How To Flip Houses In New Hampshire: 15-Step Home Renovation Guide

Mar 10, 2025

Flipping houses in New Hampshire offers a compelling opportunity for real estate investors seeking profitable ventures in a thriving market. With a low unemployment rate and limited months of inventory, the state presents a conducive environment for those eager to learn how to flip houses in New Hampshire. The enticing combination of a stable job market and a shortage of available homes creates a strong demand for well-renovated properties, making it an ideal destination for aspiring flippers.

In this comprehensive guide, we'll explore the intricacies of house flipping in New Hampshire, equipping investors with the knowledge and strategies they need to navigate the state’s competitive marketplace. We'll break down the fundamental steps of flipping houses, from finding lucrative deals to securing financing and executing successful renovations.

Whether you're a seasoned investor looking to expand your portfolio or a newcomer to the real estate market, we aim to provide you with all of the insights and tools necessary to thrive in New Hampshire's real estate market, including:

- What Is Flipping Houses?

- Why Flip Houses In New Hampshire?

- New Hampshire House-Flipping Statistics

- How To Flip Houses In New Hampshire In 15 Steps

- How Much Do House Flippers Make In New Hampshire?

- Is House Flipping Illegal In New Hampshire?

- Do You Need A License To Flip Houses In New Hampshire?

- How Much Does It Cost To Flip A House In New Hampshire?

- How To Flip A House In New Hampshire With No Money

- What's The Best Place To Flip Houses In New Hampshire?

- Is It Hard To Flip Houses In New Hampshire?

- How Do You Find Contractors For Flipping Houses In New Hampshire?

- Final Thoughts On Flipping Homes In New Hampshire

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

What Is Flipping Houses?

House flipping is an exciting investment strategy involving purchasing, renovating, and selling properties for a profit. This process is a cornerstone of the real estate investing community, offering the potential for substantial returns when executed effectively.

Flipping a house typically involves three main stages that interplay to boost profit margins: buying, rehabbing, and selling.

The buying stage is where the journey begins. Investors scout for distressed properties or homes needing renovation that can be acquired at a favorable price. The key here is to identify properties with untapped potential and the possibility of being transformed into desirable homes. Once the right property is secured, the next step is rehabbing.

During the rehabbing stage, the transformation begins. This phase entails carefully planning and executing renovations to enhance the property's value and market appeal. From structural repairs and cosmetic upgrades to modernizing amenities, each improvement contributes to the overall transformation of the house. The goal is to balance cost-effective improvements and maximize the property's selling potential.

After the renovations, the refurbished property is strategically listed and marketed to attract potential buyers. Effective pricing and presentation are crucial in driving interest and securing a sale at the best price. The successful completion of each stage boosts the property's value and ensures a seamless transition from one phase to the next, ultimately leading to a successful house flip.

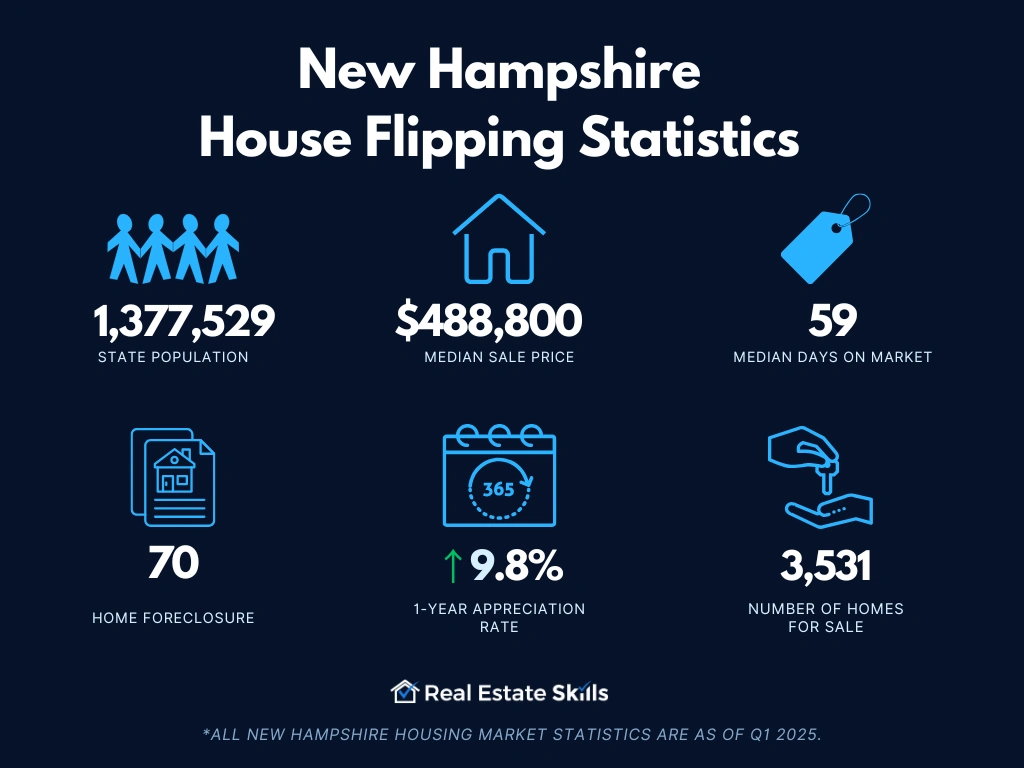

New Hampshire House-Flipping Statistics

From average home prices and the number of homes for sale to time-on-market data, these statistics unveil the nuances that underpin successful house-flipping ventures in the Granite State:

- Population: 1,377,529

- Employment Rate: 64.7%

- Median Household Income: $96,838

- Median Sale Price: $488,800 (+9.8% Year-Over-Year)

- Number Of Homes Sold: 952 (-0.94% Year-Over-Year)

- Median Days On Market: 59 (+13 Year-Over-Year)

- Number Of Homes For Sale: 3,531 (+6.5% Year-Over-Year)

- Number Of Newly Listed Homes: 1,128 (+7.2% Year-Over-Year)

- Months Of Supply: 2 (+0 Year-Over-Year)

- Homes Sold Above List Price: 36.6% (-4.4 Points Year-Over-Year)

- Homes With Price Drops: 15.7% (+2.4 Points Year-Over-Year)

- Foreclosure: 70

*All New Hampshire housing market statistics are as of Q1 2025.

How To Flip Houses In New Hampshire In 15 Steps

Flipping New Hampshire real estate becomes a lot easier when investors follow these seven steps:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Choosing the right market is a critical first step in the house-flipping process, as it significantly influences your potential return on investment. In New Hampshire, several factors should guide your market selection, including local real estate trends, economic conditions, and population growth. Focus on cities and towns where property values are increasing and there is strong demand for renovated homes. Analyzing recent sales data and market reports can help identify areas with the best opportunities for profitable flips.

Another essential consideration is the type of properties that are in demand within your chosen market. In New Hampshire, different regions may have varying preferences, such as historic homes in Portsmouth or more modern properties in Manchester. Understanding what buyers are looking for in each area allows you to target your renovations effectively and align your property with market expectations.

Additionally, consider the competition and saturation level in your selected market. In areas with high competition, finding undervalued properties may be more challenging, but the potential for higher profits can be worth the effort. On the other hand, markets with less competition may offer more opportunities for acquiring properties at lower prices. By carefully evaluating these factors and selecting a market that aligns with your investment goals, you can set yourself up for a successful house-flipping venture in New Hampshire.

Find Your Money

Securing financing is a pivotal aspect of flipping houses in New Hampshire. Before embarking on your project, it’s essential to identify and obtain the necessary funds to purchase and renovate properties. Your options for funding can include traditional mortgages, private lenders, and hard money lenders. Each type of financing comes with its own set of advantages and requirements, so understanding these will help you make the most informed decision for your house-flipping venture.

Private lenders and hard money lenders are particularly popular in the house-flipping community due to their flexibility and speed in funding. These lenders typically focus on the value of the property and the potential profitability of the flip, rather than just your credit score or income. By tapping into these resources, you can secure the capital needed to move forward with your renovation projects and take advantage of profitable opportunities in the New Hampshire market.

How To Find Private & Hard Money Lenders

Finding the right private and hard money lenders is crucial for financing your house-flipping projects. These lenders can provide the capital needed for both the purchase and renovation of properties, often with faster approval processes than traditional loans.

Private lenders are individuals or organizations that provide loans based on the property's value and the borrower's project plan. To find a private lender, network within local real estate investment groups or associations where private lenders often seek out potential borrowers. Online platforms like Kiavi and Lima One can also help connect you with a list of local and national private lenders, providing contact information and loan terms that suit your needs.

Hard money lenders specialize in providing short-term loans secured by real estate. These lenders focus on the value of the property rather than the borrower's financial history. To find hard money lenders, explore platforms such as Kiavi and Lima One, which offer comprehensive lists of both local and national lenders. These platforms provide detailed information on lenders’ contact details, loan requirements, and terms, making it easier to select the right lender for your project.

Securing funding from private and hard money lenders can streamline the process of flipping houses in New Hampshire. By leveraging resources like Kiavi and Lima One, you can find suitable lenders and obtain the financial support necessary to successfully complete your renovation projects. Ensure you thoroughly vet potential lenders and understand their terms to maximize the benefits of your financing options.

Find Three Contractors

Finding reliable contractors is essential to ensure the success of your house-flipping project in New Hampshire. Engaging with at least three contractors is a good practice to get a range of quotes and services. This approach not only helps you compare pricing but also allows you to evaluate different strategies and perspectives on the renovation work required. It is crucial to choose contractors who have experience with the type of renovations needed and a track record of delivering quality work on time and within budget.

Start by researching contractors through platforms like HomeAdvisor and Thumbtack, where you can find profiles, reviews, and ratings from previous clients. It’s also beneficial to seek recommendations from local real estate investment groups or other house flippers who have experience with contractors in New Hampshire. Once you have a shortlist, meet with each contractor to discuss your project in detail and request written estimates. This will give you a clearer understanding of the scope of work and the cost involved, helping you make an informed decision.

How To Find A General Contractor

Finding a general contractor who meets your needs is a crucial step in flipping houses. Start by researching potential candidates through reputable platforms such as HomeAdvisor and Houzz, where you can find detailed profiles, customer reviews, and ratings. These platforms provide insights into contractors' experience, reliability, and the quality of their past work.

Additionally, leverage local networks and real estate investment groups for recommendations. Often, seasoned flippers and real estate professionals have established relationships with dependable general contractors. By tapping into these networks, you can gain access to trusted referrals and firsthand feedback on contractors’ performance. Be sure to interview several candidates, review their previous projects, and check their credentials to ensure they are licensed and insured. This thorough vetting process will help you select a general contractor who can effectively manage your renovation projects and contribute to the success of your house-flipping venture.

Find An Investor-Friendly Agent

Finding an investor-friendly real estate agent is essential when flipping houses in New Hampshire. An agent who understands the intricacies of real estate investment can offer invaluable insights into market trends, property values, and potential areas for high returns. Look for agents with experience working with investors, as they are familiar with the needs of house flippers and can provide strategic advice to maximize your investment.

A knowledgeable agent will help you identify properties that meet your criteria, negotiate favorable purchase terms, and provide guidance throughout the renovation and selling process. Their local market expertise can help you avoid common pitfalls and make informed decisions that align with your flipping goals. Additionally, an investor-friendly agent can connect you with other professionals, such as contractors and lenders, who can further support your project.

How To Find An Investor-Friendly Agent

To find an investor-friendly real estate agent in New Hampshire, start by seeking recommendations from fellow investors or local real estate groups. Investors who have successfully flipped houses can provide referrals to agents who have proven experience in this niche. Additionally, explore online platforms such as Zillow and Realtor.com to find agents with high ratings and reviews, particularly those who mention experience with investment properties.

When interviewing potential agents, ask specific questions about their experience with house flipping and their understanding of the local market. Look for agents who have a track record of working with investors and can demonstrate their ability to find profitable properties and provide valuable market insights. Ensure that the agent you choose is proactive, communicates effectively, and is committed to helping you achieve your investment goals. By selecting an experienced and investor-friendly agent, you can enhance your house-flipping efforts and increase your chances of success.

Find A House To Flip

Finding the right property is crucial for a successful house-flipping project in New Hampshire. Several strategies can help you identify potential properties that offer strong investment opportunities. One effective method is driving for dollars, which involves driving through neighborhoods to spot distressed or vacant properties. This hands-on approach allows you to find houses that might not be listed online and can often lead to finding motivated sellers.

Direct mail campaigns are another powerful tool for locating houses to flip. By sending targeted mailers to homeowners in specific neighborhoods or areas with high potential for appreciation, you can reach property owners who may be considering selling. Crafting compelling offers and using data-driven targeting can increase the likelihood of receiving responses from sellers who are open to negotiations.

Utilizing the Multiple Listing Service (MLS) is a traditional but effective method for finding houses to flip. The MLS provides access to a wide range of properties listed by real estate agents, allowing you to filter for those that meet your investment criteria. Regularly monitoring the MLS and working with an investor-friendly agent can help you spot promising deals before they are snapped up by other buyers.

Alternative Strategies to Find a House

While driving for dollars, direct mail campaigns, and MLS are effective methods, there are additional strategies to enhance your search for the perfect flip property:

- The Day Zero Strategy involves targeting newly listed properties that have just hit the market. These properties may not have received multiple offers yet, giving you the chance to negotiate a favorable purchase price before the competition intensifies. Being quick to act on new listings can provide a competitive edge in the New Hampshire market.

- The Old Listing Strategy focuses on properties that have been on the market for an extended period without selling. These listings might be overlooked by other investors, but they can present opportunities for negotiation. Sellers of long-standing listings may be more willing to accept lower offers or entertain creative financing options.

- The Wholesaler Strategy involves working with wholesalers who specialize in finding distressed properties and assigning the purchase contract to investors. Wholesalers often have access to off-market deals and can help you find properties that fit your criteria. Establishing relationships with reputable wholesalers can expand your network and provide access to exclusive investment opportunities.

Finding a house to flip in New Hampshire requires a combination of strategies to uncover the best opportunities. By employing methods such as driving for dollars, direct mail campaigns, and utilizing the MLS, you can identify potential properties that align with your investment goals. These strategies can further enhance your search and increase your chances of securing profitable flips. By being proactive and leveraging these approaches, you can successfully find and acquire houses that offer strong potential for renovation and resale.

Analyze The Property

Analyzing the property is a critical step in the house-flipping process in New Hampshire. This phase involves using the information gathered from various sources and focusing on three essential factors: the after-repair value (ARV), repair costs, and the purchase price. These metrics will help determine whether a property is a worthwhile investment and if it aligns with your financial goals.

After-Repair Value (ARV)

The after-repair value (ARV) is a vital metric in evaluating a property for flipping. It represents the estimated market value of the property once all repairs and renovations are completed. Calculating the ARV, you need to look at comparable sales or "comps" – recently sold properties similar to the one you're considering. For accurate comps in New Hampshire, focus on properties with similar:

- Number of bedrooms and bathrooms

- Square footage (within 20% of the subject property)

- Location in the same neighborhood or within a one-mile radius

- Sale date within the last six months

Average the sale prices of these comparable properties to estimate the ARV for your property. This estimate will help you gauge potential resale value and profitability.

Repair Costs

Estimating repair costs is crucial for understanding the financial feasibility of a flip. Start by conducting a thorough inspection of the property to identify necessary repairs. Consult with experienced contractors to get detailed quotes for labor and materials. It’s also wise to set aside a contingency budget for unforeseen expenses, typically around 10-15% of the total repair costs. Accurate repair cost estimation is essential for ensuring that the renovation aligns with your budget and profit goals.

Purchase Price

To determine your maximum allowable offer (MAO), integrate the ARV and repair costs into your calculations. Consider the following elements to establish a viable purchase price:

- ARV: The estimated value of the property after renovations.

- Hard Money Loan Costs: Total costs associated with hard money loans, including interest rates (10-15%), origination fees, and points.

- Private Money Loan Costs: Costs of private money loans, factoring in interest and project duration.

- Front-End Closing & Holding Costs: Typically around 2% of the purchase price, plus ongoing expenses like insurance, utilities, and taxes.

- Backend Closing Costs: Usually 1% of the ARV.

- Realtor Fees: Typically around 6% of the purchase price, though investor-friendly agents might offer lower fees.

- Projected Profit: Factor in the desired profit margin, keeping in mind that most investors aim for a return of about 27.5% on their rehab projects, according to recent reports.

By calculating these factors and subtracting them from the ARV, you can determine your MAO – the highest price you should pay for the property to ensure a profitable flip. This comprehensive analysis will guide your investment decisions and help maximize your returns in New Hampshire’s real estate market.

Call Agents & Submit Written Offers

The next step in flipping houses in New Hampshire is to contact the listing agent and formally submit your written offer. This step is crucial for moving forward in the acquisition process and demonstrates your seriousness as a buyer. Ensure your offer is based on the maximum allowable offer (MAO) you calculated earlier, which aligns with your investment strategy and budget.

It’s important to have either the listing agent or an investor-friendly agent represent you in this process. An experienced agent will handle the paperwork and ensure that your offer is professionally presented. In New Hampshire, agents typically use the New Hampshire Association of Realtors’ Purchase and Sale Agreement. Having a knowledgeable agent handle the submission ensures that all necessary details are correctly included and that your offer stands out.

Here’s what you need to provide the agent to draft the offer:

- Purchaser Name: Clearly state whether the purchase is under your name or an LLC. If using an LLC, include articles of incorporation to verify your authority as a signer.

- Offer Price: Specify the offer price based on your MAO calculations.

- Deposit Amount (Earnest Money Deposit): Include an earnest money deposit, generally 1% to 5% of the purchase price, to show your commitment. This deposit is usually refundable if contingencies are not met.

- Contingencies: Add an inspection contingency, typically seven days, allowing you to inspect the property and back out if significant issues arise.

- Closing Date: Propose a closing date, ideally within 14 days or sooner if possible. A quick closing can be attractive to sellers, particularly if you’re paying in cash.

- Title Guarantee: Ensure the seller provides a clear title, free of liens or encumbrances, to avoid legal complications.

- Buyer’s Agent Name: Include the name of the agent representing you in the transaction.

- Proof Of Funds: Attach proof of funds or a pre-approval letter from your lender to demonstrate your financial ability to complete the purchase.

Submitting a well-prepared written offer is a key step in the house-flipping process in New Hampshire. By working with your agent to craft a professional and compelling offer, you increase your chances of securing the property and advancing to the next stage of your flip. Effective communication and thorough documentation are essential to making successful offers and achieving your investment goals.

Perform Due Diligence When The Offer Is Accepted

Once your offer is accepted, performing thorough due diligence is crucial to ensure a successful house flip in New Hampshire. This step involves a comprehensive review of the property and its legal standing to confirm that there are no hidden issues that could affect your investment. Begin with a detailed home inspection to identify any structural problems, pest infestations, or other potential issues that might not have been apparent during initial viewings. This inspection will provide a clear picture of the necessary repairs and help you adjust your renovation plans and budget accordingly.

Additionally, verify the property’s legal status, including title searches to ensure there are no liens or claims against it. This step is essential to avoid legal complications and ensure that you are acquiring a property with a clear title. Confirm that all necessary permits and zoning regulations are in order, as non-compliance can lead to costly delays and legal issues during the renovation process.

By thoroughly performing due diligence, you safeguard your investment, allowing you to proceed with confidence and avoid potential pitfalls that could impact the profitability of your flip. This comprehensive review is a critical component of successful house flipping in New Hampshire, ensuring that you make well-informed decisions throughout the renovation process.

Close On The Deal

Closing on a house flip in New Hampshire is the final step in acquiring the property and sets the stage for your renovation work. Once all due diligence is completed and you’re satisfied with the results, the next step is to finalize the purchase through the closing process. This involves a series of legal and financial steps that officially transfer ownership of the property from the seller to you.

During the closing process, you’ll work closely with a real estate attorney or a title company to handle the necessary paperwork and ensure that all legal requirements are met. This includes signing the final purchase agreement, reviewing and settling any closing costs, and ensuring that the title is transferred free of liens or encumbrances. You will also need to provide the remaining balance of the purchase price, which could involve coordinating with your lender if you’re financing the deal.

Once all documents are signed and payments are made, the title to the property will be officially transferred to you, completing the purchase. It’s essential to carefully review all documents and confirm that everything is in order to avoid any issues that could arise post-closing. Successfully closing on the deal marks the beginning of your renovation project and sets the stage for turning your investment into a profitable house flip in New Hampshire.

Renovate The House

Renovating the house is a critical step in flipping properties in New Hampshire. The goal is to enhance the property to meet or exceed the projected after-repair value (ARV) while staying within budget. Carefully planned renovations that align with the local market and comparable properties (comps) are key to maximizing profitability. It’s important to strike a balance—avoid over-renovating, which can lead to unnecessary expenses, and ensure the property meets or slightly surpasses the standard set by nearby homes.

Before you begin the renovation process, protecting yourself with essential documentation is crucial. These documents help to clearly define expectations, mitigate risks, and safeguard your investment:

-

Independent Contractor Agreement: This contract details the terms and conditions between you and your contractor. It sets clear payment terms, project timelines, and responsibilities, ensuring both parties are aligned and protected.

-

Final Scope of Work: This document outlines the specific tasks, materials, and timelines required for the renovation. It serves as a detailed blueprint, ensuring the contractor understands and delivers on your renovation needs.

-

Payment Schedule: The payment schedule specifies the amounts and timing of payments to the contractor. Linking payments to project milestones helps keep the work on track and within budget.

-

Insurance Indemnification Agreement: This agreement confirms that the contractor holds the necessary insurance and agrees to cover any potential accidents or damages, protecting you from liability.

-

W-9: This tax form provides the contractor’s taxpayer identification information, which is necessary for compliance and reporting purposes.

-

Final Lien Waiver: A final lien waiver ensures that the contractor has been fully paid and waives any future claims against the property, protecting you from additional financial demands.

With these documents in place, you can proceed with the renovation confidently. Proper planning and documentation help ensure that your New Hampshire property is transformed into an attractive, market-ready home that aligns with your financial goals.

Prep & List The House On The MLS

The final step in flipping houses in New Hampshire is preparing and listing the property on the Multiple Listing Service (MLS). This process involves several key tasks to ensure the house is presented in the best possible light and attracts potential buyers. Start by addressing the final details that can make a significant difference in the property's appeal and value.

-

Final Punchlist: Before listing the house, create a final punchlist to address any remaining tasks or minor repairs. This list should include touch-ups, fixes to any overlooked issues, and ensuring that everything is in working order. Completing the final punchlist ensures the property is in pristine condition, which can significantly impact buyer impressions and help secure a faster sale.

-

Home Staging: Home staging is an essential step to make the property look its best. This involves arranging furniture and decor in a way that highlights the home’s strengths and allows potential buyers to envision themselves living there. Professional staging can make a substantial difference in how quickly the home sells and at what price, by showcasing the property’s best features and creating a welcoming atmosphere.

-

Professional Photos: High-quality, professional photos are crucial for attracting buyers. In today’s market, most buyers start their search online, so the visual presentation of your property can significantly influence their decision to visit in person. Invest in a professional photographer to capture the property’s best angles and features, ensuring that the listing stands out and entices potential buyers.

Set An Enticing Asking Price

Setting an enticing asking price is a critical component of a successful listing. The price should reflect the value of the property post-renovation and be competitive within the New Hampshire market. Conduct a thorough analysis of comparable properties (comps) in the area to determine a realistic and attractive asking price. Aim to price the property slightly below market value to generate interest and potentially create a bidding war. This strategy can help you achieve a quick sale and maximize your return on investment.

By following these steps—completing the final punchlist, staging the home, and using professional photos—you set the stage for a successful sale. Proper preparation and strategic pricing are essential for attracting buyers and achieving your desired outcome in the New Hampshire real estate market.

Field Offers & Negotiate

Once your property is listed on the MLS, the next step in flipping houses in New Hampshire is to field offers and engage in negotiations. This stage is crucial for maximizing your return on investment and ensuring a smooth transaction.

When offers begin to come in, it's important to review each one carefully. Evaluate the proposed purchase price, contingencies, and the buyer's financial qualifications. Consider not only the offer amount but also the buyer's flexibility and ability to close on the property. A higher offer might seem attractive, but terms such as the closing date and contingencies can impact the overall benefit of the deal.

Effective negotiation is key to securing the best possible outcome. Use the information gathered from competing offers to negotiate favorable terms. Be prepared to counteroffer and address any concerns or objections the buyer may have. This process might involve adjusting the price, modifying terms, or offering concessions to reach an agreement that satisfies both parties.

In New Hampshire's competitive market, being proactive and responsive during negotiations can make a significant difference. Aim to create a win-win situation that aligns with your financial goals while facilitating a smooth closing process.

Accept The Best Offer

After fielding offers and engaging in negotiations, the next critical step in flipping houses in New Hampshire is to accept the best offer. This decision can significantly impact your overall profitability and the efficiency of the sale process.

Carefully evaluate each offer based on several key factors beyond just the purchase price. Consider the buyer’s financial stability, their ability to close on the property within your desired timeframe, and any contingencies or conditions they may have. An offer with fewer contingencies and a quicker closing date can often be more advantageous, even if it’s slightly lower in price.

Once you’ve identified the best offer, communicate your acceptance promptly to the buyer and their agent. Ensure that all terms are clearly outlined in a formal agreement, and work closely with your real estate agent and legal advisor to finalize the contract. Accepting the best offer isn’t just about choosing the highest price but also about ensuring a smooth, secure transaction that aligns with your investment goals.

Sell The House & Get Paid

The final step in flipping houses in New Hampshire is to sell the house and get paid. Once you’ve accepted the best offer, the sale process moves towards closing, where the property is officially transferred to the new owner. This stage involves several key actions to ensure a smooth and successful transaction.

During the closing process, coordinate with your real estate agent and the closing attorney to finalize all necessary paperwork. This includes reviewing and signing the closing documents, ensuring that the title is clear, and making any required disclosures. It’s also crucial to confirm that all contractual obligations have been met and that any last-minute repairs or adjustments have been completed as agreed.

After the closing, the funds from the sale will be disbursed according to the terms of the sale. This typically involves paying off any existing liens or mortgages on the property, covering closing costs, and receiving your portion of the proceeds. Ensure that all financial transactions are accurately recorded and that you receive the full payment as stipulated in the contract. Completing these steps effectively will ensure that you realize the financial benefits of your flip and conclude the project on a successful note.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make In New Hampshire?

In New Hampshire, house flippers can expect to see substantial returns on their investments, with the average gross flipping profit hovering around $75,000, according to recent data from ATTOM Data Solutions. This figure, however, can vary widely depending on factors like the specific location within the state, the initial purchase price of the property, renovation costs, and the overall market conditions at the time of sale. New Hampshire's strong housing market and consistent demand for renovated properties make it a promising area for house flipping.

New Hampshire also stands out nationally with cities that rank among the top for gross flipping profits. According to the latest Home Flipping Report by ATTOM Data Solutions, three of the top five cities in the state with the highest average gross flipping profits on median-priced transactions include:

- Manchester, NH: $90,000 average gross flipping profit

- Nashua, NH: $85,000 average gross flipping profit

- Concord, NH: $78,000 average gross flipping profit

These cities offer flippers lucrative opportunities due to their robust property values and the consistent demand for quality housing. Flipping houses in these areas can yield particularly high returns, making them ideal locations for investors looking to maximize their profits.

To achieve these returns, it's crucial to understand New Hampshire's local market trends and have a strategic approach to purchasing and renovating properties. Securing properties below market value and managing renovation costs effectively are essential to ensuring that the net profit from each flip meets or exceeds expectations.

Is House Flipping Illegal In New Hampshire?

House flipping is not illegal in New Hampshire; it is a legitimate real estate investment strategy widely practiced across the state. However, like any real estate transaction, house flipping in New Hampshire is subject to state and local laws, including zoning regulations, building codes, and disclosure requirements. Investors must ensure that all renovations comply with these regulations to avoid legal issues. Failure to adhere to these laws can result in fines, penalties, or even legal action, so it's essential to work with licensed contractors and stay informed about local regulations.

Additionally, while house flipping itself is legal, New Hampshire, like other states, has laws against mortgage fraud, which can be a concern if unethical practices are used to obtain financing or manipulate property values. Investors should operate transparently, maintaining accurate records and following ethical guidelines to ensure their flipping activities remain above board. By doing so, flippers can successfully navigate the legal landscape and capitalize on the opportunities available in New Hampshire’s real estate market.

Read Also: Is Wholesaling Real Estate Legal In New Hampshire?

Do You Need A License To Flip Houses In New Hampshire?

Aspiring house flippers are not required to hold a real estate license in New Hampshire.

While obtaining a real estate license is an option, it involves undergoing extensive coursework, adhering to regulatory requirements, and incurring associated fees. Investors can choose whether or not to pursue a license based on their goals.

Read Also: How To Get MLS Access: The (Ultimate) Guide

How To Flip A House In New Hampshire With No Money?

Flipping houses in New Hampshire without your own funds is achievable, enabling a wider range of individuals to enter the real estate investment arena. The key lies in leveraging the resources offered by private and hard money lenders. These lenders provide financial backing for your house-flipping projects, focusing primarily on the property's potential rather than your credit score, making the process more accessible and democratized. By collaborating with these lenders, investors can access the necessary capital to purchase, renovate, and sell properties for a profit.

Furthermore, another option for those who haven’t yet learned how to flip houses in New Hampshire is to break into wholesaling. Wholesaling connects motivated sellers with prospective buyers, effectively acting as an intermediary. This approach doesn't demand any upfront capital investment, as you're essentially facilitating the transaction between parties and earning a fee. This strategic pathway enables novice investors to enter the real estate world without financial barriers.

What's The Best Place To Flip Houses In New Hampshire?

Choosing the best place to flip houses in New Hampshire depends on various factors, including property price trends, population growth, and local economic conditions. The following cities are prime locations for house flipping, offering strong potential for profit due to their real estate market dynamics.

- Manchester: As the largest city in New Hampshire, Manchester offers a thriving real estate market with a median home value of around $410,000, up approximately 6% from the previous year. The city's growing population and strong job market contribute to a steady demand for housing, making it an attractive location for house flippers. The combination of affordable home prices and increasing demand provides a solid foundation for successful flips.

- Nashua: Nashua is another top spot for house flipping in New Hampshire, with a median home value of about $450,000, reflecting a 5% increase year-over-year. Its proximity to the Massachusetts border and the Boston metropolitan area makes it a desirable location for commuters, driving demand for renovated homes. Nashua's strong economy and expanding population further enhance its appeal as a profitable market for flippers.

- Concord: As the state capital, Concord offers a stable real estate market with a median home price of approximately $380,000, up 4% from the previous year. The city's steady growth and government-driven economy provide a consistent demand for housing. Flipping homes in Concord can be particularly lucrative for investors who focus on properties in need of renovation in established neighborhoods.

- Portsmouth: Portsmouth, a historic coastal city, boasts a median home value of around $600,000, which has increased by 7% over the past year. Its charming downtown, proximity to the ocean, and vibrant cultural scene make it a sought-after location for buyers. House flippers can find excellent opportunities in Portsmouth, especially in older homes that can be restored to their former glory, appealing to both locals and out-of-state buyers.

- Dover: Dover, located in the Seacoast region, has seen a notable rise in its real estate market, with median home prices around $420,000, reflecting a 6% increase year-over-year. The city's mix of urban amenities and small-town charm attracts a diverse range of buyers. Flippers in Dover can benefit from the growing demand for well-renovated homes, especially as more people seek affordable alternatives to nearby Portsmouth.

When considering where to flip houses in New Hampshire, it's essential to research each city's unique market conditions and trends. By focusing on locations with strong economic growth, population increases, and rising home values, investors can position themselves for successful and profitable house-flipping ventures

Is It Hard To Flip Houses In New Hampshire?

Flipping houses in New Hampshire presents its own set of challenges, but it can be a rewarding venture with the right approach. One of the primary difficulties is the competitive real estate market, particularly in popular cities like Manchester and Portsmouth, where demand for properties is high. Finding undervalued homes that offer significant profit potential can be tough, especially as more investors enter the market. Additionally, the state's older housing stock often requires extensive renovations, which can lead to higher costs and longer project timelines.

However, New Hampshire also offers advantages that can mitigate these challenges. The state's relatively low property taxes, strong economy, and growing population create a favorable environment for house flipping. With careful market research, effective project management, and a keen eye for promising properties, investors can navigate the complexities and succeed in flipping houses in New Hampshire. While it may not be easy, the potential for profit makes it a worthwhile endeavor for those willing to put in the effort.

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

How Do You Find Contractors For Flipping Houses In New Hampshire?

Finding reliable contractors is crucial to the success of any house-flipping project in New Hampshire. To streamline the process, consider using several key platforms that connect homeowners with experienced professionals.

- HomeAdvisor is a valuable resource for finding vetted contractors in New Hampshire. The platform allows you to view ratings and reviews from other homeowners, helping you choose contractors with a proven track record in home renovations. With detailed profiles and customer feedback, HomeAdvisor can simplify the selection process and ensure you hire reputable professionals.

- Thumbtack offers a user-friendly way to connect with local contractors. By entering details about your project, you receive quotes and profiles from various professionals in New Hampshire. This service is particularly useful for comparing costs and evaluating contractors' qualifications before making a final decision.

- Angi (formerly Angie’s List) provides a comprehensive directory of contractors in New Hampshire, complete with customer reviews and ratings. This platform helps you find highly-rated professionals for different aspects of your renovation, from general contractors to specialized tradespeople.

- Houzz is another excellent platform for finding contractors, especially if you’re looking for inspiration alongside professional services. Houzz features portfolios and reviews of contractors and designers, allowing you to see their past work and read client testimonials.

- Craigslist can be useful for finding local contractors, particularly for more budget-conscious projects. While it requires careful vetting, Craigslist often has listings for experienced professionals who offer competitive rates. Be sure to check references and reviews thoroughly when using this platform.

- Facebook is increasingly becoming a go-to resource for finding contractors through local community groups and business pages. Many contractors in New Hampshire use Facebook to promote their services and interact with potential clients, making it a practical tool for finding and evaluating local professionals.

By leveraging these platforms, you can efficiently locate and hire the right contractors for your house-flipping projects in New Hampshire, ensuring that your renovations are completed on time and within budget.

Final Thoughts On Flipping Homes In New Hampshire

Aspiring New Hampshire investors can confidently flip houses with the seven steps outlined above. Individuals can enhance their chances of success in this lucrative field by understanding the intricacies of each stage – from finding distressed properties to raising capital, executing renovations, and ultimately reselling homes. By learning how to flip houses in New Hampshire, investors can navigate the challenges and complexities of rehabbing, eventually turning properties into profit.

Are you eager to learn how to flip houses in New Hampshire? Don't navigate the complexities of the real estate market alone. Reach out to Real Estate Skills today for expert guidance and support. Our experienced team will provide the knowledge and tools you need to flip houses successfully in New Hampshire. Contact us now to embark on your flipping journey with confidence and purpose.

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.