How To Flip Houses In Montana: Step-By-Step Home Renovation Guide

Mar 12, 2025

Montana presents aspiring real estate investors with a promising landscape for house flipping. The Treasure State boasts a thriving economy with a low unemployment rate, a great job market, and a substantial influx of net migration. According to World Population Review, the state’s growth rate is right around 1.48%, which is promising to say the least.

As more people flock to this picturesque region seeking new opportunities, the demand for housing has surged, suggesting that there may be no better time to learn how to flip houses in Montana.

This comprehensive guide will tell investors everything they need to know about the intricacies of flipping houses in Montana, including:

- What Is Flipping Houses?

- Montana House Flipping Statistics

- How To Flip Houses In Montana (7 Steps)

- How To Find Houses To Flip In Montana

- Do You Need A License To Flip Houses In Montana?

- How To Flip A House In Montana With No Money

- Best Cities To Flip Houses In Montana

- Final Thoughts On Flipping Homes In Montana

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

What Is Flipping Houses?

Flipping houses, a lucrative real estate investment strategy, revolves around three fundamental pillars: buying, rehabbing, and selling. In Montana, as in other states, this strategy offers investors the opportunity to purchase properties at a discount and renovate them before selling them at a higher price. The key to successful house flipping is identifying undervalued homes needing repairs or facing foreclosure.

The initial step involves acquiring the investment property at a favorable price; this is accomplished by targeting motivated sellers willing to sell their homes for less than their market value. By securing the property at a discounted price, investors set the stage for more substantial profit margins upon resale.

Once the property is acquired, the real work begins with meticulous planning and execution of renovations and upgrades. In Montana's competitive real estate market, investors must strategically invest in upgrades that enhance the property's appeal to potential buyers while remaining within budget constraints. The goal is to create a property that stands out in the market, attracting more attention than comparable homes in the area, thus maximizing potential returns.

A well-executed flip culminates in putting the renovated property back on the market to be sold at a higher purchase price than the initial investment. Investors repay any loans and interest accrued and enjoy the profits from the successful house flip.

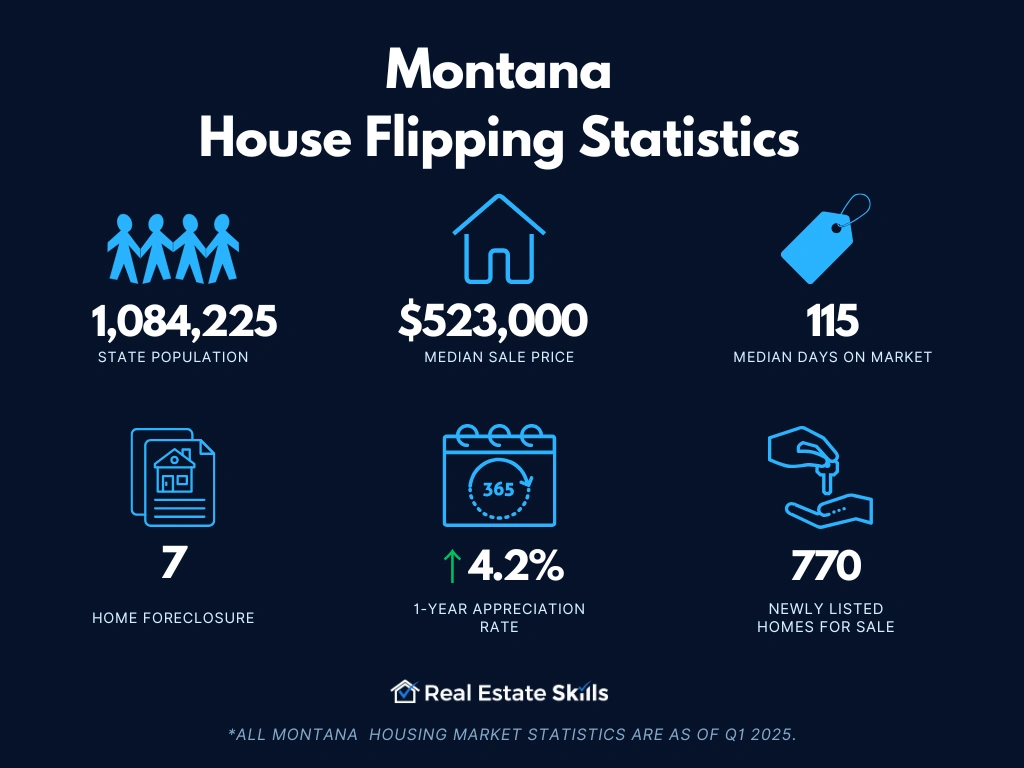

Montana House Flipping Statistics

Here’s a list of the most critical house-flipping statistics investors need to familiarize themselves with before they invest a single dollar in a deal:

- Population: 1,084,225

- Employment Rate: 60.8%

- Median Household Income: $70,804

- Median Sale Price: $523,000 (+4.2% year-over-year)

- Median Days On Market: 115 (+8 year-over-year)

- Number Of Newly Listed Homes: 770 (-18.2% year-over-year)

- Homes Sold Above List Price: 0.0% (-0.15% year-over-year)

- Homes With Price Drops: 72.9%

- Home Foreclosure: 7 properties

*All Montana housing market statistics are as of Q1 2025.

How To Flip Houses In Montana (7 Steps)

When learning how to flip houses in Montana, investors are advised to follow these seven steps:

- Find A House-Flipping Mentor

- Research The Local Housing Market

- Find & Analyze Distressed Properties

- Raise Capital To Fund The Deal

- Close On The House

- Renovate The Property

- Resell The House

Find A House-Flipping Mentor

For aspiring home flippers in Montana, the vast knowledge required to successfully navigate the world of house flipping can feel overwhelming. While research and reading reliable sources are valuable, there's no substitute for learning from someone who has already succeeded in the industry. Consequently, we recommend seeking a house-flipping mentor to expedite the learning process.

A seasoned mentor can provide guidance, share real-world insights, and offer valuable strategies that accelerate your learning curve and boost your chances of success in Montana's competitive real estate market. By enlisting the help of a mentor, new investors can mitigate risks, optimize project efficiency, and create a solid business plan tailored to the unique challenges and opportunities in the Montana real estate landscape.

Having a mentor by your side instills the confidence to take that first step into house flipping. With their support, the seemingly daunting task of completing your first deal becomes more approachable and achievable. Moreover, a mentor can offer a supportive network, helping you build essential connections within the industry and gain a unique perspective on navigating challenges in the ever-evolving market.

Research The Local Housing Market

Along with the insight gained from a mentor, investors should turn to these reputable resources to supplement their knowledge further.

- Zillow Housing Data Research

- Zillow’s Montana Market Overview

- Redfin’s Montana Housing Market Overview

- Realtor.com’s Montana Market Overview

- com’s Residential Data Library

- Montana Association Of Realtors

- ATTOM DataSolutions’ Montana Real Estate & Property Data

- SoFi’s State Foreclosure Data

- U.S. Census Bureau’s Montana Data

- Bureau Of Labor Statistics’ Montana Economic Data

- Montana Board of Realty Regulation

- Federal Reserve Bank of St. Louis’ Montana Data

Find & Analyze Distressed Properties

For new investors seeking to flip houses in Montana, finding and analyzing distressed properties is a crucial skill to master. A practical approach to kickstart your analysis process is by employing the 70% rule. This rule is a valuable guideline to prevent overpaying for potential deals and ensure sufficient room for profitable margins.

The first step to effectively applying the 70% rule is determining the subject property's after-repair value (ARV); this involves thoroughly analyzing recent sales data of comparable properties (comps) in the same area or utilizing reliable ARV calculators to determine housing prices that will work for the investor. By knowing the ARV, you can gain insight into the property's expected value after repairs.

With the ARV established, the calculation can begin. Multiply the ARV by 70% (or 0.70) and subtract the estimated rehab costs, including expenses for hiring a general contractor and materials. The resulting figure represents the maximum allowable offer (MAO), which should represent the upper limit of what investors can spend to acquire a deal.

Here is the formula:

ARV - Fixed Cost - Rehab Costs - Desired Profit = Maximum Allowable Offer (MAO)

While the 70% rule provides a quick snapshot of a deal's potential, it should not be the sole basis for analysis. Instead, it is a complementary tool combined with other evaluation methods to understand the property's viability. Factors like market trends, potential risks, and the property's condition should also be considered, so don’t rely on the 70% rule alone. It is, however, a great place to start.

Raise Capital To Fund The Deal

The next critical step in the house flipping process is raising the necessary capital to fund the deal. While some investors may use their cash reserves, seeking external financing can be advantageous, especially for those looking to scale their house-flipping businesses without depleting personal savings.

Private and hard money loans are Montana's preferred funding sources for home flippers. Despite higher interest rates, these loans offer significant advantages. Borrowing from private money lenders and hard money lenders ensures quick access to capital, essential in today's competitive real estate market. These loans typically have fewer strict approval requirements than traditional banks, making the process smoother and faster for investors.

Another benefit of using private and hard money loans is the short-term nature of these arrangements. Unlike long-term mortgages, flip loans are designed for short periods, aligning perfectly with the typical timeline of house-flipping projects; this prevents investors from incurring years of amortized payments, allowing them to focus on the immediate success of their projects.

Close On The House

In Montana, the closing process operates under an escrow system, which includes the following key steps:

- Negotiation And Purchase Agreement: The first step involves investors making an offer and negotiating the purchase price and terms with the seller. Once both parties reach an agreement, a purchase and sale agreement is drafted to document the deal's terms.

- Title Search And Property Inspection: Before finalizing the deal, investors conduct a title search to ensure no ownership discrepancies and verify a clear transfer of title. A thorough property walkthrough is performed to assess its condition and identify potential issues.

- Preparation And Signing of Documents: The transaction proceeds to the closing table with due diligence completed. With the assistance of their respective agents, homebuyers, and sellers, if involved, prepare, review, and sign all the necessary paperwork to formalize the property transfer.

- Distributions: At closing, funds are collected and distributed as agreed upon in the purchase and sale agreement. The agents representing each side of the transaction ensure that all financial transactions are accurate and secure. At the same time, the original owner will give up their keys to the property.

- Recording Of Title: Once all documents are in order and the deal is finalized, the transfer of title is recorded with the local Recorder's Office. This official record ensures that the property's new ownership is properly documented.

Following the escrow process in Montana, house flippers can confidently close on the property, secure their investment, and begin renovating and preparing the home for resale. Understanding and navigating the closing process is essential for success as a house flipper in the thriving Montana real estate market.

Renovate The Property

While flipping houses in Montana, renovations are pivotal in increasing the property's value and potential for higher returns. To make the most of the renovation budget, investors should prioritize cost-effective improvements that significantly impact the property's overall appeal.

By focusing on strategic and cost-effective renovations, house flippers in Montana can significantly increase the property's market value and attract high-quality buyers. According to Remodeling Magazine, the renovations that return the most money to investors in Montana (and the rest of the Mountain region of the United States) are:

- Electric HVAC Conversion: Recoups 114.5% of the original cost

- Fiber-Cement Siding Replacement: Recoups 107.4% of the original cost

- Garage Door Replacement: Recoups 99.7% of the original cost

- Manufactured Stone Veneer: Recoups 96.7% of the original cost

- Vinyl Siding Replacement: Recoups 92.9% of the original cost

It is rare for renovations to yield a return higher than their cost. However, investors have come to understand that renovations merely need to stir up demand. Any enhancement or modification that increases a home's appeal brings an inherent value that should be considered. Projects that elevate a home's demand can spark competition, leading to an increase in perceived value.

Resell The House

After completing the strategic renovations, the next crucial step in flipping houses in Montana is to resell the property at a price that exceeds the total investment, ensuring an attractive profit margin. There are several key considerations to remember during the resale process:

- Effective Marketing: Investors can market the property by hosting open houses and utilizing various listing platforms. However, partnering with a professional real estate agent can provide a significant advantage. An experienced agent will have intimate knowledge of the local market, allowing them to position and promote the property to potential buyers effectively.

- Timely Sale: A quick sale is essential to avoid mounting holding costs, such as property taxes and utility bills. A fast deal ensures that profits are realized sooner, allowing investors to move on to the next profitable venture.

- Price Setting: Accurately setting the selling price is an important step. Overpricing the property may lead to extended market time while underpricing could mean leaving money on the table. Properly assessing the local market trends and recent comparable sales (comps) can help determine the optimal listing price.

- Highlighting Improvements: Emphasize the strategic renovations made during the flip to attract potential buyers. Showcase the property's enhanced features and improvements, such as upgraded kitchens, bathrooms, and energy-efficient enhancements, to justify the asking price.

- Negotiation Skills: A skilled real estate agent can be instrumental during the negotiation process, working to secure the best possible offer from potential buyers.

- Closing Process: Ensure a smooth closing process by preparing all necessary paperwork and documents for the final transaction. Collaborate with the agent, title company, and other parties to expedite the closing process.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How To Find Houses To Flip In Montana

Here are some effective strategies for discovering houses to flip in the state of Montana:

- Utilize the expertise of local real estate agents and Realtors who possess in-depth market knowledge. They are the best resources to uncover various opportunities and potential deals.

- Whether through your license or becoming a Realtor, gain access to the Multiple Listing Service (MLS). As the largest database of properties for sale in the United States, the MLS can direct Montana investors toward homeowners already looking to sell.

- Attend local foreclosure auctions. Bidding on real estate assets no longer wanted can result in acquiring deals below market value for investors who know what they are doing.

- Take a trip to the local Recorder’s Office, where the records of distressed homeowners are publicly available. Identifying homeowners who have received foreclosure notices can increase your odds of finding motivated sellers.

- Physically mail letters to homeowners using a direct mail campaign. In doing so, let local homeowners know your intentions and offer a solution for their financial issues.

- Otherwise known as “driving for dollars,” investors can simply drive through neighborhoods to identify poorly kept or neglected homes. The idea is that unkempt properties may be owned by uninterested homeowners, which means they may be more willing to sell.

Read Also: Finding Motivated Seller Leads: Free & Paid Tactics

Do You Need A License To Flip Houses In Montana?

While possessing a real estate license is not mandatory for flipping homes in Montana, obtaining one can be highly beneficial. By becoming a licensed real estate professional, investors unlock valuable advantages.

Despite the obligation of paying annual fees and passing regular exams to maintain their professional standing, they gain entry to a vast nationwide network of agents, along with their most powerful tool: the Multiple Listing Service (MLS).

Read Also: How To Get MLS Access: The (Ultimate) Guide

How To Flip A House In Montana With No Money?

Flipping houses in Montana allows investors to avoid using their funds entirely. Instead, they can tap into financial resources provided by private lenders and hard money lenders. As a result, private and hard money loans free investors from the shackles of dealing with traditional banks, undergoing credit checks, and enduring lengthy approval procedures.

By opting for hard and private money loans, investors gain immediate access to capital, expediting the process of flipping houses in Montana. The unfettered access enables investors to seize promising off-market opportunities, ensuring they take advantage of potentially profitable ventures.

While not technically flipping, investors can also wholesale properties without using any of their own money. Wholesaling involves securing property rights and then selling them to end buyers for a fee. This approach demands minimal capital investment, making it an attractive option for astute investors looking to maximize their returns without using their money.

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

Best Cities To Flip Houses In Montana

The best cities to learn how to flip houses in Montana include, but are not limited to:

- Billings

- Missoula

- Bozeman

- Great Falls

Final Thoughts On Flipping Homes In Montana

Learning how to flip houses in Montana is an involved process. However, new investors who follow the seven steps outlined above should find the industry welcoming and full of potential. If for nothing else, establishing a solid foundation can set investors up for years of success in a very lucrative industry.

At Real Estate Skills, our team of experts is ready to provide you with the tools you need for flipping houses in Montana. We're committed to providing the knowledge, resources, and support necessary to navigate a Montana property flip successfully. So avoid common mistakes and maximize your returns by leveraging our expertise.

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.