How To Flip Houses In Vermont: 15-Step Home Renovation Guide

Oct 22, 2025

What: Flipping houses in Vermont involves purchasing undervalued properties, renovating them to increase their market value, and selling for a profit. The article covers opportunities in both larger towns like Burlington and Montpelier as well as smaller rural areas.

Why: Vermont’s housing market offers profitable opportunities due to limited inventory, strong demand for updated homes, and affordable entry points in many regions, making it ideal for house flippers.

How: Follow the article’s steps: research local Vermont markets, build a reliable renovation team, secure financing, identify undervalued properties, manage renovations efficiently, and list and sell strategically to maximize profit.

Learning how to flip houses in Vermont can be an exciting and financially rewarding venture for real estate entrepreneurs. With its thriving economy, a high percentage of equity-rich homeowners (75.9 percent of mortgaged homes were equity-rich), and a promising real estate market, Vermont offers a unique environment for house flipping.

Suppose you've been considering diving into real estate investing in Vermont. In that case, this step-by-step guide will provide valuable insights and strategies to help you navigate the process successfully.

We will dive into the fundamental aspects of investing in The Green Mountain State to ease new investors into the prospect of flipping houses. Whether you possess a wealth of experience in the investment industry or are taking your first steps as a beginner, this guide will equip you with everything you need to know, including:

- What Is Flipping Houses?

- Why Flip Houses In Texas?

- Vermont House Flipping Statistics

- How To Flip Houses In Vermont In 15 Steps

- How Much Do House Flippers Make In Vermont?

- Is House Flipping Illegal In Vermont?

- Do You Need A License To Flip Houses In Vermont?

- How Much Does It Cost To Flip A House In Vermont?

- How To Flip A House In Vermont With No Money

- What's The Best Place To Flip Houses In Vermont?

- Is It Hard To Flip Houses In Vermont?

- How Do You Find Contractors For Flipping Houses In Vermont?

- Final Thoughts On Flipping Homes In Vermont

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Is Flipping Houses?

Flipping houses, a popular investment strategy in the real estate sector has developed a reputation as a well-oiled wealth-building machine. If for nothing else, the growing popularity of house flipping can be observed in just about any market cycle (up or down), making it a great addition to any portfolio.

In fact, according to ATTOM Data Solutions' latest U.S. Home Flipping Report, the average flip in the United States resulted in a return on investment of 29.6%, which translated to a gross flipping profit of about $72,000 per deal. The average annual return of the S&P 500 is only around 10%, according to Nerdwallet. There are, of course, significant differences between these two investment platforms, but the fact remains that flipping houses has proven it belongs in an investment portfolio. Additionally, the State of Vermont currently has 49 properties in foreclosure, 18 bank owned properties, and 31 headed for auction, according to realtytrac .

Otherwise known as rehabbing, flipping houses can be incredibly rewarding, which leaves one crucial question: What exactly is it? Simply put, it’s a real estate investing strategy that involves buying, rehabbing, and reselling the property for a profit. However, it is essential to recognize that each step in this process is meticulously optimized to maximize profit margins and mitigate risks. To succeed, investors must dedicate themselves to thorough research, due diligence, and a keen understanding of the local market dynamics.

Why Flip Houses In Vermont?

Flipping houses in Vermont offers unique opportunities for real estate investors due to the state's attractive property values and low competition. Vermont's real estate market has demonstrated a stable appreciation trend, with the median home price in 2025 standing at approximately $414,400. This relatively moderate price point compared to neighboring states provides a more accessible entry for investors. The state's picturesque landscapes and historical charm make it appealing to buyers seeking vacation homes or second properties, which can translate into profitable flipping opportunities.

Another key factor driving the house flipping market in Vermont is its low inventory levels. With a limited supply of available homes, particularly in sought-after areas like Burlington and Stowe, properties often sell quickly. This demand creates an environment where renovated homes can command premium prices. According to recent data, the average days on market for homes in Vermont has decreased to around 45 days, highlighting the brisk pace at which properties are moving. This quick turnover is advantageous for flippers looking to maximize their returns on investment.

Vermont's favorable market conditions are further supported by a growing trend in remote work, which has led to increased interest in rural and semi-rural properties. As more individuals and families seek out serene and scenic locations for their primary residences, properties in Vermont are becoming increasingly attractive. This trend enhances the potential for profitable flips, as renovated homes in desirable areas can capture the interest of remote workers and second-home buyers alike. Overall, Vermont's stable market, low inventory, and evolving buyer preferences make it a promising state for house flipping ventures.

Read Also: How To Wholesale Real Estate In Vermont

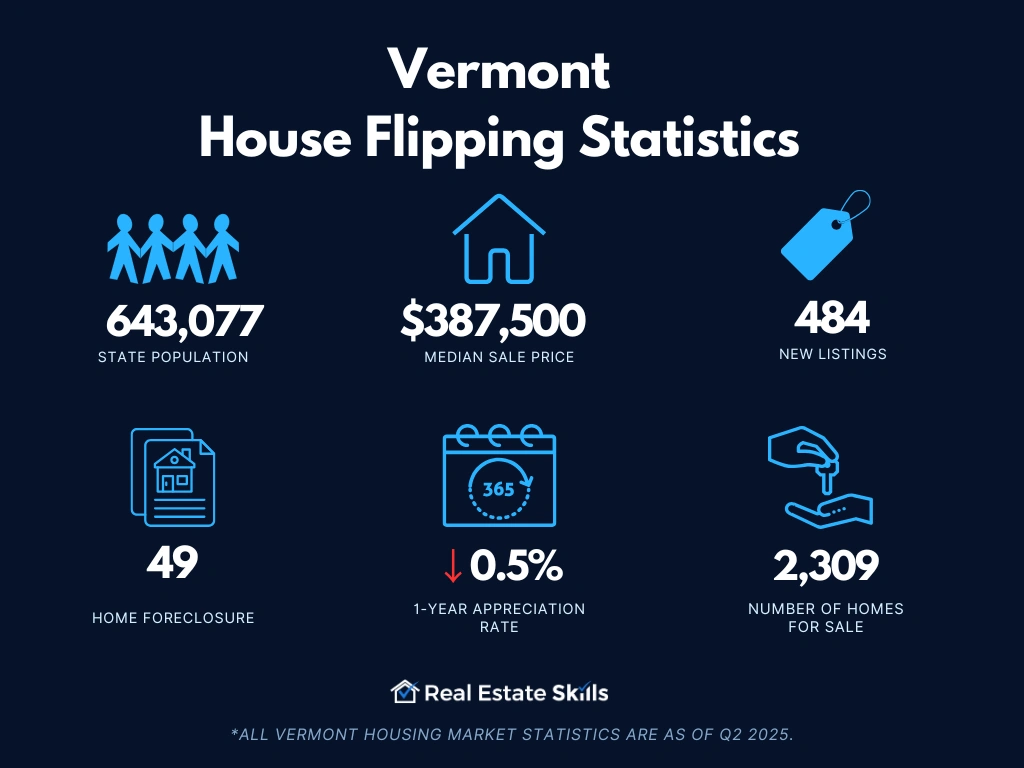

Vermont House Flipping Statistics

Investors must grasp the local market's key indicators to learn how to flip houses in Vermont. They must acquire and internalize the following information (at the very least) before investing a single dollar:

- Population: 643,077

- Employment Rate: 63.2%

- Median Household Income: $81,211

- Median Sale Price: $387,500 (+7.2% Year-Over-Year)

- Number Of Homes Sold: 374 (+0.5% Year-Over-Year)

- Median Days On Market: 94 (+27 Year-Over-Year)

- Number Of Homes For Sale: 2,309 (+15.8% Year-Over-Year)

- Number Of Newly Listed Homes: 484 (-18.4% Year-Over-Year)

- Months Of Supply: 5 (+0 Year-Over-Year)

- Homes Sold Above List Price: 19.0% (-7.9 Points Year-Over-Year)

- Homes With Price Drops: 14.2% (+2.4 Points Year-Over-Year)

- Home Foreclosure: 49

*All Vermont housing market statistics are as of Q2 of 2025.

How To Flip Houses In Vermont In 15 Steps

Learning how to flip houses in Vermont isn’t as intimidating or confusing as many assume; it’s only as complex as investors want to make it. For those who want to make the process more approachable, consider following this seven-step guide:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Choosing the right market is a crucial first step in house flipping, as it significantly impacts the potential profitability of your investment. In Vermont, the key is to focus on areas with strong demand, stable property values, and promising growth trends. Cities such as Burlington, South Burlington, and Stowe are notable for their robust real estate markets and can offer lucrative opportunities for flippers. Analyzing recent market trends and property values in these locations helps identify neighborhoods with potential for high returns.

Consider factors such as local economic conditions, job growth, and population trends when selecting your market. For instance, Burlington, being Vermont’s largest city, has seen a steady increase in property values and offers a dynamic market with diverse buyer interests. On the other hand, South Burlington’s growing amenities and expanding residential areas make it an attractive choice for long-term investments and higher resale values. Assessing these elements will ensure you target markets with strong demand and stable or increasing home prices.

Additionally, evaluate local competition and saturation levels in your chosen market. A market with fewer active flippers and a high demand for renovated homes can provide a competitive edge. Researching local real estate reports and connecting with local realtors can offer valuable insights into which areas are ripe for flipping. By carefully selecting your market, you can enhance your chances of achieving a profitable house-flipping venture in Vermont.

Find Your Money

Securing the right financing is essential for successfully flipping houses in Vermont. Finding reliable funding sources helps you cover acquisition costs, renovation expenses, and other financial aspects of your project. The two primary options are private lenders and hard money lenders, each offering distinct advantages. Private lenders are often individuals who provide personal funds for real estate investments, while hard money lenders are specialized institutions that focus on short-term, asset-based loans. Understanding how to access these resources can significantly impact the success of your house-flipping venture.

To find private and hard money lenders, you need to explore various channels and evaluate your options carefully. Each type of lender has its own criteria, terms, and application processes, so it’s crucial to choose the one that best aligns with your project needs and financial situation.

How To Find Private & Hard Money Lenders

Private lenders can offer flexible terms and a more personalized approach to financing. To locate a private lender, start by networking within real estate investment groups, attending local meetups, or leveraging personal connections. Building relationships with real estate agents and other investors can also lead to introductions to private lenders. Websites and platforms such as Kiavi and Lima One provide directories of both local and national lenders, making it easier to find potential private lenders and review their offerings.

Hard money lenders typically offer faster access to funds compared to traditional financing options. To find a hard money lender, research reputable companies online and compare their loan terms and interest rates. Platforms like Kiavi and Lima One are valuable resources for locating hard money lenders, as they list various options and provide contact information. Additionally, attending real estate investment seminars and joining industry forums can help you connect with hard money lenders who are familiar with Vermont’s real estate market.

In conclusion, securing the right financing through private or hard money lenders is crucial for a successful house-flipping project in Vermont. By exploring various resources and establishing strong connections, you can access the funds needed to execute your investment strategy and maximize your profits.

Find Three Contractors

Securing reliable contractors is a key step in the house-flipping process. For a successful renovation, it’s crucial to work with experienced professionals who can handle various aspects of the project, from plumbing and electrical work to general construction. Finding three trustworthy contractors ensures you have options to compare bids, expertise, and timelines, which helps you make informed decisions and potentially save on costs. Additionally, having multiple contractors provides flexibility in scheduling and execution, reducing the risk of delays in your project.

Start by gathering recommendations from real estate agents, local investment groups, and fellow flippers. Online platforms like HomeAdvisor, Thumbtack, and Angi offer directories of pre-screened contractors, complete with reviews and ratings. These resources can help you find contractors with the right skills and a proven track record. It’s important to vet each contractor thoroughly, checking their credentials, past work, and references to ensure they meet your project’s requirements.

How To Find A General Contractor

Finding a general contractor involves several steps to ensure you select a reputable and skilled professional for your house-flipping project. Begin by researching local general contractors through online platforms like HomeAdvisor and Angi. These platforms provide detailed profiles, customer reviews, and ratings, which can help you assess the contractor’s reputation and suitability for your project. Look for contractors with experience in similar renovation projects and a solid track record of delivering quality work on time and within budget.

Another effective method is to ask for recommendations from real estate agents, property managers, and other real estate investors in Vermont. Personal referrals often lead to reliable and trustworthy contractors who are familiar with local building codes and market conditions. Additionally, consider visiting ongoing or completed projects by potential contractors to evaluate their workmanship and project management skills. By thoroughly vetting your options and gathering multiple bids, you can select a general contractor who will contribute to the success of your house-flipping venture.

Find An Investor-Friendly Agent

Finding an investor-friendly real estate agent is crucial for navigating the Vermont housing market effectively. An agent with experience in working with investors can provide valuable insights, assist with property selection, and offer strategies for maximizing returns on your house-flipping projects. They understand the unique needs of flippers, such as identifying undervalued properties, assessing renovation potential, and negotiating deals that align with investment goals. Selecting an agent who is familiar with Vermont’s market trends and neighborhoods will enhance your chances of securing profitable opportunities.

An investor-friendly agent not only helps with finding properties but also provides guidance on market conditions, pricing strategies, and potential resale values. Their local knowledge and network can facilitate access to off-market deals and connect you with other professionals in the real estate industry. By leveraging their expertise, you can streamline the house-flipping process and make well-informed decisions that contribute to the success of your investment.

How To Find An Investor-Friendly Agent

To find an investor-friendly real estate agent, start by seeking referrals from other investors, real estate groups, or online forums. Look for agents who specialize in working with investors and have a proven track record of successful flips. You can also explore real estate platforms and websites to find agents with strong reviews and ratings from other investors.

Interview potential agents to assess their experience with investment properties and their understanding of the Vermont market. Ask about their previous success with house flipping projects and how they approach finding and negotiating deals for investors. An effective agent will demonstrate a proactive approach, offer market insights, and provide a clear strategy for supporting your flipping goals. By choosing an agent who aligns with your investment objectives, you can enhance your house-flipping efforts and achieve better outcomes in Vermont’s real estate market.

Find A House To Flip

Finding the right property is crucial for a successful house-flipping venture in Vermont. Start by using various methods to identify potential homes that meet your investment criteria. One effective approach is "driving for dollars," which involves exploring neighborhoods to spot distressed or vacant properties that may not yet be listed for sale. This hands-on method allows you to uncover hidden opportunities that might not be visible online.

Direct mail campaigns are another powerful tool. By sending targeted letters or postcards to property owners who might be motivated to sell, you can generate leads on potential flips. Focus your campaigns on areas with high turnover rates or neighborhoods experiencing economic changes. Combining this with data from the Multiple Listing Service (MLS) can give you a comprehensive view of available properties. The MLS provides access to up-to-date listings, including detailed information on property conditions, pricing, and market trends, which can help you make informed decisions.

Alternative Strategies to Find a House

When exploring alternative strategies to find houses, consider the following methods:

-

The Day Zero Strategy: This involves targeting newly listed properties immediately as they hit the market. Act fast to make offers on homes before they become highly competitive or attract multiple bidders.

-

The Old Listing Strategy: Look for properties that have been on the market for a while and have not sold. These listings may indicate a motivated seller open to negotiations or price reductions.

-

The Wholesaler Strategy: Network with real estate wholesalers who specialize in finding and negotiating deals on distressed properties. They often have access to off-market deals and can present opportunities that align with your flipping goals.

In conclusion, finding a house to flip in Vermont requires a combination of proactive searching and strategic approaches. By leveraging methods such as driving for dollars, direct mail campaigns, and MLS data, you can uncover valuable opportunities. Additionally, employing alternative strategies like The Day Zero Strategy, The Old Listing Strategy, and The Wholesaler Strategy can enhance your search and increase your chances of securing a profitable flip.

Analyze The Property

Analyzing the property is a crucial step in the house-flipping process in Vermont. This phase involves examining key financial metrics to assess whether the property is a sound investment. The primary factors to consider are the after-repair value (ARV), repair costs, and purchase price. Understanding these elements helps you gauge the potential profitability of the flip and make informed decisions.

After-Repair Value

Calculating the ARV, or after-repair value, is essential for estimating the potential market value of a property once renovations are completed. To determine the ARV, use comparable sales, or "comps," which are properties similar to the one you plan to flip that have recently sold in the area. For accurate comparisons, look for properties with similar features such as bed and bath count, square footage, and location within the same neighborhood or nearby area. Once you gather these comps, calculate the average sale price to derive the ARV for your property. This estimate helps set realistic expectations for the property's post-renovation value and informs your investment strategy.

Repair Costs

Estimating repair costs is another critical component of property analysis. Conduct a thorough inspection of the property to identify all necessary repairs and renovations. Obtain quotes from multiple contractors to get an accurate estimate of both labor and material costs. It's also wise to include a contingency budget for unexpected expenses, typically around 10-15% of the total repair budget. By carefully assessing repair needs and consulting with professionals, you can accurately project the costs involved and avoid potential financial pitfalls.

Purchase Price

Determining the right purchase price involves integrating the ARV and repair costs into a comprehensive formula to calculate your maximum allowable offer (MAO). This formula should include:

- ARV: The expected value of the property after repairs.

- Hard Money Loan Costs: Total expenses related to hard money loans, including interest rates, origination fees, and points.

- Private Money Loan Costs: Costs associated with private money loans, including interest and duration.

- Front-End Closing & Holding Costs: Costs incurred during the purchase and holding period, such as insurance and taxes.

- Backend Closing Costs: Typically around 1% of the ARV.

- Realtor Fees: Standard fees are around 6% of the purchase price, though investor-friendly agents might accept lower rates.

- Projected Profit: Desired profit margin based on typical returns, which can vary but should be factored into the overall investment calculation.

By subtracting these costs from the ARV, you determine your MAO, which is the highest price you can pay for the property while still ensuring a profitable flip. This careful analysis helps in making well-informed investment decisions and maximizing your potential returns.

Perform Due Diligence When The Offer Is Accepted

Once your offer on a Vermont property is accepted, the next critical step is to perform thorough due diligence. This process involves a detailed evaluation of the property to ensure there are no hidden issues that could affect the profitability of your flip. Begin by reviewing the property’s "scope of work"—a comprehensive list of repairs and renovations needed to bring the home up to your desired standard and achieve your after-repair value (ARV).

Start with a professional property inspection to identify any structural, electrical, or plumbing issues that might not have been apparent during your initial assessment. This inspection will provide a detailed report on the property's condition, including any necessary repairs or improvements. Use this information to refine your scope of work and adjust your renovation budget accordingly.

Additionally, verify the property’s title to ensure there are no liens or legal encumbrances that could complicate the transaction. Ensure that all permits and zoning regulations are in place for the planned renovations. By meticulously reviewing the scope of work and conducting thorough due diligence, you can mitigate risks and enhance the potential for a successful and profitable house flip in Vermont.

Close On The Deal

Closing on a property is the final step in the house-flipping process, and it's crucial to execute it smoothly to ensure your investment is secure. In Vermont, closing involves several key steps, starting with finalizing your financing and securing all necessary funds. If you’ve used a hard money lender or private funding, ensure that the funds are in place and ready for disbursement at closing.

Review and sign all closing documents, which typically include the purchase agreement, title transfer documents, and loan documents if applicable. It’s essential to carefully read these documents to ensure all terms and conditions match what was agreed upon. Your attorney or closing agent will help coordinate this process and ensure that everything is in order.

During the closing meeting, you’ll also need to make the final payment, which includes the purchase price of the property, any closing costs, and fees. After payment, the title of the property will be transferred to your name or your LLC, officially completing the purchase. Ensure that the property’s title is clear and that no outstanding liens or issues remain.

Successfully closing on the deal in Vermont marks the official beginning of your house-flipping project. With the property now under your control, you can move forward with your renovation plans and start working toward turning the property into a profitable investment.

Renovate The House

Renovating the house is a crucial step in the flipping process, as it transforms the property to meet or exceed its projected After-Repair Value (ARV) and aligns it with comparable properties. In Vermont, it's important to focus on renovations that will appeal to the local market without overextending your budget. Aim to enhance the property to a standard that is competitive but not extravagant, ensuring you strike a balance between improving the home and maximizing your return on investment.

Before you begin, ensure you have six essential documents in place to protect your investment and clarify expectations:

-

Independent Contractor Agreement: This document outlines the terms of your working relationship with the contractor, including payment terms, timelines, and specific responsibilities. It helps establish clear expectations and provides legal protection for both parties throughout the renovation.

-

Final Scope Of Work: This detailed outline lists all the tasks, materials, and timelines required for the renovation project. It ensures that both you and the contractor have a clear understanding of what needs to be done, helping to keep the project on track and within budget.

-

Payment Schedule: This document specifies the amounts and timing of payments to the contractor based on the completion of defined milestones. It helps manage the contractor’s progress and ensures that payments are made in alignment with the work completed.

-

Insurance Indemnification Agreement: This agreement confirms that the contractor has the necessary insurance coverage and protects you from liability for any accidents or damages that occur during the renovation process.

-

W-9: This tax form collects the contractor's taxpayer identification information for IRS reporting purposes. It ensures compliance with tax regulations and facilitates accurate reporting of payments made to the contractor.

-

Final Lien Waiver: This document, signed by the contractor, confirms that they have received full payment and relinquish any future claims against the property. It protects you from potential disputes or additional financial demands after the renovation is complete.

With these documents in place, you can proceed with the renovation confidently, knowing that you’ve covered all legal and financial bases. This will help ensure a smooth renovation process, ultimately leading to a successful house flip in Vermont.

This is a lot of information to take in, and navigating the complexities of flipping houses in Vermont can be challenging. If you're interested in learning how to flip houses in Vermont successfully, please enroll in our free training program. Our program will provide you with everything you need to confidently and profitably flip homes in Vermont.

Prep & List The House On The MLS

Once the renovation is complete, the next step in flipping houses in Vermont is to prepare the property for sale and list it on the Multiple Listing Service (MLS). This process is critical as it involves presenting the home in its best light to attract potential buyers and achieve the highest possible selling price. Ensuring that every detail is addressed before listing will make your property stand out in a competitive market.

-

Final Punchlist: Begin with a final punchlist to address any minor repairs or finishing touches needed. This list should include tasks like fixing small imperfections, touching up paint, and ensuring that all systems and fixtures are in working order. A thorough final inspection will help to catch any last-minute issues that might detract from the home’s appeal.

-

Home Staging: Home staging is an essential step to showcase the property’s full potential. According to the Real Estate Staging Association (RESA), investing about 1% of the sale price into staging can yield an ROI of 5% to 15% over the asking price. Staging involves arranging furniture and decor to highlight the home’s strengths and create a welcoming environment that helps buyers envision themselves living there.

-

Professional Photos: High-quality, professional photos are crucial for making a strong first impression. Good photography can capture the home’s best features and make it more appealing in online listings. Invest in a professional photographer to ensure that the images are well-lit, properly staged, and accurately represent the property.

Set An Enticing Asking Price

Setting the right asking price is critical to attracting potential buyers and achieving a successful sale. To determine an enticing asking price, consider recent sales of comparable properties in the area, the overall condition of your home, and the local real estate market trends. Your asking price should reflect the value added through renovations while remaining competitive within the Vermont housing market. Collaborate with a knowledgeable real estate agent to set a price that balances your investment goals with market realities, ensuring that you attract serious buyers and maximize your return on investment.

Field Offers & Negotiate

Once your house is listed on the MLS, you'll start receiving offers from potential buyers. Fielding these offers and negotiating effectively is crucial to securing a favorable deal. Begin by reviewing each offer carefully to assess its strengths and weaknesses. Key aspects to consider include the offer price, contingencies, and the proposed closing timeline. It’s important to weigh these factors against your goals and needs for the sale.

During the negotiation process, maintain clear communication with potential buyers and be prepared to counteroffer. Focus on negotiating terms that align with your financial goals, such as maximizing the sale price and minimizing contingencies. Flexibility can be an advantage, so be open to compromise on certain terms to facilitate a smoother transaction. If multiple offers are received, use this as leverage to potentially drive up the offer price and secure the best possible deal. Effective negotiation can significantly impact the overall profitability of your flip, so approach this stage with a strategic mindset and a keen understanding of the market dynamics.

Sell The House & Get Paid

The final step in flipping houses in Vermont is to complete the sale and receive your payment. Once you’ve accepted an offer and the transaction has moved past the acceptance stage, the next phase is the closing process. This involves finalizing all legal and financial paperwork, which is typically handled by a real estate attorney or closing agent. They will ensure that all documents are correctly completed and that the sale complies with local regulations.

During closing, the buyer will transfer the funds to you, and you will transfer the property’s ownership to the buyer. This usually involves signing a deed of sale and other necessary documents. Once everything is in order, the transaction is officially recorded, and you receive your payment. Ensure that all aspects of the sale are handled efficiently to avoid delays in receiving your funds. After closing, review the final settlement statement to confirm that all financial details are accurate and that you have received the correct amount. This completes the process of flipping a house, marking the successful end of your investment journey and setting the stage for your next opportunity.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make In Vermont?

In Vermont, house flippers can expect to see varying levels of profitability depending on the specific market conditions and the cities they choose to invest in. As of the latest data from ATTOM Data Solutions, the average gross flipping profit in Vermont stands at approximately $50,000. This figure reflects the typical profit margins after accounting for renovation and acquisition costs, but actual profits can fluctuate based on local demand and property values.

Three of the top cities in Vermont where flippers are seeing substantial returns are:

-

Burlington, VT: With an average gross flipping profit of $65,000, Burlington offers some of the highest returns in the state. Its vibrant economy and strong real estate demand contribute to these favorable profit margins.

-

Stowe, VT: Known for its popular ski resorts and tourism appeal, Stowe sees an average gross flipping profit of $60,000. The area's seasonal influx of visitors boosts the demand for well-renovated properties.

-

South Burlington, VT: Investors in South Burlington can expect an average gross flipping profit of $55,000. The city's growing population and expanding amenities make it a promising location for profitable flips.

Flipping houses in Vermont can be quite lucrative, especially in these high-profit areas. To maximize your returns, focus on understanding local market trends, choosing properties with strong appreciation potential, and effectively managing renovation costs. By leveraging these strategies, you can optimize your investment outcomes in Vermont's real estate market.

Do You Need A License To Flip Houses In Vermont?

While flipping houses in Vermont doesn't require a real estate license, considering its potential advantages is worthwhile. With a license, individuals gain access to a vast professional network, including agents, brokers, and experts who provide valuable connections, insights, and resources. Holding a license also grants direct access to the MLS.

It's essential to stay informed about licensing requirements and regulations specific to Vermont, as they may vary between states. While not mandatory for house flipping in Vermont, being aware of local laws ensures compliance with any licensing requirements that may apply.

Read Also: Vermont Real Estate Classes: Wholesaling, Flipping & Licensing

How To Flip A House In Vermont With No Money

Flipping houses in Vermont without personal funds is possible through alternative financing methods. Private money lenders and hard money lenders, in particular, offer invaluable sources of funding, circumventing traditional banks, credit checks, and lengthy approval processes. These lenders specialize in short-term financing solutions, enabling investors to access funds quickly and expedite their house-flipping projects.

Another effective strategy for flipping houses in Vermont without personal funds is wholesaling. While it may not fit the traditional flip model, wholesaling allows investors to generate returns without using money. In this approach, wholesalers secure a property under contract and then assign that contract to cash buyers for a fee. This method enables investors to generate income without needing significant upfront capital.

What's The Best Place To Flip Houses In Vermont?

Choosing the right city for house flipping in Vermont can significantly influence your success. Here are five cities in Vermont that offer promising opportunities for real estate investors based on property price trends, population growth, and local economic conditions:

- Burlington: Burlington is Vermont’s largest city and a prime location for house flipping due to its strong demand for housing. The city has seen a steady increase in property values, with median home prices rising by approximately 5% over the past year. Burlington’s vibrant economy, driven by education and healthcare sectors, supports a robust real estate market, making it a top choice for flippers seeking reliable returns.

- South Burlington: As a growing suburb of Burlington, South Burlington offers appealing opportunities for house flippers. The city has experienced a notable 4% increase in home values over the past year. With its expanding amenities and strong local job market, South Burlington provides a promising environment for profitable flips, particularly for investors targeting family homes and new developments.

- Stowe: Known for its scenic beauty and popular ski resorts, Stowe is an attractive location for flipping houses aimed at vacationers and second-home buyers. The town has seen property values rise by around 6% in the past year. Its seasonal appeal and high demand for vacation properties make Stowe a lucrative market for those looking to capitalize on Vermont’s tourism-driven real estate sector.

- Rutland: Rutland offers a more affordable entry point for house flippers compared to some of Vermont’s more prominent cities. The median home value in Rutland has increased by about 3% over the last year. With its steady demand for affordable housing and ongoing community development projects, Rutland presents a solid opportunity for investors looking for lower-cost properties with potential for appreciation.

- Montpelier: As Vermont’s capital, Montpelier provides a stable real estate market with moderate growth. The city has experienced a 4% increase in median home prices in the past year. Montpelier’s stable economy and demand for housing from government employees and professionals make it a viable location for house flipping, especially for those targeting properties in the mid-range price bracket.

By focusing on these cities, house flippers can take advantage of Vermont’s diverse real estate opportunities and target markets with favorable growth trends and demand.

With this in mind, we invite you to join our FREE training on house flipping in Vermont. We'll guide you through the ins and outs of finding the perfect property, performing the right renovations, and, ultimately, flipping for a profit. Don't miss out on the chance to turn California's real estate opportunities into your financial success story. Sign up for our free training today!

Read Also: 17 Best Cities To Wholesale Real Estate [UPDATED 202]

Is It Hard To Flip Houses In Vermont?

Flipping houses in Vermont presents both challenges and opportunities. While the state's relatively stable real estate market can offer favorable conditions for flipping, it is not without its difficulties. The main challenges include navigating local regulations, which can be stringent, and dealing with the state's seasonal weather conditions that may impact renovation timelines. Vermont's unique building codes and permitting processes require thorough research and adherence to ensure successful projects.

On the other hand, Vermont's lower property prices compared to neighboring states can make house flipping more accessible for investors. The average home price of around $405,000 provides a more affordable entry point for many flippers. Additionally, the state’s growing demand for homes, particularly in areas like Burlington and Stowe, can create lucrative opportunities if investors are prepared to handle the local market dynamics and renovation challenges effectively.

Final Thoughts On Flipping Homes In Vermont

Flipping houses in Vermont requires strategic planning, effective execution, and leveraging essential resources. Investors can unlock success in Vermont's real estate industry by following proven strategies and adapting to the local market. As a result, it’s critical to learn how to flip houses in Vermont before even taking a single step. Doing so will increase the odds of success and mitigate risk.

At Real Estate Skills, our team of experts is ready to provide you with the tools you need for flipping houses in Vermont. We're committed to providing the knowledge, resources, and support you need to successfully navigate a Vermont property flip. So avoid common mistakes and maximize your returns by leveraging our expertise.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.