How To Flip Houses In Massachusetts: Step-By-Step Home Renovation Guide

Mar 12, 2025

The prospect of flipping real estate in any state is as exciting as it is full of potential, and the Massachusetts real estate market is no exception. Brimming with opportunity and plenty of demand, Massachusetts real estate has become a commodity.

As of the end of last year, the total market value of residential real estate in Massachusetts was about $1.58 trillion, according to a report from Zillow. Massachusetts has the country's seventh most valuable residential real estate market at that valuation. As a result, investors are lining up to learn how to flip houses in Massachusetts.

It is always a good idea to dive headfirst into house flipping with a sound plan and working knowledge of the Massachusetts real estate market. From navigating market trends to evaluating the best exit strategies for a subject property, prospective flippers must consider several factors before flipping homes.

In this article, we’ll teach you everything about how to flip houses in Massachusetts, including:

- What Is Flipping Houses?

- Massachusetts House Flipping Statistics

- How To Flip Houses In Massachusetts (7 Steps)

- How To Find Houses To Flip In Massachusetts

- Do You Need A Real Estate License To Flip Houses In Massachusetts?

- How To Flip A House In Massachusetts With No Money

- Best Cities To Flip Houses In Massachusetts

- Final Thoughts On Flipping Homes In Massachusetts

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

What Is Flipping Houses?

Flipping houses is a real estate investing strategy that involves purchasing physical property (traditionally single-family homes) to rehab and resell for a profit. The term “flipping” describes the quick turnaround time between the original purchase and the final sale (the fix and flip).

The goal of every home flipper is to purchase the subject property (preferably below its actual market value) and increase its value with strategic renovations and repairs. Of course, not just any renovations will do; they need to add value to the home without weighing too heavily on profit margins. House flippers should be able to sell the home for more than they invested.

It is important to note that the location in which homes are flipped will impact the results. Therefore, anyone wanting to learn how to flip houses in Massachusetts should consider the local real estate market.

Read Also: Is Wholesaling Real Estate Legal In Massachusetts?

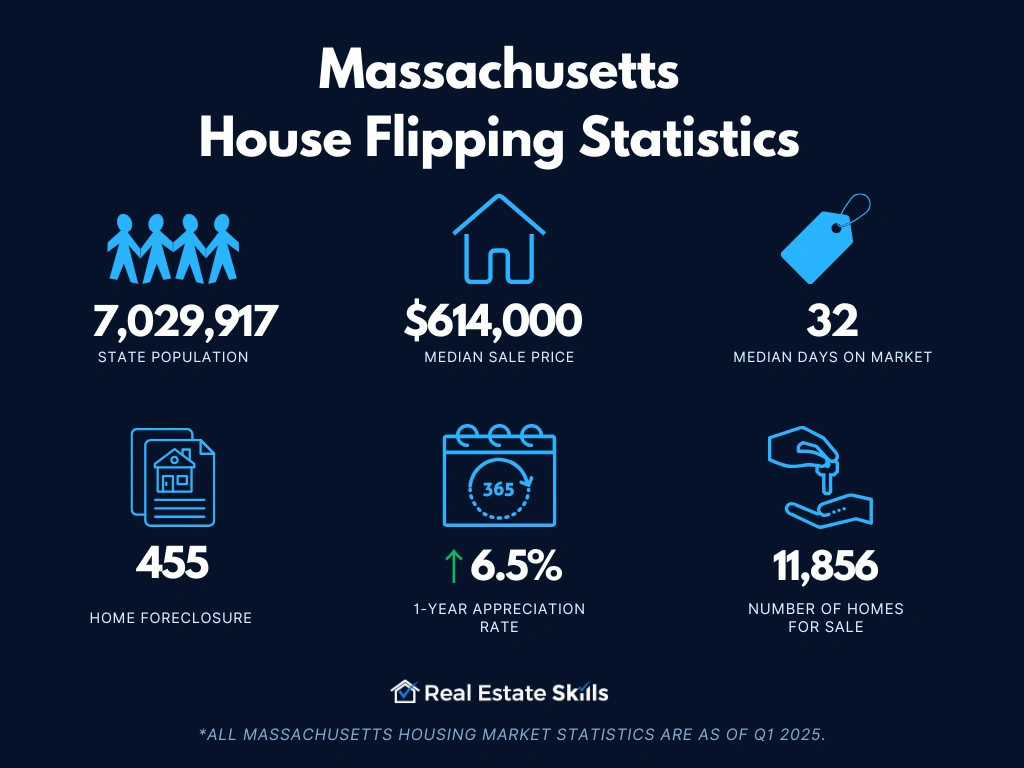

Massachusetts House Flipping Statistics

Here’s a quick look at some of the most critical Massachusetts house-flipping statistics:

- Population: 7,029,917

- Employment Rate: 64.4%

- Median Household Income: $99,858

- Median Sale Price: $614,000 (+6.5% Year-Over-Year)

- Number Of Homes Sold: 3,164 (-1.2% year-over-year)

- Median Days On Market: 32 (+4 year-over-year)

- Number Of Homes For Sale: 11,856 (-0.0084% year-over-year)

- Number Of Newly Listed Homes: 4,500 (-9.15% year-over-year)

- Homes Sold Above List Price: 42.8% (1.7% year-over-year)

- Homes With Price Drops: 43.2% (16.2% year-over-year)

- Home Foreclosure: 455 properties

*All Massachusetts housing market statistics are as of the first quarter of 2025.

How To Flip Houses In Massachusetts (7 Steps)

Learning how to flip houses in Massachusetts doesn’t have to be scary or intimidating. While it may seem particularly daunting to flip real estate, breaking the process down into several easy-to-follow steps can go a long way.

Follow the steps outlined below to mitigate risk, avoid mistakes, and increase your chances of success:

- Find A House-Flipping Mentor

- Research The Local Housing Market

- Find & Analyze Distressed Properties

- Raise Capital To Fund The Deal

- Close On The House

- Renovate The Property

- Resell The House

Find A House-Flipping Mentor

Aspiring investors can benefit significantly from working with a qualified mentor on the path to learning how to flip houses in Massachusetts. Enlisting the services of a house-flipping specialist can offer invaluable guidance and support in an industry where knowledge represents the difference between success and failure.

An experienced mentor—one who has already accomplished what you hope to achieve—should be able to assist your efforts at every point in the flipping process, from securing funding for a deal to overseeing renovations and selling for a profit. Equally as important as what they tell you to do, however, is what they tell you not to do. If for nothing else, you will be able to learn from their mistakes and mitigate risk, which is worth the effort of finding a mentor in and of itself.

Working with a mentor will fast-track learning how to flip houses in Massachusetts. At the same time, a mentor can optimize your efforts while mitigating your risk, which is a much better place to start than those going about things alone.

Research The Local Housing Market

Researching the state-wide real estate industry is essential for anyone who wants to learn how to flip houses in Massachusetts. An in-depth knowledge of current market conditions will reveal critical information for making informed decisions. Researching the local market can also help investors identify potential challenges and opportunities unique to the area, allowing them to tailor their investment strategies accordingly.

Learn the most you can about the Massachusetts real estate market by visiting some of today’s most dependable sources listed below:

- Massachusetts Association of Realtors

- Zillow Housing Data Research

- Redfin’s Massachusetts Housing Market Overview

- U.S. Bureau Of Labor Statistics’ Massachusetts Economic Data

- RealtyTrac’s Massachusetts Data

- Rocket Homes’ Massachusetts Market Data

Find & Analyze Distressed Properties

Aspiring investors must research and gather information on the local housing sector to find and analyze Massachusetts real estate market deals. In addition, the resources listed above should be used to identify areas with high demand and properties that are undervalued or need repairs.

When the research finally directs investors to a particular subject property, the next step is to start analyzing the potential deal by determining the property's after-repair value (ARV), which is the best estimate of the home's worth after repairs. Comparables, or “comps,” are a good barometer for determining how much the subject property may be worth after the necessary repairs.

Next, add up all the costs associated with the deal. In addition to the purchase price, get multiple contractor bids to estimate the rehab costs and factor in holding fees, property taxes, and unexpected expenses.

Read Also: How To Find Off-Market Properties In Massachusetts

While not perfect, new investors may want to reference the 70% rule. According to the arbitrary rule, you should aim to purchase a property for 70% of the ARV minus rehab costs and holding costs. The number investors are left with is the maximum allowable offer (MAO), or how much you can buy the home for while leaving a reasonable profit margin.

Raise Capital To Fund The Deal

Investors must secure funding to buy the home and carry out the necessary renovations if a satisfactory path to profitability can be identified.

Consequently, private and hard money loans will be given to real estate investors at a higher interest rate than traditional lenders. In return for the higher interest rate, however, investors will gain access to the funds almost immediately.

Close On The House

Investors should move quickly to buy the property at or below their maximum allowable offer. Speed is of the utmost importance, as competition is never far behind. However, investors can’t close on the house until they enlist the help of a real estate attorney. Massachusetts is an “attorney state,” meaning the state requires an attorney to be involved in the real estate transaction closing process. An attorney will help investors navigate all aspects of the closing process.

In Massachusetts, the closing process typically begins with a purchase and sale agreement. As its name suggests, a purchase and sale agreement contains vital information about the impending transaction, like the purchase price, closing date, and potential contingencies. Next, the attorney will review the agreement on behalf of the investors and negotiate any necessary changes.

The attorney will conduct a title search; it should reveal the current owner has the right to sell the subject property and there is no risk of future encumbrances. Secondly, the attorney will ensure the funding is ready for transfer.

When closing day arrives, the attorney will oversee the transfer of ownership and the exchange of funds. They will also confirm that all documents are filled out correctly and documented accordingly.

Learning how to flip houses in Massachusetts is more straightforward than in escrow states when all is said and done. At the very least, the heavy lifting in the closing process is done by a qualified attorney.

Renovate The Property

Renovations must be made to the property immediately after the investor takes ownership. Any delays will result in higher holding costs and hurt the deal’s bottom line. That said, it’s not enough to make any repairs without strategically thinking them through; you need to make the proper repairs that will add the most value with the least amount invested.

According to Remodeling Magazine, the renovations that return the most money to investors at the time of a sale are:

- Electric HVAC Conversion: Converting an HVAC unit to electric will cost about $19,992, but investors can expect to recoup about 113.2% of the cost of repairs when they sell the home in the future.

- Fiber-Cement Siding Replacement: Replacing existing siding with fiber-cement siding will cost about $21,165, but investors expect to recoup about 101.2% of the expense when they sell the home in the future.

- Manufactured Stone Veneer: Adding manufactured stone veneer will cost about $11,823, but investors can expect to recoup about 94.7% of the expense when they sell the home in the future.

- Midrange Kitchen Remodel: Remodeling a kitchen with midrange appliances will cost about $27,827, but investors can expect to recoup about 83.8% of the expense when they sell the home in the future.

To be clear, these are just a few of the renovations that may be required to flip houses in Massachusetts. Investors may find their projects need fewer or more renovations to restore the properties to their avatar repair values. Regardless of the number of renovations, however, the end goal for every deal is to increase the home's perceived value without going over budget.

Resell The House

Real estate investors cannot afford to rest on their laurels; they must act quickly to sell their investment property. The longer an investment property is held, the more costs and expenses the investor will incur. These expenses include property taxes, utility bills, general holding costs, and others that increase daily. Moreover, the longer the investor remains illiquid, the higher the opportunity cost. Selling the property fast will simultaneously put the proceeds in the investor's pocket and allow them to move on to the next deal.

Investors should consider working with a real estate agent to expedite the sales process. While their services will cost a percentage of the sales price, there's a good chance that their expertise will result in a more profitable sale. Working with a real estate agent should be viewed as an investment in and of itself, as their services can help ensure a timely and profitable sale.

With their knowledge of the local market, agents can help set a competitive price and market the property to potential homebuyers, increasing the likelihood of a successful sale. Ultimately, the costs of working with an agent outweigh the potential benefits of a successful and timely sale.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How To Find Houses To Flip In Massachusetts

There are several ways to find houses to flip in Massachusetts, but the most popular and reliable options for today’s real estate investors include the following:

- Working With Real Estate Agents: Nobody is more in tune with the Massachusetts real estate market than local real estate agents and Realtors. Working with them could reveal both on and off-market deals.

- The MLS: Access to the Multiple Listing Service (MLS) will give investors an entire database of motivated sellers.

- Foreclosure Auctions: Foreclosed properties typically end up back in possession of the loan originators. Since banks don’t like to hold on to non-performing assets, they are more inclined to sell them at auction, often at a discounted price.

- Public Records: To verify a home's chain of title, local municipalities maintain public records of foreclosures, which allows investors to visit their local Recorder's Office and identify distressed homeowners who may be motivated to sell their property.

- Direct Mail Campaigns: To reach potential sellers, investors can use a direct mail campaign to target entire neighborhoods or distressed seller lists, which involves sending letters to households expressing one’s interest in buying homes for cash.

- Locating Distressed Homes: Finding houses to flip can be a straightforward process that involves driving through neighborhoods and identifying poorly maintained properties. Neglect may signify that the owner is no longer interested in keeping the property and could be motivated to sell.

Read Also: Motivated Sellers: How To Find And Negotiate With Them

Do You Need A Real Estate License To Flip Houses In Massachusetts?

There’s no need to acquire a real estate license to flip houses in Massachusetts. Investors can implement rehabbing exit strategies throughout the state without obtaining a professional license. That said, just because you don’t have to have a license doesn’t mean you can’t get one. Licensed investors must exercise full transparency and disclose their position as agents or Realtors.

Read Also: Do You Need A Real Estate License To Flip Houses?

How To Flip A House In Massachusetts With No Money

Flipping real estate in Massachusetts requires money, but nobody ever said the money had to be your own. For a clearer understanding of how to navigate real estate investing without deploying your own capital, don't miss our in-depth video on how to get started investing in real estate with no money! It's a step-by-step guide that breaks down the process of securing funds for your real estate ventures:

If you want to secure and fund a real estate deal with the help of other people’s money, flip loans can provide you with the necessary capital to invest in a property in Massachusetts. The following strategies allow you to avoid draining your personal savings while still participating in the real estate market:

- Private Money Loans: The preferred source of short-term cash for today’s investors, private money loans originate from anyone with excess capital and an interest in investing it. These loans come with a higher interest rate than their traditional counterparts, but the speed at which borrower gains access to the money is unmatched.

- Hard Money Lenders: Hard money lenders are similar to private lenders but usually work under professional lending companies specializing in real estate investments. Rates are similarly high but also offer significant advantages for investors.

- Wholesaling: Wholesaling real estate is an entirely different exit strategy, but it does allow investors to profit from real estate without spending any of their own money. Instead of buying a property, a wholesaler will acquire the rights to buy a property. Then, the investor will turn around and sell their right to buy the home to an end buyer for a fee.

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

Best Cities To Flip Houses In Massachusetts

The best cities to flip houses in Massachusetts include, but are not limited to:

- Boston: Boston is a great place to flip real estate. In addition to the above-average housing activity, the number of homes for sale has increased by 6.6% year-over-year. With more homes on the market, 47.7% of Boston’s inventory has sold below the asking price, giving investors a better chance of increasing profit margins.

- Springfield: With a median home value nearly half that of the state, Springfield has gained much attention from value-oriented buyers. Among today’s buyers are investors looking to capitalize on affordable real estate opportunities and rental properties complimented by a diverse economy that includes healthcare, education, manufacturing, and hospitality.

- Worcester: Worcester has a relatively low median home price relative to other major cities in Massachusetts. As a result, many buyers have turned their attention to Worcester when interest rates are rising at a historic pace, and prices are near all-time highs. The increased activity should give investors enough opportunities to capitalize on affordable multi-family and single-family real estate opportunities.

Final Thoughts On Flipping Homes In Massachusetts

Embarking on a journey to flip houses in Massachusetts can indeed prove rewarding, given the right approach and adequate preparation. In an industry that often poses as much risk as opportunity, it's essential to be well-versed in local market conditions, financial considerations, and effective investment strategies. Seeking the guidance of a seasoned mentor can significantly enhance the chances of success in this endeavor.

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.