How To Flip Houses In Alabama: 15-Step Home Renovation Guide

flipping houses real estate investing strategies real estate markets (states) Oct 21, 2025

What: Flipping houses in Alabama means buying undervalued properties, renovating them to increase value, and selling for profit. It’s one of the most accessible real estate investment strategies for both beginners and experienced investors.

Why: Alabama’s affordable housing market, growing economy, and strong rental demand make it an ideal place to flip homes. With the right strategy, investors can earn significant returns while revitalizing local communities.

How: Follow the steps in this guide—research the market, secure financing, find profitable deals, estimate renovation costs, and sell strategically. Mastering these steps will help you confidently flip houses in Alabama and scale your investing success.

Are you ready to learn how to flip houses in Alabama? If you're tired of the daily grind, overwhelmed by debt, or eager to take charge of your financial future, house flipping—also known as rehabbing or fixing and flipping—might be exactly what you need. Few investment opportunities offer the attractive profit potential of house flipping without the need for an expensive diploma, a real estate license, or mountains of personal savings. That’s why we’ve developed this step-by-step rehab guide to flipping houses in Alabama: to help you rehab with confidence and purpose. We’ll cover everything you need to know about how to start flipping houses in Alabama:

- What Is Flipping Houses?

- Why Flip Houses In Alabama?

- Alabama House-Flipping Statistics

- How To Flip Houses In Alabama In 15 Steps

- How Much Do House Flippers Make In Alabama?

- Is House Flipping Illegal In Alabama?

- Do I Need A Real Estate License To Flip Houses In Alabama?

- How Much Does It Cost To Flip A House In Alabama?

- How To Flip A House In Alabama With No Money?

- What's The Best Place To Flip Houses In Alabama?

- Is It Hard To Flip Houses In Alabama?

- Pros And Cons Of Flipping Houses In Alabama

- How Do You Find Contractors In Alabama?

- FAQ: Alabama House Flipping

- Final Thoughts On Flipping Homes In Alabama

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Is Flipping Houses?

Flipping houses is an investment strategy involving the acquisition of properties at a value below market rate, enhancing them through strategic renovations, and subsequently placing them back on the market for a profit. When executed with a keen eye for detail and strategic planning, house flipping can prove to be a highly lucrative venture.

The realm of house flipping is not limited to single-family homes. Investors can expand their portfolio by exploring the potential of multi-family apartments, duplexes, triplexes, or even short-term rentals. The United States real estate landscape, including markets like Alabama, has opportunities for astute investors to acquire, transform, and profit from this profitable strategy.

Beneath the surface, house flipping is more than just a popular real estate exit strategy; it’s one of the best investment vehicles for anyone looking to transform their lives. It offers the opportunity to generate significant profits, gain financial independence, and take control of one’s future. By turning distressed properties into desirable homes, investors achieve personal success and contribute to the revitalization of communities. This powerful combination of profit potential and positive impact makes learning how to flip houses in Alabama a compelling decision for those eager to make a positive change.

Read Also: How To Wholesale Real Estate In Alabama

Why Flip Houses In Alabama?

Thinking about how to flip houses in Alabama and why it's a smart move right now? Here's why. According to RealtyTrac, Alabama has 1,664 properties in foreclosure, 322 bank owned properties, and 1,342 headed for auction. This abundance of distressed properties offers numerous opportunities to buy low, renovate, and sell high—an important distinction to make when placed in context with national averages. If you already know how to buy foreclosed homes in Alabama, you already have an advantage.

According to ATTOM Data Solutions' latest annual Home Flipping Report, the average gross flipping profit is $72,000 nationwide, translating to a 29.6 percent return on investment. In comparison, the S&P 500 averages a 10% return per year, according to NerdWallet. Real estate also serves as a hedge against inflation, making it a potentially more secure and profitable investment. With so many properties available and the potential for high returns, now is the ideal time to learn how to flip houses in Alabama and start building your financial future.

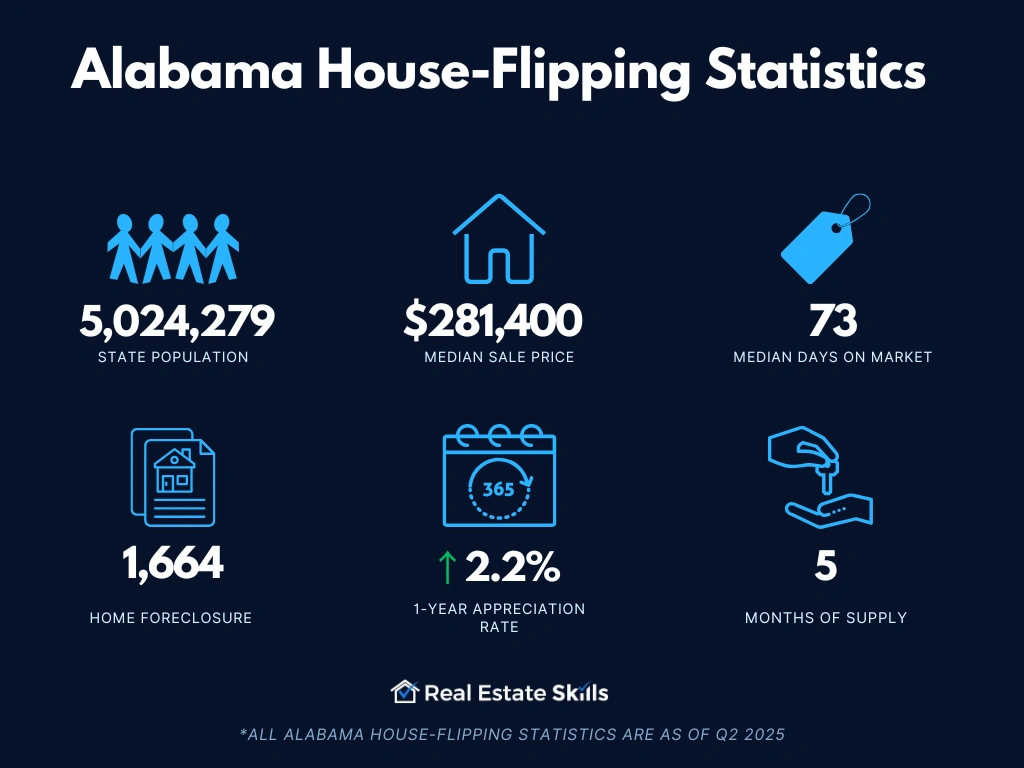

Alabama House-Flipping Statistics

An investor's success often depends on their data's quality and reliability. Accordingly, anyone learning how to flip houses in Alabama should prioritize recent and dependable housing indicators, not unlike those listed below (data provided by the U.S. Census Bureau, RedFin, and ATTOM Data Solutions):

- Population: 5,024,279

- Employment Rate: 55.8%

- Median Household Income: $62,212

- Median Sale Price: $281,400(+4.1% Year-Over-Year)

- Number Of Homes Sold: 3,938 (-8.4% Year-Over-Year)

- Median Days On Market: 73 (+9 Year-Over-Year)

- Number Of Homes For Sale: 24,093 (+10.1% Year-Over-Year)

- Number Of Newly Listed Homes: 6,013 (-3.3% Year-Over-Year)

- Months Of Supply: 5 (+0 Year-Over-Year)

- Homes Sold Above List Price: 15.9% (-1.6 Points Year-Over-Year)

- Homes With Price Drops: 22.9% (+1.7 Points Year-Over-Year)

- Foreclosure: 1,664

*All Alabama housing market statistics are as of Q2 2025

Not unlike something you'd learn in a Flipping Houses 101 course, it's essential to equip yourself with thorough market data, monitor economic trends, and understand the prices within your chosen market. This knowledge can steer your investment strategies, assisting you in learning how to flip houses in Alabama. For your research, consider the following resources:

- Zillow’s Alabama Market Overview: Zillow delivers the current median home value in Alabama, incorporating a historical overview of the state's home value index. This resource offers vital insights into Alabama's market trends.

- Realtor.com Alabama Housing Market Data: Realtor.com's housing market pages provide real estate investors with properties listed in Alabama by county, city, and ZIP code.

- ATTOM’s Alabama Real Estate & Property Data: ATTOM presents up-to-date Alabama investment property data and offers curated, engaging real estate reports for each state in the US.

- SoFi’s State Foreclosure Data: SoFi's exhaustive guide delivers an overview of foreclosure rates across all 50 states, including Alabama. This information is highly valuable for house flippers, offering insights into potential opportunities in the distressed property market.

- U.S. Census Bureau’s Alabama Data: Here, you can discover vital demographic and economic statistics about the state of Alabama. Real estate investors can gain an understanding of the state's population distribution, income levels, housing situation, and more, which can help shape investment decisions and strategies.

- Bureau Of Labor Statistics’ Alabama Economic Data: The Bureau of Labor Statistics provides a comprehensive perspective of Alabama's employment scenario, covering data on unemployment rates and sector-wise job distribution. House flippers in Alabama would find this data particularly useful as it offers insights into the state's job market—a critical factor influencing the health of the real estate market.

How To Flip Houses In Alabama (15 Steps)

If you're ready to dive into house flipping in Alabama, you're in the right place. This guide offers a comprehensive roadmap for successfully navigating the process of property flipping in Alabama. Whether you're new to real estate investment or looking to enhance your flipping skills, follow these step-by-step instructions to rehab a house and maximize your profits:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Flipping houses in Alabama begins with selecting the right market. This decision is crucial as it directly influences the success of your investment. Local economic conditions, housing demand, and property values should guide your choice.

Living close to your chosen market offers distinct advantages, although it's not mandatory. Proximity allows for easier coordination with contractors, attorneys, and real estate agents, facilitating smoother project management and decision-making. Familiarity with local neighborhoods also aids in accurately assessing potential investments.

Conversely, investing remotely in a market unfamiliar to you presents challenges. Coordinating renovations, understanding local market dynamics, and evaluating neighborhood nuances become more complex. Assessing factors like school quality and nearby amenities becomes more challenging without local insight.

Choosing the right market sets the stage for a successful house-flipping venture in Alabama. It provides a solid foundation for navigating the intricacies of property rehabilitation and maximizing your investment returns.

Find Your Money

Once you've identified your target market in Alabama, the next critical step is securing financing. Securing funding precedes finding a property and putting it under contract because having cash readily available is essential for closing deals swiftly. Without financing lined up, investors risk missing out on valuable opportunities, underscoring the importance of planning your funding strategy early in the process.

Contrary to common misconceptions, finding lenders in Alabama is not difficult, and you don't necessarily need substantial personal funds to invest in real estate. Numerous lenders are eager to finance promising deals, allowing you to proceed without using your capital. This approach, known as leveraging other people's money (OPM), enables you to fund entire projects and maximize your investment potential.

Investors typically rely on two primary types of lenders: hard money lenders and private money lenders. Hard money lenders base their lending decisions on the potential return of the investment and typically finance between 70% and 90% of the loan-to-cost (LTC) ratio, requiring you to cover the remaining project costs. Private money lenders, on the other hand, are individuals seeking higher returns on their investments, offering more flexibility in terms of loan terms and interest rates.

Utilizing lenders' funds instead of your own preserves liquidity and allows you to scale your house-flipping operations effectively. This strategic use of OPM minimizes personal financial risk and facilitates faster growth in Alabama's competitive real estate market.

Finding reputable private and hard money lenders is crucial for successful house flipping in Alabama. These lenders play a pivotal role in financing projects quickly and efficiently, enabling investors to capitalize on lucrative opportunities without delay.

How To Find Private & Hard Money Lenders

Securing private and hard money lenders for house flipping in Alabama involves distinct approaches from traditional lending methods, but it doesn't have to be difficult. Here’s how you can connect with these valuable financing sources:

Finding hard money lenders starts with attending local Real Estate Investor Association (REIA) meetings. These gatherings offer excellent networking opportunities with experienced investors and lenders actively seeking to finance profitable real estate ventures. Alternatively, conducting a straightforward online search for "hard money lenders in [your city]" can yield a list of local and national lenders along with their contact details. Kiavi and Lima One are two reputable lenders known for supporting real estate investments.

Private money lenders, on the other hand, are individuals looking for higher returns on their capital investments. Begin by tapping into your personal network—friends, family, and acquaintances—who may have an interest in real estate investing or know others who do. Attend networking events, seminars, and local investment clubs where you can present your investment opportunities to potential private lenders. Highlighting the potential returns and security of your projects can attract their interest and financial support.

Securing financing from private and hard money lenders is crucial for obtaining a proof of funds (POF) letter. This letter is essential when making offers on properties, demonstrating to sellers that you have the financial backing required to close deals promptly and confidently. By leveraging these financing options, you enhance your ability to compete in Alabama's competitive real estate market and capitalize on profitable house-flipping opportunities.

Find Three Contractors

When flipping houses in Alabama, hiring professional contractors is a crucial step in ensuring successful renovations. While it may be tempting to undertake the rehab yourself, opting for DIY can lead to underestimated costs and extended timelines due to unforeseen issues. Professional contractors bring efficiency, expertise, and the ability to complete projects swiftly and with high quality.

As an investor, your time is best spent on strategic activities that drive business growth rather than on hands-on renovation work. By outsourcing the rehab to contractors, you can scale your house-flipping operations effectively. It frees you to focus on securing new deals and expanding your real estate portfolio.

When selecting contractors in Alabama, aim to gather estimates and proposals from at least three general contractors. General contractors are essential because they oversee the entire renovation process, manage subcontractors as necessary, and ensure that all aspects of the project are executed professionally. This approach not only streamlines project management but also enhances the quality and efficiency of your house-flipping ventures.

How To Find A General Contractor

Finding a skilled general contractor is crucial for successful house flipping in Alabama. Start by reaching out to at least three general contractors to obtain multiple quotes and perspectives on your project. Comparing prices and services will help you select the contractor that best fits your budget and project requirements.

Networking is key to finding reliable contractors. Attend local Real Estate Investor Association (REIA) meetings where seasoned investors often recommend reputable contractors they have worked with. These meetings provide valuable opportunities to build connections and gather referrals from experienced professionals in the Alabama real estate market.

Another effective strategy is to explore neighborhoods where renovations are underway. Approach workers directly or obtain contact information from project signage. Additionally, frequenting home improvement stores like Lowe’s and Home Depot allows you to interact with contractors who visit these stores for supplies. You can ask the staff for contractor recommendations or connect directly with contractors on-site.

Find An Investor-Friendly Agent

Finding and collaborating with investor-friendly real estate agents is a pivotal step when flipping houses in Alabama. These agents bring invaluable expertise, local knowledge, and extensive networks to the table, enhancing your ability to negotiate favorable deals and maximize profitability.

Not all real estate agents are well-versed in working with investors. Some may prefer focusing on luxury residential properties or high-dollar transactions. It's essential to seek out an agent who is enthusiastic about working with investors and adept at submitting multiple offers on your behalf.

Partnering with an investor-friendly agent is critical because the majority of home sellers enlist the services of a real estate agent. According to the National Association of Realtors, "89% of sellers were assisted by a real estate agent when selling their home." This statistic underscores the importance of leveraging agents to access deals listed on the Multiple Listing Service (MLS). Their local market insights, negotiation skills, and MLS access provide a distinct advantage in identifying and securing lucrative investment opportunities.

While agent services typically incur a commission, typically around 2.5% of the sale price, the seller customarily covers this cost. Investors only incur these fees upon selling the renovated property, making it a cost-effective investment in securing profitable deals in Alabama's competitive real estate market.

How To Find An Investor-Friendly Agent

Understanding the importance of working with a knowledgeable agent, let's explore effective strategies to find one in Alabama.

Firstly, attending local Real Estate Investment Association (REIA) meetings is a prime opportunity for networking with agents who are experienced in working with investors. These gatherings foster connections and provide insight into agents who understand the nuances of investment properties.

Secondly, gaining access to the Multiple Listing Service (MLS) allows you to identify distressed properties in your target area. Agents listing these properties are often well-versed in investor transactions and may be open to collaborating on similar deals.

Teaming up with an investor-friendly real estate agent means you can capitalize on their expertise and industry connections to uncover and secure lucrative investment opportunities. This partnership streamlines the process of flipping houses in Alabama, enhancing efficiency and profitability in your real estate ventures.

Read Also: How To Get MLS Access In Alabama

Find A House To Flip

There are numerous ways to find houses to flip in Alabama, such as driving for dollars, browsing public records at local courthouses, and direct mail campaigns. However, we are confident that the best way to find houses to flip in Alabama is to use the database that already contains the majority of homes for sale: the Multiple Listing Service (MLS). The MLS is a comprehensive database that real estate agents use to list properties for sale. It includes detailed information about each property, making it an invaluable resource for finding potential flips in Alabama.

Every listing on the MLS represents someone who wants to sell, simplifying the process of identifying motivated sellers. The key is to find properties that align with your flipping strategy, which involves analyzing listings to identify homes that are undervalued, in need of repairs, or located in high-demand areas. Accessing the MLS requires a real estate license or working with a real estate agent, which is why we recommended teaming up with a local real estate agent in step four.

By collaborating with an investor-friendly agent, you can gain access to the MLS and tap into a wealth of information about available properties. Agents can help you set up customized searches that filter listings based on your criteria, such as price range, location, and property condition. This targeted approach saves you time and effort, allowing you to focus on properties with the highest potential for profit.

Alternative Strategies To Find A House

There are several ways to find houses to flip in Alabama, but our favorite source of deals is the MLS. This platform is favored because it requires zero dollars in marketing costs and has proven highly effective. The MLS is a good source for finding distressed homes due to its comprehensive listings and detailed property information.

To find distressed homes, search for properties that have been on the market for an extended period. Homes listed for too long often indicate sellers eager to close a deal, presenting a potential flip opportunity. Additionally, look for properties in need of repair or those sold "as is." These homes typically require significant work but can be purchased at a lower price, increasing profit margins after renovation.

Utilize specific keywords in your MLS search to identify distressed properties. Keywords like "handyman special," "needs TLC," "diamond in the rough," and "fixer-upper" often signal that a home is in less-than-ideal condition. These properties are usually listed below market value, offering a chance to add substantial value through renovations.

It's important to learn how to talk to the sellers' agents representing distressed homes. Investors must come across as professionals and problem solvers. When you can provide a solution for the distressed homeowner, you are more likely to land a deal. Approach conversations with empathy and professionalism to build trust and demonstrate your ability to resolve their challenges efficiently. This strategy increases your chances of securing profitable flipping opportunities.

Accessing the MLS typically requires a real estate license or collaboration with a licensed agent. Partnering with a local real estate agent who understands investment properties is advisable. They can set up customized searches on the MLS based on your criteria, such as price range, location, and property condition, saving you time and focusing your efforts on properties with the highest profit potential.

Once you have access to the MLS, consider employing these strategies to find houses to flip in Alabama:

- The Day Zero Strategy: Monitor new MLS listings daily and identify distressed properties listed within the last 24 hours. Promptly contact the listing agent through your own agent to express interest, aiming to secure a deal quickly before others.

- The Old Listing Strategy: Filter MLS listings to find properties that have been on the market for 60 days or more. These homes often signal motivated sellers willing to negotiate on price, potentially offering opportunities for significant discounts.

- The Wholesaler Strategy: Collaborate with real estate wholesalers who specialize in identifying distressed properties. Wholesalers secure contracts on undervalued homes and assign these contracts to investors for a fee, facilitating quick acquisitions. Networking at REIA meetings or joining specialized programs can connect you with reputable wholesalers.

These strategies not only help investors find viable properties but also create mutually beneficial solutions for sellers in distressed situations. By acting swiftly and strategically, investors can capitalize on opportunities in the Alabama real estate market, maximizing profitability while providing value to homeowners in need. If MLS access is limited, alternative listing platforms like Redfin, Zillow, and Realtor.com offer similar opportunities, although the MLS remains preferred for its comprehensive data and direct contact capabilities. When all is said and done, learning how to flip houses in Alabama is a process, and this step will make things a lot easier.

Make Discovery Calls To Listing Agents

Once potentially distressed homes have been identified, the next step in flipping houses in Alabama is making discovery calls to listing agents. These calls are essential for gathering crucial information about the properties. You can either conduct these calls yourself or delegate them to your real estate agent. The goal of these calls is to conduct preliminary research before proceeding to the next phase, not to make an immediate offer—unless a compelling opportunity arises.

It’s important to note that these are not cold calls. Listing agents are motivated to sell the property as they earn their commission upon sale, which facilitates smoother and more productive conversations with potential buyers.

During these discovery calls, focus on gathering detailed insights into the property's condition, the seller's motivations, and any potential deal-breaking issues. Ask pertinent questions such as:

- Is the listing still active?: Ensuring the property is still available avoids wasting time on deals already under contract.

- Are the listing photos up to date?: Accurate visuals help assess the property's current state and estimate renovation costs.

- What is the current condition of the home?: Understanding any existing issues is crucial for planning renovations and calculating expenses.

- Are you willing to work with an investor?: Clarifying the agent's openness to investor offers establishes mutual expectations.

- What is the owner’s reason for selling?: Knowing the seller's motivations can provide leverage in negotiations and help tailor your offer.

- Is there significant competition for the property?: Understanding the level of interest helps in strategizing your approach and making competitive bids.

With these questions asked, you gather essential details that inform your decision-making process. Conclude the call by indicating your intention to review the information with your team before proceeding further. This approach ensures a methodical evaluation and strategic planning, which are crucial for successful house flipping ventures in Alabama.

Analyze The Property

The next step in flipping houses in Alabama is analyzing the property. This involves using the information gathered from the listing agent and supplementing it with further details, focusing on "the big three": the after-repair value (ARV), the repair costs, and the purchase price. These crucial metrics help determine if a property is a viable investment.

After-Repair Value (ARV)

The ARV represents the estimated value of a property after all necessary repairs and renovations have been completed. Calculating the ARV involves using comparable sales, or "comps," which are recently sold properties similar to the one you are considering flipping. Real estate comps provide a benchmark for the property's potential market value, helping investors estimate what the home could sell for post-renovation. To find accurate comps, look for properties that meet these criteria:

- The same bed and bath count as the subject property

- Within 20% of the subject property’s square footage

- Located in the same neighborhood

- Located within one-half mile of the subject property

- Sold within six months

- Recently renovated

Once comps have been identified, average out the prices of the eligible comps. This involves calculating the average sale price of the comparable properties that closely match your investment property. By doing this, you can derive a realistic estimate of the ARV, which will guide your investment decisions and help determine the potential profitability of the flip.

Repair Costs

To estimate repair costs on a fix-and-flip property in Alabama, conduct a thorough property inspection and consult with experienced contractors. Start by making a detailed list of all necessary repairs and renovations. Then, obtain multiple quotes from contractors to get a realistic estimate of labor and material costs. Additionally, factor in a contingency budget for unexpected expenses, typically around 10-15% of the total repair costs. By leveraging professional expertise and comprehensive planning, you can accurately estimate repair costs, ensuring a profitable flip.

Purchase Price

Once you have the ARV and the rehab costs, the next step is to determine your maximum allowable offer (MAO). This is the highest price you can pay for the property while ensuring a profitable investment. To accurately determine your purchase price, account for all of these factors:

- The ARV: The value you expect the home to be after repairs are made.

- Hard Money Loan Costs: Include the interest rate (usually between 10% and 15%), origination fees, points, and the duration you expect to hold the loan balance.

- Private Money Loan Costs: Include the interest and duration of the project.

- Front-End Closing & Holding Costs: Typically around 2% of the purchase price for closing costs, plus holding costs such as insurance, utilities, and taxes.

- Backend Closing Costs: Usually 1% of the ARV.

- Realtor Fees: Generally around 6% of the purchase price, but negotiate with an investor-friendly agent for a smaller fee if possible.

- Projected Profit: Factor in your desired profit margin, aiming for a return similar to the national average of 27.5% on rehab projects.

Subtract all of these costs from the ARV to determine your MAO. This represents the highest price you can pay for the property while still ensuring a profitable investment.

Call Agents & Submit Written Offers

The next step in flipping houses in Alabama is to call the listing agent you previously spoke with and inform them of your intention to submit a written offer. Ensure your offer aligns with the maximum allowable offer you calculated. By submitting a well-informed written offer, you position yourself as a serious buyer and move closer to securing the property.

You want the agent representing you, whether it's the listing agent or the investor-friendly agent you aligned with earlier, to acknowledge your terms and submit a written offer on your behalf. Having the agent submit the offer appears more professional, as they'll bring the appropriate contract and know exactly what to do. In Alabama, you can use the standard Residential Purchase Agreement contract.

To be perfectly clear, here are the contact details you need to provide for the representing agent who will draw up the contract:

- Purchaser Name: Identify the purchaser, whether it’s under your name or an LLC. (We recommend forming an LLC (Limited Liability Company) for added asset protection). Note that if you are buying the property under an LLC, you’ll need to include the articles of incorporation, which show that you are a signer for your company.

- Offer Price: Include the offer price you determined above.

- Deposit Amount (Earnest Money Deposit): Include an earnest money deposit (usually 1% to 5% of the purchase price) to show you are a serious buyer. Note that earnest money deposits are typically refundable, but just to be safe, include a contingency (like the one below).

- Contingencies: Include a seven-day inspection contingency. This allows you to inspect the home to make sure you don’t uncover anything out of the ordinary. If, for any reason, you don’t like what you see, you can back out of the deal and get your deposit back.

- 14-Day (Or Sooner) Closing: Require a quick closing to appeal to the seller. Using cash allows the deal to close much faster than homes bought with traditional loans, which most sellers will appreciate.

- Seller To Deliver Free & Clear Title: This prevents you from buying a property with title discrepancies like liens, unexpected notes, and additional mortgages.

- Buyer’s Agent Name: Identify the buyer's agent so it’s clear who is representing you in the deal.

- Proof Of Funds: Including the proof of funds from your lender in the offer demonstrates your financial capability to close the deal, making your offer more compelling and credible to the seller.

Calling agents and submitting written offers is a crucial step in learning how to flip houses in Alabama. By having your agent acknowledge your terms and submit a professional, well-structured offer, you increase your chances of securing a profitable deal. Mastering this process is essential for successfully flipping houses in Alabama and maximizing your investment potential. Above all else, remember that written offers lead to deals.

Perform Due Diligence When The Offer Is Accepted

Once the representing agent presents the contract terms to the seller and they sign it, you have an accepted offer. This is an exciting step, but it’s crucial to perform due diligence before taking ownership. This ensures you're fully aware of the property's condition and any potential issues, which is key to successfully flipping houses in Alabama.

Act quickly, as timelines kick in at this point. The earnest money deposit is due within three days of offer acceptance, the inspection period starts, and the countdown to closing day begins, which you promised would happen in 14 days or less. The inspection clause protects you; if you find something you don’t like, you can use it to back out of the deal. However, you only have a week to do so, so prompt action is essential.

So, what should investors do after an offer is accepted?

First, walk through the property with your contractor. This walkthrough aims to identify all necessary repairs to bring the home up to the after-repair value (ARV) you calculated. During this inspection, you and your contractor will compile a detailed scope of work, listing all the items that need renovation. This step can become quite complex, making it essential to have a reliable and experienced contractor by your side.

A good contractor will provide valuable insights into the property's condition and the extent of repairs needed. Obtain detailed quotes from multiple contractors (and walk through the property with each of them if necessary) to compare costs and services. Choose the contractor you feel most comfortable working with, ensuring they have a track record of completing similar projects efficiently and to a high standard. This thorough preparation will set the foundation for a successful flip and help you stay on budget and on schedule.

Additionally, hire a professional inspector to conduct a thorough evaluation of the property. Their expertise can uncover hidden issues that might not be apparent during your initial walkthrough. The $200 to $500 cost of an inspection is well worth it if it allows you to back out of a deal that could turn into a money pit.

Close On The Deal

Closing day on your Alabama house flip is a momentous occasion—the renovation journey is about to begin. But before celebratory handshakes, some crucial steps ensure a smooth handover and protect your investment.

A thorough inspection and due diligence act as your safety nets. Unforeseen issues uncovered during this phase can be addressed through contingencies in your contract, allowing you to back out if the deal becomes unprofitable. However, if everything checks out and the potential for a good return remains strong, proceed with confidence.

Closing involves the transfer of ownership and securing a clean title. Promissory notes, essentially an IOU to your lenders for the loan amount plus interest, will be established during this process. These notes are payable when you sell the property for a profit, protecting your lenders and increasing your chances of securing financing for future flips.

A title search is vital to ensure there are no outstanding claims or liens on the property. This is critical to avoid legal headaches and guarantee a smooth resale after the renovations. A clean title paves the way for a successful flip.

By carefully navigating these closing steps, you'll solidify your ownership, secure your lenders' interests, and confidently embark on the next stage: transforming the property and reaping the rewards of your Alabama house flip.

Renovate The House

The next step in flipping houses in Alabama is renovating the property to reach your projected ARV while keeping it in line with the comps you used. It’s crucial not to over-renovate; aim to make the house comparable or slightly better than the comps it will be compared to. This strategy ensures that your house stands out in the neighborhood, remains under budget, and increases profit margins. Before starting the renovation, it's essential to protect yourself with six key documents. These documents ensure your project is legally sound, clearly outline expectations, and safeguard your investment throughout the renovation process:

- Independent Contractor Agreement: This legally binding document outlines the terms and conditions of the working relationship between you and your contractor. It clearly defines payment terms, timelines, and responsibilities, ensuring both parties are aligned and protected throughout the renovation process.

- Final Scope of Work: This detailed document outlines all the tasks, materials, and timelines required for the renovation project. It ensures the contractor knows exactly what needs to be done, helping to keep the project on time, within budget, and to the desired quality standards.

- Payment Schedule: This document outlines the specific amounts and timelines for payments to the contractor throughout the renovation project. It ties payments to the completion of defined milestones, ensuring work progresses as planned.

- Insurance Indemnification Agreement: This document ensures the contractor has the necessary insurance coverage and agrees to hold you harmless for any accidents or damages that occur on the property. This protects you from liability and financial loss resulting from incidents during the renovation process.

- W-9 Form: This tax form collects the contractor's taxpayer identification information, necessary for reporting payments to the IRS. It ensures compliance with tax regulations and allows you to issue a 1099 form at the end of the year for any payments made to the contractor.

- Final Lien Waiver: This document, signed by the contractor, states they have received full payment and relinquished any future claims against the property. It protects you from contractors seeking additional money after the renovation is complete, ensuring all financial obligations are settled.

Once all these forms are completed, it's time to let the contractors start making your Alabama dream a reality. With the proper documentation in place, you can confidently move forward with the renovation, knowing your investment is well-protected.

Navigating the complexities of flipping houses in Alabama can be challenging, but with the right preparation and understanding of the process, you can achieve success. If you're interested in learning more about how to flip houses in Alabama successfully, consider booking a call with us today. Our program provides everything you need to confidently and profitably flip homes in Alabama.

Prep & List The House on the MLS

With the rehab complete, it's time to transform your Alabama flip from a project into a desirable property. This crucial phase involves preparing the house for listing and showcasing it effectively on the MLS.

In getting the house ready to list on the MLS, there are three specific tasks to check off:

- Final Punchlist: A punch list is a document that outlines the final tasks and loose ends the contractor needs to address before the home is ready to sell. It ensures all minor issues are resolved, guaranteeing the property is in top condition for potential buyers.

- Home Staging: Staging a home involves arranging furniture and decor to make the property more appealing to potential buyers, which can significantly increase the resale value of a flip. According to the Real Estate Staging Association (RESA) via the National Association of Realtors, "With an average investment of 1% of the sale price into staging, about 75% of sellers saw an ROI of 5% to 15% over asking price."

- Professional Photos: Having professional real estate photos taken when listing a house on the MLS is crucial for attracting potential buyers. A 2013 RedFin study found that "homes professionally photographed with high-performance Digital Single-Lens Reflex (DSLR) sold quicker and for thousands of dollars more than homes shot with amateur photos." High-quality images make a significant impact on a property's online presence, increasing interest and ultimately leading to faster sales and higher offers.

Once the home is ready, your real estate agent should implement a comprehensive marketing strategy to maximize exposure to potential buyers. This strategy includes:

- Listing the Property on the MLS: Ensures maximum visibility to potential buyers.

- Yard Sign: Attracts local interest.

- Online Listing Platforms: Posting on popular sites like Zillow and Redfin to reach a wider audience.

- Open Houses: Allow potential buyers to view the property in person.

- Email Lists and Social Media: Target specific buyer groups and generate interest.

Leveraging these various marketing channels, your agent can effectively promote the property and increase the chances of a quick and profitable sale.

Set An Enticing Asking Price

Marketing a property isn't complete without setting an asking price. In the context of how to flip houses in Alabama, it’s recommended to ask for a range around the price you hope to achieve, which is the ARV based on your calculations. Setting the asking price approximately 5% above and below your target sale price should be sufficient.

This pricing strategy has several benefits:

- Attracts a Wider Pool of Potential Buyers: Including those who might have initially considered the property out of their budget.

- Creates Opportunity for More Offers: Soliciting lower offer prices can bring in more offers, allowing you to counteroffer and encourage a competitive bidding environment.\

- Incites Bidding Wars: A lower asking price can lead to a bidding war, driving the final sale price higher than the original ARV, thereby maximizing your profit.

A well-thought-out pricing strategy is crucial in flipping houses in Alabama, as it maximizes your chances of selling quickly and profitably. It’s a key element in ensuring the success of your Alabama real estate investment, allowing you to achieve the best possible return on your efforts. By leveraging competitive market dynamics, you can turn a carefully calculated ARV into a highly profitable sale.

Field Offers & Negotiate

The next phase in flipping houses in Alabama involves managing offers and negotiating deals. Once your property is effectively listed and marketed, you'll start receiving bids from potential buyers. These initial offers can vary significantly in both price and conditions. Your objective as an investor is to thoroughly evaluate each proposal and negotiate to optimize your return.

Begin by reviewing all offers with your real estate agent, taking into account not just the price but also the terms and contingencies. It's important to assess each buyer's financial qualifications and their ability to close the deal. While some offers might come in below your asking price, they can serve as a basis for negotiation.

Using counteroffers is a common tactic to bring buyers closer to your desired price. If you have multiple offers, leverage this by informing buyers of the competition, which could potentially ignite a bidding war and drive up the final sale price.

Negotiation goes beyond just the price; consider other aspects such as closing timelines, inspection contingencies, and financing terms. By adeptly handling the negotiation process, you can secure the best deal for your property, ensuring a profitable outcome for your flipping project. Mastering this stage is essential for successfully flipping houses in Alabama and achieving your investment objectives.

Accept The Best Offer

The next step in flipping houses in Alabama is selecting and accepting the best offer you receive. It's essential to evaluate all offers thoroughly, considering not only the price but also the terms and conditions. Choose the one that provides the best overall value and has the highest likelihood of closing successfully. Once you accept an offer, the buyer's timelines begin, mirroring the process when you originally purchased the house.

The buyer will submit an earnest money deposit to demonstrate their commitment to the purchase. Following this, they will conduct their own due diligence, including a home inspection and an appraisal. The inspection allows the buyer to identify any issues that may need attention, while the appraisal confirms that the property is worth the agreed-upon price. During this period, the buyer might request certain repairs or negotiate concessions based on the inspection findings.

After the due diligence phase, the buyer will perform a final walkthrough of the property. This step ensures that any agreed-upon repairs have been completed and that the property is in the expected condition before closing. The final walkthrough is a critical checkpoint for the buyer to confirm everything is in order.

By understanding and managing these steps effectively, you can ensure a smooth transition from offer acceptance to closing, securing a successful and profitable sale in your house-flipping journey in Alabama.

Sell The House & Get Paid

The final phase in flipping houses in Alabama involves completing the sale and receiving your profits. Once the buyer has completed their due diligence and any necessary repairs have been addressed, you will proceed to the closing stage, which is typically handled through an escrow process. In this process, a neutral third party holds all funds and documents related to the transaction until all conditions of the sale are satisfied.

The closing process begins with both the buyer and seller signing the necessary documents, such as the deed transfer and settlement statement. The buyer will deposit the purchase funds into the escrow account, and if they have a lender, the loan will be funded at this time. The escrow agent will then ensure that all terms of the contract, including contingencies and required repairs, have been met.

Once all conditions are confirmed, the escrow agent will disburse the funds. First, the proceeds will be used to pay off any outstanding loans and accrued interest, as outlined in your agreements. The remaining balance after these payments is your profit.

Receiving the proceeds marks the successful end of your house-flipping project. This profit can be reinvested into future ventures, helping you grow your real estate portfolio. By effectively managing this final step, you ensure a profitable outcome and set yourself up for continued success in flipping houses in Alabama.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make In Alabama

Flipping houses in Alabama can be a profitable venture, with the average gross flipping profit varying by city and market conditions. According to recent data from ATTOM Data Solutions, house flippers in Alabama can expect significant returns on their investments, although these returns can fluctuate based on various factors such as location, renovation costs, and overall market trends.

Here are some notable cities in Alabama and their average gross flipping profits:

- Birmingham, AL: Birmingham, the largest city in Alabama, offers robust opportunities for house flippers. The average gross flipping profit in Birmingham is approximately $58,000. The city's growing economy and affordable property prices make it an attractive market for real estate investors.

- Huntsville, AL: Huntsville is known for its strong job market and booming tech industry. House flippers in Huntsville see an average gross flipping profit of around $64,000. The city's high demand for housing, driven by its economic growth, contributes to these profitable margins.

- Mobile, AL: Mobile, a historic port city, presents lucrative flipping opportunities as well. The average gross flipping profit in Mobile is about $52,000. The city's diverse economy and strategic location along the Gulf Coast make it a favorable market for real estate investments.

Understanding local market trends and having a solid renovation plan is key to maximizing profits when flipping houses in Alabama. Securing properties at a lower purchase price, effectively managing renovation costs, and staying informed about the housing demand in specific cities can significantly impact the net profit from each flip. By focusing on these critical factors, house flippers in Alabama can optimize their investment returns and thrive in the state's real estate market.

Is House Flipping Illegal In Alabama?

House flipping is entirely legal in Alabama, similar to many other states. However, it is essential to adhere to the laws and regulations governing real estate transactions to ensure that all activities are conducted legally and ethically. The primary legal concerns associated with house flipping in Alabama, as in other states, revolve around potential fraud, particularly mortgage or loan fraud.

Mortgage or loan fraud occurs when an appraiser or mortgage broker deliberately overestimates a property's value to secure a higher loan amount. This inflated value can lead to significant financial losses for lenders if homeowners default on their loans, as the bank cannot recoup its costs. Engaging in such fraudulent activities is illegal and can result in severe penalties, including fines and imprisonment.

Illegal property flipping involves similar fraudulent practices, where the flippers overinflate the property's value using dishonest appraisers or mortgage brokers. The goal is to sell the home at an inflated price to unsuspecting buyers, misrepresenting the actual value of the property. While it is not illegal to sell a property for more than its market value, it is unlawful to falsify the appraisal or mislead potential buyers about the property's true worth.

To ensure house flipping remains legitimate and profitable in Alabama, it is crucial to follow legal and ethical practices. This involves using reputable appraisers for accurate property valuations, providing full transparency about the property's condition to buyers, adhering to all relevant laws and regulations, and conducting all transactions with integrity and honesty.

Do I Need A Real Estate License To Flip Houses In Alabama?

No, you do not need a license to flip houses in Alabama. However, it’s important to understand local real estate laws and regulations. While a real estate license isn't required, having one can provide advantages, such as access to the MLS and a deeper understanding of market dynamics. Working with licensed professionals like real estate agents and contractors can also help ensure successful and legal transactions.

How Much Does It Cost To Flip A House In Alabama?

House flipping can be a profitable venture in Alabama's real estate market. However, understanding the associated costs is crucial to accurately predict potential profits and ensure a successful project. In this section, we'll delve into the various costs involved in flipping a house in Alabama.

The Home Purchase Price

In Alabama, the median sales price for a home is significantly lower than in many other states, making it an attractive market for house flippers. The median sales price is approximately $281,400. You can find properties in various conditions, ranging from foreclosures priced as low as $50,000 to more upscale homes listed for over $500,000. A portion of this price will be your down payment, typically requiring 5-20% out of pocket, with the remaining amount financed through a mortgage. Alternatively, you can purchase the home in full with cash.

The Home Repair Costs

The cost to repair a distressed property in Alabama can vary widely. For a standard three-bedroom, one-bathroom home, you might expect to spend between $20,000 and $40,000 on renovations. The cost per square foot for repairs generally ranges from $15 to $40, depending on the extent of the work needed. For the most accurate estimate, consult at least three general contractors and have them inspect the home before purchasing.

The Carrying Costs

Carrying costs are often overlooked by first-time flippers but are essential to consider. These costs include property taxes, homeowners insurance, general liability insurance, utilities (gas, water, electricity), and general upkeep such as lawn maintenance and cleaning fees. In Alabama, property taxes are relatively low, averaging about 0.4% of the home's value annually.

Closing, Marketing, & Sales Costs

These costs encompass real estate agent commissions, listing fees, notary fees, marketing expenses, closing costs, title transfer fees, and any legal fees incurred while consulting a real estate attorney. In Alabama, real estate agent commissions typically range from 5-6% of the home's sale price. Closing costs can add another 2-5% to your expenses.

How To Flip A House In Alabama With No Money?

You don't need a huge savings account to flip houses in Alabama. Investors can flip houses without using any of their own money, thanks to plenty of lenders ready to provide the necessary funds. If you know where to look, you can find these lenders. Here are the different types of lenders flippers use:

- Private Lenders: Private money lenders will sometimes fund 80% - 100% of the deal plus construction costs! Wealthy mentors with a deep understanding of the Alabama market could be a good option here.

- Hard Money Lenders: Hard money lenders are similar to private money lenders, but they have one distinct caveat: they are slightly more expensive. Interest rates are usually at least 10%. You’ll also need to pay origination and processing fees.

- Wholesaling: Though not technically a flip, wholesaling real estate in Alabama is a great strategy for investors with no money. Instead of buying a property, wholesaling involves a contract between the owner of a home and the investor. Find a property, put it under contract, and then assign the contract over to a new buyer for a fee.

- Crowdfunding: Crowdfunding entails pooling money together with peers and other investors. This is a great option if you want to be the operator but don’t have the money to invest.

What's The Best Place To Flip Houses In Alabama?

Finding the best place to flip houses in Alabama involves considering several factors, including market trends, affordability, and potential for appreciation.

Birmingham stands out as one of the best places to flip houses in Alabama. With its diverse economy, ongoing revitalization efforts, and relatively affordable real estate prices compared to larger cities, Birmingham offers ample opportunities for profitable house flipping. The city's strategic location and growing sectors, such as healthcare and technology, contribute to a stable market with potential for appreciation, making it an attractive choice for investors looking to capitalize on Alabama's real estate market.

The following cities offer particularly favorable conditions. This list highlights the best cities in the state for house flipping, considering factors like market demand, economic stability, and property affordability. Here are the top cities to consider for successful real estate investments in Alabama:

- Birmingham: Birmingham is the largest city in Alabama, with a diverse economy and a growing real estate market. Affordable property prices and a strong demand for renovated homes make it a prime location for house flipping.

- Huntsville: Known for its high-tech and defense industries, Huntsville has a robust economy and a steadily increasing population. This city offers excellent opportunities for profitable flips due to its growing demand for housing.

- Mobile: Mobile's historic charm and revitalization efforts make it an attractive market for house flippers. The city's port and industrial activities contribute to economic stability and housing demand.

- Montgomery: As the state capital, Montgomery boasts a stable government job market and affordable real estate. Investors can find numerous distressed properties with significant potential for profit after renovation.

- Tuscaloosa: Home to the University of Alabama, Tuscaloosa benefits from a constant demand for housing driven by students and faculty. The city's vibrant economy and affordable property prices create favorable conditions for flipping houses.

Is It Hard To Flip Houses In Alabama?

Flipping houses in Alabama presents its own set of challenges, akin to other states with active real estate markets. The state's competitive landscape, particularly in cities like Birmingham and Huntsville, can necessitate swift decisions and higher purchase prices to secure properties, potentially impacting profit margins. Additionally, the demand for skilled contractors and laborers in Alabama's booming construction industry may lead to delays or increased renovation costs, requiring meticulous planning and scheduling.

Understanding local market dynamics is crucial for successful house flipping. Identifying neighborhoods poised for growth and implementing strategic selling tactics can help mitigate challenges and maximize returns on investment. Despite these hurdles, Alabama's real estate market offers opportunities for profitable ventures. With careful market analysis, effective project management, and a proactive approach to navigating market conditions, investors can thrive in Alabama's dynamic real estate sector.

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

Pros And Cons Of Flipping Houses In Alabama

Understanding both the pros and cons of flipping houses in Alabama is crucial for making informed investment decisions. Knowing the advantages helps you leverage opportunities, while being aware of the challenges prepares you for potential pitfalls. To assist you, we've created a comprehensive list of pros and cons below.

The Pros Of Flipping Homes In Alabama

There are several benefits of learning how to flip homes in Alabama, not the least of which include:

- Affordable Property Prices: Alabama offers relatively low property prices, allowing investors to purchase homes at a lower cost and increase profit margins after renovations.

- Growing Real Estate Market: With steady population growth and economic development, Alabama's real estate market is expanding, providing more opportunities for successful flips.

- Favorable Regulations: Alabama has investor-friendly regulations, making it easier to navigate the house flipping process without excessive red tape.

- Profit Potential: The combination of low purchase prices and rising property values creates significant profit potential for house flippers.

- Strong Rental Market: If flipping doesn't yield the desired profit, Alabama's strong rental property market offers a viable backup plan for generating income, at least until the resale value is where you want it.

- No Experience Or Savings Necessary: Many lenders are willing to finance house flips in Alabama, enabling investors to start without substantial personal capital or prior experience.

The Cons Of Flipping Homes In Alabama

There are several drawbacks to learning how to flip homes in Alabama, not the least of which include:

- Renovation Challenges: Unexpected issues can arise during renovations, leading to increased costs and project delays.

- Time-Consuming: Flipping homes requires significant time and effort, from finding properties to managing renovations and selling the property.

- Investment Risks: Like all investments, flipping houses in Alabama comes with risks, including the potential loss of money. However, with a good plan in place, investors can significantly limit their downside.

- Market Volatility: Real estate markets can be unpredictable, and fluctuations in property values may affect profit margins.

How Do You Find Contractors For Flipping Houses In Alabama?

Finding reliable contractors is crucial for successful house flipping in Alabama. Here are effective ways to connect with contractors and some of the best websites to find them:

Online Platforms

- HomeAdvisor: HomeAdvisor is a comprehensive platform that connects homeowners with local contractors for various home improvement projects. You can browse contractor profiles, read reviews from previous clients, and request quotes directly through the platform. This makes it easy to compare services and pricing before making a decision.

- Thumbtack: Similar to HomeAdvisor, Thumbtack allows you to find and hire local professionals for home projects. It offers a wide range of services, including renovations and repairs, and provides a platform for direct communication with contractors. Checking both HomeAdvisor and Thumbtack can help you find contractors who may not be listed on both platforms.

- Angi (formerly Angie's List): Angi connects users with local service professionals, including contractors specializing in home renovations. The platform provides verified reviews and ratings to help you choose reputable contractors based on their performance and customer feedback.

- Houzz: While primarily known for home design inspiration, Houzz also features a directory of renovation professionals. You can explore portfolios, read client reviews, and contact contractors directly through the platform. It's a valuable resource for finding contractors with expertise in specific types of renovations or design preferences.

Local Networking

- Local Real Estate Associations: Joining local real estate associations or networking groups can help you connect with experienced contractors who specialize in house flipping. These associations often host events where you can meet contractors and discuss potential projects.

- Community Referrals: Utilize community forums, neighborhood groups on social media platforms like Facebook, or ask for referrals from fellow investors or real estate professionals in Alabama. Personal recommendations can provide insights into a contractor's reliability and quality of work.

Direct Outreach

- Contractor Directories: Some directories specifically list contractors in Alabama, categorizing them by expertise and location. These directories often include contact information and brief descriptions of services, making it easier to find contractors tailored to your project needs.

Finding the right contractors for flipping houses in Alabama requires thorough research and vetting. By leveraging online platforms, local networks, and direct outreach methods, you can build a team of reliable professionals who can help execute your house-flipping projects efficiently and effectively.

FAQ: Alabama House Flipping

It's crucial for new investors to have answers to the most frequently asked questions about flipping homes in Alabama to make informed decisions and avoid common pitfalls. Understanding these FAQs can provide clarity and confidence, helping investors navigate the process smoothly. To save readers time, we have curated a list of the most frequently asked questions and their answers below.

How Much Money Do I Need To Start Flipping Houses In Alabama?

Flipping houses requires a lot of capital, but there's no rule saying the money used needs to be your own. In fact, one of the best tips for flipping houses in Alabama is leveraging other people's money. Flippers can use loans to fund their projects, meaning they don't need any of their own money to get started. This approach allows investors to enter the market without substantial personal savings.

How Long Does It Take To Flip A House In Alabama?

New flippers in Alabama can expect their first flip to take anywhere from a few months to a year. The duration depends on factors such as the flipper's experience, the renovation timeline, and the time it takes to sell, including unforeseen circumstances. However, due to the terms of most short-term loans, many flips are completed within a year to avoid high interest costs.

What Are The Legal Considerations For Flipping Houses In Alabama?

When flipping houses in Alabama, there are a few legal considerations to keep in mind. First, ensure compliance with local zoning laws and building codes, which can vary by city and county. It's also important to obtain the necessary permits for any renovations. Additionally, be aware of disclosure laws that require you to inform buyers of any known issues with the property. Working with a real estate attorney can help navigate these legalities and avoid potential pitfalls, ensuring a smooth flipping process.

Is Alabama A Good State For Flipping Properties?

Yes, Alabama is a good state for flipping properties. The state offers affordable property prices, a growing real estate market, and investor-friendly regulations. Additionally, the strong rental market provides a safety net if selling takes longer than expected. These factors combined make Alabama an attractive location for real estate investors looking to flip houses.

Final Thoughts On Flipping Homes In Alabama

Learning how to flip houses in Alabama presents a promising opportunity, but it's important to remember that successful investing requires a comprehensive understanding and the right skill set.

At Real Estate Skills, we're committed to providing you with the tools and training necessary to navigate the world of real estate investment. Whether you're a seasoned investor or a novice eager to learn, our comprehensive training programs can help streamline your path to success in the exciting world of house flipping.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.

FREE Training

How To Consistently Wholesale, Flip Houses, & Invest In Rental Properties From The MLS

(Without Spending $1 On Marketing)

Author: Alex Martinez

Founder & CEO at Real Estate Skills

Alex Martinez, the founder of Real Estate Skills, is known for his strong, practical expertise in real estate, starting from a beginner with no family connections in the industry to completing over 50 real estate deals, including wholesale and flips, within his first year.

He has dedicated his career to providing cutting-edge education and resources for real estate professionals. He emphasizes the importance of self-taught knowledge through mentors, books, and hands-on experience.

His journey from earning a modest income to becoming a successful real estate entrepreneur and educator showcases his expertise and dedication to the field.

Editor: Ryan Zomorodi

Co-Founder & Chief Operating Officer

Ryan Zomorodi, co-founder and COO of Real Estate Skills, leverages his experience from a diverse background in real estate investment, construction management, and entrepreneurship to provide comprehensive education in the real estate sector.

His expertise is rooted in hands-on experience, extensive industry knowledge, and a commitment to empowering others through education.

Ryan's journey reflects a blend of practical experience and entrepreneurial success, contributing to his role in developing a platform that educates and supports aspiring real estate professionals.

Read Ryan's Full Bio >>