How To Flip Houses In Rhode Island: 15-Step Home Renovation Guide

Oct 22, 2025

What: Flipping houses in Rhode Island means purchasing undervalued or distressed properties, renovating them to increase market value, and selling them for a profit. The article outlines this process for the state’s unique markets, from Providence to smaller coastal towns.

Why: Rhode Island offers lucrative opportunities due to high demand in desirable neighborhoods, limited housing inventory, and the potential for value-add renovations to generate strong returns.

How: Follow the step-by-step guidance in the article: research local market trends, assemble a skilled renovation team, secure financing, identify and evaluate properties, manage renovations efficiently, and list and sell strategically to maximize profit.

With a modest 1,545 square miles, Rhode Island is the smallest state in the country. Yet, despite its diminutive size, The Ocean State offers plenty of upside for anyone who learns how to flip houses in Rhode Island. In particular, the state’s 3.0% unemployment rate is well below the national average and down year-to-date. Comparatively, most states have seen unemployment rise in the wake of the Fed’s attempt to slow the economy and combat inflation.

Rhode Island’s economy looks relatively insulated from economic uncertainty, and the local housing market is the primary beneficiary. Home price appreciation in Rhode Island has outpaced the national average due to supply and demand, which bodes well for real estate investors who know how to find and flip homes.

Whether new to investing or a seasoned professional, now is a great time to learn how to flip houses in Rhode Island. As a result, we‘ve developed this comprehensive guide to teach aspiring real estate entrepreneurs the secrets of successfully flipping homes in Rhode Island. Everything from here on out equips investors with the knowledge they need to navigate the Rhode Island real estate market, including:

- What Is Flipping Houses?

- Rhode Island House Flipping Statistics

- How To Flip Houses In Rhode Island (7 Steps)

- How To Find Houses To Flip In Rhode Island

- Do You Need A License To Flip Houses In Rhode Island?

- How To Flip A House In Rhode Island With No Money

- Best Cities To Flip Houses In Rhode Island

- Final Thoughts On Flipping Homes In Rhode Island

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Is Flipping Houses?

Flipping houses is one of the most incredible real estate investment vehicles for building wealth. Over the course of last year, in fact, the average home flip generated about $67,900 in gross profit, resulting in a 26.9% return on investment (ROI), according to ATTOM Data Solutions. For context, the “average stock market return is about 10% per year for nearly the last century,” according to Nerd Wallet.

On the surface, home flipping is nothing short of a great real estate investing strategy. Beneath the surface, however, there are a lot of moving parts. Investors must be able to simultaneously increase profit margins and mitigate risk while carrying out three critical tasks: buying, rehabbing, and reselling.

To succeed, real estate investors must find deals that suit their specific needs. For example, investors must acquire deals below market value instead of buying any home listed for its full purchase price. Typically, investors will target motivated sellers who are incentivized to sell quickly and for a discount, like those at risk of foreclosure. The lower the investors can secure a deal, the more risk they will mitigate and the higher profit potential they will create.

The next step after the property is purchased is to restore the home to its desired condition, making it slightly better than those it’s being compared to. In doing so, investors must carry out cost-effective rehabs and fixes that add value to the subject property without exceeding the budget.

Finally, real estate investors can sell the home once it is restored to its desired condition. If done correctly, the proceeds from the sale will exceed the amount invested.

The home-flipping process is carefully crafted at every stage to generate returns. However, flipping houses in Rhode Island is a complex undertaking, requiring specialized knowledge and skills for success. Only those who have mastered the art of house flipping can make success habitual.

If you're ready to delve deeper into the world of flipping houses, let's begin by exploring the most important fundamentals in the Rhode Island marketplace.

Why Flip Houses In Rhode Island?

Flipping houses in Rhode Island presents a unique and rewarding opportunity for both new and experienced investors, thanks to the state's manageable size, strong housing demand, and potential for profitable returns.

While it may be one of the smallest states in the U.S., Rhode Island still offers a steady stream of distressed properties for investors to explore. According to RealtyTrac, the state currently has 236 properties in foreclosure, 35 bank-owned properties, and 173 headed for auction. These numbers illustrate that even in a compact market like Rhode Island, there is no shortage of opportunities for house flippers looking to secure deals at below-market value.

What’s more, flipping homes in Rhode Island can yield impressive profits. ATTOM Data Solutions' latest Home Flipping Report shows that the average gross flipping profit nationwide is $72,000. While this figure represents the national average and not Rhode Island specifically, it highlights the earning potential that savvy investors can unlock—even in smaller real estate markets.

In short, Rhode Island's balance of affordability, opportunity, and strong buyer demand makes it an attractive place to start or expand a house-flipping business. With the right knowledge and strategy, flipping houses in Rhode Island can offer returns that rival or even exceed traditional investments.

Would you like to follow this up with a section on the best places to flip houses in Rhode Island?

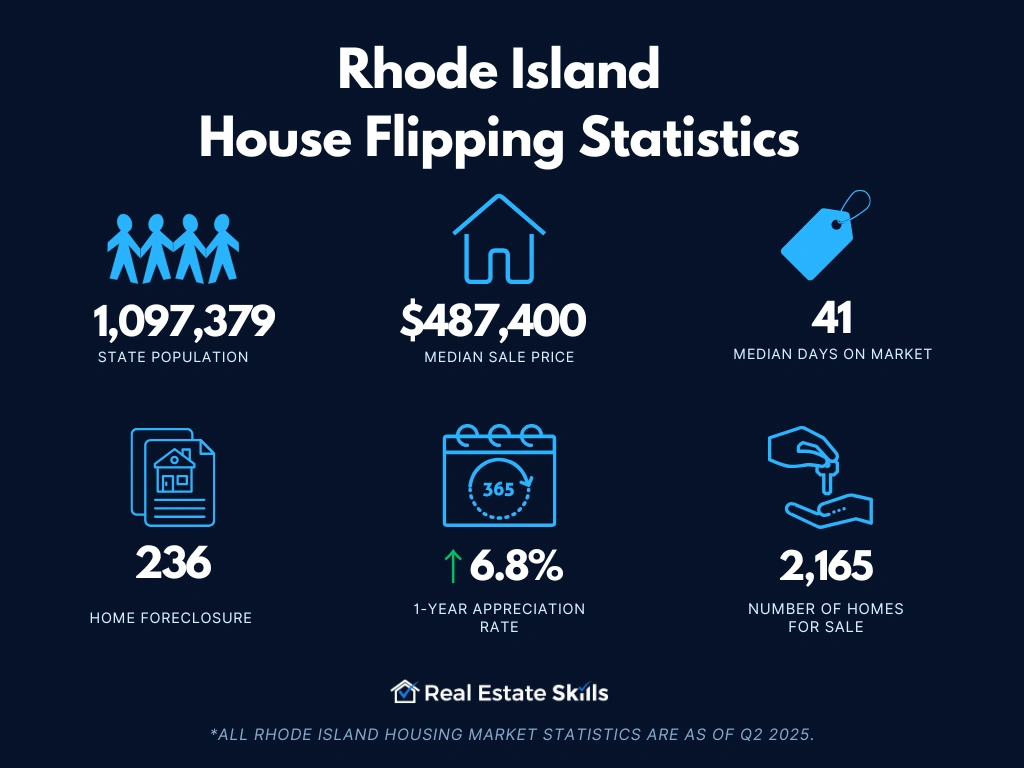

Rhode Island House Flipping Statistics

Becoming a successful house flipper in Rhode Island requires investors to become students of the local market. Understanding Rhode Island house flipping statistics and data provides a competitive edge. With this in mind, let's explore some key data and statistics that offer valuable insights into the state's market dynamics:

- Population: 1,097,379

- Employment Rate: 61.0%

- Median Household Income: $84,972

- Median Sale Price: $487,400 (+6.8% Year-Over-Year)

- Number Of Homes Sold: 612 (-4.8% Year-Over-Year)

- Median Days On Market: 41 (+4 Year-Over-Year)

- Number Of Homes For Sale: 2,165 (+3.3% Year-Over-Year)

- Number Of Newly Listed Homes: 782 (-8.1% Year-Over-Year)

- Months Of Supply: 2 (+0 Year-Over-Year)

- Homes Sold Above List Price: 40.5% (-5.2 Points Year-Over-Year)

- Homes With Price Drops: 16.5% (+3.2 Points Year-Over-Year)

- Home Foreclosure: 236

*All Rhode Island housing market statistics are as of Q2 2025.

How To Flip Houses In Rhode Island (7 Steps)

Flipping houses in Rhode Island doesn't have to be intimidating. Although it demands hard work and effort, new investors can kickstart their venture by following these seven steps:

- Find A House-Flipping Mentor

- Research The Local Housing Market

- Find & Analyze Distressed Properties

- Raise Capital To Fund The Deal

- Close On The House

- Renovate The Property

- Resell The House

Find A House-Flipping Mentor

Plenty of new investors start their flipping careers independently, without any help from anyone. However, starting a career in the real estate industry is unquestionably easier with a little push in the right direction. Aspiring investors who seek the help of a mentor gain a significant edge over the competition. If for nothing else, the guidance of an experienced home flipper is invaluable and can often make or break entire careers.

Under the watchful eye of a seasoned home flipper, even novice investors can minimize risks, increase efficiency, and greatly enhance their likelihood of success. More importantly, new investors won’t have to experiment with trial and error; they can take what they learn from their mentor and avoid costly mistakes.

Above all else, however, a mentor instills confidence, empowering new investors to take that crucial first step. With proper guidance, the first steps are much more approachable and manageable, unlocking the true potential of aspiring investors through encouragement.

Research The Local Housing Market

Even with the help of a mentor, investors will want access to today’s best information. After all, knowledge is power in the house-flipping industry. With that in mind, here is a list of trusted sources to initiate your research on the Rhode Island real estate market:

- Zillow Housing Data Research

- Zillow’s Rhode Island Market Overview

- Redfin’s Rhode Island Housing Market Overview

- Rhode Island Realtors Association Market Data

- Realtor.com’s Rhode Island Market Overview

- ATTOM DataSolutions’ Rhode Island Real Estate & Property Data

- SoFi’s State Foreclosure Data

- U.S. Census Bureau’s Rhode Island Data

- Bureau Of Labor Statistics’ Rhode Island Economic Data

Find & Analyze Distressed Properties

In the Rhode Island real estate market, investors can find an analyze distressed properties with the help of several proven strategies. However, not all strategies are created equal; some are inherently more involved than others. Novice investors, for that matter, aren’t typically awarded the luxury of executing the most advanced valuation techniques. Instead, they should stick to the 70% rule.

The 70% rule is a simplified tool for new investors to evaluate deals, but it should not be considered 100% accurate. Although it has limitations and should not be treated as the objective truth, the rule offers a rough estimate of how much an investor can spend on a deal while leaving room for worthwhile profits.

Here is the formula:

ARV - Fixed Cost - Rehab Costs - Desired Profit = Maximum Allowable Offer (MAO)

To use the 70% rule, investors must calculate the property's after-repair value (ARV). As its name suggests, the ARV is the estimated worth of the subject property once renovations and repairs are finished. Determining the ARV involves analyzing recent sales of comparable properties ("comps") in the area, providing a reliable benchmark. This method simplifies the process without unnecessary complexity, allowing investors to gauge the house's potential value after improvements are completed.

After calculating the ARV, multiply it by 70% (or 0.70), then subtract the estimated rehab costs. The result of this equation represents the maximum allowable offer (MAO), which indicates the highest amount investors should pay to acquire a deal. Limiting the acquisition price leaves enough room for profits to be realized on the backend of a deal.

Raise Capital To Fund The Deal

The next step involves securing financing for the deal, and while investors can use their funds, borrowing money offers distinct advantages. Firstly, borrowing external funds prevents investors from depleting their savings and risking financial uncertainty in the face of unforeseen circumstances. Secondly, accessing external capital allows investors to scale their businesses in a way that would be more challenging if they solely relied on their cash reserves.

The consensus agrees that raising capital is the preferred approach for flipping homes, leading to the question: Where can investors find the cash they need to flip houses in Rhode Island? While various options exist, private and hard money loans are particularly suitable for home flippers.

Although these funding sources typically have higher interest rates, the added costs are justified. Investors can quickly access the funds by agreeing to pay a higher interest rate (sometimes 15% or more), providing a significant advantage in today's competitive market. The speed at which these loans may be received is just the advantage investors need to beat out the competition, making them more than a welcomed source of capital.

Read Also: How to Start & Grow A Real Estate Business | The (ULTIMATE) Guide

Close On The House

As an attorney state, Rhode Island’s real estate closing process must be overseen by qualified attorneys. Outside of that, however, closing on a house in Rhode Island will follow the steps of a traditional close, like those listed below:

- Contract Negotiations: The buyer and seller will negotiate the terms of the impending deal, which are later formalized in a purchase and sale agreement.

- Attorney Review: The attorneys representing each party will review the purchase and sale agreement, ensuring legal compliance and protecting their client’s best interests.

- Title Search: The buyer’s attorney is responsible for conducting a title search to ensure there are no discrepancies, and that the chain of title may be passed to the buyer without any complications.

- Inspections & Due Diligence: The buyer and their attorney will mind due diligence and ensure everything with the property and its respective documents are in order. The buyer usually hires an inspector to confirm the home's condition, and the attorney will ensure all documents are ready.

- Prepare For The Closing: Each side’s attorneys are responsible for preparing the necessary closing documents, like the deed, settlement statement, loan documents, and anything else required to complete the transaction.

- Close The Deal: Each side meets to complete the transaction. When everyone is together, both sides sign the appropriate documents. The buyer will pay the agreed-upon price, and the seller will hand over the keys to the home when all the terms are met.

- Record The New Chain Of Title: The buyer’s representative will confirm the transfer of title is recorded with the correct entity.

Renovate The Property

When flipping houses in Rhode Island, investors should prioritize cost-effective renovations that enhance curb appeal and add value to the property. Investors must exercise restraint and avoid unnecessary spending on renovations. Instead, they should focus on projects with the highest return on investment.

According to Remodeling Magazine, the renovations that return the most money to investors in Rhode Island (and the rest of the Northeast region of the United States) are:

- Electric HVAC Conversion: Recoups 113.2% of the original cost

- Fiber-Cement Siding Replacement: Recoups 101.2% of the original cost

- Manufactured Stone Veneer: Recoups 94.7% of the original cost

- Vinyl Siding Replacement: Recoups 89.0% of the original cost

- Minor Midrange Kitchen Remodel: Recoups 83.8% of the original cost

Resell The House

Investors are encouraged to sell the home as quickly as possible. The sooner the house sells, the sooner profits are realized. Also, the longer the deal is held, the more it costs the investor. Fees and holding costs add up the longer the property sits idle, so it’s essential to find a buyer as quickly as possible.

Investors can attempt to sell the house independently, but hiring a real estate agent or Realtor is almost always a better idea. The commission will cost a percentage of the sales price, but it’s common for agents to sell homes faster and for more money than FSBOs (for sale by owner). An agent can make the seller more money than the cost of their fees. As a result, investors can make more money without the headaches of selling a house by themselves.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How To Find Houses To Flip In Rhode Island

The best ways to find houses to flip in Rhode Island are:

- Don’t be afraid to tap into the knowledge of local real estate agents and Realtors; they possess an unparalleled understanding of their respective markets. Collaborating with a real estate professional can lead to a deal, or at least someone who knows about a deal.

- Access the Multiple Listing Service (MLS) through your license or by partnering with an agent. This comprehensive database offers many potential deals, including motivated homeowners looking to sell their properties.

- Participate in foreclosure auctions hosted by banking institutions to bid on off-market homes. These auctions provide a chance to secure properties below market value, as banks aim to alleviate non-performing loan burdens.

- Visit the local Recorder's Office to identify Rhode Island homes at risk of foreclosure. By understanding the indicators and utilizing public foreclosure records, diligent investors can locate distressed homeowners and potential investment opportunities.

- Implement a targeted direct mail campaign to reach homeowners in the desired area. While response rates may vary, a successful deal resulting from this campaign can make it highly worthwhile.

- Explore neighborhoods by driving around and identifying neglected properties. Although not always the case, such properties may lead to owners who are more inclined to sell, creating potential opportunities for investors.

Do You Need A License To Flip Houses In Rhode Island?

There is absolutely no need to have a real estate license to flip homes in Rhode Island. Investors are free to flip properties without a license.

However, getting a license may be beneficial. If investors are willing to pay the required fees and maintain their licensed status, they will have access to the MLS and a nationwide network of like-minded professionals.

Read Also: Rhode Island Real Estate Classes: Wholesaling, Flipping & Licensing

How To Flip A House In Rhode Island With No Money?

One of the best things about flipping houses in Rhode Island is that the strategy doesn’t require investors to use their own money. Instead, investors are advised to seek funding, especially from private and hard money lenders. These like-minded investors are actively searching for lucrative opportunities, and home flippers may present precisely what they desire.

Private money lenders and hard money lenders serve as alternatives to traditional banking institutions, eliminating the need for investors to navigate the complex processes typically associated with big banks or refinance their properties to access funds. With these lenders, investors can bypass minimum credit score requirements and avoid the months-long waiting period for approval, minimizing the risk of losing a deal.

While private and hard money lenders may have specific guidelines, investors can anticipate immediate access to their cash. This is where the primary advantage of utilizing a hard money loan lies: its speed of implementation is second to none and often increases the odds of landing a deal.

Investors who have yet to learn how to flip houses in Rhode Island can still invest without utilizing their funds. An alternative strategy known as wholesaling eliminates the need for extensive renovations or significant capital investment. With a wholesale real estate strategy, investors obtain the rights to purchase a property and subsequently sell those rights to someone on their buyers' list for a fee. This method presents a viable investment opportunity that relies on something other than personal cash.

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

Best Cities To Flip Houses In Rhode Island

The Rhode Island real estate market is full of opportunities, but the best city to flip houses in is shaping up to be Providence, RI. With an estimated 194,801 residents, Providence makes up approximately 17.5% of the state’s capital. In other words, Providence is the most populous city in an economically resilient state.

As a result, investors should see plenty of activity for their deals. And, with a median home value well above the national average, profit margins may be more significant for those who learn how to flip homes in Rhode Island correctly.

Final Thoughts On Flipping Homes In Rhode Island

The Rhode Island real estate market is teeming with opportunities despite its size. Investors who learn how to flip houses in Rhode Island with the system above should be able to take advantage of an economically resilient marketplace and increase their odds of success.

The growing demand for local housing all but ensures a steady stream of buyers, and proactive investors should be able to capitalize on the current trends.

At Real Estate Skills, our team of experts is ready to provide you with the tools you need for flipping houses in Rhode Island. We're committed to providing the knowledge, resources, and support you need to successfully navigate a Rhode Island property flip. So avoid common mistakes and maximize your returns by leveraging our expertise.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.