How To Flip Houses In Nebraska: 15-Step Home Renovation Guide

Mar 10, 2025

Flipping houses presents a unique avenue for building wealth and achieving financial independence while enjoying a flexible schedule. Aspiring real estate investors keen to explore this exciting venture might find Nebraska an ideal starting point. With its low unemployment rate, robust demand for housing, and affordability, Nebraska sets the stage for an investor-friendly environment. These factors converge to create a marketplace that offers ample opportunities for those interested in house flipping.

In this article, we will explore how to flip houses in Nebraska. From understanding the fundamental steps to navigating the intricacies of the real estate market in the state, we provide valuable insights to equip new investors with everything they need to embark on a successful house-flipping journey in Nebraska, including:

- What Is Flipping Houses?

- Why Flip Houses In Nebraska?

- Nebraska House-Flipping Statistics

- How To Flip Houses In Nebraska In 15 Steps

- How Much Do House Flippers Make In Nebraska?

- Is House Flipping Illegal In Nebraska?

- Do You Need A License To Flip Houses In Nebraska?

- How Much Does It Cost To Flip A House In Nebraska?

- How To Flip A House In Nebraska With No Money

- What's The Best Place To Flip Houses In Nebraska?

- Is It Hard To Flip Houses In Nebraska?

- How Do You Find Contractors For Flipping Houses In Nebraska?

- Final Thoughts On Flipping Homes In Nebraska

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

What Is Flipping Houses?

House flipping, commonly referred to as rehabbing, is a standard real estate investment strategy involving the purchase of distressed properties, their renovation or rehabilitation, and their subsequent sale at a profit. This strategy entails a series of well-defined steps investors follow to turn a rundown property into an appealing and marketable home.

The process begins with locating a property needing repair, often acquired at a discounted price due to its condition. Once acquired, the property undergoes a thorough renovation, which includes repairs, upgrades, and improvements aimed at increasing its overall value and appeal to potential buyers. The goal is to make the property more attractive while addressing structural or aesthetic deficiencies.

After the rehabilitation, the investor strategically prices the property, aiming to sell it higher than the combined costs of acquisition, renovation, and other associated expenses. The key to profitability lies in meticulous budgeting, wise investment in renovations that add value, and careful market analysis to determine the optimal selling price.

By adhering to these fundamental steps and achieving a successful flip, investors capitalize on the difference between the purchase price, renovation costs, and the final sale price. This margin constitutes their profit and rewards their efforts in restoring the property, providing them with a significant financial return on their investment.

Read Also: How To Wholesale Real Estate In Nebraska

Why Flip Houses In Nebraska?

Flipping houses in Nebraska presents a unique opportunity due to its affordable real estate market and steady property appreciation. As of 2024, the median home price in Nebraska is approximately $285,000, which is significantly lower than the national average. This affordability creates a favorable environment for house flippers who can acquire properties at a lower cost and invest in renovations to increase their value. Cities like Omaha and Lincoln offer particularly promising prospects, with Omaha experiencing a 6.5% annual increase in property values and Lincoln showing a similar upward trend of around 5.8%. These growth rates suggest a healthy market for flipping houses, where investors can capitalize on increasing home values.

Nebraska’s relatively low competition in the house-flipping market is another compelling reason to consider investing here. Unlike high-demand states with saturated markets, Nebraska offers a less competitive environment where investors might find better deals and opportunities for profit. The state's real estate market has been characterized by steady, moderate growth rather than the volatile spikes seen in more competitive regions. This stability provides a safer investment landscape, where house flippers can anticipate gradual but consistent returns on their investments.

Additionally, Nebraska benefits from a business-friendly environment with favorable regulations and tax policies for real estate investors. The state's tax climate is supportive of property investments, with lower property taxes compared to the national average. Moreover, Nebraska has streamlined property transaction processes, making it easier for house flippers to navigate the buying and selling process. These favorable conditions, combined with the state's overall economic stability, make Nebraska an attractive location for house-flipping ventures.

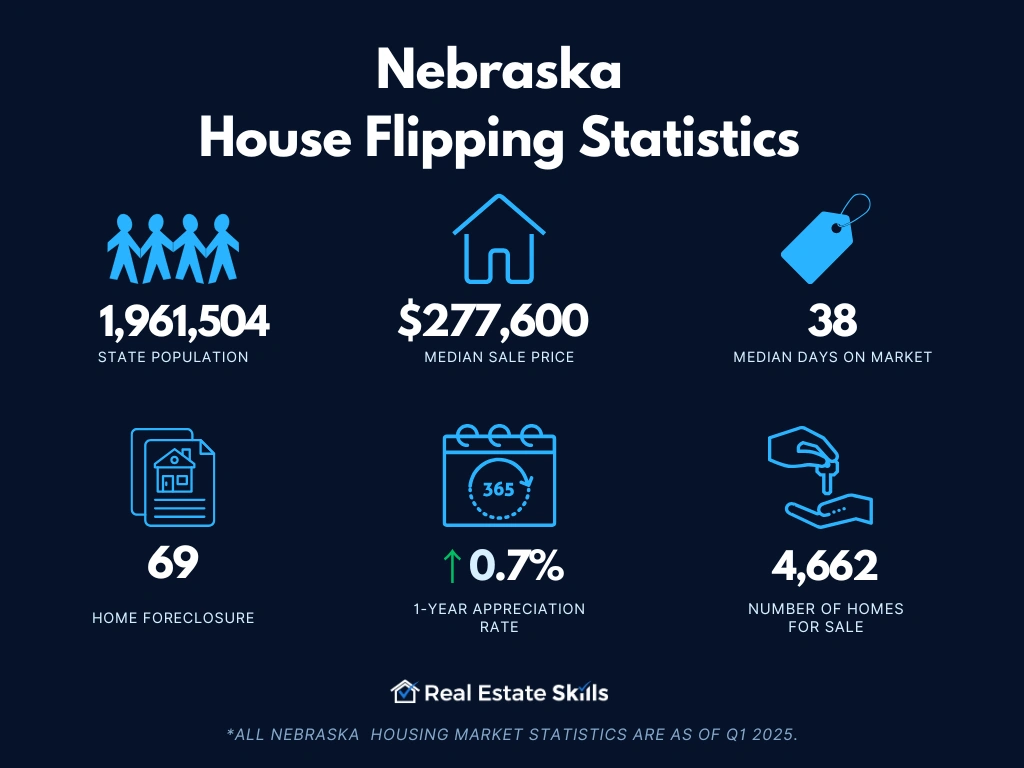

Nebraska House-Flipping Statistics

Prospective investors seeking to learn how to flip houses in Nebraska should arm themselves with the best housing statistics and data. Understanding key indicators such as median home prices and property appreciation rates can help them make informed decisions.

By analyzing these fundamental figures, investors can gain insights into the local market dynamics and make strategic choices that align with their flipping goals and aspirations (data provided by the U.S. Census Bureau, RedFin, and ATTOM Data Solutions):

- Population: 1,961,504

- Employment Rate: 66.8%

- Median Household Income: $74,590

- Median Sale Price: $277,600 (+0.7% Year-Over-Year)

- Number Of Homes Sold: 1,227 (+4.7% Year-Over-Year)

- Median Days On Market: 38 (+6 Year-Over-Year)

- Number Of Homes For Sale: 4,662 (+13.1% Year-Over-Year)

- Number Of Newly Listed Homes: 1,510 (+22.0% Year-Over-Year)

- Months Of Supply: 2 (-0 Year-Over-Year)

- Homes Sold Above List Price: 18.3% (-2.3 Points Year-Over-Year)

- Homes With Price Drops: 26.6% (+6.8 Points Year-Over-Year)

- Foreclosure: 69

*All Nebraska housing market statistics are as of Q1 2025.

In Flipping Houses 101, understanding the local market is key to success, and Nebraska is no exception. To excel in flipping houses in Nebraska, familiarize yourself with regional property trends, economic indicators, and pricing dynamics specific to cities like Omaha and Lincoln. By gaining insights into Nebraska’s unique real estate landscape, you can refine your house-flipping strategies and make informed investment decisions that align with the state’s market conditions. Equip yourself with the right knowledge to navigate Nebraska’s housing market and enhance your potential for successful property flips.

How To Flip Houses In Nebraska In 15 Steps

To maximize profits when flipping houses in Nebraska, it's crucial to understand local market trends and carefully plan renovations. Acquiring properties at below-market prices, budgeting accurately for renovations, and choosing desirable neighborhoods can significantly impact the net profit from each flip. To increase the likelihood of a profitable house flip, follow these 15 steps:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Choosing the right market is a critical first step in flipping houses in Nebraska. To begin, focus on cities with a strong real estate market and promising growth potential. Omaha and Lincoln are prime examples, offering a blend of stable property values and steady economic growth. Research recent property trends and population changes in these areas to ensure they align with your investment goals.

Next, consider neighborhoods within these cities. Look for areas experiencing revitalization or those with increasing demand. Neighborhoods with good schools, accessible amenities, and low crime rates typically attract more buyers, leading to potentially higher returns. Analyzing local real estate reports and trends can help you identify which neighborhoods are on the rise.

Finally, evaluate the competition and market saturation. While Nebraska generally has a less competitive market compared to larger states, understanding the level of investor activity in your chosen area is essential. A market with high demand but lower competition can offer better opportunities for profitable flips. Assessing these factors will help you select the most advantageous market for your house-flipping venture.

Find Your Money

Securing financing is a crucial step in flipping houses in Nebraska. Start by evaluating your financial options, including traditional mortgages, private loans, and hard money loans. Traditional mortgages can be suitable if you have good credit and sufficient down payment, but they often come with longer approval times. For more flexibility and faster funding, especially if you're a seasoned investor, private or hard money lenders might be better suited to your needs.

It’s important to assess the cost of borrowing, including interest rates and loan terms, to ensure your investment remains profitable. Having a clear financial plan and understanding the different funding options available will help you manage costs effectively and maintain your cash flow throughout the renovation and resale process.

How To Find Private & Hard Money Lenders

Private lenders are individuals or companies that provide funding based on personal relationships and negotiation rather than traditional banking criteria. To find a private lender, start by networking within real estate investment groups or local business circles. Attend local real estate meetings or join online forums where investors and lenders connect. You can also reach out to real estate agents and attorneys who may have connections with private lenders. Platforms like Kiavi and Lima One offer lists of local and national lenders, which can help you find potential private funding sources.

Hard money lenders specialize in providing short-term loans for real estate investments, often based on the value of the property rather than the borrower’s creditworthiness. To find hard money lenders, search online for reputable lenders in Nebraska and review their terms and rates. Networking with other real estate investors can also lead to valuable referrals. Platforms like Kiavi and Lima One provide comprehensive lists of both local and national hard money lenders, making it easier to compare options and choose the best fit for your project.

Find Three Contractors

Finding reliable contractors is essential to the success of your house-flipping project in Nebraska. Start by seeking out at least three contractors who have experience with residential renovations and understand the local market. Compare their credentials, past work, and client reviews to ensure you’re hiring skilled professionals who can handle your specific renovation needs. Effective communication and clear expectations are key to a smooth renovation process.

It's also wise to check references and review each contractor’s previous projects to gauge their quality of work and reliability. Consider obtaining detailed estimates from each contractor to compare pricing and scope of work. This step helps in budgeting accurately and choosing the best contractor who aligns with your project’s requirements and financial constraints.

How To Find A General Contractor

Finding a general contractor involves a few strategic steps. Start by leveraging online resources such as HomeAdvisor, Thumbtack, and Angi, which offer directories of qualified contractors with customer reviews and ratings. Additionally, asking for recommendations from local real estate investors or industry professionals can provide reliable leads.

Once you have a list of potential contractors, schedule interviews to discuss your project in detail. During these meetings, assess their experience with similar renovations, their understanding of your needs, and their approach to project management. Requesting and reviewing detailed bids will help you evaluate their pricing and ensure that their work aligns with your project goals. Checking references and reviewing past projects can further confirm their suitability for your house-flipping venture

Find An Investor-Friendly Agent

Finding an investor-friendly real estate agent is crucial for navigating the Nebraska housing market effectively. An agent with experience working with house flippers will have a deep understanding of market trends, investment properties, and the nuances of property valuation. They can provide valuable insights into the best neighborhoods for flipping, help you find potential properties, and assist in negotiating deals that align with your investment goals.

An investor-friendly agent will also be familiar with the local contractors, lenders, and other professionals you might need during your flip. Their network and expertise can streamline your renovation process and help you make informed decisions. Choosing an agent who understands the specifics of house flipping will enhance your chances of a successful and profitable project.

How To Find An Investor-Friendly Agent

To find an investor-friendly real estate agent, start by searching for agents who specialize in investment properties and have a proven track record in house flipping. Online platforms such as Zillow, Realtor.com, and local real estate forums can provide listings of agents with relevant experience. Additionally, reaching out to real estate investment groups or networks in Nebraska can offer personal recommendations.

When evaluating potential agents, look for those who demonstrate a clear understanding of the local market and have experience working with investors. Schedule interviews to discuss your project and gauge their knowledge of renovation costs, market trends, and investment strategies. An effective agent should be proactive, resourceful, and able to provide valuable advice throughout your house-flipping journey.

Find A House To Flip

Finding the right house to flip in Nebraska involves a combination of strategic methods and diligent research. One effective approach is driving for dollars,, which entails physically driving through neighborhoods to identify potential properties that may be ideal for flipping. Look for homes that appear neglected or in need of repair, as these can often be acquired at a lower price and offer high-profit potential after renovation.

Another useful strategy is implementing direct mail campaigns. This involves sending targeted mail to property owners in specific areas, especially those with older homes or absentee owners. Direct mail can be a proactive way to generate leads and potentially secure off-market properties that might not be listed elsewhere. Be sure to craft compelling messages that address the property owner’s needs and highlight the benefits of selling to an investor.

Utilizing the Multiple Listing Service (MLS) is also essential. The MLS provides access to a broad range of properties currently for sale, including those that may be suitable for flipping. By working with a real estate agent familiar with the MLS, you can efficiently search for properties based on specific criteria, such as price range, location, and condition.

Alternative Strategies to Find a House

Once you know what to look for, there are three strategies you can implement to find houses to flip in Nebraska:

- The Day Zero Strategy involves targeting properties that have just entered the market. Acting quickly on newly listed homes gives you a competitive edge, as these properties might still be undervalued and offer better purchase prices before other investors have a chance to act.

- The Old Listing Strategy focuses on properties that have been on the market for an extended period. These homes may be overpriced or overlooked by other buyers. By making a reasonable offer on these listings, you might find opportunities for significant deals that other investors have missed.

- The Wholesaler Strategy involves working with real estate wholesalers who specialize in finding and negotiating deals for distressed properties. Wholesalers often have access to off-market deals and can provide valuable leads on properties that are ripe for flipping.

In conclusion, a multifaceted approach to finding a house to flip in Nebraska will enhance your chances of securing a profitable investment. By combining methods like driving for dollars, direct mail campaigns, and utilizing the MLS with alternative strategies such as the Day Zero, Old Listing, and Wholesaler strategies, you can identify the best properties and set yourself up for a successful house-flipping venture.

That said, some investors in Nebraska might not have access to the MLS for various reasons. Fortunately, alternative listing platforms such as RedFin, Zillow, and Realtor.com can be used effectively as well. Applying the strategies mentioned earlier to these websites can help in finding potential properties to flip. However, it's important to note that the MLS remains the preferred source due to its more detailed data and direct contact information with sellers.

Make Discovery Calls To Listing Agents

Making discovery calls to listing agents is a crucial step in the house-flipping process in Nebraska. This proactive approach ensures that you gather key information about potential properties, streamlining your decision-making process and improving your chances of securing a worthwhile investment.

- Is the listing still active? It's essential to confirm with the listing agent whether the property is still active to avoid wasting time on homes that are already under contract. Knowing the property’s current status helps you focus only on available opportunities and move forward with serious inquiries.

- Are the listing’s photos up to date? Asking if the photos are recent is vital for understanding the property's current condition. Outdated images may not reflect recent changes or issues, which can affect your assessment of the required repairs and renovations. Accurate visuals are critical for estimating costs and potential profit margins.

- What is the current condition of the home? Inquiring about the home’s current condition helps determine if the property is distressed and suitable for flipping. It also uncovers any hidden issues that may not be visible in the listing photos, allowing for a more accurate evaluation of repair costs and potential challenges.

- Are you willing to work with an investor? Finding out if the listing agent is open to working with investors helps set clear expectations and fosters transparent communication. If you don’t have a representative agent, this could also be an opportunity to discuss working with the listing agent directly, potentially benefiting both parties through commission arrangements.

- What is the owner’s reason for selling? Understanding the owner's motivation for selling can provide valuable insights into the negotiation process. While agents may not always disclose this information, any details you can obtain about the seller’s urgency or circumstances can help you structure a more compelling offer.

- Is there a lot of competition for the property? Asking about the level of interest and competition for the property informs you of the market dynamics and urgency. If the property is attracting multiple offers, you can strategize accordingly to make a competitive bid or adjust your approach to avoid overpaying.

By making these discovery calls, you’ll gather essential information that aids in evaluating the viability of potential investment properties, ultimately leading to smarter and more informed decisions in your house-flipping endeavors in Nebraska.

Analyze The Property

Analyzing the property is a crucial step when flipping houses in Nebraska. This process involves evaluating key metrics such as the after-repair value (ARV), repair costs, and purchase price to determine whether the property will be a profitable investment. These factors collectively help in assessing the potential success of the flip.

After-Repair Value

The after-repair value (ARV) is a fundamental metric used to estimate the property's worth once all renovations are completed. Calculating the ARV involves comparing your property to similar, recently sold homes, known as "comps," which have been renovated. For Nebraska, focus on comps that match the following criteria:

- Similar number of bedrooms and bathrooms

- Within 20% of the property’s square footage

- Located in the same neighborhood

- Sold within the past six months

By averaging the sale prices of these comparable properties, you can estimate the ARV. This figure provides a realistic market value for your flipped home, guiding your investment decisions and helping to forecast potential profits.

Repair Costs

Estimating repair costs is essential for determining the feasibility of your flip. Begin with a thorough inspection of the property to identify necessary repairs and renovations. Obtain quotes from multiple contractors to get a clear picture of labor and material costs. In Nebraska, repair costs can vary, but having a detailed budget and a contingency fund of around 10-15% of the estimated costs is prudent to cover unexpected expenses. Accurate repair cost estimates ensure that you stay within budget and maximize your investment return.

Purchase Price

To determine the purchase price, incorporate the ARV and repair costs into a formula to calculate your maximum allowable offer (MAO). The MAO represents the highest price you can pay for the property while still achieving a profit. Consider the following factors:

- The ARV: Expected value of the home after repairs.

- Hard Money Loan Costs: Interest rates and fees associated with borrowing.

- Private Money Loan Costs: Costs associated with private lending.

- Front-End Closing & Holding Costs: Includes insurance, utilities, and taxes.

- Backend closing costs : Typically around 1% of the ARV.

- Realtor Fees: Standard fees are around 6%, though investor-friendly agents might offer lower rates.

- Projected Profit: Factor in desired profit margins, aiming for a return in line with industry standards.

Subtracting these costs from the ARV gives you the MAO, helping you make informed decisions and ensuring a profitable flip in Nebraska.

Call Agents & Submit Written Offers

The next step in flipping houses in Nebraska involves reaching out to the listing agent to inform them of your intent to submit a written offer. Ensure that your offer aligns with the maximum allowable offer (MAO) you calculated earlier. By presenting a well-structured written offer, you demonstrate seriousness and advance toward securing the property.

Engage the listing agent or your investor-friendly agent to formalize and submit the offer. This professional approach enhances your credibility, as the agent will handle the necessary paperwork and follow the correct procedures. In Nebraska, use the standard Nebraska Purchase Agreement for residential transactions to formalize your offer.

Provide the following details to the representing agent to draft the contract:

- Purchaser Name: Specify whether the purchase is under your personal name or an LLC. For additional protection, consider using an LLC (Limited Liability Company). If using an LLC, include articles of incorporation to verify your authority as a signer.

- Offer Price: State the offer price based on your previous calculations.

- Deposit Amount (Earnest Money Deposit): Include an earnest money deposit, typically ranging from 1% to 5% of the purchase price, to signal your seriousness. Note that earnest money deposits are often refundable if contingencies are included.

- Contingencies: Incorporate a contingency clause for inspection, generally around seven days, allowing you to inspect the property and withdraw if necessary without losing your deposit.

- Closing Timeline: Request a prompt closing, ideally within 14 days or sooner, if possible. Cash offers usually expedite the process compared to traditional financing.

- Title Clarity: Ensure the seller delivers a free and clear title to avoid issues like liens or unresolved mortgages.

- Buyer’s Agent Name: Clearly identify your buyer’s agent for transparency.

- Proof Of Funds: Attach proof of funds from your lender to validate your ability to complete the purchase, making your offer more appealing to the seller.

Calling agents and submitting written offers are crucial steps in flipping houses in Nebraska. By working closely with your agent to submit a professional and well-informed offer, you enhance your chances of securing a profitable deal. Mastering this process is key to successfully flipping houses and maximizing your investment returns in Nebraska.

Perform Due Diligence When The Offer Is Accepted

Once your offer is accepted, performing due diligence is a critical step in ensuring that your house-flipping project in Nebraska proceeds smoothly. This phase involves thoroughly investigating the property to confirm that it aligns with your initial assessments and to identify any potential issues that could impact your investment.

Start with a comprehensive home inspection to assess the property's condition. A professional inspector will evaluate the structural integrity, electrical systems, plumbing, and overall safety of the home. This inspection can uncover hidden problems that might not have been evident during your initial property evaluation, such as mold, pest infestations, or major structural issues. Addressing these findings early helps avoid unexpected repair costs and ensures the property's value is accurately reflected.

Additionally, review the property's title report to confirm that it is free of liens or legal encumbrances. This step involves verifying that the seller has clear ownership and that there are no outstanding claims against the property. Ensuring a clean title prevents legal complications and ensures you can proceed with renovations and eventual resale without hindrances.

By conducting thorough due diligence, you safeguard your investment and set the stage for a successful house-flipping project in Nebraska. This careful approach minimizes risks and helps ensure that the property meets your expectations and financial goals.

Close On The Deal

Closing on the deal is the final step in securing a property for your house-flipping project in Nebraska. This process involves completing all the necessary legal and financial transactions to transfer ownership of the property from the seller to you. It's crucial to understand the key components of this stage to ensure a smooth and successful closing.

First, you will need to coordinate with a title company or real estate attorney to handle the closing process. They will ensure that all legal documents are prepared and reviewed, including the purchase agreement, title transfer documents, and any additional paperwork required by Nebraska state law. The title company will also conduct a final title search to confirm that there are no outstanding issues or liens on the property.

Next, you'll need to arrange for the payment of closing costs. These costs typically include the down payment, closing fees, title insurance, and other expenses associated with the transaction. Be prepared to provide the funds required, either through a wire transfer or certified check, as specified by your closing agent.

Once all documents are signed and funds are transferred, you'll receive the keys to the property, officially making you the new owner. It's important to review all closing documents carefully and ensure that every detail is correct before finalizing the transaction. Successfully closing on the deal sets the stage for the next phase of your house-flipping journey—renovation and resale.

Renovate The House

Renovating the house is a crucial phase in flipping properties in Nebraska. This step involves transforming the property to meet your projected after-repair value (ARV) while aligning it with the quality and standards of comparable homes in the area. It’s essential to strike a balance between making necessary improvements and avoiding excessive upgrades that could exceed your budget. To maximize profitability, focus on renovations that enhance the property’s appeal and functionality without overdoing it.

Before beginning renovations, ensure you have six essential documents to safeguard your investment and streamline the renovation process:

-

Independent Contractor Agreement: This legally binding document outlines the terms and conditions between you and your contractor, including payment terms, timelines, and specific responsibilities. It helps prevent misunderstandings and ensures both parties are clear on the project's scope and expectations.

-

Final scope of work,: A detailed outline of the renovation tasks, materials, and timelines required for the project. This document acts as a blueprint for the contractor, ensuring that all necessary work is completed to your standards and within the agreed timeframe.

-

Payment Schedule: This document specifies the amounts and deadlines for payments to the contractor, typically linked to the completion of specific project milestones. It helps maintain financial control and ensures that work progresses as planned.

-

Insurance Indemnification Agreement: Ensures that the contractor has adequate insurance coverage and agrees to protect you from any accidents or damages occurring during the renovation. This protects you from potential liability and financial loss.

-

W-9: Collects the contractor's taxpayer identification information for IRS reporting purposes. This form is necessary for issuing a 1099 form at year-end for any payments made to the contractor, ensuring tax compliance.

-

Final Lien Waiver: Signed by the contractor to confirm they have received full payment and waive any future claims against the property. This document prevents any additional financial claims from the contractor after the renovation is completed.

With these documents in place, you can proceed confidently with the renovation process, knowing that your project is legally protected and well-organized. Effective renovation not only increases the property's market value but also enhances your chances of a successful and profitable flip.

Prep & List The House On The MLS

Once the renovation is complete, preparing and listing the house on the MLS is the final step to ensure it reaches potential buyers effectively. This stage involves several key actions to maximize the property's appeal and attract serious offers. Start by addressing the final details of the renovation, staging the home to highlight its best features, and capturing high-quality photos that showcase its full potential.

-

Final Punchlist: Before listing the property, create a final punchlist to address any remaining touch-ups or minor issues. This list should include any cosmetic fixes, cleaning tasks, or repairs that need to be completed to ensure the house is in top condition. A well-executed punchlist ensures that the property presents as a polished and move-in-ready home, increasing its appeal to potential buyers.

-

Home Staging: Home staging is crucial for making the property look its best and helping buyers envision themselves living there. Arrange furniture and decor to highlight the home's strengths and create an inviting atmosphere. Effective staging can enhance the property's appeal and make it stand out in a competitive market.

-

Professional Photos: High-quality, professional photos are essential for capturing the property’s features and attracting potential buyers. Invest in a professional photographer to take clear, well-lit images that showcase the home's best aspects. These photos will be used in online listings and marketing materials, making them a critical component of your sales strategy.

Set An Enticing Asking Price

Setting the right asking price is crucial to attracting buyers and ensuring a successful sale. To determine an enticing asking price, analyze the recent sales data of comparable properties in the area to establish a competitive price point. Consider the property's renovation quality, current market conditions, and any unique features that might justify a higher price. An attractive asking price, combined with effective staging and professional photos, will help you generate interest and secure a profitable sale.

Field Offers & Negotiate

Once your house is listed on the MLS, you'll begin receiving offers from potential buyers. The process of fielding and negotiating offers is crucial to maximizing your return on the property. Start by reviewing each offer thoroughly to ensure it meets your financial goals and aligns with your expectations. Pay attention to the offered price, contingencies, and proposed closing dates.

During negotiations, maintain open communication with potential buyers and be prepared to make counteroffers. Assess each buyer's level of seriousness and financial capability, as well as any conditions they may attach to their offer. Negotiation is often a balancing act—while aiming to secure the best price, be flexible enough to address buyers' concerns and find common ground. Effective negotiation can help you achieve a favorable sale price and terms that meet your investment objectives, ultimately closing the deal on a profitable note.

Accept The Best Offer

After reviewing and negotiating the offers on your flipped property, it’s time to select and accept the best one. Choosing the right offer involves more than just considering the highest bid. Evaluate each offer based on key factors such as the buyer's ability to close, the proposed closing timeline, and any contingencies that might impact the sale.

The best offer is not only about the price but also about the overall terms and reliability of the buyer. For instance, an offer with fewer contingencies and a quicker closing date can be more advantageous, even if the bid is slightly lower. Once you’ve determined the most favorable offer, formally accept it and proceed with the necessary paperwork to finalize the sale. Ensuring that all aspects of the deal align with your goals will help you close the transaction successfully and achieve your investment objectives.

Sell The House & Get Paid

Once you have accepted the best offer on your flipped property, the final step is to sell the house and receive payment. This phase involves working with a closing agent or attorney to finalize all necessary paperwork and ensure a smooth transaction. The closing process typically includes signing the final documents, transferring ownership, and addressing any remaining contingencies or issues.

After the paperwork is complete and the transaction is officially closed, you will receive the proceeds from the sale. This step marks the successful culmination of your house flipping project, transforming your investment into profit. Ensure that you review the final settlement statement carefully to confirm that all financial details are accurate and that you receive the full amount owed to you. With everything settled, you can reflect on the success of your flip and prepare for your next investment opportunity.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make In Nebraska?

In Nebraska, house flipping can be quite profitable, though the figures may vary significantly based on location and property specifics. As of 2024, the average gross profit for house flippers in Nebraska is around $40,000, according to ATTOM Data Solutions. This represents a healthy return, particularly given the state's more affordable real estate market compared to national averages. However, it’s important to consider that individual profits can fluctuate based on factors like renovation costs, market demand, and purchase price.

For those targeting cities with the highest gross flipping profits, Nebraska presents some promising options. The following cities in Nebraska are among the top for median-priced transactions and gross flipping profits:

- Omaha, NE: $48,000 average gross flipping profit

- Lincoln, NE: $42,000 average gross flipping profit

- Grand Island, NE: $38,000 average gross flipping profit

These cities offer attractive opportunities for house flippers due to their rising property values and stable real estate markets. Omaha and Lincoln, in particular, stand out for their robust market conditions, which can lead to substantial returns on investment.

To maximize profits while flipping houses in Nebraska, it’s crucial to thoroughly analyze local market trends and carefully manage renovation costs. Additionally, securing properties at favorable purchase prices and understanding the specific dynamics of Nebraska’s housing market can significantly impact your overall profitability.

Is House Flipping Illegal In Nebraska?

House flipping is not illegal in Nebraska, provided that investors adhere to state and local regulations. Nebraska has no specific laws that prohibit house flipping, but flippers must comply with general property laws and municipal codes. This includes obtaining necessary permits for renovations, adhering to building codes, and ensuring that all work is completed to standard. Failure to follow these regulations can lead to fines or legal issues, but as long as the proper procedures are followed, house flipping remains a legal and viable investment strategy in the state.

However, investors should be aware of Nebraska's property disclosure laws, which require sellers to disclose known issues with the property. This means that flippers must ensure they address and disclose any property defects they find during renovations. Complying with these disclosure requirements helps avoid potential legal disputes and maintains transparency in transactions. As long as these guidelines are followed, house flipping is a legitimate and profitable endeavor in Nebraska.

Do You Need A License To Flip Houses In Nebraska?

Flipping homes in Nebraska doesn't require a real estate license for investors. Engaging in buying, rehabbing, and selling properties for profit falls within the scope of real estate investment activities.

A real estate license is generally required for professionals engaged in traditional real estate transactions, such as representing buyers and sellers in property sales.

Read Also: How To Get MLS Access: 6 Strategies For Real Estate Investors

How Much Does It Cost To Flip A House In Nebraska?

Flipping a house in Nebraska involves several key expenses, each contributing to the overall cost of the project. Understanding these costs is crucial for accurately assessing potential profits. Here’s a breakdown of the typical expenses associated with house flipping in Nebraska.

The Home Purchase Price

In Nebraska, the median home price is approximately $285,000 as of 2024. Depending on the location and condition of the property, prices can vary significantly. For example, a three-bedroom, one-bathroom fixer-upper might be available for around $150,000 to $200,000 in smaller towns, while more desirable properties in cities like Omaha and Lincoln can reach up to $350,000. The down payment generally ranges from 5-20% of the purchase price, with the remainder often financed through a mortgage or paid in cash.

The Home Repair Costs

Repair costs in Nebraska vary based on the extent of renovations required. On average, a standard rehab for a three-bedroom, one-bathroom house can cost between $20,000 and $40,000. This estimate covers essential repairs such as kitchen and bathroom upgrades, painting, flooring, and exterior work. The cost per square foot for repairs typically ranges from $15 to $30, depending on the quality of materials and the scope of work. For an accurate estimate, it’s advisable to consult with local contractors to assess the specific needs of the property.

Carrying Costs

Carrying costs include ongoing expenses while the property is under renovation and before it is sold. In Nebraska, these costs encompass property taxes, homeowners insurance, utilities (electricity, gas, water), and general maintenance. Depending on the size of the property and local rates, carrying costs can range from $500 to $1,500 per month. It’s important to factor in these costs to avoid any surprises that could impact overall profitability.

Closing, Marketing, & Sales Costs

When selling the flipped property, additional costs include real estate agent commissions (typically 5-6% of the sale price), listing fees, marketing expenses, and closing costs. These fees can collectively amount to 7-10% of the sale price, affecting the final profit from the flip. Additionally, budget for any legal fees and title transfer costs associated with the sale.

By carefully considering these expenses and planning accordingly, you can better manage your house-flipping project in Nebraska and optimize your return on investment.

How To Flip A House In Nebraska With No Money?

Flipping houses often demands substantial upfront investment, which can be challenging for many investors. In such scenarios, tapping into alternative financing becomes crucial. Instead of relying solely on personal funds, investors frequently seek assistance from hard money lenders or private money lenders.

While money is required to acquire and renovate a property, it doesn't necessarily have to be the investor's capital. Borrowing from these lenders allows investors to secure the necessary funds for purchase and rehabilitation, enabling them to seize profitable opportunities that might otherwise be out of reach. This approach minimizes the need for substantial upfront cash investment and allows investors to embark on their house-flipping journey with limited personal funds.

Read Also: How To Flip Houses With No Money: Top 10 Expert Strategies

What's The Best Place To Flip Houses In Nebraska?

Choosing the right city in Nebraska for flipping houses involves considering factors such as property values, economic growth, and market trends. Here are five top cities in Nebraska for house flipping, based on recent statistics and market conditions:

- Omaha: Omaha stands out for its robust real estate market and steady property value increases. The city's median home price is around $290,000, with a year-over-year price increase of 6.5%. Omaha's diverse economy and growing population make it a prime location for house flippers looking for strong potential returns.

- Lincoln: As the state capital, Lincoln offers a favorable market for house flipping with a median home price of $275,000. The city has experienced a 5.8% increase in property values over the past year. Lincoln’s stable economic conditions and expanding population contribute to its attractiveness for real estate investments.

- Grand Island: Grand Island provides a more affordable entry point for flippers, with median home prices around $200,000. The city has seen a 4.2% increase in home values recently. Grand Island’s lower property prices combined with steady appreciation make it an appealing option for investors.

- Kearney: Kearney’s real estate market is characterized by affordable property prices and moderate growth. The median home price is approximately $220,000, with a 3.9% increase in property values over the past year. Kearney’s stable market conditions are favorable for house flipping ventures.

- Bellevue: Bellevue, located near Omaha, offers a competitive market with a median home price of $250,000 and a 5.1% increase in home values. The city benefits from its proximity to Omaha while maintaining a more affordable price range, making it a good choice for house flippers looking to capitalize on growth in the region.

Each of these cities offers unique opportunities for house flippers, depending on your budget and investment goals. Conducting thorough research and understanding the local market dynamics can help you make the most informed decisions for your house-flipping ventures in Nebraska.

Read Also: 17 Best Cities To Wholesale Real Estate [UPDATED 2024]

Is It Hard To Flip Houses In Nebraska?

Flipping houses in Nebraska is generally less challenging compared to more competitive markets, but it still requires careful planning and execution. Nebraska’s real estate market, characterized by relatively stable property values and lower competition, can make it easier for investors to find and purchase affordable properties. However, success in flipping houses depends on understanding local market trends, managing renovation costs effectively, and navigating property regulations. Investors should be prepared for the effort involved in renovating properties to meet market standards and maximize returns.

While the overall process may be smoother due to lower property prices and fewer market fluctuations, it is essential to conduct thorough research and work with local experts. Property values in Nebraska cities like Omaha and Lincoln have shown steady increases, which can be beneficial, but flippers must stay informed about local economic conditions and potential changes in the market. By staying updated and well-prepared, investors can overcome challenges and achieve profitable outcomes in Nebraska’s real estate landscape.

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

How Do You Find Contractors For Flipping Houses In Nebraska?

Finding reliable contractors is crucial for a successful house-flipping project in Nebraska. To ensure quality renovations and timely completion, consider using several reputable platforms that connect you with local professionals:

-

HomeAdvisor: This platform provides a comprehensive list of pre-screened contractors based on customer reviews and ratings. It helps you find experienced professionals in Nebraska who are suited for various renovation tasks.

-

Thumbtack: Thumbtack allows you to compare quotes from local contractors and read reviews from previous clients. It’s a useful tool for getting multiple estimates and selecting the best fit for your project.

-

Angi: Formerly known as Angie’s List, Angi offers a detailed directory of local contractors with verified customer feedback. It’s a valuable resource for finding trusted professionals for house renovations in Nebraska.

-

Craigslist: While not as formal as other platforms, Craigslist can be a good source for finding local contractors. Be sure to vet any candidates thoroughly to ensure they meet your project’s needs and standards.

-

Facebook: Facebook’s Marketplace and local community groups can connect you with contractors who are actively working in Nebraska. It's also a great way to get recommendations from friends and neighbors.

Utilizing these resources will help you find skilled and reliable contractors to manage your house-flipping projects effectively in Nebraska.

Final Thoughts On Flipping Homes In Nebraska

With the seven steps detailed above, aspiring investors have a solid foundation to elevate their careers in the house-flipping industry. By following these strategies, investors can navigate the process effectively, reducing risks and maximizing profits. Now equipped with the knowledge of how to flip houses in Nebraska, investors are poised for success in this dynamic market.

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.