How To Flip Houses In Missouri: 15-Step Home Renovation Guide

Mar 10, 2025

With a median age of just under 38, Missouri’s unique demographics present an exciting opportunity for real estate investors. After all, millennials have been one of the largest demographics of buyers for the better part of a decade, and their continued desire for homeownership creates a favorable environment for those who have learned how to flip houses in Missouri.

As a result, we will explore the ins and outs of flipping homes in Missouri. From identifying target neighborhoods to implementing modern design elements, we'll provide you with the tools you need to tap into this growing market and achieve profitable returns, including the following:

- What Is Flipping Houses?

- Why Flip Houses In Missouri?

- Missouri House Flipping Statistics

- How To Flip Houses In Missouri In 15 Steps

- How Much Do House Flippers Make In Missouri?

- Is House Flipping Illegal In Missouri?

- Do You Need A License To Flip Houses In Missouri?

- How Much Does It Cost To Flip A House In Missouri?

- How To Flip A House In Missouri With No Money

- What's The Best Place To Flip Houses In Missouri?

- Is It Hard To Flip Houses In Missouri?

- How Do You Find Contractors For Flipping Houses In Missouri?

- Final Thoughts On Flipping Homes In Missouri

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

What Is Flipping Houses?

Already an enticing real estate investing strategy, flipping houses has recently proven it belongs in the pantheon of today’s greatest wealth-building vehicles. As recently as the first quarter of this year, the average flipped home in the U.S. generated a gross profit of $56,000, up 4.7% from the previous quarter, according to ATTOM Data Solutions. The gross profit on the average flip translated to a 22.5% return on investment (ROI), easily exceeding other investment vehicles.

Beyond serving as a tremendous wealth-building opportunity, flipping houses is exactly what it sounds like. Investors will find and acquire homes to rehab and sell for a profit. The key is to improve profit margins around every corner, so investors will prioritize buying distressed homes below market value and restoring them to an acceptable condition, only to sell them for more money than they have invested.

To be clear, learning how to flip houses in Missouri is an involved process and requires investors to wear many hats. From finding and analyzing properties to rehabbing and reselling assets, investors must utilize several skill sets and meld them into a single exit strategy. Once each step complements the others, investors will find flipping houses is a great way to build wealth.

Read Also: How To Wholesale Real Estate In Missouri

Why Flip Houses In Missouri?

Flipping houses in Missouri offers a promising opportunity for real estate investors due to the state's robust housing market and favorable economic conditions. As of 2024, Missouri's real estate market remains strong, with steady property appreciation and a median home value of around $230,000, which is below the national average. This affordability makes it an attractive location for investors looking to maximize their returns, as lower entry costs can lead to higher profit margins when flipping homes. Additionally, Missouri's diverse economy, with significant contributions from agriculture, manufacturing, and healthcare sectors, supports a stable job market and drives demand for housing.

Missouri's urban areas, such as St. Louis, Kansas City, and Springfield, present particularly lucrative opportunities for house flippers. These cities have seen consistent population growth and increased demand for housing, which translates to a higher demand for renovated homes. For example, Kansas City has been experiencing a revitalization in its downtown area, attracting young professionals and families who are looking for modern, updated homes. This trend creates a ripe environment for flippers to purchase distressed properties, renovate them, and sell them at a premium, capitalizing on the growing desire for updated, move-in-ready homes.

In addition to the economic and demographic factors, Missouri's relatively low cost of living and favorable business climate make it an appealing state for real estate investors. The state's business-friendly policies, including low property taxes and fewer regulations compared to other states, reduce the overall cost of flipping houses and increase potential profit margins. Moreover, Missouri offers a variety of financing options, including hard money loans, which are commonly used in the house-flipping industry. These factors combined make Missouri an attractive market for both new and experienced real estate investors looking to flip houses and achieve substantial returns.

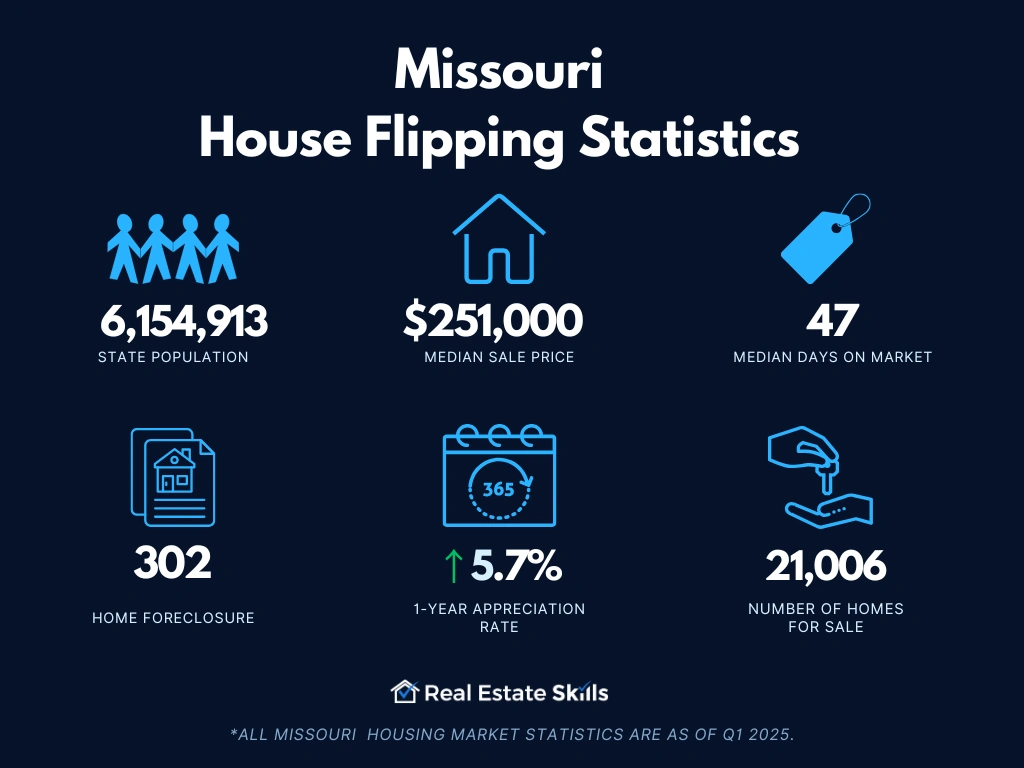

Missouri House Flipping Statistics

To thrive as a house flipper in Missouri, investors must learn the fundamental indicators shaping the local market trends. Armed with this knowledge, flippers will have an easier time listening to what the market has to say and making the appropriate corresponding moves (data provided by the U.S. Census Bureau, RedFin, and ATTOM Data Solutions):

- Population: 6,154,913

- Employment Rate: 61.5%

- Median Household Income: $68,545

- Median Sale Price: $251,000 (+5.7% Year-Over-Year)

- Number Of Homes Sold: 4,469 (+3.4% Year-Over-Year)

- Median Days On Market: 47 (+5 Year-Over-Year)

- Number Of Homes For Sale: 21,006 (+11.7% Year-Over-Year)

- Number Of Newly Listed Homes: 5,758 (+7.1% Year-Over-Year)

- Months Of Supply: 3 (+0 Year-Over-Year)

- Homes Sold Above List Price: 16.2% (-0.81 Points Year-Over-Year)

- Homes With Price Drops: 23.4% (+0.4 Points Year-Over-Year)

- Foreclosure: 302

*All Missouri housing market statistics are as of Q1 2025.

Mastering the essentials of Missouri's real estate market is key to successful investments, and a Flipping Houses 101 approach will arm you with the necessary tools. By gaining a deep understanding of local market conditions, monitoring Missouri's economic indicators, and analyzing property values, you can develop effective strategies tailored to this state. This knowledge is crucial for navigating the Missouri market and maximizing your house-flipping potential.

How To Flip Houses In Missouri In 15 Steps

To maximize profits when flipping houses in Missouri, it's crucial to understand local market trends and carefully plan renovations. Acquiring properties at below-market prices, budgeting accurately for renovations, and choosing desirable neighborhoods can significantly impact the net profit from each flip. To increase the likelihood of a profitable house flip, follow these 15 steps:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Choosing the right market is a crucial step in flipping houses in Missouri. Start by researching various cities and neighborhoods to identify areas with strong real estate potential. Key factors to consider include property values, market trends, and local economic conditions. For instance, cities like St. Louis and Kansas City offer vibrant real estate markets with growing demand for renovated homes, making them attractive choices for house flippers. On the other hand, smaller cities such as Springfield or Columbia may offer more affordable entry points and less competition.

Another important aspect is understanding the local demographics and economic indicators. Markets with a growing population, low unemployment rates, and increasing median household incomes often present more opportunities for profitable flips. Analyze recent sales data and property appreciation trends to gauge the potential for future growth. Areas with an increasing demand for housing or undergoing revitalization can provide excellent opportunities for higher returns on your investment.

Additionally, consider the competition and your own expertise when selecting a market. If you’re new to house flipping, it might be beneficial to start in a less competitive area where you can gain experience before moving to more competitive markets. Conversely, if you have more experience and resources, targeting a high-demand area with higher property values could yield greater profits. Thorough market research and a strategic approach will help you choose the best market for your house-flipping venture in Missouri.

Find Your Money

Securing financing is a critical step in flipping houses, as it allows you to purchase and renovate properties while managing your cash flow effectively. There are several avenues to explore when looking for money to fund your house-flipping project. Traditional bank loans are one option, but they often come with stringent requirements and lengthy approval processes. For faster and more flexible financing, many investors turn to private and hard money lenders. Understanding the differences between these types of financing and knowing where to find them can significantly impact the success of your flip.

Private lenders are individuals or companies that provide loans based on your project’s potential rather than your credit score alone. They can offer flexible terms and quicker access to funds compared to traditional banks. Hard money lenders, on the other hand, specialize in short-term loans secured by real estate. These loans are typically used for property purchases and renovations, with the property itself serving as collateral. Hard money loans often have higher interest rates but are valuable for quick funding and when conventional financing isn’t an option.

How To Find Private & Hard Money Lenders

To find a private lender, start by leveraging your personal and professional network. Reach out to real estate investment groups, attend local real estate meetups, and connect with other investors who might have recommendations. Private lenders often operate within local circles and may be found through referrals or direct outreach. Additionally, consider using online platforms and forums dedicated to real estate investing to connect with potential lenders who have experience in your target market.

For hard money lenders, online platforms such as Kiavi and Lima One are valuable resources. These platforms provide lists of local and national lenders, including their contact information and loan terms. By researching and comparing options on these platforms, you can identify hard money lenders who offer competitive rates and terms suited to your project’s needs. Engaging with these lenders early in your planning process will help ensure that you have access to the funds required to execute a successful house flip in Missouri.

Find Three Contractors

Finding reliable contractors is essential for a successful house flip in Missouri. Your choice of contractors will directly impact the quality and efficiency of the renovation process. Start by identifying at least three contractors who specialize in home renovations and have experience with similar projects. This approach allows you to compare bids, timelines, and expertise, helping you make an informed decision. It's crucial to select contractors who are not only skilled but also trustworthy, as delays or subpar work can significantly affect your project's success.

When evaluating contractors, consider their past work, customer reviews, and references. A good contractor should provide detailed estimates, including a breakdown of labor and material costs. Additionally, check their licensing and insurance to ensure they meet local regulations and can cover any potential issues during the renovation. Meeting with multiple contractors also provides an opportunity to discuss your project's specifics and gauge their understanding of your vision and requirements.

How To Find A General Contractor

To find a general contractor, start by searching online directories and review platforms such as HomeAdvisor, Thumbtack, and Angi. These platforms offer a list of contractors along with customer reviews, which can help you gauge their reputation and reliability. Look for contractors with experience in flipping houses or similar renovation projects to ensure they understand the unique demands of your project.

Another effective method is to ask for recommendations from local real estate investors or real estate agents. They often have connections with reputable general contractors who have a proven track record in the area. Additionally, attending local real estate investment meetings or trade shows can help you network with professionals and gather referrals. By thoroughly researching and interviewing potential contractors, you can find a general contractor who will help bring your Missouri house-flipping project to successful completion.

Find A House To Flip

Finding the right property is one of the most critical steps in flipping houses in Missouri. Start by exploring various methods to identify potential candidates for your project. Driving for dollars is a traditional but effective strategy where you drive through neighborhoods to find distressed properties with "For Sale" signs or signs of neglect. This approach allows you to identify properties that might not yet be listed on the market but could be excellent candidates for flipping.

Another effective method is to use direct mail campaigns. By targeting property owners in specific areas with personalized mailers, you can reach out to individuals who may be considering selling their property. This approach often requires compiling a list of potential leads and sending out well-crafted offers or inquiries about their interest in selling.

Utilizing the Multiple Listing Service (MLS) is also a crucial strategy. The MLS provides a comprehensive database of properties currently on the market, including those that may be underpriced or in need of renovation. Regularly monitoring the MLS can help you spot opportunities and act quickly before other investors.

Check out our in-depth video on "How to Gain Access to the MLS Without a License." We cover key insights and practical tips to unlock potential property opportunities you might have been missing out on!

Alternative Strategies to Find a House

When it comes to finding houses to flip, there are several alternative strategies that can complement traditional methods:

-

The Day Zero Strategy: This involves targeting properties that have just come on the market. Acting quickly can give you an advantage in securing a deal before competition increases. Monitoring new listings daily and having a swift response plan is essential for this strategy.

-

The Old Listing Strategy: Look for properties that have been on the market for an extended period. These properties might have become stale or overlooked, making them potential bargains for investors willing to negotiate. Often, sellers are more motivated to accept lower offers on long-standing listings.

-

The Wholesaler Strategy: Working with real estate wholesalers can be an effective way to find investment properties. Wholesalers often have access to off-market deals and can present you with properties that fit your criteria. Establishing relationships with local wholesalers can help you access exclusive opportunities.

In conclusion, successfully finding a house to flip in Missouri involves utilizing a combination of strategies to maximize your chances of finding a profitable property. By employing methods such as driving for dollars, direct mail campaigns, and leveraging the MLS, along with alternative strategies like The Day Zero Strategy, The Old Listing Strategy, and The Wholesaler Strategy, you can increase your chances of identifying and securing the perfect flip. Each method has its advantages and can be tailored to fit your specific investment goals and market conditions.

Analyze The Property

Analyzing the property is a crucial step in flipping houses in Missouri. This process involves evaluating key metrics to determine whether a property is a good investment. The primary factors to consider are the after-repair value (ARV), repair costs, and purchase price. Each of these elements plays a significant role in assessing the profitability of your investment.

After-Repair Value

The after-repair value (ARV) is a vital component in analyzing a property for a flip. Calculating the ARV involves estimating the property's market value once all necessary repairs and renovations are completed. To determine this value, you'll need to examine comparable sales or "comps"—recently sold properties similar to the one you're considering.

For accurate comps, select properties that:

- Have similar bed and bath counts

- Are within 20% of the property's square footage

- Are located in the same neighborhood or within a one-half mile radius

- Were sold within the past six months

- Have been recently renovated

Average the sale prices of these comparable properties to estimate the ARV. This will provide you with a realistic idea of what the property could be worth after renovations, guiding your investment decisions and potential profitability.

Repair Costs

Estimating repair costs is essential for a successful flip. Start by conducting a thorough property inspection and consulting with experienced contractors. Make a detailed list of all necessary repairs and obtain multiple quotes to get a realistic estimate of labor and material costs. It's also wise to set aside a contingency budget—typically 10-15% of the total repair costs—to cover unexpected expenses. By leveraging professional advice and thorough planning, you can ensure accurate repair cost estimates, which are crucial for determining the overall feasibility of the flip.

Purchase Price

Determining the purchase price involves using the ARV and repair costs to calculate your maximum allowable offer (MAO). This is the highest price you can pay for the property while still ensuring a profitable investment. Here’s how to calculate it:

- The ARV: The estimated value of the home after repairs

- Hard Money Loan Costs: Include interest rates, origination fees, and points

- Private Money Loan Costs: Consider the interest and duration of the project

- Front-End Closing & Holding Costs: Typically around 2% of the purchase price, plus insurance, utilities, and taxes

- Backend closing costs : Usually 1% of the ARV

- Realtor Fees: Typically 6% of the purchase price, but can be negotiated

- Projected Profit: Aim for a return on investment that aligns with industry standards, such as the 27.5% return reported by ATTOM Data Solutions.

Subtract these costs from the ARV to determine your MAO. This figure represents the highest price you can offer for the property while still ensuring a profitable outcome. By carefully analyzing these factors, you can make informed decisions and maximize the success of your house-flipping venture in Missouri.

Perform Due Diligence When The Offer Is Accepted

Once your offer is accepted, performing due diligence is a critical step in ensuring that the property is a sound investment. This phase involves a thorough investigation of the property to confirm its condition and verify that there are no hidden issues that could affect your investment.

Begin with a detailed inspection of the property, focusing on structural integrity, systems (like plumbing and electrical), and any signs of pest infestations or mold. Hire a professional home inspector to identify potential problems that might not be immediately visible. This inspection will provide a comprehensive report, which can be used to negotiate repairs or adjustments to the purchase price if significant issues are discovered.

Additionally, review the property’s history and documentation. Check for any outstanding liens or legal issues that could impact the ownership or value of the property. This includes verifying the title report to ensure there are no encumbrances or claims against the property. Confirm that the seller can provide a clear and marketable title.

Finally, evaluate the neighborhood and local market conditions. Research recent sales of comparable properties in the area to validate your after-repair value (ARV) estimates and ensure that your investment aligns with market trends. Understanding the local real estate environment helps you anticipate any potential changes that could affect your property's value.

Performing diligent checks during this phase is essential to safeguard your investment and ensure a successful flip. By addressing potential issues before finalizing the purchase, you can avoid costly surprises and increase your chances of a profitable flip.

Close On The Deal

Closing on the deal is the final and crucial step in the house-flipping process. This stage involves completing the legal and financial formalities necessary to transfer ownership of the property from the seller to you. It typically involves several key activities to ensure a smooth and successful transaction.

Start by coordinating with your title company or closing attorney to review and finalize all necessary documents. This includes the purchase agreement, title deed, and any other legal paperwork required to transfer ownership. Verify that all documents are correct and complete, and ensure that there are no last-minute issues or discrepancies that could delay the closing process.

Prepare for the financial aspects of closing, which include paying the down payment and closing costs. Closing costs can vary but generally include fees such as title insurance, escrow fees, and recording fees. Ensure that your funds are in place and ready for transfer, and review your final settlement statement to confirm that all costs and credits are accurately accounted for.

Finally, once all documents are signed and payments are made, the property’s title will be officially transferred to you. Obtain a copy of the signed closing documents and the updated title deed as proof of ownership. At this point, you can begin your renovation plans and proceed with the house-flipping project.

Closing on the deal is a pivotal moment in the house-flipping process. Ensuring that all aspects of the transaction are handled accurately and promptly will set the stage for a successful renovation and a profitable flip.

Renovate The House

Renovating the house is a pivotal step in the house-flipping process, crucial to achieving your projected after-repair value (ARV) and aligning with the market comps. The goal is to enhance the property to a level that meets or slightly exceeds the standard of comparable homes in the area. This ensures that the property remains competitive in the market while maximizing your potential return on investment.

Before starting renovations, it's essential to safeguard your project with six key documents. These documents not only protect your investment but also ensure clarity and legality throughout the renovation process:

- Independent Contractor Agreement: This document formalizes the relationship between you and your contractor, specifying payment terms, project timelines, and responsibilities. It ensures both parties have a clear understanding of expectations and protects against potential disputes.

- Final scope of work: A detailed scope of work outlines all tasks, materials, and deadlines for the renovation. It provides a comprehensive guide for your contractor, helping to keep the project on track and within budget.

- Payment Schedule: This schedule specifies payment amounts and timing based on project milestones. Tying payments to completed stages of work helps ensure the contractor stays on schedule and meets agreed-upon standards.

- Insurance Indemnification Agreement: This agreement ensures the contractor carries adequate insurance and agrees to indemnify you against any damages or accidents that occur during the renovation. It protects you from financial liability and potential legal issues.

- W-9: A W-9 form collects the contractor's tax information, necessary for reporting payments to the IRS. It ensures compliance with tax regulations and facilitates accurate reporting at the end of the year.

- Final Lien Waiver: This document confirms that the contractor has been paid in full and waives any future claims against the property. It protects you from additional financial demands after the renovation is completed.

With these documents in place, you can proceed with the renovation, confident that your project is legally protected and your investment is secure. Proper planning and documentation help streamline the renovation process and ensure a successful flip.

Field Offers & Negotiate

Once your property is listed on the MLS and potential buyers start expressing interest, the next step in flipping houses in Missouri is to field offers and engage in negotiations. This phase is critical, as it involves evaluating offers, negotiating terms, and ultimately choosing the best deal that aligns with your investment goals.

As offers come in, your real estate agent will present them to you, detailing each buyer's proposed price and terms. Carefully review each offer to understand the buyer's financial position, contingencies, and proposed closing timeline. Pay attention to factors such as the offer amount, earnest money deposit, and any contingencies or conditions attached to the offer. This will help you gauge the seriousness and readiness of each potential buyer.

Once you’ve reviewed the offers, you can enter into negotiations to seek better terms or higher offers. This may involve counteroffers where you propose different terms or ask for concessions. Effective negotiation requires balancing your financial goals with the buyer's willingness to meet your terms. Key negotiation points may include the sale price, closing costs, repair credits, and the closing date. It’s important to be flexible yet firm in your negotiations to achieve the best outcome for your investment.

In addition to negotiating price and terms, assess the strength of each buyer. Look for buyers who have pre-approval letters or proof of funds, as this indicates their ability to follow through with the purchase. Buyers with fewer contingencies or quicker closing timelines may also be more attractive, as they reduce the risk of deal delays or complications.

Navigating offers and negotiations effectively is crucial in achieving a successful house flip. By carefully evaluating offers, skillfully negotiating terms, and considering the strength of each buyer, you can secure the most favorable deal and move closer to a profitable sale

Accept The Best Offer

After fielding offers and engaging in negotiations, the final step in the process is to accept the best offer. This decision is pivotal as it determines which buyer will move forward with the purchase, impacting both the success of your flip and your overall profitability.

When deciding which offer to accept, consider not only the offer price but also other crucial factors. Examine the buyer's financial qualifications, including their ability to secure financing or proof of funds. Review any contingencies, such as inspection or appraisal clauses, that might affect the transaction's outcome. Additionally, consider the proposed closing date and whether it aligns with your timeline and financial goals. By assessing these elements, you ensure that the offer you choose maximizes both your return and the likelihood of a smooth transaction.

Once you’ve chosen the best offer, communicate your acceptance to the buyer and their agent. Ensure that all terms agreed upon are clearly outlined in the purchase agreement. This includes confirming the sale price, deposit amount, and any additional terms negotiated. Your agent will assist in preparing the necessary documentation and updating the listing status to reflect the accepted offer. At this stage, it’s important to stay in close contact with your agent and the buyer to address any final details or adjustments that may arise.

With the offer accepted, the next steps involve preparing for the closing process. This includes coordinating with your attorney or escrow company to ensure that all legal and financial requirements are met. Ensure that all necessary inspections, appraisals, and paperwork are completed in a timely manner. By effectively managing this phase, you can facilitate a smooth transition from offer acceptance to the final sale, achieving your goal of a successful house flip.

Accepting the best offer is a crucial step in the house flipping process. By carefully evaluating all factors, finalizing the deal, and preparing for closing, you can ensure that you maximize your investment and achieve a profitable outcome.

Sell The House & Get Paid

The final step in flipping houses in Missouri is to sell the house and get paid. Once the closing process is complete and all paperwork has been signed, the transaction moves toward settlement. This involves transferring ownership from you to the buyer, finalizing any remaining financial arrangements, and ensuring all legal requirements are met.

As the seller, you will receive the sale proceeds minus any closing costs or outstanding mortgages. This payment is typically disbursed through the escrow company handling the transaction, which ensures that funds are correctly allocated to all parties involved. Ensure that you have addressed any last-minute details or conditions that could affect the final payout, such as resolving any remaining liens or fees.

With the house sold and funds received, your role in the flip is complete. It’s important to review the financial outcomes to assess your investment’s success, including evaluating your overall profit relative to the initial projections. This final step wraps up your house-flipping venture and provides the opportunity to reflect on the process and plan for future investments.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make In Missouri?

Is House Flipping Illegal In Missouri?

House flipping is not illegal in Missouri; however, it's essential for investors to comply with state regulations and ethical standards to avoid legal issues. Missouri law allows real estate investors to buy, renovate, and sell properties for profit, but like in other states, investors must follow local zoning laws, building codes, and disclosure requirements. Failure to adhere to these regulations can result in fines or legal disputes, particularly if the renovations do not meet safety standards or if material facts about the property are not disclosed to buyers.

Additionally, while house flipping is legal, investors should be aware of potential risks such as mortgage fraud and predatory lending practices, which are illegal in Missouri and can carry severe penalties. It's crucial to conduct thorough due diligence, work with reputable contractors, and ensure all transactions are transparent and lawful. By staying informed and following the rules, house flippers can successfully navigate the Missouri market without running into legal trouble.

Do You Need A License To Flip Houses In Missouri?

Flipping houses in Missouri does not require obtaining a real estate license. However, there are potential benefits for investors who choose to acquire one. Holding a real estate license grants access to a vast network of industry professionals. Moreover, licensed individuals can directly access the MLS without relying on external assistance.

It is crucial to bear in mind that requirements and regulations can differ among states. In the case of Missouri, a real estate license is not necessary for house flipping. Nevertheless, it is always prudent to consult local laws and regulations to comply with specific licensing requirements.

Read Also: How To Get MLS Access: The (Ultimate) Guide

How Much Does It Cost To Flip A House In Missouri?

House flipping in Missouri can be a profitable venture, but understanding the associated costs is essential for success. The total cost to flip a house in Missouri includes several key expenses, such as the purchase price, renovation costs, carrying costs, and closing costs. Let's break down these costs to provide a clear picture of what you can expect when flipping a house in Missouri.

The Home Purchase Price

The first significant expense in a house flip is the acquisition cost. In Missouri, the median home value as of 2024 is around $230,000, which is significantly lower than the national average. This affordability makes Missouri an attractive market for investors. Depending on the property's condition and location, you might find homes priced as low as $50,000 in smaller towns or rural areas, while properties in major cities like St. Louis or Kansas City could cost upwards of $300,000. The down payment for financing these properties typically ranges from 5% to 20% of the purchase price, with the rest financed through a mortgage or other funding sources.

The Home Repair Costs

Renovation costs can vary widely depending on the scope of work required. In Missouri, you can expect to spend anywhere from $20,000 to $60,000 on average for a standard three-bedroom, one-bathroom home. This includes essential repairs such as roofing, plumbing, electrical work, and cosmetic updates like flooring, paint, and kitchen renovations. The cost per square foot for renovations in Missouri usually falls between $15 and $40, depending on the quality of materials and the complexity of the work. It's crucial to obtain multiple quotes from contractors and budget for unexpected expenses to ensure your project stays on track financially.

The Carrying Costs

Carrying costs are often an overlooked aspect of flipping, but they can add up quickly if the project takes longer than expected. These costs include property taxes, homeowner's insurance, utilities, and maintenance fees while the home is being renovated. In Missouri, property taxes are relatively low, averaging about 0.93% of the property's assessed value, but they still need to be factored into your budget. Additionally, you'll need to consider the cost of insuring the property during the renovation, which can range from $500 to $1,500 depending on the property's value and location.

Closing, Marketing, & Sales Costs

Finally, when it comes time to sell the flipped property, you'll incur closing, marketing, and sales costs. These expenses include real estate agent commissions (typically 5% to 6% of the sale price), listing fees, and closing costs such as title insurance and transfer taxes. In Missouri, these costs can add up to around 7% to 10% of the property's sale price. Additionally, marketing costs, such as professional photography and staging, should be included in your budget to ensure a quick and profitable sale.

By understanding and planning for these costs, you can better estimate your potential profits and make informed decisions when flipping houses in Missouri.

Read Also: How To Flip Houses With No Money: Top 10 Expert Strategies

How To Flip A House In Missouri With No Money

Flipping houses in Missouri can be done without relying on personal funds through alternative financing. Private and hard money lenders serve as valuable resources, providing the necessary capital without needing a refinance, traditional bank, credit check, or lengthy approval process. These lenders specialize in short-term financing solutions, ensuring quick cash access and expediting the flipping process.

Another viable strategy in Missouri is wholesaling, which requires no upfront investment like traditional rental properties or flips. Wholesalers secure a property under contract and assign it to cash buyers for a fee, allowing investors to generate income without significant capital expenditure.

To succeed in flipping houses, investors must carefully explore these financing options and select the most suitable approach based on their circumstances and objectives.

You can also check our video on "How To Wholesale & Flip Houses With NO MONEY!", which outlines strategies and insights on navigating the real estate world without hefty bank account withdrawals.

What's The Best Place To Flip Houses In Missouri?

Missouri offers several prime locations for house flipping, each with unique advantages based on property price trends, population growth, and local economic conditions. Here are five of the best cities in Missouri for house flipping:

- Louis: St. Louis is one of Missouri's top markets for house flipping, thanks to its affordable housing and strong demand for renovated properties. The city's median home value is approximately $170,000, with a 5.2% increase in home values over the past year. St. Louis also boasts a growing job market, making it an attractive location for buyers, particularly first-time homeowners and investors.

- Kansas City: Kansas City is another excellent location for flipping houses, with a median home value of around $230,000. The city has seen a 6.8% increase in home values over the last year, driven by its robust economy and influx of new residents. Kansas City's diverse neighborhoods offer a variety of opportunities for flippers, from affordable fixer-uppers to more upscale properties in revitalized areas.

- Springfield: Springfield is known for its affordable real estate market, with a median home value of $180,000. The city has experienced a 4.5% increase in home values over the past year, making it a promising market for house flippers. Springfield's growing population, driven by its status as an educational and healthcare hub, continues to fuel demand for renovated homes.

- Columbia: Columbia, home to the University of Missouri, is a vibrant college town with a strong rental market and a median home value of $250,000. The city's home values have risen by 5.7% over the past year, reflecting its appeal to both investors and homeowners. Columbia's steady population growth and thriving local economy make it a solid choice for house flippers looking for consistent returns.

- Independence: Independence, a suburb of Kansas City, offers a lower median home value of $180,000, making it an attractive option for budget-conscious flippers. The city has seen a 4.3% increase in home values over the past year, driven by its proximity to Kansas City's amenities and ongoing revitalization efforts. Independence provides a mix of older homes with great potential for renovation and resale.

These cities represent some of the best opportunities for house flippers in Missouri, each offering unique benefits based on current market trends and economic conditions. Whether you're looking for affordable entry points or more established markets, Missouri has a range of options to suit your investment strategy.

Read Also: 17 Best Cities To Wholesale Real Estate [UPDATED 2024]

Is It Hard To Flip Houses In Missouri?

Flipping houses in Missouri can be challenging, but with the right knowledge and resources, it's a manageable and rewarding endeavor. Missouri's real estate market offers a mix of opportunities and obstacles. On the one hand, the state's relatively low property prices make it easier to enter the market, especially for first-time flippers. However, competition can be fierce in popular areas like St. Louis and Kansas City, requiring investors to be diligent in finding undervalued properties and moving quickly to secure deals. Additionally, navigating local regulations, securing reliable contractors, and managing renovation costs can add complexity to the process.

Market conditions in Missouri can also impact the difficulty of flipping houses. While home values have been steadily increasing, with some areas seeing a 5-7% rise in property prices over the past year, the pace of these changes can vary across the state. Flippers need to stay informed about local market trends and be prepared to adapt their strategies based on shifts in buyer demand and economic conditions. Despite these challenges, with careful planning and execution, flipping houses in Missouri can be a profitable venture.

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

How Do You Find Contractors For Flipping Houses In Missouri?

Finding reliable contractors is crucial for a successful house flip in Missouri. The quality of your renovations can make or break your investment, so it's essential to work with experienced professionals who can deliver high-quality work on time and within budget. Here are some of the best ways to find contractors for your house-flipping project in Missouri:

-

HomeAdvisor: This platform connects you with vetted contractors in Missouri based on your specific project needs. You can read reviews, compare quotes, and choose the best fit for your renovation.

-

Thumbtack: Thumbtack allows you to post your project and receive bids from local contractors. You can view their profiles, past work, and customer reviews to make an informed decision.

-

Angi (formerly Angie's List): Angi is a trusted resource for finding contractors in Missouri. The platform provides detailed reviews and ratings from homeowners, helping you select reliable professionals for your flip.

-

Craigslist: While Craigslist can be hit or miss, it remains a popular option for finding affordable contractors in Missouri. Be sure to vet candidates thoroughly and check references before hiring.

-

Facebook: Local Facebook groups and community pages can be valuable resources for finding recommended contractors. Many homeowners and investors share their experiences and refer trusted professionals to these groups.

By leveraging these platforms, you can find qualified contractors who will help ensure your Missouri house flip is a success. Be sure to get multiple quotes, check references, and establish clear contracts to protect your investment.

Final Thoughts On Flipping Homes In Missouri

Flipping houses in Missouri presents a lucrative opportunity for investors. More importantly, investors can maximize their chances of success by following the steps outlined above. With careful planning and execution, anyone who learns how to flip houses in Missouri can confidently navigate the real estate market and increase the odds of a profitable outcome.

At Real Estate Skills, our team of experts is ready to provide you with the tools you need for flipping houses in Missouri. We're committed to providing the knowledge, resources, and support you need to navigate a Missouri property flip successfully. So avoid common mistakes and maximize your returns by leveraging our expertise today.

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.