How To Flip Houses In New Mexico: Step-By-Step Home Renovation Guide

Mar 12, 2025

New Mexico offers a wealth of opportunities if you're an aspiring real estate investor looking to break into the house-flipping industry. With its unique blend of vibrant culture, stunning landscapes, and thriving real estate market, the state presents an attractive landscape for those who learn how to flip houses in New Mexico.

In particular, the state’s lack of positive net migration in the past may benefit forward-thinking investors in the future. With just over 2 million people, New Mexico’s population has only grown about 2.47% since 2010, which translates to one of the lowest growth rates in the country.

That said, New Mexico is starting to be considered one of the last bastions of affordability. With a median home value below the national average, New Mexico should see added demand as home prices continue to appreciate nationwide and “work-from-home” trends continue to accelerate. As a result, there may be no better time to learn how to flip houses in New Mexico than today.

In this guide, we'll explore the essential steps and strategies for successfully flipping houses in New Mexico, from understanding the local market to navigating the intricacies of the house-flipping process. To get things started, we’ll explore the following:

- What Is Flipping Houses?

- New Mexico House Flipping Statistics

- How To Flip Houses In New Mexico (7 Steps)

- How To Find Houses To Flip In New Mexico

- Do You Need A License To Flip Houses In New Mexico?

- How To Flip A House In New Mexico With No Money

- Best Cities To Flip Houses In New Mexico

- Final Thoughts On Flipping Homes In New Mexico

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

What Is Flipping Houses?

At its core, flipping houses is one of the most popular investment strategies for building wealth. Whereas the average stock portfolio returns about 10% per year, as measured by the S&P 500, the “typical gross flipping profit of $56,000 in the first quarter of 2023 translated into a 22.5 percent return on investment,” according to ATTOM Data Solutions. While it’s a small sample size, flipping houses has proven it is one of the best ways to invest money in today’s economy.

Learning how to flip houses in New Mexico is no exception, which begs the question: What is flipping houses? In its simplest form, flipping houses is an investment strategy that revolves around buying homes below market value, rehabbing and fixing them, and selling them for a profit. The concept relies heavily on increasing profit margins. As a result, investors will attempt to buy low, invest only what’s necessary, and sell high.

To be clear, flipping houses involves much more than simply buying and selling properties. Therefore, we are devoting the rest of this article to teaching you how to flip houses in New Mexico.

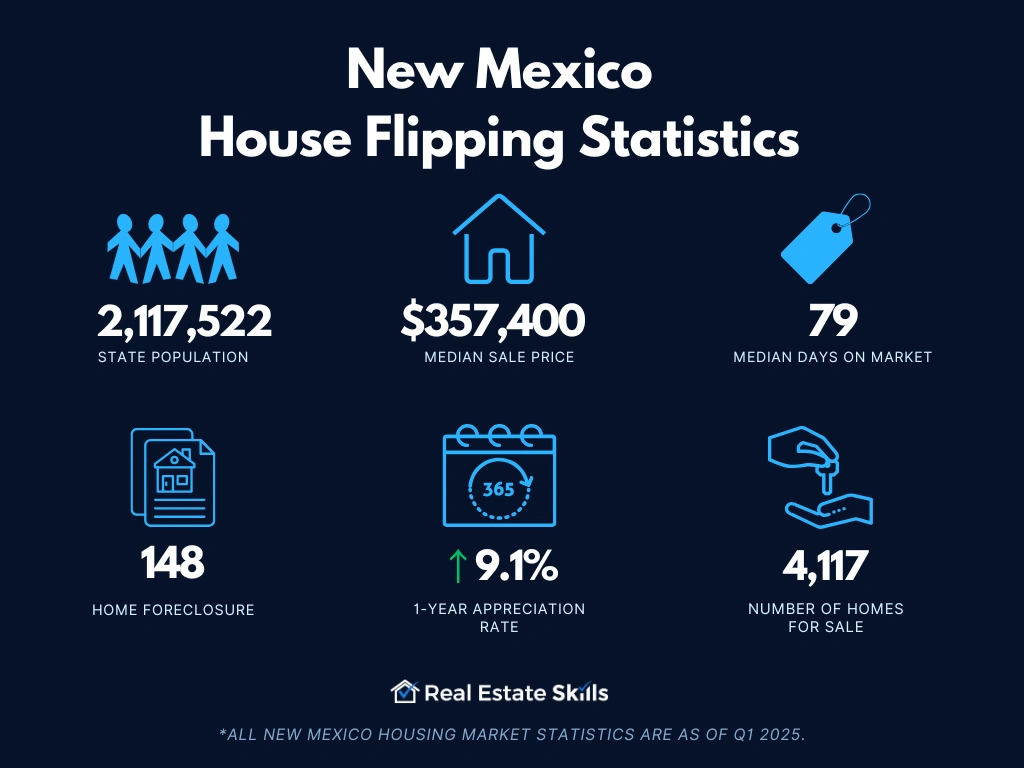

New Mexico House Flipping Statistics

Investors must understand the local dynamics before investing a single dollar in the New Mexico real estate market. Therefore, learning how to flip houses in New Mexico starts with taking a close look at these essential house-flipping statistics (data provided by the U.S. Census Bureau, RedFin, and ATTOM Data Solutions):

- Population: 2,117,522

- Employment Rate: 55.0%

- Median Household Income: $62,268

- Median Sale Price: $357,400 (+9.1% Year-Over-Year)

- Number Of Homes Sold: 671(-4.7% Year-Over-Year)

- Median Days On Market: 79 (+20 Year-Over-Year)

- Number Of Homes For Sale: 4,117 (+23.0% Year-Over-Year)

- Number Of Newly Listed Homes: 961 (+9.0% Year-Over-Year)

- Months Of Supply: 5 (+0 Year-Over-Year)

- Homes Sold Above List Price: 3.6% (-1.1 Points Year-Over-Year)

- Homes With Price Drops: 22.2% (+4.3Points Year-Over-Year)

- Home Foreclosure: 148

*All New Mexico housing market statistics are as of the first quarter of 2025.

How To Flip Houses In New Mexico (7 Steps)

Learning how to flip houses in New Mexico gets a lot easier when investors follow these seven steps:

- Find A House Flipping Mentor

- Research The New Mexico Housing Market

- Find & Analyze Distressed Properties In New Mexico

- Raise Capital To Fund The Deal

- Close On The House

- Renovate The Property

- Resell The House

Find A House-Flipping Mentor

With a foundation of knowledge to build off of, it’s time for investors to borrow some expertise. In particular, the next step in learning how to flip houses in New Mexico involves learning from the people already doing it—with a high degree of success, nonetheless.

Take the time to find a house-flipping mentor. Whether a close friend, business acquaintance, or professional investor, learning from someone who has already accomplished what you hope to achieve is the fastest way to mitigate risk and optimize efficiency.

A great house-flipping mentor can translate their expertise and experience into actionable advice to expedite a new investor's career. Partnering with a mentor offers numerous advantages, such as gaining access to real-world insights, valuable strategies, and a supportive personal and professional growth network. The experience and expertise of a mentor provide a unique perspective that can transform obstacles into opportunities.

Research The Local Housing Market

Knowledge is power in the real estate sector, so the third step involves more research. To gain better insight into the New Mexico real estate market and make more informed decisions, visit the sites listed below to round out your knowledge and prepare for the next step:

- Zillow Housing Data Research

- Zillow’s New Mexico Market Overview

- Redfin’s New Mexico Housing Market Overview

- ATTOM Data Solutions’ New Mexico Real Estate & Property Data

- Federal Reserve Bank of St. Louis’ New Mexico Data

- SoFi’s State Foreclosure Data

- U.S. Census Bureau’s New Mexico Data

- Bureau Of Labor Statistics’ New Mexico Economic Data

Find & Analyze Distressed Properties

Once investors are comfortable with local market dynamics, it’s time to find and analyze distressed properties. In doing so, however, investors will have several options. From a comprehensive analysis of a subject property to a glance at the numbers on a deal, investors have developed many ways to asses perspective deals.

One approach serves as an excellent middle ground for new investors: the 70% rule. As its name suggests, the 70% rule gives investors a good idea of what they can spend on a deal to leave enough room for profits on the backend.

Investors must determine the property's after-repair value (ARV) the first time they analyze a deal. The ARV is exactly what it sounds like; it estimates how much the home will be worth after it’s restored to its desired condition. The easiest way to determine the ARV is by analyzing recent sales data of comparable properties in the area or utilizing reliable ARV calculators.

Once the ARV is revealed, multiply it by 70% (or 0.70) and subtract the estimated rehab costs. The resulting amount represents the maximum allowable offer (MAO), which is how much investors can spend on the home and ensure sufficient profit margins.

Here is the formula:

ARV - Fixed Cost - Rehab Costs - Desired Profit = Maximum Allowable Offer (MAO)

It's important to note that while the 70% rule provides a quick snapshot of a deal's potential—it should not be solely relied upon for a comprehensive analysis. Combining it with other methods and strategies is recommended for a more thorough evaluation.

Read Also: Free ARV Calculator: After Repair Value Calculation

Raise Capital To Fund The Deal

Once a possible deal has been identified and analyzed, the next step for investors in New Mexico is to secure the necessary capital. Instead of pursuing traditional long-term financing, investors should explore shorter-term alternatives that can provide faster access to funds. Private money and hard money loans are excellent sources of capital that can meet the short-term needs of house flippers.

While these loans typically come with higher interest rates than traditional financing options, their benefits outweigh the costs. Accepting higher rates allows investors to swiftly access the funds they need, giving them a competitive advantage in New Mexico’s dynamic real estate market without the hurdles typically associated with traditional lenders.

Private and hard money lenders are asset-based lenders who prioritize the quality of the deal over the investor's credentials. Unlike traditional lenders who rely heavily on credit scores and financial history, private and hard money lenders focus on the value and potential of the flipped property.

They assess the property's potential (not unlike what the investor already did), marketability, and the investor's strategy for renovation and resale. This approach allows investors with limited credit or financial background access to the capital they need for their house-flipping projects.

Close On The House

Closing on a house in New Mexico follows a process similar to other escrow states. While there may be exceptions, investors can expect to encounter the following steps:

- Agreement On Terms: The buyer and seller agree on the terms of the purchase and sale and document them in a formal agreement.

- Escrow Process: New Mexico operates as an escrow state, involving a neutral third party like an escrow agent or title company. The buyer or agent sets up an escrow account to facilitate the transaction.

- Buyer's Due Diligence: Prospective home buyers conduct due diligence to protect their interests. This includes property walkthroughs, title searches, home inspections, appraisals, contingencies, and other necessary steps.

- Document Handling: The escrow agent or title company handles all the necessary documents, ensuring their completeness and accuracy.

- Document Review & Signing: All parties meet to review and sign the required documents, ensuring legal compliance and understanding of the terms.

- Escrow Funds: After signing the document, the buyer places the funds in the account. These funds remain in escrow until all prerequisites are met. Once the escrow terms are fulfilled, the funds are released to the seller, and the buyer receives ownership of the investment property.

- Title Transfer Documentation: Following the closing, the local Recorder's Office officially records the transfer of title, confirming the buyer as the property's new owner.

By following these steps, buyers and sellers can navigate the closing process in New Mexico smoothly, ensuring a seamless and legally compliant transaction.

Renovate The Property

Effective time management and strategic decision-making are crucial to achieving success when undertaking a house-flipping project. It is essential to prioritize renovations that enhance the property's visual appeal, align with the neighborhood's standards, and meet the market's demands.

To maximize the potential returns on investment, investors should focus on cost-effective renovations that offer a high return on investment (ROI). Enhancing the property's curb appeal can significantly impact its marketability and attract potential buyers. By prioritizing projects that yield a favorable ROI, investors can optimize their profits and increase their chances of success.

According to Remodeling Magazine, the renovations that return the most money to investors at the time of a sale in New Mexico (and the rest of the Mountain Region) are:

- Electric HVAC Conversion: Recoups 114.5% of the original cost

- Fiber-Cement Siding Replacement: Recoups 107.4% of the original cost

- Garage Door Replacement: Recoups 99.7% of the original cost

- Manufactured Stone Veneer: Recoups 96.7% of the original cost

- Vinyl Siding Replacement: Recoups 92.9% of the original cost

Resell The House

Once the final renovation of the property is complete, it's time for investors in New Mexico to prepare for the reselling phase. The ultimate goal is to sell the home for a price higher than the total investment made.

To maximize profits, investors should strongly consider enlisting the services of a Realtor or real estate agent. While agents may charge a commission, their expertise, and guidance often lead to a higher net gain for investors. In many cases, the increased sale price more than compensates for the agent's fees. Working with an experienced agent increases the likelihood of a quick sale at a higher purchase price than selling the home independently.

Remember that investors will only receive a portion of the sale price. After a successful sale, the priority is to repay the lender, including any accrued interest. Only after fulfilling this financial obligation can investors consider the final step of the process complete.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How To Find Houses To Flip In New Mexico

Here are several proven methods to help investors discover distressed properties and maximize their chances of success in the New Mexico real estate market:

- Collaborate With Local Real Estate Professionals: Forge partnerships with nearby real estate agents and professionals to expand the pool of potential on-market and off-market properties.

- Utilize The Power Of The Multiple Listing Service (MLS): Whether through a real estate license or a partnership with a real estate agent, gain access to the MLS. The largest database of listings in the country, the MLS is full of motivated sellers.

- Seize Opportunities At Foreclosure Auctions: Financial institutions that have repossessed homes would rather sell them back to investors than keep them on their books as non-performing assets. Therefore, seek out the nearest foreclosure auction and prepare to compete with other investors.

- Conduct Thorough Research Using Public Records: Visit the local Recorder's Office and search for motivated sellers. Identifying distressed homeowners will give investors a list of motivated sellers and their contact information.

- Implement Targeted Marketing Campaigns: Launching targeted direct mail campaigns to reach homeowners in specific areas of interest can significantly increase the chances of finding profitable deals. By communicating their interest in purchasing distressed properties and their ability to close quickly, investors can capture the attention of motivated sellers.

- Drive For Dollars: Driving around neighborhoods and searching for neglected properties can uncover hidden opportunities that aren’t even listed. While not guaranteed to identify a distressed owner, a neglected home can suggest the owner is less inclined to keep it.

By combining these strategies and approaches, investors can establish a reliable pipeline of potential house-flipping deals in New Mexico, setting the stage for success in a competitive real estate market.

Read Also: Finding Motivated Seller Leads: Free & Paid Tactics

Do You Need A License To Flip Houses In New Mexico?

Flipping homes in New Mexico without a real estate license is possible, although there are potential advantages for investors seeking one. By becoming licensed, investors gain access to an extensive network of industry professionals, opening doors to valuable connections and resources. Additionally, holding a real estate license enables individuals to access the MLS directly, eliminating the need for external assistance in accessing crucial property information.

It's important to note that licensing requirements and regulations may vary across states. While a real estate license is not mandatory for house flipping in New Mexico, it is advisable to stay informed about local laws and regulations to ensure compliance with any specific licensing requirements applicable in the state.

Read Also: How To Get MLS Access: The (Ultimate) Guide

How To Flip A House In New Mexico With No Money

When learning how to flip houses in New Mexico, investors will quickly find that they don’t need to use their money to finance a deal. Instead, they can use money from private and hard money lenders; these flip loans provide necessary capital without the need for traditional banks, refinancing, credit checks, or lengthy approval processes. Hard money and private money lenders focus on short-term financing solutions, ensuring swift access to cash and expediting the flipping process.

In addition to alternative financing, wholesaling is another effective strategy in New Mexico. While it’s not a form of flipping, this approach allows investors to generate income without a significant upfront investment. Wholesalers secure a property under contract and assign it to cash buyers for a fee, allowing for income generation without substantial capital expenditure and presenting a low-risk entry point for investors.

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

Best Cities To Flip Houses In New Mexico

The best cities to flip houses in New Mexico include, but are not limited to:

- Rio Rancho: Due just north of Albuquerque and adjacent to Corrales, Rio Rancho offers buyers comparable home values and growing demand. Investors who learn how to flip houses in New Meixo will find Rio Rancho has the perfect environment for rehabbers looking to capitalize on unbalanced supply and demand levels.

- Las Cruces: With a median home price well below the state average, Las Cruces is seeing a rise in demand. With prices near historic highs, more people are looking to call Las Cruces home.

- Santa Fe: Homes in Santa Fe are well above the state average, but the city offers a unique blend of cultural richness, natural beauty, and a thriving arts scene, making it an attractive destination for tourists and potential renters. The resulting demand should enable investors to increase profit margins.

Final Thoughts On Flipping Homes In New Mexico

Learning how to flip houses in New Mexico can be lucrative for real estate investors willing to navigate the unique dynamics of the state's housing market. More importantly, investors can maximize their chances of success by employing effective strategies, leveraging local resources, and adapting to the market’s specific conditions.

At Real Estate Skills, our team of experts is ready to provide the tools you need to flip houses in New Mexico and start real estate investing. We're committed to providing the knowledge, resources, and support you need to successfully navigate a New Mexico property flip. So avoid common mistakes and maximize your returns by leveraging our expertise today.

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.