How To Wholesale Real Estate In Texas: Step-By-Step (2025)

Apr 17, 2025

If you’ve been wondering how to wholesale real estate in Texas, the answer is simpler—and more exciting—than you might think. Wholesaling is one of the fastest ways to break into real estate investing without needing to buy, renovate, or even own property. And in a high-growth state like Texas, the opportunities to wholesale houses are everywhere.

From booming cities like Austin and Dallas to small towns bursting with potential, Texas real estate offers the perfect playground for new investors. The combination of a strong job market, steady population growth, and housing demand makes Texas wholesaling a smart and scalable business model. Whether you’re starting with zero experience or already know a bit about real estate wholesaling strategies, there’s room for you here.

In this guide, we’ll walk you through exactly how to get started, step by step. Here’s what you’ll learn about wholesaling real estate in Texas:

- What Is Wholesaling Real Estate?

- How To Wholesale Real Estate In Texas (9 Steps)

- Is Wholesaling Houses Legal In Texas?

- How Much Do Real Estate Wholesalers Make In Texas?

- Wholesale Real Estate Contract Texas

- Do You Need A License To Wholesale Real Estate In Texas?

- Can A Realtor Wholesale Property In Texas?

- How Much Money Do You Need To Wholesale Real Estate In Texas?

- Can A Beginner Do Wholesaling Real Estate In Texas?

- Is Wholesaling In Texas Easy?

- Final Thoughts On Wholesaling In Texas

Ready to take your real estate investing to the next level? Learning how to wholesale real estate in Texas is just the beginning. Schedule a FREE Strategy Session with us to learn how our Ultimate Investor Program can unlock even more opportunities and strategies in the Texas market. We'll also help you tailor an investment strategy that's right for you. Don't miss out—take the next step toward maximizing your investment potential today!

*Before we begin our guide on wholesaling real estate in Texas, we invite you to view our video on How To Wholesale Real Estate Step by Step (IN 21 DAYS OR LESS)! Host and CEO of Real Estate Skills, Alex Martinez, provides a comprehensive, step-by-step guide for beginners to start wholesaling real estate!

What Is Wholesaling Real Estate?

In general, wholesaling real estate works like this: the wholesaler and seller enter into a contract for the sale of the property. However, rather than closing on the property and taking possession, the wholesaler agrees to assign his or her rights under the sale contract to a third-party buyer. Unlike the wholesaler, this buyer takes possession of the property. That's important to note; investors aren't buying houses; they are wholesaling contracts.

Rather than purchasing the property and taking possession, the wholesaler has entered into a temporary contract with the owner. The wholesale contract Texas homeowners sign differs from the typical real estate contract in that it gives the wholesaler the right to sell the property to the ultimate buyer on the owner’s behalf, keeping whatever profit they can turn for themselves.

You might wonder why a homeowner would agree to let someone else receive profits from the sale of their home. The answer is that every situation is different. Whether it is due to death, divorce, financial restraints, or some other reason, there are times when an owner wants or needs to dispose of a property quickly. Or, they simply do not want to do the work required to get the property ready to go on the market.

Many of the homes that end up wholesaled are distressed properties, such as homes that are about to go into foreclosure. So, instead, these homeowners contract with an investor to take the problem off their hands. As a result, wholesaling real estate in Texas is not only a viable investment opportunity but common and potentially lucrative.

Read Also: How To Wholesale Real Estate With No Money

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How To Wholesale Real Estate In Texas (9 Steps)

Having a system to launch and operate your real estate investing business is integral to anyone wholesaling real estate in Texas. Following a step-by-step plan as you build your wholesaling business gives you a greater chance for success.

Here are nine steps to consider as you plan to launch your Texas real estate wholesaling business:

- Partner With A Wholesale Mentor

- Learn Texas Wholesaling Laws & Contracts

- Understand The Texas Real Estate Market

- Build A Cash Buyers List

- Find Motivated Sellers & Distressed Properties

- Put Distressed Properties Under Contract

- Assign The Contract To A Cash Buyer

- Close Deal & Collect Assignment Fee

- Double Close or Wholetail When Necessary

Partner With A Wholesale Mentor

The first step when wholesaling real estate in Texas is partnering with a wholesale mentor. While it’s possible to figure it all out on your own, why reinvent the wheel when you can fast-track your success by learning from someone who’s already been there? A mentor offers real-world experience, proven strategies, and guidance through the challenges you’ll face as a new investor.

Texas is a competitive market, and having a mentor can make all the difference. They’ll teach you how to identify the best deals, negotiate with motivated sellers, and build a network of cash buyers—all while avoiding common mistakes. More importantly, a mentor provides the confidence that comes with knowing you’re following a tested blueprint, not just winging it.

Think of wholesaling real estate in Texas like learning to drive. You could teach yourself, but having an instructor ensures you learn the right way, faster, and with fewer bumps along the road. By partnering with someone who has successfully navigated the Texas market, you’ll accelerate your learning curve and be ready to close deals sooner than you ever thought possible.

So, while you can start wholesaling on your own, why not make it easier by learning directly from an expert? It’s the smartest investment you can make in your success.

Read Also: Wholesale Real Estate Mentor: The ULTIMATE Beginner's Guide

Learn Texas Real Estate Wholesaling Laws & Contracts

One of the biggest problems that can arise when operating a real estate wholesaling business is for an unlicensed, inexperienced wholesaler to act like a licensed real estate agent. Before you begin wholesaling, you need to have a thorough understanding of Texas real estate wholesaling laws so you don’t make a misstep before you even get started.

To ensure you operate legally, familiarize yourself with Texas laws and regulations about real estate wholesaling. Seek legal advice if you feel you need it. Texas tightened the laws about wholesaling without a license in 2017 with the passage of Senate Bill 2212. This bill amended the Texas Occupations Code by adding Section 1101.0045. In addition, Section 5.086 was added to the Texas Property Code.

Section 1101.0045 allows you to assign a real estate contract without holding a license as long as you do not use your option or the purchase contract to engage in real estate brokerage and as long as you disclose the nature of your equitable interest to any potential buyer. In other words, you disclose all terms of the purchase contract you have with the seller. Failing to make such disclosures is considered to be engaging in real estate brokerage.

Further, Section 5.086 of the Texas Property Code spells out that before assigning an interest in a real estate contract, a wholesaler must disclose to any potential buyer that they are selling an option or assigning an interest in a contract, making it clear that as a wholesaler, they do not have legal title to the real property.

Failure to adhere to the law by acting as a real estate brokerage without being licensed can result in a Class A misdemeanor. Multiple offenses can result in a felony.

Understand The Texas Real Estate Market

Once you’ve found a mentor, the next step in how to wholesale real estate in Texas is understanding the local market. Texas is massive, with diverse real estate markets ranging from booming urban areas like Dallas and Houston to smaller towns with hidden opportunities. To succeed, you need to know what makes your target market tick.

Start by researching key factors like property values, rental demand, and growth trends in your chosen area. Are people moving in or out? What neighborhoods are up-and-coming? Understanding these details will help you spot deals that cash buyers will jump on.

*Before we continue our guide, be sure to watch our video on the 10 BEST States To Wholesale Real Estate and learn why Texas made our top 10 list!

Covering the entire span of the country, we delve into what sets each of these states apart, creating a perfect environment for both wholesalers and real estate investors.

Want more real estate videos? Be sure to visit our YouTube channel here!

You’ll also need to familiarize yourself with Texas-specific real estate laws and regulations if you plan on wholesaling contracts. Unlike some states, Texas is non-disclosure, meaning sale prices aren’t publicly available. This makes it crucial to learn how to analyze comps and work with tools like the MLS to price deals correctly.

Knowing your market also means understanding your buyers. Are they flippers looking for rehab projects, or are they buy-and-hold investors searching for cash-flow properties? Tailoring your approach to their needs will help you close deals faster.

In short, understanding the Texas market gives you a competitive edge, allowing you to identify opportunities, structure deals, and build relationships that lead to long-term success.

Build A Cash Buyers List

When learning how to wholesale real estate in Texas, you need a solid pool of cash buyers ready to take deals off your hands. Once you secure a wholesale real estate contract, the clock starts ticking, and the window you have to get it to a cash buyer starts closing. This isn’t the time to scramble to find buyers or build relationships—it’s homework that needs to be done ahead of time.

*Be sure to check out this quick video below that talks about how to find cash buyers online for free!

Start by reaching out to potential cash buyers before you land your first deal. Let them know you’re getting into the business and that you would love to connect. This proactive approach not only builds your network but also gives you insight into what they’re looking for in a property. Are they flipping homes in need of repairs or searching for turnkey rentals? Understanding their preferences helps you tailor your deals to their needs.

This step is also a chance to deepen your knowledge of the Texas market. Conversations with cash buyers will give you a clearer picture of demand in specific neighborhoods, price points, and property types. By preparing in advance and fostering these relationships, you’ll be ready to hit the ground running and assign contracts with confidence when the opportunity arises.

Find Motivated Sellers & Distressed Properties

The next step in how to wholesale real estate in Texas is finding motivated sellers and distressed properties. Texas offers a wide range of opportunities in this area, thanks to its diverse housing market and economic activity. Motivated sellers are often individuals facing financial difficulties, foreclosure, or a pressing need to sell quickly. Distressed properties, on the other hand, are typically undervalued due to poor condition or the seller’s circumstances.

Focusing on motivated sellers and distressed properties is essential because these situations allow wholesalers to secure properties below market value. In turn, this creates room to negotiate favorable terms and earn profitable assignment fees when wholesaling contracts to cash buyers.

Here are a few ways to find motivated sellers and distressed properties when wholesaling real estate in Texas:

- Delinquent Property Taxes: Many Texans face foreclosure due to unpaid property taxes. Helping these owners settle their tax debt can be a win-win situation, as you save them from auction while securing a deal.

- Foreclosure Auctions: Texas has a fast foreclosure process, making pre-foreclosure leads an excellent opportunity. Paying off the mortgage or negotiating with the lender can help close deals quickly.

- Inherited Properties: Heirs in Texas often inherit homes they don’t want to maintain. Reaching out to probate attorneys or using obituaries as leads can connect you with motivated sellers.

- Code Violations: Many Texas cities issue code violation notices for properties needing repairs. Networking with local inspectors can help identify owners eager to sell.

- Liens and Debts: Multiple liens on a property often signal financial trouble, making these owners prime candidates for quick sales.

- FSBO Properties: Texas has a strong FSBO market, with many properties needing repairs or being overpriced. Connecting with these sellers can yield great deals.

- Expired MLS Listings: Unsuccessful property listings often have underlying issues like high prices or needed repairs, presenting opportunities for wholesalers.

Additionally, the Ultimate Investor Program by Real Estate Skills teaches strategies to acquire, flip, and wholesale real estate in Texas, including sourcing deals directly from the MLS. By leveraging these techniques, you’ll be well on your way to wholesaling success in Texas.

Read Also: How To Find Off-Market Properties In Texas: The 4 Best Sources

Put Distressed Properties Under Contract

Once you’ve identified distressed properties, you will want to do your due diligence before making an offer. Figure out the property’s after-repair value or ARV so you can determine what to offer. You don’t want to go too high and then have problems finding a cash buyer.

The maximum allowable offer (MAO) is a proven calculation real estate investors use to decide what to offer for a particular investment property. Understanding this equation ensures a desired profit given the property’s expected fixed and rehab costs.

Before you determine your MAO, let's look at how to lock in that property.

Watch this video to learn how to confidently fill out real estate contracts and secure your deal.

You can calculate the MAO for a potential property by beginning with the ARV and then subtracting the fixed costs, costs of rehab, and your desired profit. This number represents the MAO, which will tell you the top dollar you should offer for the property.

Once you know the MAO, you know what the final buyer will likely pay, which will help you determine what to offer.

Read Also: Estimating Rehab Costs: A 5-Step Guide For Real Estate Investors

Assign The Contract To A Cash Buyer

The next step in how to wholesale real estate in Texas is assigning the contract to a cash buyer. After securing a property under contract with a motivated seller, your focus shifts to transferring your rights to purchase the property to a cash buyer in exchange for an assignment fee. Understanding how this process works in Texas is critical for a smooth and profitable deal.

To find cash buyers in Texas, leverage networking opportunities, local real estate investment groups, and online platforms to market your deal. Texas has a thriving investor community, making it easier to connect with active buyers interested in properties like yours.

Dive into real estate wholesaling with confidence. Download our FREE Wholesaling Cold Calling Script!

Once you’ve identified a buyer, you’ll execute an assignment contract. This legal agreement transfers your rights in the original purchase contract to the buyer and outlines the assignment fee. For example, if you contracted a property for $200,000 and negotiated a $15,000 assignment fee, the buyer will pay you $15,000 while proceeding with the original $200,000 agreement with the seller.

This strategy is particularly effective in Texas, where wholesaling can be done without requiring you to purchase the property outright. By leveraging a wholesale real estate contract, you can generate profits quickly and efficiently, making wholesaling a viable and rewarding investment strategy in the Lone Star State.

Close Deal & Collect Assignment Fee

The next step in how to wholesale real estate in Texas is closing the deal—where everything becomes official. Whether you’re assigning a contract or double closing, this step solidifies your profits and completes the transaction. With a wholesale contract, Texas cash buyers can't say no; this step will get easier and easier.

When wholesaling contracts, closing the deal means transferring your rights under the purchase agreement to the cash buyer. This typically takes place at a title company or a real estate attorney’s office, as required by Texas law. The cash buyer pays the assignment fee, and the title company facilitates the property’s transfer from the original seller to the buyer. For instance, if the seller agreed to $150,000 and you negotiated a $10,000 assignment fee, you’ll receive your $10,000 as part of the closing process.

If you’re double closing, the process involves two consecutive transactions. First, you’ll close on the property with the seller, temporarily taking ownership. Immediately after, you’ll sell the property to the cash buyer at a higher price. While double closing requires two sets of closing costs and additional coordination, it can be beneficial if either party prefers not to disclose the assignment fee.

Both methods are commonly used when real estate wholesaling Texas assets and ensure you can navigate the final steps smoothly. Mastering these closing processes is essential for successful wholesaling.

Double Close Or Wholetail When Necessary

Double closing is a type of real estate investment strategy when two real estate transactions take place simultaneously. This strategy typically involves three parties: the seller, the wholesaler, and the end buyer. It conceals the amount you make on the deal from both the seller and the end buyer and is the perfect Plan B for anyone wholesaling in Texas. Here’s how it works:

The wholesaler purchases a distressed property at a discount from the seller and then immediately sells the property to the end user. The funding is set up so that the cash proceeds from the sale of the property to the end buyer can fund the purchase from the original seller through escrow.

This strategy involves the title company receiving the end buyer's funds and then closing out the original transaction so that the wholesaler can immediately close the second transaction. Those proceeds are what the wholesaler makes on the deal.

One caveat, however. In Texas, it is not legal to use proceeds from the second portion of the deal to fund the first purchase. Instead, you’ll have to use hard money, sometimes called same-day funds or one-day bridge funding, to make the original purchase. You can then sell immediately to the end buyer. The goal of concealing what you make is still realized despite the separate requirements under Texas law.

If you don't line up a buyer in time for a double closing, consider wholetailing the property.

Wholetailing is a strategy that entails purchasing the wholesale deal, cleaning up and making minor improvements to the property, and then listing it on the multiple listing service (MLS) to sell to an investor buyer. It doesn't entail completing a full rehab. However, the minor upgrades often result in amplified profits for the wholesaler.

Read Also: How To Get MLS Access In Texas

Is Wholesaling Houses Legal In Texas?

The short answer is yes, wholesaling houses is legal in Texas, whether you are in Houston or Austin or Dallas—or wherever you plan to operate in the state of Texas. However, you have to understand the real estate law that applies and ensure you follow all state laws and regulations that apply to operating a wholesaling real estate business in Texas.

The Texas Real Estate Commission (TREC) set forth the rules governing all real estate transactions in the state, including wholesaling houses.

The most common reason for problems to arise is for a wholesaler to cross the line and start acting like a real estate agent or broker, despite not being licensed. Once investors start doing things that require a license, they are at risk of breaking the law. As a result, you need to know how to wholesale real estate in Texas in a way that circumvents the need for a license.

To avoid this, keep in mind you aren’t marketing the home to the masses as a real estate agent would. Instead, your goal is to identify properties and match them up with cash buyers, either by contract assignment or facilitation of a short-term sale. Wholesaling real estate in Texas is legal as long as you abide by the laws and regulations that govern the strategy.

How Much Do Real Estate Wholesalers Make In Texas?

Real estate wholesaling Texas properties can coincide with a lot of potential. Because wholesalers are self-employed, there is really no limit to what they can potentially make at wholesale. You just need to have the ability to develop a proven method for finding quality real estate deals and connecting those homeowners with qualified potential buyers.

But, if you’re wondering what you are likely to make, don’t expect a six-figure income right out of the gate. It takes time to build your real estate investing business, just like any endeavor. If you’re willing to put in the time and effort, however, you can expect a decent return.

There are plenty of examples of wholesalers earning from $250,000 all the way to $700,000 and more. They’ve found success by creating a system that works. And, while they may tweak it here and there, it’s a process they continue to follow, again and again, to identify and close wholesale deals. If for nothing else, wholesaling real estate in Texas can be broken down into easy-to-follow steps, not the least of which we can teach you how to accomplish.

Wholesale Real Estate Contract Texas

Assuming you don’t already have your real estate license in Texas, you will need to familiarize yourself primarily with two documents important to your wholesale real estate business before you start looking for that first deal.

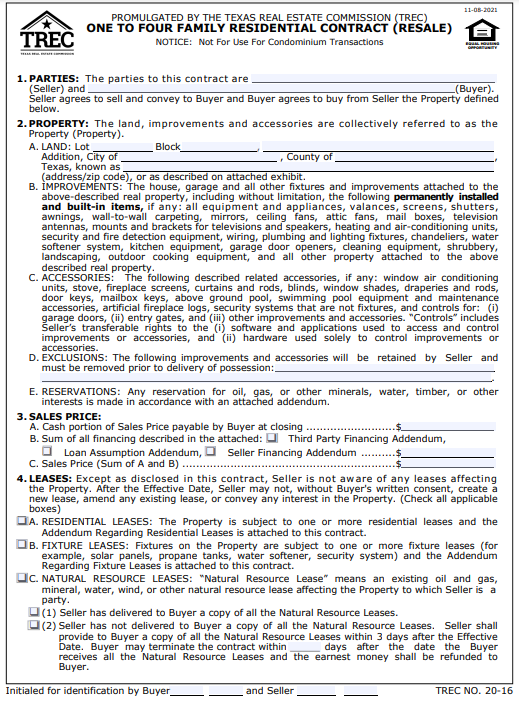

The first is the primary purchase agreement used for residential real estate in Texas. Here’s the first page of the resale purchase agreement form available through the Texas Real Estate Commission:

Using this wholesale real estate contract, you will input the property address and selling price, as well as the seller and buyer (your) information. You will also answer a number of questions regarding the property itself.

Executing this contract is the step you will need to take with a seller and property before you can wholesale it. Wholesaling involves assigning your rights and obligations of a contract over to the ultimate buyer. If you have no contract, you have nothing to assign.

Keep in mind that a seller may not have experience with wholesaling and may not even realize it is a legal real estate investment strategy. But even sellers who have never heard of wholesaling in the past will likely not object as long as they are (1) guaranteed to receive the sales amount stipulated by the contract; and (2) can close on the property on time, as called for in the contract. Be sure to have this conversation early so you don’t surprise a seller after they are under contract.

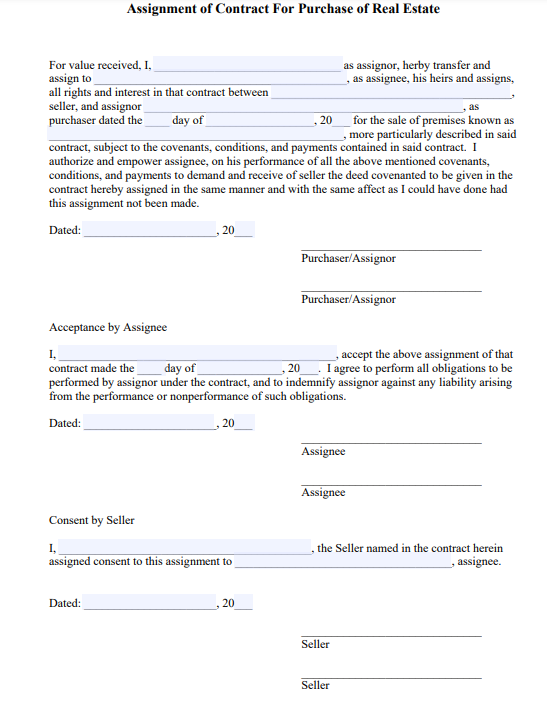

When learning how to wholesale real estate in Texas, the second document you need to familiarize yourself with is the assignment contract itself. You can create this contract yourself as long as you include all the terms of the assignment. Here is one example of an assignment contract:

In addition to the terms outlined in the above example, it’s also important to include the fee that will be received by the assignor as well as the date(s) it will be received. In addition to providing all terms, the assignment contract will need to be signed by the assignor and assignee.

A signed assignment contract is absolutely necessary to wholesale the property in Texas legally.

Read Also: Wholesale Real Estate Contracts: Download FREE PDF Templates

Do You Need A License To Wholesale Real Estate In Texas?

A lot of people come to us asking the same question: Do you need a real estate license to wholesale in Texas? No, just as with other types of real estate investment, you do not need a real estate license to wholesale real estate in Texas. As discussed earlier, however, you need to ensure you do not act as a real estate brokerage when operating your real estate investment business.

However, there are advantages to having a real estate license and engaging in wholesaling. If licensed, you are not limited by laws that apply to non-licensed wholesalers regarding assignment contracts and marketing of properties.

Can A Realtor Wholesale Property In Texas?

Yes, a realtor can wholesale property in Texas. If you have your real estate license, you have some advantages over a non-licensed individual. If licensed, you will earn a commission instead of, or in addition to, a wholesale fee.

A licensed agent does not need to be as concerned about the laws that apply to non-licensed wholesalers regarding the ability to market a property and to execute an assignment contract. There are fewer legal worries when you’re a licensed agent.

A real estate license also gives you more credibility with a seller in most cases. This can be important if you’re competing with non-licensed wholesale operators for a property. You can assure the potential seller that you will do everything according to the standards you’re held to as a realtor. Be sure to disclose your status as a licensee in all of your wholesale real estate contracts and purchase agreements.

How Much Money Do You Need To Wholesale Real Estate In Texas?

If you already know how to wholesale real estate in Texas, you know you can do it with a surprisingly small budget. The beauty of doing wholesale real estate is that—unlike other types of real estate investment—you can get started with very little capital. That’s because you don’t have to purchase the property, so you aren’t putting large amounts of money at risk like you are with a different type of investing, like flipping houses.

That’s not to say you can just dive in without a penny in your pocket and have no game plan or mentor yet, but expect to be successful. But, because you serve as the middleman, your financial risk is very low as long as you have a strategy that helps you connect the right buyer with the right property.

Following a step-by-step process will allow you to grow your business over time, making money from selling a property you never owned. You’ll find that rather than 30 to 45 days or more to wait for closing, as with many real estate transactions, you’ve got deals that close within days—even hours—of going under contract.

Your risk is also further reduced because you will be dealing with cash buyers. One of the biggest risks in more traditional real estate transactions is that the buyer’s financing falls through, and the deal doesn’t close.

Despite not needing a great deal of money upfront, there are still some costs to consider:

- Direct mail marketing

- Costs associated with identifying undervalued properties, which could involve subscriptions to lead-generating platforms and wholesaling software

- Locating motivated sellers

- Real estate market research

- Building a real estate network of potential buyers, which may include costs such as subscriptions to networking clubs

- Service or platform that enables you to track your numbers

- Cost of finding homeowner contact information

- Paying an advisor or other trusted investor to guide you through your first few deals

Read Also: Real Estate Marketing Ideas: The 10 Best Campaign Strategies

Can A Beginner Wholesale Real Estate In Texas?

Yes, a beginner can learn how to wholesale real estate in Texas successfully. However, it’s advisable to engage an experienced, successful wholesaler to guide you through your first few transactions.

It’s also advisable you do your homework ahead of time. Be sure you understand the market and have a ready list of cash buyers.

Read Also: Best Places To Buy Rental Property In Texas For 2025

Is Wholesaling In Texas Easy?

No, but it can be easier with a coach, a mentor, and extensive training like we offer at Real Estate Skills in the Ultimate Investor Program. With a little preparation and perseverance, you can build a successful business in real estate wholesaling!

But don't just take my word for it. Watch the 4+ year journey of Michael, a member of the Ultimate Investor Program at RealEstateSkills.com. Over the past 4 years, Michael has undergone a remarkable transformation from having no prior real estate knowledge to becoming a successful investor in the Rockwall, Texas market.

If you want to shortcut your path to success, join a community of expert wholesalers and receive step-by-step wholesaling instruction from highly accomplished investors. Then, check out our free training and get started with Real Estate Skills today!

Read Also: How To Invest In Real Estate In Texas: Top Strategies In 2025

Final Thoughts On Wholesaling In Texas

Wholesaling real estate is one of the most accessible ways to break into the Texas real estate market—and it doesn’t take a lot of money to get started. While you absolutely can build a full-time income through real estate wholesaling in Texas, your success will come faster if you take the time to learn the strategy, understand the local laws, and study your market.

The most successful wholesalers don’t go it alone—they connect with mentors, ask smart questions, and surround themselves with experienced investors. If you're serious about learning how to wholesale real estate in Texas, be sure to stay compliant, sharpen your negotiation skills, and keep your pipeline full of leads.

With the right knowledge, support, and consistency, there's no reason you can't build a thriving business wholesaling real estate in one of the most opportunity-rich states in the country.

Ready to take your real estate investing to the next level? Learning how to wholesale real estate in Texas is just the beginning. Watch our Free Real Estate Investor Training to learn how our Ultimate Investor Program can unlock even more opportunities and strategies in the Texas market. Don't miss out—take the next step toward maximizing your investment potential today!

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.