to invest in those locations. The best thing about this tool is that you can search for properties that match your search criteria in up to five different markets simultaneously.

Just like the tools we’ve covered above, you can filter the search results using the following metrics:

- Location

- Budget

- Property type

- Rental strategy

- Number of bedrooms and bathrooms

The Property Finder is the best tool for real estate beginners who want to start their search for lucrative investment properties. This tool lists the properties in descending order based on the cash-on-cash return for the preferred rental strategy. In short, the most profitable properties are listed at the top of the search results.

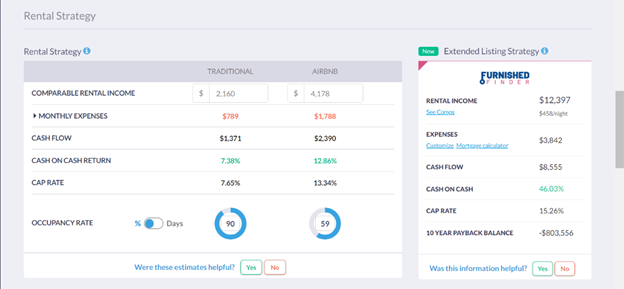

Investment Property Calculator

Once a user on Mashvisor has a list of potential investment properties in their preferred location, it’s now time to calculate the profit potential. The Mashvisor Investment Property Calculator is thus another tool we need to look at in this Mashvisor review. It helps you conduct investment property analysis by providing you with all the crucial numbers you need to make a wise investment decision.

The Mashvisor Property Calculator provides you with the following property information:

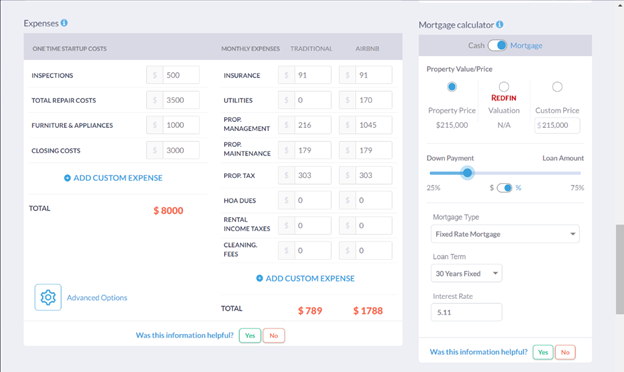

- Rental Expenses: This tool gives investors accurate estimations of all property expenses. The expenses include one-time costs, such as closing fees, inspection, and furniture, as well as recurring expenses, such as property taxes, insurance, maintenance, and utilities. Expenses are essential for determining the monthly cash flow.

- Rental Income: The Investment Property Calculator also provides you with monthly rental income estimates. Estimating rental income manually is a nerve-racking process. However, this tool streamlines this process as it provides accurate estimates for both Airbnb and long-term rental properties based on the performance of comparative rentals in the area.

- Cash Flow: Once you have the income and expenses estimates, you can now calculate the monthly cash flow. This tool calculates the cash flow for you to see whether the investment makes financial sense.

- Return on Investment: The main reason why investors carry out an investment property analysis is to see its profit potential which is indicated by the return on investment. This tool helps you calculate the most popular metrics for return on investment, which are cash on cash return and cap rate.

- Occupancy Rate: Occupancy rate data helps an investor know the rental demand in a location. The demand influences the rental income and, ultimately, the return on investment. Estimating this metric manually is hard since you have to account for many factors, such as the desirability of the neighborhood, market conditions, property type, and many others. However, our property calculator provides accurate occupancy rate data based on rental comps.

The Mashvisor Calculator also comes with an integrated interactive mortgage calculator. You can calculate the cash flow and return on investment based on the mortgage specifications such as loan type, loan term, down payment, and interest rate.

Rental Comps

Comps refer to comparable properties within the same neighborhood that are currently being rented out. This data is important for real estate investors to determine whether their rental property is reasonably priced to avoid asking too much or too little for rent.

The Rental Comps & Insights tab helps investors instantly access rental comps data. This tool allows you to see the comparable rental properties and other insights displayed on simple graphs.

Read Also: How To Find Real Estate Comps To Determine The House Value

Real Estate Agent Directory

While Mashvisor may provide you with all these tools to help you in your investment journey, most investors, especially beginners, require the help of a real estate agent. There are many benefits of working with a real estate agent.

First, they understand the local market more than you do. They can help you decide on the best neighborhoods to invest in your location. Second, they’re experienced in carrying out negotiations. This skill comes in handy when making an offer and meeting with the seller or buyer.

Mashvisor understands that not many real estate investors may be familiar with the local market just yet. That’s why the platform offers a comprehensive real estate agent directory to help you find an experienced agent in any market.

An individual investor can view an agent’s profile to see the following important details:

- Agent name

- Contact details

- Real estate license

- Experience

- Specialties

- Active listings

- Off-market properties

- Client reviews

In this Mashvisor review, it is important to highlight that this tool helps you choose a top-performing agent in the market of your choice. You want to work with an agent whose skills and experience match what you’re looking for, and Mashvisor’s real estate agent directory helps you do that.

Read Also: 8 Best Real Estate Wholesaling Tools

What Is Mashvisor Good For?

According to various Mashvisor reviews, Investors love Mashvisor for the myriad of benefits it offers them. The investors have found the platform to be an effective tool for carrying out a real estate market analysis as well as accessing property data.

Here are other reasons why you need to use Mashvisor:

- Save time: Mashvisor review articles have specifically pointed out the amount of time using the platform saves investors. You don’t have to waste your time sifting through unwanted listings, manually analyzing properties, or wasting your energy on a neighborhood only to realize it’s not profitable. You can do all this in about 15 minutes.

- Find off-market properties: Many real estate investors love off-market properties since they tend to be sold for a bargain. However, not all investors have access to these deals. Mashvisor helps you access these deals through the Property Marketplace tool. In addition, this tool provides you with property owner data for easier contact.

- Choose an optimal rental strategy: As we’ve mentioned, for every key metric, Mashvisor provides values for both traditional and vacation rental strategies. This will help you compare and select the rental strategy that will help you reach your goals.

How Accurate Is Mashvisor?

The Mashvisor platform has been lauded for its data accuracy. This is mainly because Mashvisor pulls its data from accurate and reliable sources. Some of its data sources include the MLS, Redfin, Zillow, Rent Jungle, Hotpads, public records, and many others.

Short-term rental data is pulled from the Airbnb website itself. In addition, the Mashvisor Data team compares the data and investment analysis with active Airbnb hosts on a regular basis to verify its accuracy.

Mashvisor offers a few packages and pricing plans to meet the needs of various investor groups. Here is a breakdown of the packages:

- Lite: The Lite package goes for $17.99/month and is billed annually. With this package, you get traditional and Airbnb investment property analysis for individual properties based on rental comps.

- Standard: The Standard package goes for $49.99/month billed annually. This package lets you research and helps uncover lucrative investment properties, neighborhoods, and cities that align with your customized financial goals and expense profile.

- Professional: This package goes for $74.99/month billed annually. This package helps full-time investors or real estate agents analyze large tracts of data. You can apply multifamily or foreclosure filters on your property search.

Mashvisor Competitors

Mashvisor reviews show that the platform is useful for both beginners and experienced real estate investors. However, most investors want to have a wide range of options to choose from. The best thing is that there are many options, each with its own unique features and set of tools. Let’s look at some of Mashvisor’s closest competitors:

Mashvisor vs AirDNA

AirDNA is one of the most popular online real estate platforms for short-term rentals. Most investors look for Mashvisor vs AirDNA reviews when looking for a real estate analytics tool.

Unlike Mashvisor, AirDNA only focuses on vacation rental property data. The platform covers over 10 million short-term rental properties in a plethora of markets all across the world. Thanks to its market forecasts and historical data, investors can use it to understand and analyze the short-term rental market.

AirDNA doesn’t offer the same tools and features as Mashvisor. What it has instead is one special tool known as the AirDNA Rentalizer which is similar to the Mashvisor Airbnb Calculator. Investors can use this tool to calculate the potential Airbnb income from their investment property.

The main issue with this tool is that you must enter the property address for you to receive the rental analysis. This can be limiting, especially for novice investors who are still not sure what exactly they’re looking for. Moreover, you don’t get the same detailed analysis of the investment potential of the property.

Is AirDNA accurate?

AirDNA pulls its data from public listings available on platforms such as Airbnb, HomeAway, and Vrbo. However, it’s difficult to ascertain whether the data is indeed accurate since their data isn’t double-checked.

Mashvisor vs Redfin

In this Mashvisor review, we should emphasize that, unlike Mashvisor, Redfin is an online real estate brokerage platform that is popular for having agents who work on lower commissions compared to ordinary agents. The main reason why Redfin is preferred by many investors is because of the huge savings potential it offers.

Redfin has a buying service called Redfin Now that allows its users to make an offer and close a deal online. This service makes the whole process faster compared to the traditional way of making an offer and closing.

One major potential downside with Redfin is that the major commission discounts may cause service trade-offs as the agents may fail to pay individual attention. Redfin fails to provide a perfect balance of savings and personalized service.

Mashvisor vs PropStream

PropStream is an analytics tool specializing in helping real estate investors, agents, brokers, and property managers find tools to aid their businesses. The platform offers real estate market data to help its users make business decisions.

PropStream collects its data from the MLS, county recordings, and other private sources. While the MLS is a credible source of real estate information, the reliability of the private sources of data may be a bit questionable.

Among its features and tools, the Rehab Estimator has to be the most impressive one. This tool helps PropStream users to calculate the possible renovations and maintenance expenses the buyer will have to spend. This helps investors avoid buying properties that might need a huge budget to remodel.

Read Also: PropStream Review

Mashvisor vs Roofstock

When talking about Mashvisor competitors, it would be impossible to conclude without mentioning Roofstock. Roofstock is an online real estate platform that focuses on single-family homes. This makes the range of property investments to choose from significantly narrower.

However, it’s a good option for investors whose main focus is on single-family rental properties. The properties on this platform are reasonably priced and sized well. One major benefit of Roofstock is that all property listings are certified. They have to pass through Roofstock’s stringent list of requirements.

Roofstock has a couple of features and tools, including Roofstock One for accredited investors who want to generate passive income from their investments. Roofstock Academy is a learning program for both beginner and experienced real estate investors. The program teaches them anything about real estate, from how to start investing and making realistic offers, to negotiating deals.

A potential downside with Roofstock is that non-accredited investors have no passive investment approach.

Mashvisor Promo Code

To test all the tools and features described in this Mashvisor review, you can sign up for a 7-day free trial of the platform followed by a 20% discount on all plans for life here.

Mashvisor FAQs

Since we’ve covered Mashvisor reviews and seen some of its worthy competitors, it’s only right to include some of the most frequently asked questions by investors:

Does Mashvisor Have a Free Trial?

Yes, Mashvisor does have a free trial period. All packages come with a free 7-day trial period.

Besides, if you've yet to make up your mind, you can request a demo. The demo gives you an in-depth glimpse into what Mashvisor has to offer.

A free demo account allows you to set an investment budget as well as a timeline to purchase what you’re looking for. You can also fill in more information such as how you’ll be purchasing the property, which renter you’re targeting, and how many properties you own already.

You’ll then get access to a heatmap with rental properties in your area of choice based on the information you’ve provided. However, you can’t access the analytics until you sign up.

Where Is Mashvisor Located?

Mashvisor’s head offices are located in Campbell, CA, United States. However, the Mashvisor real estate investment platform covers the entire US market.

Who Owns Mashvisor?

Mashvisor was founded in 2014 by Peter Aboalzolof, who serves as the current CEO, and Mohammed Jebrini, who’s the company’s CTO.

Does Mashvisor Have MLS Data?

Mashvisor listings and property details are pulled from the MLS. You’re therefore assured of getting the latest and most accurate data about the properties for sale and rent within any area.

How To Cancel Mashvisor Subscription?

You can follow the following steps to cancel your Mashvisor subscription:

- Log in to your Mashvisor account

- Find “My Account” at the top right corner

- Access your account information by clicking on “View Profile”

- Go to the account settings page and click on “Billing” on the left-side tab

- Click on “Cancel Plan” at the top right corner

Final Thoughts

Real estate investors always have scores of daily tasks to achieve. These tasks can become taxing and time-consuming. However, the use of technology has made everything easier and streamlined our lives.

Mashvisor is a one-stop shop for smart investors who wish to make profitable investment decisions. As seen in this Mashvisor review, this platform definitely leads the way among its competitors.

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.