How To Flip Houses In Ohio: 15-Step Home Renovation Guide

Mar 11, 2025

According to ATTOM Data Solutions’ latest Home Flipping Report, rehabbers across the country managed to average a 25% return on investment (ROI) as recently as the end of 2022, or a gross-flipping profit of about $62,000 per deal. Perhaps even more importantly, few states award investors the same opportunity to realize flipping profits like Ohio.

The Buckeye State combines the lucrative potential of rehabbing with the one thing investors need to capitalize on more opportunities: a relatively high foreclosure rate.

If you want to see what the housing market has in store for the real estate investing community in 2023, there’s no better time to learn how to flip houses in Ohio.

This guide will teach you everything you need to know, including:

- What Is House Flipping?

- Why Flip Houses In Ohio?

- Ohio House Flipping Statistics

- How To Flip Houses In Ohio In 15 Steps

- How Much Do House Flippers Make In Ohio?

- Is House Flipping Illegal In Ohio?

- Do You Need A Real Estate License To Flip Houses In Ohio?

- How Much Does It Cost To Flip A House In Ohio?

- How To Flip A House In Ohio With No Money?

- What's The Best Place To Flip Houses In Ohio?

- Is It Hard To Flip Houses In Ohio?

- How Do You Find Contractors For Flipping Houses In Ohio?

- Final Thoughts On Flipping Homes In Ohio

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

What Is Flipping Houses?

House flipping, otherwise known as rehabbing, is one of today’s most popular investment strategies in the real estate sector.

Not surprisingly, house flipping involves buying a property below its market value (preferably in need of repairs or renovations), making the necessary improvements, and selling (flipping) the updated asset to a buyer for potential profits.

Read Also: How To Wholesale Real Estate In Ohio

Why Flip Houses in Ohio?

Ohio is an attractive state for house flippers due to its diverse real estate market and relatively low cost of living, which provides a fertile ground for profitable investments. In recent years, Ohio has seen steady population growth, particularly in urban centers like Columbus, Cincinnati, and Cleveland, driving demand for housing and real estate investments. According to a 2023 report by ATTOM Data Solutions, Ohio ranks among the top states for home flipping, with a gross return on investment (ROI) averaging around 56.4%. This impressive ROI is driven by the state's affordable housing market, where the median home price is significantly lower than the national average, allowing investors to buy properties at a low cost and sell them for a substantial profit.

Ohio's strong economy further bolsters the potential for successful house flipping. The state has a diverse industrial base, including manufacturing, healthcare, and technology sectors, which contribute to a stable job market and consistent demand for housing. For instance, Columbus has been recognized as one of the fastest-growing cities in the U.S., with a population increase of over 10% in the last decade. This population growth has fueled a thriving real estate market, with home prices in Columbus rising by nearly 7.5% in 2023 alone, making it an ideal location for house flippers looking to capitalize on the city's expansion.

Additionally, Ohio offers a favorable environment for real estate investors due to its relatively low property taxes and a range of state-level incentives aimed at revitalizing urban areas. For those exploring how to invest in real estate in Ohio, programs such as the Ohio Historic Preservation Tax Credit and various local grants encourage the rehabilitation of older properties, making it easier for flippers to improve homes and sell them at a premium. With these advantages, Ohio presents a compelling opportunity for house flippers to achieve significant returns on their investments while contributing to the revitalization of its cities and communities.

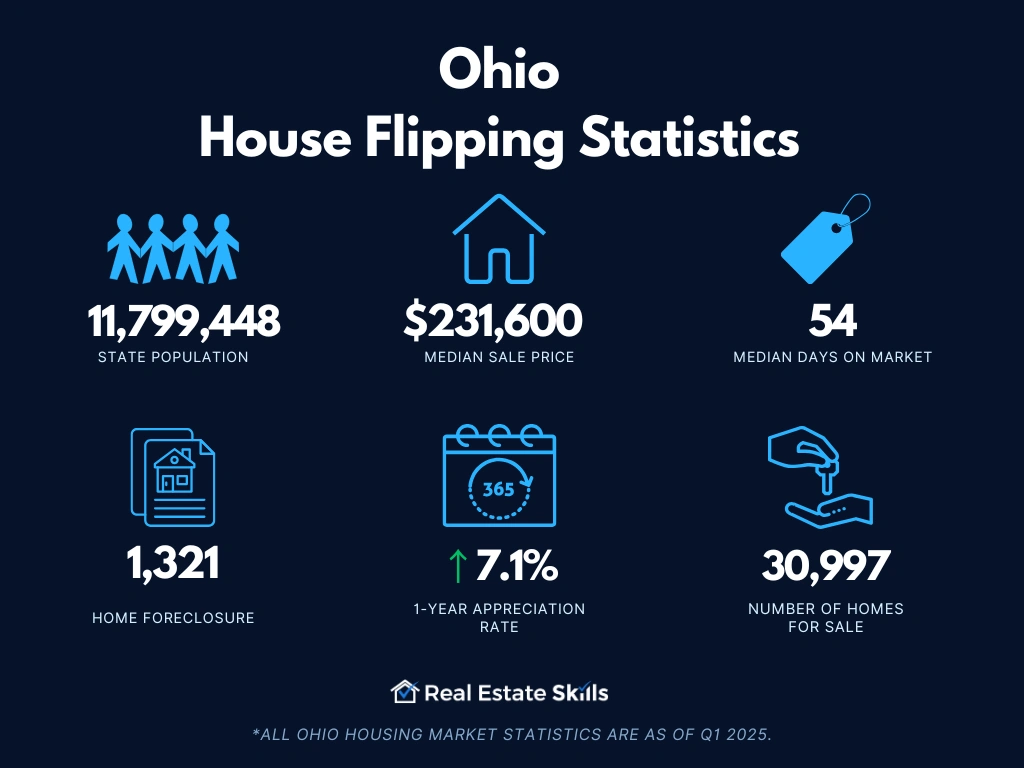

Ohio House Flipping Statistics

House flipping has already proven to be a lucrative investment strategy in every state, and Ohio is no exception. That said, Ohio real estate investors may have an advantage over their counterparts in most other states. Ohio’s relatively high distribution of foreclosures presents local real estate investors with more opportunities to capitalize on.

According to ATTOM Data Solutions’ Year-End 2022 U.S. Foreclosure Market Report, Ohio had the fifth-highest number of foreclosure filings throughout 2022. Trailing only California, Texas, Florida, and Illinois, The Buckeye State saw the foreclosure process begin on 13,469 properties. Despite having the fifth-highest foreclosure filings, Ohio had the fourth-highest foreclosure rate.

Today, foreclosure filings are improving, but the state still has a high distribution of distressed homes. According to SoFi, Ohio’s 3,167 foreclosure filings in March were enough to give it the ninth-highest foreclosure rate in the country.

Here are dependable housing indicators if you're learning how to flip houses in Ohio (data provided by the U.S. Census Bureau, and RedFin):

- Population: 11,799,448

- Employment Rate: 60.8%

- Median Household Income: $67,769

- Median Sale Price: $231,600 (+7.1% Year-Over-Year)

- Number Of Homes Sold: 7,246 (-1.5% Year-Over-Year)

- Median Days On Market: 54 (+12 Year-Over-Year)

- Number Of Homes For Sale: 30,997 (+8.2% Year-Over-Year)

- Number Of Newly Listed Homes: 9,593 (-6.6% Year-Over-Year)

- Months Of Supply: 3 (+0 Year-Over-Year)

- Homes Sold Above List Price: 27.3% (-2.3 Points Year-Over-Year)

- Homes With Price Drops: 22.2% (+0.4 Points Year-Over-Year)

- Foreclosure: 1,321

*All Ohio housing market statistics are as of Q1 2025

How To Flip Houses In Ohio In 15 Steps

The Ohio real estate market’s high distribution of foreclosures presents plenty of opportunities for investors. As a result, there may be no better time to learn how to flip houses in Ohio than now. To fast-track your education, try following the seven steps outlined below:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Choosing the right market is one of the most critical steps in flipping houses in Ohio. The state offers a diverse range of real estate markets, from bustling urban centers like Columbus and Cincinnati to quieter suburban and rural areas. Each market has its own set of opportunities and challenges, making it essential to do thorough research before deciding where to invest. Factors such as property values, neighborhood growth potential, and local economic conditions should guide your decision. By carefully selecting a market that aligns with your budget and investment goals, you can set yourself up for a successful flip.

In Ohio, urban areas often provide higher potential returns due to their larger populations and greater demand for housing. Cities like Cleveland, for example, have neighborhoods that are undergoing revitalization, offering opportunities for investors to purchase properties at lower prices and sell them at a significant profit after renovation. However, these markets can also be more competitive, requiring investors to act quickly and efficiently. On the other hand, suburban and rural areas may offer lower entry costs and less competition, though the profit margins might be smaller and properties may take longer to sell.

Understanding local market trends is crucial when picking your market. Look for areas with rising home values, population growth, and new developments, as these indicators often signal a strong market for house flipping. Additionally, consider the availability of distressed properties, as these can be excellent opportunities for investors to buy low, renovate, and sell at a higher price. By focusing on markets with a positive outlook and strong potential for growth, you can maximize your chances of success in flipping houses in Ohio.

Find Your Money

Securing the necessary funding is a crucial step in any house-flipping venture. In Ohio, investors have various financing options to choose from, including traditional bank loans, private money, and hard money lenders. Each option comes with its own set of advantages and potential drawbacks, so it’s essential to understand which one aligns best with your investment strategy and financial situation. Having your finances in order before purchasing a property not only streamlines the process but also gives you a competitive edge in a fast-moving market.

Private and hard money lenders are often the go-to choice for house flippers due to their flexibility and speed compared to traditional bank loans. These lenders understand the unique needs of real estate investors and can provide quick access to capital, often with fewer requirements than conventional loans. However, it’s important to carefully evaluate the terms and interest rates associated with these loans, as they can be higher than those of traditional financing options. By securing the right funding, you can confidently move forward with your house-flipping project in Ohio.

How To Find Private & Hard Money Lenders

Finding reliable private and hard money lenders is key to successfully financing your house-flipping project in Ohio. Private lenders are typically individuals or groups of investors who are willing to provide capital in exchange for a return on their investment. Hard money lenders, on the other hand, are companies that specialize in short-term real estate loans, often secured by the property itself. Both types of lenders can be invaluable resources for securing quick financing, especially in competitive markets where timing is everything.

Private lenders are often found through networking within the real estate community. Attending local real estate investment meetings, joining online forums, and building relationships with fellow investors can lead you to private individuals who are willing to finance your deals. These lenders are usually more flexible and can tailor their loan terms to fit your specific needs. Unlike traditional bank loans, private money is often more accessible to those with less-than-perfect credit or unconventional investment strategies. Platforms like Kiavi and Lima One also provide access to a network of private lenders, making it easier to find someone who is a good match for your project.

Hard money lenders are more structured than private lenders and typically offer faster access to funds with less emphasis on credit scores and more focus on the property’s potential value. These lenders can be found through a variety of online platforms, including Kiavi and Lima One, which offer comprehensive listings of local and national hard money lenders. You can also search through real estate investment groups and industry-specific websites. When choosing a hard money lender, it’s important to compare interest rates, loan terms, and fees to ensure you’re getting the best possible deal for your investment.

Whether you choose to work with a private lender or a hard money lender, it’s important to do your due diligence and understand the terms of your loan agreement. Both types of financing can provide the capital needed to successfully flip houses in Ohio, but the right choice will depend on your individual circumstances and the specifics of your investment project. By leveraging the resources available, including platforms like Kiavi and Lima One, you can secure the funding you need to make your house-flipping venture a success.

Find Three Contractors

When flipping houses in Ohio, finding the right contractors is one of the most critical steps in ensuring your project’s success. You’ll need a reliable team of professionals to handle various aspects of the renovation, from plumbing and electrical work to painting and carpentry. It's essential to have at least three contractors lined up for each aspect of the job. This not only ensures you have backups if one contractor becomes unavailable but also allows you to compare bids and timelines, helping you choose the best option for your budget and schedule.

Working with multiple contractors can also provide different perspectives on the renovation process. Some may have innovative solutions or cost-effective alternatives that could save you money and time. Additionally, having a team of three contractors per trade ensures that your project stays on track, even if unforeseen issues arise with one of them. This approach adds a layer of security to your investment, as the success of a house flip often hinges on the quality and efficiency of the renovation work.

Finally, when selecting contractors, it’s crucial to verify their credentials, check their references, and review their past work. A contractor’s experience and reputation in the Ohio market are key indicators of their reliability and quality of work. Make sure they are properly licensed and insured, which protects you from potential legal and financial issues down the line. By carefully vetting each contractor and keeping open lines of communication, you can create a strong team that will help you achieve your house-flipping goals in Ohio.

How To Find A General Contractor

Finding a general contractor who is trustworthy and skilled is vital to the success of your house flip. Start by asking for recommendations from fellow real estate investors, friends, or family members who have recently completed similar projects. Word of mouth can be a reliable way to find contractors who have a proven track record. Additionally, you can explore online platforms like HomeAdvisor, Thumbtack, Angi, and Houzz, where you can read reviews, compare services, and get quotes from multiple contractors. These platforms allow you to filter searches based on location, ratings, and specific project needs, making it easier to find a contractor who meets your criteria.

When evaluating potential general contractors, it’s important to conduct interviews to discuss your project in detail. Ask them about their experience with similar types of renovations, their availability, and their approach to handling unexpected challenges. Request a detailed estimate that breaks down labor and material costs, and be sure to clarify the timeline for completion. This transparency helps set clear expectations from the outset, minimizing the risk of delays or budget overruns.

Finally, always check the credentials and references of any general contractor you consider hiring. Ensure they have the appropriate licenses and insurance coverage required by Ohio law. Contact their previous clients to inquire about their experience working with the contractor, including the quality of work, adherence to deadlines, and overall professionalism. By taking these steps, you can confidently select a general contractor who will help bring your house-flipping project to successful completion.

Find An Investor-Friendly Agent

Securing an investor-friendly real estate agent is crucial to your success when flipping houses in Ohio. Unlike regular real estate agents, investor-friendly agents understand the unique needs of property investors, including the importance of finding undervalued properties, navigating the local market, and closing deals quickly. These agents are well-versed in the dynamics of the Ohio real estate market and can provide valuable insights into neighborhoods with high potential for profit. They can also help you identify properties that may not yet be listed on the Multiple Listing Service (MLS) but are ripe for investment.

An investor-friendly agent is more than just a property locator; they are your strategic partner in the flipping process. They can assist in negotiating the purchase price, which is critical to ensuring a profitable flip. Furthermore, they often have a network of contacts, including contractors, inspectors, and other real estate professionals, which can be a valuable resource as you move through the renovation and selling stages. By working with an agent who understands your goals and has experience with flips, you can make more informed decisions and potentially increase your overall return on investment.

When choosing an investor-friendly agent in Ohio, it’s essential to look for someone who has a proven track record of working with real estate investors. They should have a deep understanding of market trends, know how to spot a good deal, and be able to move quickly to secure properties in competitive markets. A good agent will also be proactive in finding deals, even in off-market opportunities, giving you an edge over other investors. Building a strong relationship with such an agent can significantly streamline the process of buying, renovating, and selling your flip properties.

How To Find An Investor-Friendly Agent

Finding the right investor-friendly agent in Ohio requires a bit of research and networking. Start by asking for recommendations from other real estate investors in your area. Networking events, local real estate investment groups, and online forums can also be valuable resources for finding agents who specialize in working with investors. These connections can provide firsthand experiences and insights into which agents have a strong reputation for delivering results in the Ohio market.

Another effective way to find an investor-friendly agent is to search for professionals who have been involved in multiple investment transactions. Look at their past deals and see if they have experience with the type of properties you’re interested in flipping. You can also use online platforms like Zillow or Realtor.com to read reviews and check an agent’s transaction history. When you identify potential agents, reach out to them and ask specific questions about their experience with investment properties, their familiarity with local market trends, and their approach to finding deals. This will help you gauge whether they are a good fit for your flipping business.

In addition, consider working with agents who are part of larger real estate teams that focus on investment properties. These teams often have access to exclusive listings and can provide more comprehensive support throughout the flipping process. By doing your due diligence and selecting an agent who truly understands the needs of real estate investors, you’ll be better positioned to find profitable deals and successfully flip houses in Ohio.

Find A House To Flip

Finding the right house to flip in Ohio is a critical step in ensuring a successful investment. The process of locating a property that has the potential to generate significant profits requires a strategic approach. One of the most effective methods is driving for dollars, where you physically drive through neighborhoods looking for distressed properties or homes that appear to be in need of repair. These properties are often excellent candidates for flipping, as they can be purchased at a lower price and, after renovations, sold at a much higher value.

Another proven method is using direct mail campaigns. This involves sending targeted letters or postcards to homeowners who may be motivated to sell, such as those facing foreclosure, dealing with probate, or managing inherited properties. Direct mail allows you to reach out directly to potential sellers, often before the property hits the open market, giving you a competitive edge in securing deals. Personalizing your messages and following up consistently can increase the chances of getting a positive response.

The Multiple Listing Service (MLS) is also a valuable resource for finding flip-worthy properties. The MLS provides access to a comprehensive database of properties listed for sale by real estate agents, including foreclosures and fixer-uppers. By working with a real estate agent who has access to the MLS, you can quickly identify properties that match your criteria and move fast in a competitive market. The MLS also allows you to track price reductions and new listings, helping you spot potential deals as soon as they become available.

Alternative Strategies to Find a House

While driving for dollars, direct mail campaigns, and the MLS are effective strategies, there are alternative approaches that can also yield great results. These methods can help you uncover hidden opportunities and stay ahead of the competition:

- The Day Zero Strategy: Focuses on making offers on properties as soon as they are listed on the MLS, giving you a first-mover advantage.

- The Old Listing Strategy: Targets properties that have been on the market for an extended period, where sellers may be more willing to negotiate a lower price.

- The Wholesaler Strategy: Involves working with property wholesalers who specialize in finding and assigning contracts on distressed properties, often at below-market prices.

By diversifying your approach and incorporating these strategies, you can increase your chances of finding profitable flip opportunities.

In conclusion, finding the right house to flip in Ohio requires a combination of persistence, creativity, and strategy. Whether you’re driving through neighborhoods, sending out direct mail, or leveraging the MLS, it’s essential to stay proactive and adaptable in your search. Incorporating alternative strategies like The Day Zero Strategy, The Old Listing Strategy, and The Wholesaler Strategy can further enhance your ability to identify and secure the best properties for your flipping projects.

That said, some investors in Ohio may not have access to the MLS for various reasons. Fortunately, these strategies can also be applied to alternative listing platforms like RedFin, Zillow, and Realtor.com. When flipping homes in Ohio, you can adapt the strategies mentioned above to these websites. However, it's important to note that the MLS remains the preferred option due to its more comprehensive data and contact information.

Make Discovery Calls To Listing Agents

When flipping houses in Ohio, making discovery calls to listing agents is an essential step to gather vital information that could influence your investment decision. These calls allow you to clarify details that aren't always apparent from a property listing, helping you determine whether a particular house is worth pursuing. Engaging with listing agents can also open doors to off-market opportunities and create relationships that may benefit future deals.

During these calls, it's crucial to ask targeted questions that will provide you with a clear picture of the property's status, condition, and potential challenges. Each question serves a specific purpose, from verifying the availability of the listing to understanding the seller's motivations. By being thorough and direct, you can ensure that you have all the necessary information to make an informed decision.

Here are some key questions to ask during your discovery calls with Ohio listing agents:

-

Is the listing still active?

It's important to ask a listing agent if the property listing is still active to ensure it's not already under contract with another buyer. Knowing the property is still available prevents investors from wasting time on deals that aren't accessible. This step streamlines the process and keeps your focus on viable opportunities. -

Are the listing’s photos up to date?

Asking listing agents if the photos are up-to-date is crucial because it ensures you have an accurate understanding of the property's current condition. Knowing the home's true state helps investors gauge the extent of repairs and renovations needed. This information is essential for accurately estimating costs and potential profit margins. -

What is the current condition of the home?

Inquiring about the current condition of the home is crucial as it serves a dual purpose. First, it encourages the agent to disclose if the home is distressed, confirming its suitability for a flip. Second, it can reveal hidden issues that aren't immediately obvious, allowing investors to better assess repair costs and potential challenges. -

Are you willing to work with an investor?

Asking the listing agent if they are open to working with an investor is important for several reasons. This transparency fosters honest communication and sets clear expectations moving forward. Additionally, if you don't currently have an agent, this could be an opportunity to convince the listing agent to represent you on the deal, allowing them to earn commissions on both ends of the transaction and potentially building a beneficial working relationship for future deals. -

What is the owner’s reason for selling?

Understanding the owner's reason for selling can provide insight into the seller's motivations. While the agent may not always disclose this information, any details you can gather can be valuable in negotiating a better deal. Knowing the seller's urgency or circumstances can give you leverage to structure an offer that meets their needs while benefiting your investment strategy. -

Is there a lot of competition for the property?

Asking the listing agent about how much competition the property is getting is important because it helps you gauge the urgency and competitiveness of the situation. Knowing if there are multiple offers or significant interest can inform your strategy, enabling you to make a more competitive bid if necessary. This information helps you avoid overpaying or missing out on a potentially profitable deal.

These discovery calls can make the difference between securing a successful flip or encountering unforeseen challenges. By asking the right questions, you'll position yourself to make informed, strategic decisions in the Ohio real estate market.

Analyze The Property

Analyzing the property is a crucial step in the house flipping process, as it helps investors assess whether a property is a viable investment. In Ohio, this analysis involves evaluating three key factors: the after-repair value (ARV), repair costs, and the purchase price. Understanding these elements will guide your decision-making and help ensure a profitable flip.

After-Repair Value

The after-repair value (ARV) is a critical metric for assessing a property’s potential profitability. It represents the estimated market value of a property once all necessary repairs and renovations are completed. Calculating the ARV involves researching comparable sales, or "comps," which are recently sold properties similar in size, location, and condition to your target property.

To find accurate comps in Ohio, focus on properties that have the same number of bedrooms and bathrooms, are within 20% of your property’s square footage, and are located within the same neighborhood or a half-mile radius. The comps should have sold within the last six months and ideally be recently renovated. Once you have a list of suitable comps, calculate the average sale price to estimate the ARV. This figure will help you determine the potential selling price of the property after renovations and guide your investment strategy.

Repair Costs

Estimating repair costs is essential to ensure your project remains within budget and yields a profit. Begin by conducting a thorough inspection of the property and compiling a detailed list of needed repairs and upgrades. Consult with multiple contractors to obtain accurate quotes for both labor and materials. It’s also wise to set aside a contingency budget—typically 10-15% of the total estimated repair costs—to cover any unexpected expenses that may arise during the renovation process. By carefully estimating repair costs, you can better manage your budget and enhance the likelihood of a successful flip.

Purchase Price

Determining the right purchase price is the final piece of the analysis puzzle. To find your maximum allowable offer (MAO), use the ARV and estimated repair costs. The MAO represents the highest price you can pay for the property while ensuring profitability. Factor in various costs, including:

- The ARV: The expected market value after repairs.

- Hard Money Loan Costs: Interest rates, origination fees, and points, along with the anticipated loan duration.

- Private Money Loan Costs: Interest and terms of the private money loan.

- Front-End Closing & Holding Costs: Typically around 2% of the purchase price, plus ongoing expenses like insurance, utilities, and taxes.

- Backend Closing Costs: Usually 1% of the ARV.

- Realtor Fees: Typically 6% of the purchase price, though a reduced fee may be possible with an investor-friendly agent.

- Projected Profit: Desired profit margin based on industry standards, such as the 27.5% average return reported by ATTOM Data Solutions.

Subtract all these costs from the ARV to calculate the MAO. This will help you determine the highest price you can offer while still achieving a profitable outcome. By carefully analyzing these factors, you can make informed decisions and increase the likelihood of a successful house flip in Ohio.

Renovate The House

Renovating the house is a pivotal step in the house flipping process in Ohio. Your goal is to enhance the property to meet or exceed the projected after-repair value (ARV) while aligning with the standards of comparable properties in the area. It’s important to focus on improvements that add substantial value without over-improving beyond what the local market supports. This strategy helps maximize your return on investment while maintaining control over renovation costs.

Before the renovation begins, it's essential to secure six key documents that will help manage the project effectively and protect your investment:

- Independent Contractor Agreement: This document formalizes the relationship between you and your contractor, specifying payment terms, deadlines, and job responsibilities. It ensures that both parties have a clear understanding of their roles and expectations, minimizing the potential for disputes.

- Final Scope Of Work: A comprehensive scope of work details every aspect of the renovation, including specific tasks, materials, and timelines. This document serves as a blueprint for the project, helping ensure that renovations meet your standards and stay within budget.

- Payment Schedule: The payment schedule outlines when and how much you will pay the contractor based on project milestones. It helps keep the renovation on track by linking payments to completed stages, which also motivates the contractor to adhere to the agreed-upon schedule.

- Insurance Indemnification Agreement: This agreement verifies that the contractor holds adequate insurance coverage and agrees to protect you from any liabilities arising from accidents or damages during the renovation. It safeguards you from potential financial losses related to workplace incidents.

- W-9: The W-9 form collects the contractor's tax identification information, which is necessary for IRS reporting. It ensures compliance with tax regulations and allows you to issue a 1099 form for payments made to the contractor throughout the year.

- Final Lien Waiver: The final lien waiver is a document confirming that the contractor has been fully paid and waives any future claims against the property. This protects you from any further financial demands once the renovation is complete.

With these documents in place, you can proceed with the renovation confidently, ensuring that the work done on the property will enhance its value and align with your financial goals. Proper documentation helps keep the project on track and protects you from potential risks, allowing you to focus on transforming the property into a successful investment.

Prep & List The House On The MLS

Once renovations are complete, preparing and listing the house on the MLS is the final step before selling. This phase involves ensuring the property is market-ready and appealing to potential buyers. By focusing on three key elements, you can enhance the home's presentation and increase its attractiveness in the competitive Ohio real estate market.

-

Final Punchlist: Before listing the house, conduct a thorough inspection to create a final punchlist. This checklist should address any last-minute repairs or touch-ups needed to ensure the property is in pristine condition. Common tasks might include fixing minor cosmetic issues, touching up paint, and ensuring all systems are operational. Completing this punchlist helps present the house in its best light and prevents small issues from becoming obstacles during the sale process.

-

Home Staging: Home staging plays a crucial role in showcasing the property’s potential and appealing to buyers. According to the Real Estate Staging Association (RESA) and the National Association of Realtors, an average investment of about 1% of the sale price in staging can yield a return on investment (ROI) of 5% to 15% over the asking price. Staging helps buyers visualize how they might use the space, making the home more inviting and desirable. Effective staging can make the property stand out in the MLS listings and attract more serious buyers.

-

Professional Photos: High-quality professional photos are essential for creating an impactful MLS listing. Good photography highlights the property’s best features and captures it in the most flattering light. Professional photos can significantly enhance the online listing, drawing more attention and generating greater interest. Invest in a skilled photographer to ensure the images reflect the home’s true value and appeal.

Set An Enticing Asking Price

Setting an enticing asking price is critical to attracting potential buyers and achieving a successful sale. Start by analyzing recent sales of comparable properties in the area to determine a competitive price range. Consider factors such as the home's condition, location, and the current market trends in Ohio. An accurately priced property can attract more buyers and potentially lead to multiple offers, driving up the final sale price. By pricing the home strategically and presenting it well through staging and professional photos, you can maximize your return on investment and achieve a successful flip.

Read Also: What Is Home Staging And How Can I Use It?

Field Offers & Negotiate

Once your house is listed on the MLS, the next step in the flipping process is to field offers and engage in negotiations. This phase is crucial as it determines the final sale price and terms of the deal. Effective negotiation can significantly impact your profitability, making it essential to approach this step with strategy and insight.

When you start receiving offers, review each one carefully to assess the buyer’s financial position, contingencies, and proposed terms. Look beyond the offer price to evaluate the overall strength of each proposal. For instance, consider offers with fewer contingencies or quicker closing timelines, as they can simplify the transaction and reduce the risk of delays. Be prepared to negotiate on price, closing costs, and other terms to reach an agreement that aligns with your financial goals and timelines.

Effective negotiation also involves understanding the buyer's motivations and leveraging them to your advantage. If a buyer is particularly eager or has already sold their own property, they might be more flexible on terms. Conversely, if a buyer has multiple options or is unsure, you may need to offer incentives or adjust your terms to close the deal. By staying responsive, transparent, and strategic, you can navigate the negotiation process successfully and secure the best possible outcome for your house flip in Ohio.

Sell The House & Get Paid

The final step in flipping houses in Ohio is to sell the property and secure your payment. Once you’ve accepted the best offer and completed all necessary negotiations, the sale proceeds to the closing phase. During this period, you’ll work closely with your real estate agent, the buyer’s agent, and legal representatives to finalize the transaction. This includes reviewing and signing the closing documents, which transfer the property ownership to the buyer and officially conclude the sale.

After all paperwork is completed and the closing is finalized, the funds from the sale will be distributed. Typically, the proceeds are wired directly to your account, minus any closing costs and fees. These costs might include real estate agent commissions, title insurance, and any remaining expenses related to the sale. Ensuring that all financial details are thoroughly reviewed and handled properly is crucial to maximize your profit and ensure a smooth transaction.

Once the sale is completed and the funds are received, it’s important to conduct a final review of the entire flipping process. Assess the profitability of the project, considering the original purchase price, renovation costs, and final selling price. This reflection not only confirms the success of the current project but also helps refine strategies for future investments. Selling the house and getting paid is the culmination of your efforts in flipping, and proper management of this final step will solidify the overall success of your real estate venture.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make in Ohio?

In recent years, Ohio has emerged as a lucrative market for house flippers, with the average gross flipping profit reaching $65,000 in 2023, according to ATTOM Data Solutions. While this figure represents the state average, individual profits can vary significantly depending on factors like location, property condition, and renovation costs. Successful house flippers in Ohio have the opportunity to achieve even higher returns by carefully selecting properties in areas with strong demand and favorable market conditions.

Ohio is home to several cities that rank among the nation's top locations for profitable house flipping. According to the latest Home Flipping Report by ATTOM Data Solutions, three Ohio cities stand out for their substantial gross flipping profits on median-priced transactions:

- Cleveland, OH: $90,000 average gross flipping profit

- Cincinnati, OH: $82,500 average gross flipping profit

- Columbus, OH: $75,000 average gross flipping profit

These cities offer attractive opportunities for house flippers due to their affordable property prices and growing demand for housing. The relatively low cost of acquiring homes in these areas, combined with rising property values, makes them ideal for maximizing returns on investment.

Flipping houses in Ohio requires a strategic approach, especially when it comes to budgeting for renovations and understanding local market trends. By focusing on key markets like Cleveland, Cincinnati, and Columbus, investors can tap into the potential for significant profits while navigating the unique dynamics of Ohio's real estate landscape.

Do You Need A Real Estate License To Flip Houses In Ohio?

No, you do not need a real estate license to flip houses in Ohio. Investors are free to carry out their rehabbing exit strategies across the entire state without becoming licensed professionals. It is worth noting, however, that unlicensed investors may not act as real estate agents or brokers.

While you do not need a license to flip homes in Ohio, you may benefit from having one. You can gain access to the MLS, network with like-minded professionals, and even avoid paying real estate commissions if you are licensed.

How To Flip A House In Ohio With No Money?

Flipping real estate in Ohio requires capital. However, nobody ever said the money used to buy a house has to be your own. It is possible to secure and fund a deal with the help of these flip loans:

- Private Money Loans: Originated by anyone with excess capital and a willingness to invest it, private money loans are today's investors' preferred source of short-term cash. While interest rates on private money loans are high, their speed of implementation and lack of strict approval requirements are well worth the price of admission.

- Hard Money Lenders: Second only to private money loans, hard money lenders offer the same advantages as their counterparts — with more professionalism.

- Wholesaling: While not a flip in the traditional sense, a wholesale deal will have an investor acquire the right to buy a property (at no cost). Once under contract with the original owner, the investor will sell their rights to buy the property to an end buyer.

Read Also: Private Money Lenders: The (ULTIMATE) Guide

Is It Hard To Flip Houses in Ohio?

Flipping houses in Ohio can be both challenging and rewarding, depending on your approach and knowledge of the local market. Ohio’s real estate market is diverse, with varying conditions across different cities. While the state offers numerous opportunities due to its affordable housing and growing urban areas, success largely depends on understanding regional differences, market trends, and the economic conditions of specific cities. Navigating these factors can be difficult for beginners, but those who do their homework and develop a solid investment strategy can find profitable opportunities.

One of the key challenges in flipping houses in Ohio is managing renovation costs and timelines, especially in cities where older homes require significant repairs. Ohio’s climate, with its harsh winters, can also impact the renovation process and increase costs. However, Ohio's relatively low property prices and rising home values in many areas provide a favorable environment for flipping. Investors who can effectively manage these challenges and adapt to local market conditions can achieve success in Ohio’s house-flipping market.

Final Thoughts On Flipping Homes In Ohio

Ohio property investing is growing more popular with each passing day. As more people look for supplemental income in an uncertain economy, real estate is receiving a lot of deserved attention. If for nothing else, median gross flipping profits typically eclipse those of today’s most popular investment strategies.

Those who learn how to flip houses in Ohio may have a unique advantage. With one of the highest foreclosure rates in the country, Ohio real estate investors may use the steps outlined in this ultimate guide to capitalizing on more opportunities than many of their out-of-state counterparts.

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.