How To Flip Houses In Oregon: 15-Step Home Renovation Guide

Oct 22, 2025

What: Flipping houses in Oregon involves buying undervalued properties, renovating them to increase appeal and value, and selling them for profit in markets ranging from Portland and Eugene to smaller communities throughout the state.

Why: Oregon’s strong housing demand, limited inventory, and growing population make it a profitable environment for flippers. Updated homes often sell quickly, allowing investors to benefit from appreciation and market momentum.

How: Follow the steps in the article: research Oregon market trends, learn local real estate and contractor regulations, secure funding, find motivated sellers, calculate rehab costs and ARV accurately, manage renovations efficiently, and price strategically when listing.

Investing in real estate has proven to be one of the most incredible wealth-building vehicles of our time. In particular, home flipping has become synonymous with the most popular exit strategies and the highest profit margins in the industry. Investors nationwide are flipping homes with a high level of success, and the Oregon real estate market is no exception.

With foreclosure activity doubling over the last year, according to ATTOM Data Solutions’ Year-End 2022 U.S. Foreclosure Market Report, There may be no better time to learn how to flip houses in Oregon. Profit potential remains in today’s unique real estate market, and opportunities to secure deals under market value are increasing.

With conditions growing more favorable, investors can benefit from learning how to flip houses in Oregon. As a result, we’ve developed this guide to teach you all the house-flipping tips you need to know, including the following:

- What Is Flipping Houses?

- Why Flip Houses In Oregon?

- Oregon House Flipping Statistics

- How To Flip Houses In Oregon In 15 Steps

- How Much Do House Flippers Make In Oregon?

- Is House Flipping Illegal In Oregon?

- Do You Need A License To Flip Houses In Oregon?

- How Much Does It Cost To Flip A House In Oregon?

- How To Flip A House In Oregon With No Money

- What's The Best Place To Flip Houses In Oregon?

- Is It Hard To Flip Houses In Oregon?

- How Do You Find Contractors For Flipping Houses In Oregon?

- Final Thoughts On Flipping Homes In Oregon

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Is Flipping Houses?

Flipping houses is a popular real estate investing strategy that centers on three foundational pillars: buying, rehabbing, and selling. Each pillar represents an independent step in the process, but the synergy between them is required to maximize profit margins and mitigate inefficiencies. Only when each step complements the next will real estate investors increase their odds of realizing success.

Otherwise known as rehabbing, home flipping begins with purchasing properties for less than their actual market value. In doing so, house flippers focus on homes that are undervalued, require repairs, or facing foreclosure. Many homeowners are willing to sell their assets for a discounted purchase price, which bodes well for real estate flippers.

Investors perform essential upgrades and repairs after acquiring the property for a discount. Similar to the first step, renovations are made to maximize profit potential. That means investors can’t simply make any changes they want; they need to make the right changes. The objective is to enhance the property's appeal to potential homebuyers while staying within a strict budget.

Typically, real estate investors aim to make the property slightly more appealing than comparable homes. That way, the house will receive the most attention on the market without investors overspending on unnecessary renovations. Done correctly, the attention will become competition, increasing inventors’ profit margins even further. The more people are interested in the home, the more likely it is to sell over the asking price and increase the investor’s return on investment (ROI).

If you want to learn how to start flipping, your small business should have a good idea of what flipping is.

Why Flip Houses In Oregon?

Oregon presents a compelling opportunity for house flippers due to its diverse and growing real estate market. The state has experienced steady population growth, particularly in urban areas like Portland, Eugene, and Bend, driven by a strong job market and a high quality of life. As of 2024, Oregon's population has surpassed 4.3 million, with the Portland metro area alone accounting for over 2.5 million residents. This influx has bolstered demand for housing, creating a favorable environment for flipping houses as buyers seek updated and modernized homes in these competitive markets.

The real estate market in Oregon has shown resilience, even amidst national economic fluctuations. Home values in Oregon have seen significant appreciation over the past decade, with a median home price of approximately $520,000 as of mid-2024. Portland, in particular, has been a hotspot for real estate investors, with property values increasing by nearly 6% annually over the past five years. Additionally, secondary markets like Eugene and Bend have also experienced robust growth, with annual home price increases of 5% and 7%, respectively. This upward trend in home values offers house flippers the potential for substantial returns on investment, especially when flipping homes in desirable neighborhoods with strong buyer demand.

The real estate market in Oregon has shown resilience, even amidst national economic fluctuations. Home values in Oregon have seen significant appreciation over the past decade, with a median home price of approximately $520,000 as of mid-2024. Portland, in particular, has been a hotspot for real estate investors, with property values increasing by nearly 6% annually over the past five years. Additionally, secondary markets like Eugene and Bend have also experienced robust growth, with annual home price increases of 5% and 7%, respectively.

According to RealtyTrac, the state currently has 834 properties in foreclosure, 167 bank-owned properties, and 627 headed for auction—creating opportunities for flippers to acquire distressed properties in high-demand areas. This upward trend in home values offers house flippers the potential for substantial returns on investment, especially when flipping homes in desirable neighborhoods with strong buyer demand. For context, ATTOM Data Solutions' latest Home Flipping Report shows that the average gross flipping profit nationwide is $72,000, underscoring the profit potential in Oregon’s appreciating market.

Oregon's strong environmental regulations and emphasis on sustainable living also play a role in the appeal of flipping houses in the state. Buyers in Oregon increasingly prioritize energy-efficient homes and green building practices. By incorporating eco-friendly renovations, such as energy-efficient windows, solar panels, and sustainable materials, flippers can attract a larger pool of environmentally-conscious buyers. This focus on sustainability not only meets market demand but also allows flippers to command higher prices for their renovated properties, further enhancing profit margins in the Oregon housing market.

Read Also: How To Wholesale Real Estate In Oregon

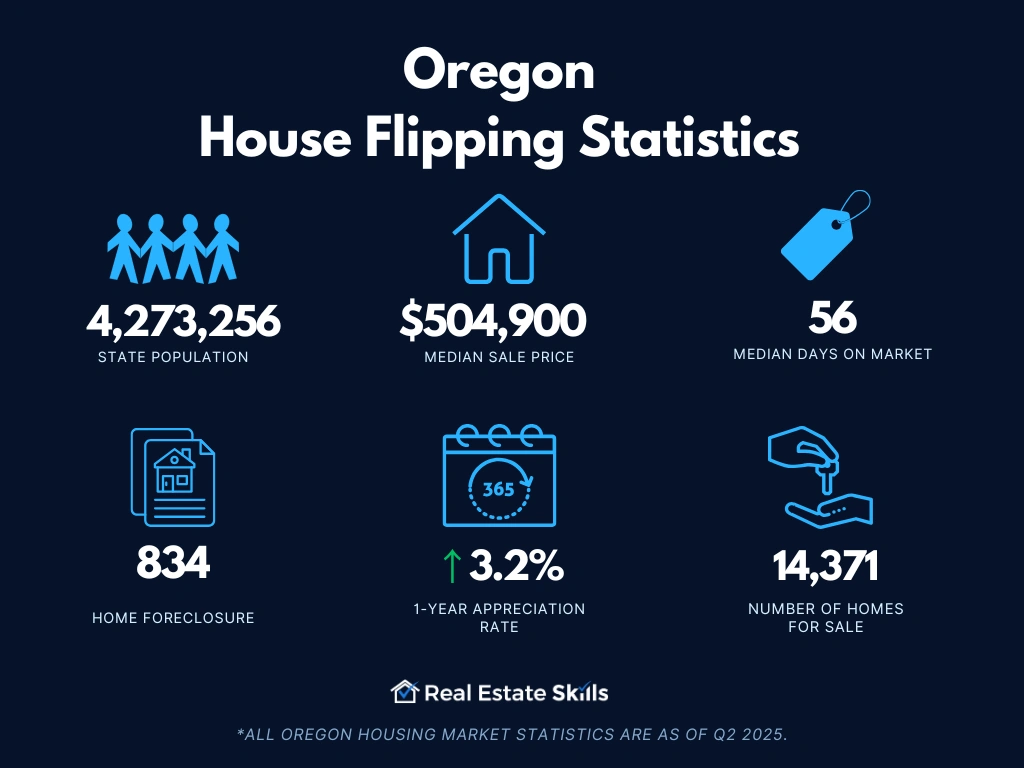

Oregon House Flipping Statistics

Even today’s greatest investors are only as good as the information they are working with. That said, here’s a quick look at some of today’s most reliable Oregon house-flipping data and statistics:

- Population: 4,273,256

- Employment Rate: 59.9%

- Median Household Income: $80,160

- Median Sale Price: $504,900 (+3.2% Year-Over-Year)

- Number Of Homes Sold: 3,042 (+2.1% Year-Over-Year)

- Median Days On Market: 56 (-1 Year-Over-Year)

- Number Of Homes For Sale: 14,371 (+10.7% Year-Over-Year)

- Number Of Newly Listed Homes: 3,845 (-7.7% Year-Over-Year)

- Months Of Supply: 4 (+0 Year-Over-Year)

- Homes Sold Above List Price: 26.2% (+2.7 Points Year-Over-Year)

- Homes With Price Drops: 23.9% (+0.8% Points Year-Over-Year)

- Home Foreclosure: 834

*All Oregon housing market statistics are as of Q2 2025

As a beginner or experienced house flipper, it's critical to arm yourself with comprehensive market data, track economic trends, and understand the median home price within your target sub-market. This information can guide your investment decisions, helping you identify promising opportunities and risks in the Oregon housing market. Consider the following resources for your research:

-

Zillow Housing Data Research: Zillow provides an easy-to-understand breakdown of the housing market. The data offers historical insight into home values, forecasts, inventory, list and sales prices, and even price reductions.

- Zillow’s Oregon Market Overview: Zillow also provides the current median home value in Oregon, including a historical overview of the state's home value index. It's a valuable resource for offering insights into Oregon's market trends.

-

Realtor.com Oregon Housing Market Data: Realtor.com's housing market pages offer real estate investors listed properties in Oregon by county, city, and ZIP code.

- Redfin’s Oregon Housing Market Overview: Redfin features key monthly metrics on the Oregon housing market. It reports on home price fluctuations, housing supply, demand, and other essential metrics for identifying potential house flipping opportunities.

- ATTOM’s Oregon Real Estate & Property Data: ATTOM offers up-to-date Oregon property data and provides curated, compelling real estate reports for each state in the US.

- SoFi’s State Foreclosure Data: SoFi's comprehensive guide presents an overview of foreclosure rates across all 50 states, including Oregon. This information is highly valuable for house flippers as it offers insight into potential opportunities in the distressed properties market.

- U.S. Census Bureaus’ Oregon Data: Here, you can find key demographic and economic statistics about the state of Oregon. Real estate investors can understand the state's population distribution, income levels, housing situation, and more, which can help inform investment decisions and strategies.

- Bureau Of Labor Statistics’ Oregon Economic Data: The Bureau of Labor Statistics offers a comprehensive view of Oregon's employment scenario, encompassing data on unemployment rates and sector-wise job distribution. Property flippers in Oregon would find this data particularly useful as it provides insights into the state's job market—a vital aspect influencing the health of the real estate market.

How To Flip Houses In Oregon In 15 Steps

Anyone interested in learning how to flip houses in Oregon should follow the seven steps outlined below:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Choosing the right market is one of the most critical steps when flipping houses in Oregon. The state offers a diverse range of real estate markets, from urban centers like Portland and Eugene to smaller, more affordable towns such as Salem and Medford. Each market presents unique opportunities and challenges, so it's important to thoroughly research and analyze local market trends, property values, and economic conditions before making your investment. Understanding the dynamics of the market you’re entering will help you make informed decisions about where to buy, how much to invest in renovations, and what kind of return on investment you can expect.

When picking your market, consider factors such as population growth, employment rates, and the overall economic health of the area. For instance, Portland is known for its robust real estate market with high demand, but it also comes with higher purchase prices and competition. On the other hand, cities like Salem and Bend offer more affordable entry points with increasing property values, making them attractive options for house flippers looking to maximize profits. Additionally, Oregon’s smaller towns can offer hidden gems with lower upfront costs and the potential for significant appreciation.

Another important aspect to consider is the local buyer demographic. Oregon’s markets vary widely, with some areas attracting young professionals and families, while others appeal more to retirees or vacation home buyers. Tailoring your flip to the preferences and needs of the local market can greatly enhance your chances of a successful sale. Whether you’re targeting a trendy urban neighborhood or a quiet suburban area, understanding who your potential buyers are and what they’re looking for will guide your renovation decisions and marketing strategy.

Find Your Money

Securing financing is a crucial step in the house-flipping process, and it's essential to explore all your options to ensure you have enough capital to purchase, renovate, and sell the property. In Oregon, real estate investors can choose from several financing methods, including traditional bank loans, private lenders, and hard money lenders. Each option has its benefits and drawbacks, so it's important to assess which one aligns best with your financial situation and investment goals. Whether you’re a first-time flipper or an experienced investor, having a solid financial plan in place will set the foundation for a successful flip.

Understanding the costs involved in flipping houses is key to determining how much money you need to raise. This includes not only the purchase price but also renovation costs, carrying costs, and selling expenses. Oregon’s real estate market can vary significantly depending on the location, so having access to flexible and reliable financing options can make or break your project. Once you've calculated your budget, it’s time to explore the different financing sources available to you, including private and hard money lenders, who can provide the funds needed to bring your flipping project to life.

How To Find Private & Hard Money Lenders

Finding the right lender is essential for funding your house flip in Oregon. Private and hard money lenders are popular options among real estate investors because they often offer more flexibility and faster approval times compared to traditional banks. These lenders specialize in short-term, high-interest loans that are typically secured by the property itself. As you navigate the Oregon real estate market, understanding how to connect with these lenders can help you secure the necessary funds to complete your project efficiently.

Private lenders are often individuals or small groups who are willing to invest in your house-flipping project in exchange for a return on their investment. To find a private lender in Oregon, consider networking within your local real estate community. Attend real estate investment groups, local meetups, or real estate conferences where you can connect with potential lenders. Additionally, online platforms like Kiavi and Lima One provide access to lists of private lenders, both local and national, where you can review their terms and contact information. Building relationships with private lenders can offer you more personalized and flexible financing options, which can be crucial for navigating the specific challenges of your market.

Hard money lenders are typically companies or individuals who provide short-term loans specifically for real estate investments. These loans are asset-based, meaning the property itself serves as collateral. To find a hard money lender in Oregon, start by researching online directories and platforms such as Kiavi and Lima One, which offer detailed lists of local and national hard money lenders, along with their contact information. Additionally, you can seek recommendations from other investors or real estate professionals in your network. Working with a reputable hard money lender can expedite your financing process, allowing you to move quickly on a property and begin renovations without delay.

By securing the right financing from private or hard money lenders, you can ensure that your house-flipping project in Oregon is well-funded from start to finish. Understanding the benefits and risks associated with each type of lender will help you make informed decisions, ultimately leading to a successful and profitable flip.

Find Three Contractors

Selecting the right contractors is a pivotal step in successfully flipping houses in Oregon. Your choice of contractors can significantly impact the quality of renovations, the timeline of your project, and ultimately, your profitability. It's essential to find three reliable contractors who can provide competitive bids and bring the necessary expertise to your project. These contractors should be well-versed in the local market and familiar with Oregon’s building codes and regulations to ensure that your renovations are up to standard and completed efficiently.

When evaluating contractors, consider their experience, reputation, and past work. Check references and reviews to gauge their reliability and craftsmanship. It’s also helpful to get detailed estimates from each contractor, including a breakdown of labor, materials, and any additional costs. By comparing these estimates, you can make an informed decision on which contractors offer the best value for your renovation needs. Engaging with multiple contractors also provides leverage in negotiations and can help ensure that your project remains within budget.

How To Find A General Contractor

Finding a reliable general contractor is crucial for managing your house-flipping project effectively. A general contractor will oversee the renovation process, coordinate subcontractors, and ensure that the work meets quality and regulatory standards. To start, look for general contractors with a solid track record in the Oregon market. Online platforms such as HomeAdvisor and Thumbtack are excellent resources for finding and reviewing local general contractors. These platforms provide access to contractor profiles, customer reviews, and contact information, making it easier to evaluate potential hires.

Networking within the local real estate and construction community can also help you find reputable general contractors. Attend real estate investment meetings or join local home improvement groups to get recommendations from other investors and industry professionals. Additionally, consider asking for referrals from real estate agents or property managers who have experience with house flips. By gathering multiple recommendations and thoroughly vetting each candidate, you can select a general contractor who is well-suited to manage your project and deliver the results you need for a successful flip.

Find An Investor-Friendly Agent

Finding an investor-friendly real estate agent is a key step in flipping houses in Oregon. An agent who understands the unique needs of investors can provide valuable insights into local market trends, identify potential properties, and assist in negotiations to secure favorable deals. Look for agents with experience working with real estate investors, as they are more likely to understand the specific requirements and challenges of house flipping, such as assessing property value, estimating repair costs, and navigating local regulations.

An investor-friendly agent can also help you streamline the buying process by offering access to off-market properties, leveraging their network to find potential deals, and providing guidance on market conditions that may impact your investment strategy. By collaborating with an agent who is familiar with the intricacies of flipping houses, you can increase your chances of finding profitable opportunities and successfully managing your projects from acquisition through to sale.

How To Find An Investor-Friendly Agent

To find an investor-friendly real estate agent in Oregon, start by seeking recommendations from other real estate investors or professionals who are active in the local market. Networking at real estate investment clubs or online forums can lead you to agents who have a proven track record with investors. Additionally, use online platforms like Zillow or Realtor.com to search for agents with specific expertise in investment properties, and review their past transactions and client feedback to assess their suitability.

Another effective approach is to interview multiple agents to gauge their understanding of the investment market. During these interviews, ask about their experience with house flipping, their knowledge of local market trends, and their ability to find and evaluate potential investment properties. An agent who is well-versed in these areas will be better equipped to support your house-flipping efforts and help you achieve your financial goals. By thoroughly vetting and selecting an agent who aligns with your investment strategy, you can ensure a smoother and more successful flipping process.

Find A House To Flip

Finding the right property is crucial to the success of your house-flipping venture in Oregon. The first step in locating a house to flip is to utilize various strategies to identify potential investment opportunities. One effective method is "driving for dollars," where you drive through neighborhoods looking for distressed or vacant properties. This hands-on approach allows you to spot houses that may not be listed online and can often lead to finding deals before they hit the market.

Another method is running direct mail campaigns, where you send letters or postcards to property owners, especially those who may be facing financial difficulties or have vacant homes. Direct mail can be an effective way to reach motivated sellers who might be willing to negotiate a favorable deal. Additionally, leveraging the Multiple Listing Service (MLS) is essential for finding properties that are actively listed for sale. The MLS provides detailed information on available properties, including recent sales data, which can help you evaluate the potential profitability of each option.

Alternative Strategies to Find a House

When exploring alternative strategies to find a house to flip, consider these approaches to gain a competitive edge:

-

The Day Zero Strategy: This involves monitoring new listings as soon as they become available. By acting quickly on freshly listed properties, you can potentially secure a deal before other investors have a chance to bid.

-

The Old Listing Strategy: Focus on properties that have been on the market for an extended period. These listings may have become stale, and the sellers could be more open to negotiating the price.

-

The Wholesaler Strategy: Connect with real estate wholesalers who specialize in finding properties under market value and selling them to investors. Wholesalers often have access to off-market deals and can be a valuable source of potential investment opportunities.

Employing a mix of these strategies will enhance your ability to find profitable houses to flip in Oregon. By combining traditional methods like driving for dollars and direct mail campaigns with MLS searches and alternative strategies, you increase your chances of identifying valuable investment opportunities. Each strategy offers unique advantages, and using them in conjunction can help you uncover the best properties for your flipping projects.

Make Discovery Calls To Listing Agents

Making discovery calls to listing agents is a crucial step in the house-flipping process in Oregon. These calls provide valuable insights that help you evaluate the property more effectively and streamline your decision-making process. Here’s what to ask to ensure you’re getting the most accurate and useful information:

-

Is the listing still active?: Confirming whether the property is still available is essential to avoid wasting time on deals that are no longer on the market. Ensure the listing hasn’t already gone under contract with another buyer to keep your focus on viable opportunities.

-

Are the listing’s photos up to date?: Inquire if the photos provided in the listing accurately reflect the current condition of the property. Up-to-date photos help you assess the state of the home and estimate the extent of repairs and renovations needed, which is critical for calculating costs and potential profits.

-

What is the current condition of the home?: Understanding the property’s current condition is vital for determining its suitability for a flip. This question helps reveal if the home is distressed and may uncover hidden issues that aren’t apparent from the listing alone, allowing you to better evaluate repair costs and potential challenges.

-

Are you willing to work with an investor?: Asking whether the listing agent is open to working with investors sets the stage for a transparent and productive relationship. If you don’t have an agent yet, this could also be an opportunity to secure representation from the listing agent, potentially earning them commissions on both sides of the transaction.

-

What is the owner’s reason for selling?: Understanding the seller’s motivation can provide useful insights for negotiating a better deal. While agents may not always disclose this information, any details about the seller’s urgency or circumstances can help you structure an offer that meets their needs while benefiting your investment strategy.

-

Is there a lot of competition for the property?: Asking about the level of competition helps you gauge the urgency and competitiveness of the situation. Knowing if there are multiple offers or significant interest allows you to adjust your strategy and make a more competitive bid if needed, helping you avoid overpaying or missing out on a potential deal.

By addressing these questions, you can gather critical information that will inform your investment decisions and enhance your ability to secure profitable flipping opportunities in Oregon.

Analyze The Property

Analyzing the property is a critical step in the house-flipping process in Oregon. This phase involves evaluating key factors to determine if a property is a worthwhile investment. The primary metrics to consider are the after-repair value (ARV), repair costs, and purchase price. By thoroughly assessing these elements, you can make informed decisions and maximize your potential profits.

After-Repair Value

The after-repair value (ARV) is a crucial metric when evaluating a potential flip. It represents the estimated market value of the property once all renovations are completed. Calculating the ARV involves analyzing comparable sales, or "comps," which are recently sold properties similar to the one you're considering. In Oregon, look for properties with the following criteria to find accurate comps:

- Similar bed and bath count as the subject property

- Within 20% of the subject property's square footage

- Located in the same neighborhood

- Within one-half mile of the subject property

- Sold within the last six months

- Recently renovated

To calculate the ARV, average the sale prices of these comparable properties. This approach provides a realistic estimate of the property's potential market value after renovations, helping guide your investment decisions and evaluate the profitability of the flip.

Repair Costs

Estimating repair costs accurately is essential for a successful flip. Begin by conducting a thorough property inspection and compiling a detailed list of necessary repairs and renovations. Consult with multiple contractors to obtain quotes for labor and materials. It's wise to include a contingency budget for unexpected expenses, typically around 10-15% of the total repair costs. By gathering detailed estimates and professional opinions, you can ensure your budget is realistic and avoid surprises during the renovation process.

Purchase Price

Determining the purchase price involves integrating the ARV and repair costs into a formula to calculate your maximum allowable offer (MAO). The MAO is the highest price you can pay for the property while still achieving a profitable investment. Factors to consider include:

- ARV: The estimated value of the home after repairs.

- Hard Money Loan Costs: Include interest rates (10-15%), origination fees, and points.

- Private Money Loan Costs: Consider interest and project duration.

- Front-End Closing & Holding Costs: Typically around 2% of the purchase price, plus ongoing expenses like insurance and taxes.

- Backend Closing Costs: Usually 1% of the ARV.

- Realtor Fees: Typically 6% of the purchase price, though negotiable with investor-friendly agents.

- Projected Profit: Factor in your desired profit margin, which often aligns with industry benchmarks.

By subtracting these costs from the ARV, you can determine the MAO and establish a competitive yet profitable purchase price for the property. This thorough analysis ensures that you make informed investment decisions and maximize your returns on house-flipping projects in Oregon.

Perform Due Diligence When the Offer Is Accepted

Once your offer is accepted, performing due diligence is crucial to ensure that the property meets your investment criteria and that there are no unforeseen issues. This process involves a comprehensive review of the property, focusing on verifying its condition and understanding any potential risks. One of the key elements of this phase is evaluating the "scope of work," which outlines the necessary repairs and renovations required to make the property suitable for flipping.

Begin by conducting a thorough property inspection to assess its current state. This includes checking structural elements, systems like plumbing and electrical, and the overall condition of the property. The inspection report will help you refine your scope of work by identifying any significant repairs or issues that need addressing. Make sure to get estimates from contractors based on the scope of work to accurately budget for the renovation costs.

In addition to the physical inspection, review all available documentation related to the property, including title reports, previous inspection reports, and any disclosures from the seller. This step helps confirm that there are no legal or structural problems that could impact your project. By performing detailed due diligence, you safeguard your investment and ensure that the house-flipping process proceeds smoothly and efficiently.

Close on the Deal

Closing on the deal is the final step in the house-flipping process, and it involves completing the legal and financial transactions required to transfer ownership of the property to you. This step ensures that all contractual obligations are fulfilled and that the property is officially yours to renovate and resell.

Start by scheduling a closing date with your real estate agent and title company. On this day, you'll review and sign various legal documents, including the purchase agreement, the deed, and any loan paperwork if you used financing. Make sure to carefully read through all documents to ensure accuracy and clarity. It’s also important to conduct a final walk-through of the property to confirm that it is in the agreed-upon condition and that no new issues have arisen since your last inspection.

Next, you'll need to provide the necessary funds for the purchase, including the down payment, closing costs, and any other financial obligations. Ensure that these funds are readily available and transferred as required by the closing instructions. Once the financial transactions are complete, the title company will record the deed with the county, officially transferring ownership to you.

Finally, make sure to obtain copies of all closing documents for your records. This documentation will be essential for future reference, including any potential tax implications. By thoroughly completing the closing process, you finalize the purchase and are ready to move forward with your renovation plans and ultimately, flipping the house.

Prep & List The House On The MLS

Once the renovations are complete, the next crucial step in flipping houses in Oregon is to prepare and list the property on the Multiple Listing Service (MLS). This involves ensuring the house is in top condition and presenting it in the best possible light to attract potential buyers. A well-executed listing can significantly impact the final sale price and help you achieve a successful flip.

-

Final Punchlist: Before listing, conduct a thorough inspection to create a final punchlist of any remaining touch-ups or minor repairs. This punchlist should address all cosmetic issues, such as paint touch-ups, minor drywall fixes, and ensuring all fixtures are in working order. Completing these final details ensures that the house looks polished and ready for showings, giving potential buyers a positive first impression.

-

Home Staging: Staging the home is a strategic move to enhance its appeal. According to the Real Estate Staging Association (RESA) via the National Association of Realtors, "With an average investment of 1% of the sale price into staging, about 75% of sellers saw an ROI of 5% to 15% over asking price." Effective staging helps buyers envision themselves living in the space, potentially leading to higher offers and a quicker sale. Consider hiring a professional stager or using high-quality furnishings to highlight the property’s best features.

-

Professional Photos: High-quality, professional photos are essential for making your listing stand out. Since online listings are often the first point of contact for potential buyers, having well-lit, high-resolution images can make a significant difference. Professional photographers can capture the property’s best angles and showcase its features effectively, helping to attract more interest and potentially leading to a faster sale.

Set An Enticing Asking Price

Setting the right asking price is crucial to a successful sale. Begin by analyzing comparable properties in the area to determine a competitive price point. Take into account recent sales, current market conditions, and the unique features of your property. Pricing the home slightly below market value can generate more interest and potentially lead to a bidding war, while pricing it too high may result in extended time on the market and reduced offers. By setting an enticing and well-researched asking price, you increase the likelihood of attracting serious buyers and achieving a profitable flip.

Field Offers & Negotiate

Once your property is listed on the MLS, you’ll start receiving offers from interested buyers. The next step in flipping houses in Oregon is to carefully evaluate these offers and negotiate to achieve the best possible deal. This process requires a keen understanding of your property’s value and the ability to negotiate effectively.

Start by reviewing each offer thoroughly. Pay attention to the offered purchase price, contingencies, and the buyer’s financial qualifications. Compare the offers against your expectations and the market value of the property. It's important to consider not only the offer amount but also the buyer's ability to close the deal, which can include their financial stability and readiness to proceed without unnecessary delays.

Negotiation is a crucial aspect of this process. Engage with buyers or their agents to discuss potential adjustments to the offer terms. This could involve negotiating the sale price, addressing contingencies, or discussing the closing timeline. Be prepared to make counteroffers and be flexible within reasonable limits to achieve a favorable outcome. Effective negotiation helps ensure you get the best possible return on your investment and can significantly impact the overall success of your house flipping venture in Oregon.

Sell The House & Get Paid

Once you’ve accepted the best offer and completed the necessary paperwork, the next step is to finalize the sale and get paid. This involves coordinating with the buyer, their agent, and the closing attorney to ensure all legal and financial aspects are in order.

At the closing, the final sale price is settled, and the transfer of ownership is officially completed. This typically involves a final walk-through by the buyer to confirm that the property meets the agreed-upon conditions. Make sure all required documents are signed, and that any outstanding fees, such as closing costs or real estate commissions, are paid.

After the closing, you will receive the net proceeds from the sale. This amount is the sale price minus any fees or costs associated with the transaction. Ensure that all financial transactions are properly documented and that you follow up to resolve any remaining issues. Successfully selling the house and receiving payment completes the flipping process and allows you to assess the overall profitability of your investment.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make In Oregon?

In Oregon, house flippers can see substantial profits, with the average gross flipping profit reaching $87,000 as of 2024, according to ATTOM Data Solutions. However, this figure can vary significantly based on location, renovation costs, and market conditions. Flipping houses in Oregon’s more competitive markets often yields higher returns, especially in areas where demand for updated properties is strong.

Oregon is home to several cities where house flippers have some of the best profit opportunities in the country. The state boasts three of the top five cities with the nation's largest gross flipping profits on median-priced transactions (according to the previously mentioned Home Flipping Report by ATTOM Data Solutions):

- Portland, OR: $122,500 average gross flipping profit

- Eugene, OR: $108,750 average gross flipping profit

- Salem, OR: $99,300 average gross flipping profit

These cities offer lucrative opportunities for house flippers, driven by strong property values and consistent buyer demand. Oregon’s diverse real estate market, combined with the right investment strategy, can provide substantial returns for those looking to learn how to flip houses in the state.

Maximizing profits in Oregon requires a keen understanding of local market trends, careful property selection, and efficient renovation management. By securing properties at favorable prices and strategically enhancing their appeal to buyers, flippers can significantly boost their net profit on each transaction in the Oregon housing market.

Is House Flipping Illegal In Oregon?

House flipping is not illegal in Oregon, but it is regulated by state laws that aim to ensure fair practices and protect consumers. Flippers must adhere to Oregon’s real estate regulations, including disclosure requirements, building codes, and zoning laws. Failure to comply with these regulations can result in legal consequences, such as fines or even lawsuits. It’s crucial for investors to work with licensed contractors and obtain the necessary permits for renovations to avoid any legal pitfalls.

Additionally, Oregon has specific anti-fraud laws that target deceptive practices in real estate transactions. This includes misrepresenting a property’s condition or failing to disclose known defects. As long as house flippers operate within the bounds of the law and conduct their business ethically, flipping houses in Oregon is a legitimate and potentially profitable endeavor. Understanding and following the state’s regulations will help ensure a smooth and legal flipping process.

Read Also: Is Wholesaling Real Estate Legal In Oregon?

Do You Need A License To Flip Houses In Oregon?

You do not need a real estate license to flip houses in Oregon. However, real estate investors in Oregon may benefit from getting their real estate license.

At the very least, a license grants investors access to a nationwide network of real estate professionals and their most valuable tool: the MLS. Of course, to become licensed, investors will need to keep up with required learning courses and pay annual fees, so it’s best to weigh the pros and cons before taking any action.

How Much Does It Cost To Flip A House In Oregon?

Flipping a house in Oregon can be a profitable venture, but understanding the costs involved is crucial to ensure a successful project. From purchasing the property to completing renovations and covering ongoing expenses, various factors influence the total cost of a flip. In this section, we'll break down the key costs you should anticipate when flipping a house in Oregon.

The Home Purchase Price

The first major expense in flipping a house in Oregon is the purchase price. As of 2024, the median home price in Oregon is around $520,000, though this can vary significantly depending on the location. For instance, in Portland, the median home price is approximately $560,000, while in smaller markets like Salem or Eugene, prices are slightly lower, averaging around $450,000 to $480,000. Depending on the deal, you might need to put down 5-20% of the purchase price upfront, with the remainder financed through a mortgage or alternative funding options like hard money loans.

The Home Repair Costs

Renovation costs in Oregon can vary widely based on the scope of work and the condition of the property. On average, investors might spend between $30,000 to $60,000 on a standard rehab for a three-bedroom, two-bathroom home. This translates to roughly $25 to $40 per square foot for typical repairs, such as updating kitchens and bathrooms, replacing flooring, and addressing structural issues. However, costs can escalate to $100 per square foot or more for high-end renovations or properties requiring significant structural work. It's essential to get multiple quotes from contractors and factor in potential unforeseen costs when budgeting.

The Carrying Costs

Carrying costs are the ongoing expenses you'll incur while holding the property during the renovation process. In Oregon, these include property taxes, which average about 1% of the home’s value annually, as well as homeowners insurance, which can range from $800 to $1,500 per year depending on the location and property value. Additionally, utilities, general upkeep, and any HOA fees should be considered. For a typical flip that takes 3-6 months, carrying costs can add several thousand dollars to your overall budget.

Closing, Marketing, & Sales Costs

Finally, don't overlook the costs associated with selling the property. In Oregon, real estate agent commissions typically range from 5-6% of the final sale price. Additional expenses include closing costs, which can be 2-3% of the sale price, marketing fees, and any legal costs related to the transaction. Altogether, these expenses can total $20,000 to $30,000 or more, depending on the property and market conditions. Properly budgeting for these costs is essential to maximize your profits when flipping houses in Oregon.

Read Also: How To Flip Houses With No Money: Top 10 Expert Strategies

How To Flip A House In Oregon With No Money

Flipping houses in Oregon doesn’t require investors to tap into their savings or checking accounts. Investors can flip homes if they don’t have any money at all. Instead, they are advised to use other people’s money, specifically funds obtained from private and hard money lenders.

These individuals are also investors looking for the best place to invest their capital; you just need to convince them that your deal is worth their money. In doing so, bring a potential deal to their table and pitch why they should lend you the money. If you can convince them that you are worth investing in, you should be able to access the funds almost immediately.

Anyone who hasn’t learned how to flip houses in Oregon isn’t out of luck; they can still invest with no money. Another option for flipping deals without using personal money is wholesaling. It involves obtaining rights to buy a property and selling those rights to an end buyer for a fee.

Wholesaling properties is a lower-capital and lower-risk approach for entering the Oregon real estate investing industry.

What's The Best Place To Flip Houses In Oregon?

Oregon offers several promising locations for house flippers, each with its unique market dynamics and growth potential. Below are five of the best cities in Oregon to consider for your next house-flipping project, based on property price trends, population growth, and local economic conditions:

- Portland: As Oregon’s largest city, Portland remains a top choice for house flippers. The city's real estate market is highly active, with a median home value of $558,000. Despite the competitive market, Portland's population growth and strong demand for housing continue to drive property values upward. In 2023, Portland saw a 6.2% increase in home prices, making it a solid market for profitable flips.

- Salem: The state capital, Salem, is another excellent option for flippers. With a more affordable median home value of $430,000, Salem has been experiencing steady growth, fueled by its expanding economy and attractive living conditions. Home values in Salem increased by 5.4% in 2023, offering significant potential for returns on investment.

- Eugene: Known for its vibrant culture and university presence, Eugene is a thriving market with a median home value of $475,000. The city has seen a 4.9% rise in home prices over the past year, supported by population growth and a strong local economy. Eugene's diverse housing market offers opportunities for both beginner and experienced flippers.

- Bend: Bend is one of Oregon’s fastest-growing cities, with a booming real estate market. The median home value in Bend is $700,000, reflecting its desirability and high demand. The city's population growth of 7% in 2023 has driven a 9.3% increase in home prices, making it a lucrative market for house flipping.

- Medford: Located in Southern Oregon, Medford is an emerging market for house flippers. The median home value in Medford is $425,000, with home prices increasing by 5.1% in 2023. The city’s growing economy, coupled with its affordable housing, makes Medford an attractive option for flippers looking for solid returns without the high costs associated with larger cities.

Each of these cities in Oregon presents unique opportunities for house flippers, depending on your budget and investment strategy. Whether you’re looking for a bustling urban market like Portland or a growing community like Bend, Oregon offers a range of options for profitable real estate investments.

Is It Hard To Flip Houses In Oregon?

Flipping houses in Oregon can present challenges, but with the right approach, it can also be a rewarding venture. The state’s real estate market is competitive, especially in desirable areas like Portland and Bend, where property prices are higher. The median home value in Oregon is around $485,000 as of 2023, making it crucial for flippers to carefully analyze their investment opportunities. Securing properties at a favorable price and managing renovation costs efficiently are key to overcoming these challenges.

Additionally, Oregon's regulatory environment adds complexity to the house-flipping process. Strict building codes, permit requirements, and environmental regulations can slow down projects and increase costs. However, those who are well-prepared and knowledgeable about the local market can still find success. By staying informed about market trends and working with experienced contractors, flippers can navigate these hurdles and achieve profitable outcomes.

Final Thoughts On Flipping Homes In Oregon

Learning how to flip houses in Oregon could prove to be a profitable venture. However, rehabbing is an extensive and involved process that can intimidate even experienced investors. As a result, it’s best to go into the process as prepared as possible. By leveraging the guidance of a mentor and prioritizing thorough research, even newcomers can navigate the best place to flip houses in Oregon.

Here at Real Estate Skills, we specialize in providing the insights, resources, and guidance needed to thrive in the unique Oregon house-flipping market. Our team of professionals is equipped with a deep understanding of this specific real estate landscape and is committed to sharing this expertise with you.

We aim to empower you with the knowledge and skillset necessary to evaluate potential deals effectively, secure the right funding, and make well-informed decisions that optimize your profitability in the Oregon real estate market.

Get in touch today to take your house-flipping ambitions from mere ideas to profitable realities. We're ready to guide you every step of the way, providing the support you need to confidently flip houses in Oregon. Begin your learning journey with Real Estate Skills, and flip houses in Oregon with newfound confidence!

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.