How To Buy Abandoned Property? The (ULTIMATE) Guide

Sep 20, 2022Abandoned properties can be found in nearly every city across the nation and their low cost is making them increasingly popular with investors. More than 16 million homes—nearly 1 in 10 American homes in all—were classified as ”vacant” in the 2020 census.

Abandoned properties are typically homes near foreclosure or under some other severe financial distress. To be considered abandoned, the owner must have vacated the property and decidedly given up rights to ownership. With no occupants, these homes often fall into serious disrepair. This makes abandoned homes attractive to investors looking for a deal, but an eyesore for neighborhoods and communities.

Locating abandoned homes, determining whether a property would actually make a good investment, and understanding how to buy and locate abandoned properties are all important considerations if you plan to include these properties in your real estate investment strategy.

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

What Is Abandoned Property?

The term “abandoned property“ as it relates to real estate has no uniformly recognized definition across the country. Instead, determining whether a vacant home is abandoned is often left to the interpretation of local ordinances and state law.

In some areas, no laws or ordinances exist to define abandoned properties and the local government relies on case law to set precedent. With private property rights considered sacrosanct, local governments can be hesitant to seize a property.

Abandoned and vacant properties are likely to fall into disrepair, which can have a destructive impact on entire neighborhoods, and even entire communities. Abandoned and vacant homes lower property values and put a strain on local governments because of the increased risk of crime and fire. With no occupants, these structures attract criminal activity and can pose a safety and health risk.

Abandoned Property vs Vacant Property vs Condemned

Not all unoccupied real estate is abandoned, of course. It’s important to understand what type of property you are dealing with. The terms “abandoned” and “vacant“ in particular are often used interchangeably.

While you will need to check with local ordinances and state statutes, a home is typically considered abandoned when a homeowner has moved out and forfeited rights of ownership.

Therefore, all abandoned homes are vacant. However, not all vacant homes are abandoned. A vacant home that still has an owner may look like an abandoned home from the exterior because both types of property often fall into disrepair. You may notice overgrown lawns, boarded or broken windows, peeling paint and other signs of severe neglect.

The third type of vacant home you are likely to encounter is a condemned home. These are properties that the local government has deemed unfit or unsafe for human occupancy. This can happen for a number of reasons.

Sometimes properties are condemned after they’ve been abandoned for a certain length of time and are no longer inhabitable due to health or safety risks. Other times a property becomes condemned because utilities are turned off or there are other conditions making it impossible for occupants to meet their basic sanitary needs or live there safely. If the owner does not make the necessary changes to the property, the local government can seize it.

How Do I Find Abandoned Property Near Me?

Identifying abandoned property for possible investment is not as difficult as it may sound; often, determining property ownership is the more challenging step. There are multiple ways to find an abandoned property including the following:

Explore Neighborhoods

One popular method for finding abandoned homes is to simply drive around town and see what potential properties you come across. The good news is, even if you find out a home isn’t abandoned, its owners may still be financially stressed or dealing with other issues that make a quick sale seem attractive.

When searching for abandoned properties by driving around neighborhoods, look for properties that have weeds and overgrown lawns, faded or peeling paint, absence of vehicles in the driveway, and structural damage to the home.

Read Also: What Is Driving For Dollars?

Check With A Mail Or Delivery Carrier

Daily mail carriers travel all around multiple neighborhoods. The next time your carrier comes by with your mail or a package, let them know you are a real estate investor and ask if they’ve seen any homes along their routes that look abandoned or vacant.

Visit City Or County Government Offices

Since local governments keep ownership records, you may be able to find abandoned properties with a visit to the local clerk‘s office. Whether a home was condemned because it had been abandoned or abandoned after being condemned, your city or county government should have a list of foreclosures and abandoned homes.

Your local tax office might be able to provide you with a list of addresses for properties with unpaid property taxes, some of which may have become abandoned. You should also check online for tax deed sales in your county. These are properties that have been seized due to the owner’s severe tax delinquency.

Attend Auctions Of Distressed Properties

Ask local government officials for a list of upcoming government-owned and foreclosed property auctions. These properties are sold “as is” and often well below market value. In addition to so-called sheriff’s auctions, property tax auctions and lenders auctions, you may also learn about REO sales, which feature bank-owned properties that failed to sell during the foreclosure process.

One word of caution: if the home is not abandoned or condemned, and merely vacant, you should be aware that the property could still have a redemption window. That means the owner could pay the back taxes in full and gain possession of the property, leaving your deed void.

In addition to contacting the local government for auction listings, you can find real estate auctions through online sites like Auctions.com or RealtyTrac.com, among others. You can find listings of both online and in-person auctions on such sites.

Read Also: Wholesaling Auction Properties: The (Ultimate) Guide

Check Local Real Estate Listings

Searching online for available properties is another way to find abandoned homes, if you’re willing to comb through property descriptions. Some listings will specifically indicate that the listing is bank- or government-owned. You should also scan the property description for keywords like immediate possession, vacant, short sale, foreclosure and “as is."

Reach Out To A Local Real Estate Agent

Local real estate agents are usually experts on the real estate markets they operate in and should be able to point you in the direction of new foreclosures and abandoned homes in the areas you’re targeting. Real estate agents often become aware of these properties because they impact a listing.

Don’t expect an agent to work for you for free, however. If they’re helping you with your property transactions, you should expect to compensate them for their expertise and property access.

Attend Federal Property Auctions Of Homes In Your Area

There are circumstances under which the federal government seizes property in the U.S. due to the owner’s violation of federal laws. These homes are typically sold at local property auctions. Check the U.S. Treasury site for a list of auctions and times.

Check With Local Banks

Banks are another source for lists of homes that are abandoned and undergoing foreclosure. Sometimes homeowners facing foreclosure or bankruptcy will abandon their home altogether. Visit some banks and ask their property managers about homes that have been recently foreclosed on or are going through the process of repossession.

How To Buy Abandoned Property (5 Steps)

The steps for buying abandoned property differ somewhat from a traditional real estate transaction and even from property to property, depending on the circumstances surrounding the property’s status as a vacant or abandoned home. For example, many abandoned homes are sold at auction, but not all.

You may come across a vacant house that isn’t yet abandoned and instead, has identifiable owners. In that case, the transaction may look very much like a traditional real estate transaction.

Let’s take a look at five steps that you will typically take when purchasing an abandoned home.

1. Find An Abandoned Property

The first order of business when buying an abandoned property is to find the right house to purchase. As already discussed, there are several sources for finding abandoned and vacant properties.

When searching in person, look for common signs of abandonment, such as the absence of any vehicles in the driveway or parked curbside; obvious run-down condition and structural damage; faded and peeling paint; boarded or broken windows; and boarded front entrances, among other signs of neglect.

You’ll want to augment your visual search by reaching out to the local government to learn about the ownership status of abandoned buildings you identify while driving through neighborhoods. In addition, your local clerk’s office should be able to provide you with a current list of vacant and abandoned homes.

As previously noted, other sources of potential properties include Realtors, USPS mail carriers, local financial institutions, real estate property websites, real estate auction sites, and the U.S. Treasury website.

Read Also: How To Find Distressed Properties To Buy

2. Determine If The Home Is Abandoned Versus Just Vacant

It can be difficult during an initial drive past a property to determine whether a home is abandoned or merely vacant. Both types of homes can look as though they are neglected and in a state of disrepair. It’s important to determine the difference, however. A vacant home still has an owner claiming legal responsibility for the property. The owner of an abandoned home has forfeited their legal rights.

A check of public records should help you determine whether the home is abandoned or merely vacant. Dealing with an abandoned home can be easier. Most are sold via auction and the information on how to take part in the bidding process is available either from the bank or the local government entity holding the auction. If not being sold at auction, you can work with the entity that has seized the property to follow the necessary steps for purchasing.

3. Identify The Property Owner And Make Contact

If the property you identify is abandoned, you will need to contact the entity controlling the property, whether that is a bank or the government.

If the property is vacant, with legal owners, you should check public records to find the correct contact information. One of the easiest ways to determine ownership is to check your county’s tax assessor website. While some of these sites may require a small fee, the additional information you can glean is well worth it.

Because a vacant or abandoned property is a blight on the community, you may find that the neighborhood HOA or local government officials are willing to assist you in identifying and contacting the owner.

You may end up checking for ownership information available through multiple agencies. Keep in mind that if records show the mailing address to be the same address as the vacant or abandoned property, you could run into a challenge. While it isn’t impossible that the owner still checks the mail or has it forwarded, there is probably a greater chance that neither of these is occurring.

Determining ownership can get murky on vacant and abandoned properties. Sometimes the owners will even appear to be divided among occupants, lenders, and other third parties. You may need to wade through multiple records to find the most current, reliable information.

4. Prepare To Bid Or Make An Offer

Whether you are considering an abandoned home or one that‘s just vacant, it’s important to conduct a home inspection so you can determine whether or not to make an offer or bid. Vacant and abandoned homes can have serious problems beyond structural defects, some of which may be costly or challenging to mitigate, such as asbestos or black mold.

Calculate the home’s after-repair value or ARV so you know your maximum allowable offer (MAO) or bid. An inspection will help you to determine if the home was abandoned due to foundation issues, structural damage or other serious complications. Inspecting the home will help you to more accurately account for renovation costs when doing due diligence to determine the current and future value of the property. You should also check for any liens against the home.

As you evaluate the estimated cost of repairs, it is not unusual to conclude the best strategy would be to knock down the existing structure and build a new home rather than go through a costly renovation that may eat up any potential profit. A lot will be determined by the neighborhood average values. This is another point where you may want to engage a real estate professional, so you gain a solid understanding of market values in the neighborhood.

If you are making use of hard money to finance your purchase, be sure to include the interest when estimating your costs.

Read Also: Estimating Rehab Costs: (Ultimate) Investor's Guide

5. Win The Property

Once you determine you want to buy the home, it’s time to make an offer or prepare to bid. Depending on the property’s status, you could be dealing with the original owner, a bank, or the government.

If the home is being sold at auction, follow the instructions to place your bid. Be sure you understand the auction terms prior to bidding. Keep in mind, that you may need to place a deposit before you are able to bid. Settlement typically takes place at the end of the auction.

If you are making an offer to purchase, you may want to engage the services of a real estate agent. You or your agent should be able to negotiate a price with the homeowner that is considerably below market value. Depending on the circumstances and the home’s condition, you may be able to purchase the property at an extreme discount.

How To Buy Abandoned Homes With No Money

Just as with other types of real estate investments, you are at an advantage as a buyer if you are able to make the purchase with cash.

But if you are a first-time investor or relatively new at real estate investing, it can be difficult to come up with enough cash, even for a low-cost property.

When it comes to abandoned properties, traditional financing through a mortgage lender is almost never an option due to the property’s defects and the inability for it to appraise. Even if you can get a local bank to finance the project by using the property as collateral, you will still need to come up with a substantial down payment.

Although it is unlikely, there is a chance that the seller will finance the purchase. This is less likely with abandoned properties than with other homes due to the high probability that a true abandoned property has been seized by a bank or the government. If just vacant, you will still be unlikely to find seller financing because the vast majority of these properties will have owners under financial distress.

A more popular way of financing real estate investments is through hard money lending. A hard money lender sometimes referred to as a private lender, is in the business of making short-term loans to real estate investors in situations such as this. Expect to pay interest or a fee for the privilege of using the lender’s money to make the purchase.

When getting a hard money loan, remember to include the renovation costs necessary to restore the home to a safe structure.

Where To Find Free Abandoned Homes Near Me?

Most abandoned houses can be purchased well below market value due to the condition of the home and the circumstances that caused it to be declared abandoned in the first place.

There are instances, however, where the local government may allow you to take over an abandoned property for free, as long as you follow through with renovation that brings it up to code and makes it suitable for occupancy, whether you flip the home or hold it for a rental. This is most likely to happen in areas where vacant homes have become a problem for the community. Contact the county clerk’s office to discuss this possibility.

There may also be cases where a homeowner may be willing to unload a vacant property at little or no cost.

While not recommended as an acquisition strategy, you should be aware that a vacant property can fall prey to squatters who occupy the space despite having no legal claim to it. A squatter can gain adverse possession of the property through involuntary transfer. Check your state laws to learn how long a squatter can occupy a property before claiming possession or given tenant status.

Pros And Cons Of Buying Abandoned Homes Or Property

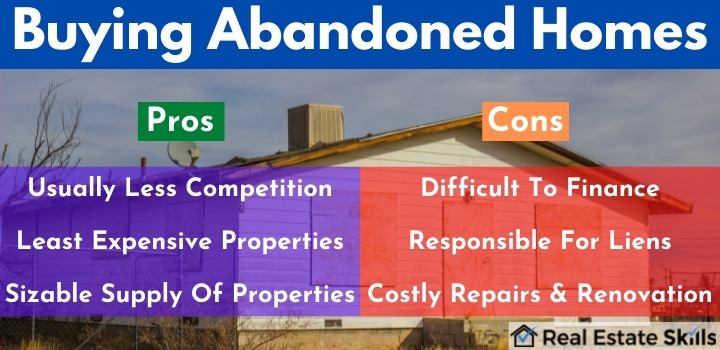

As with most types of investment property, there are advantages and disadvantages to adding abandoned properties to your investment portfolio. If you are new to real estate investing or at least new to acquiring abandoned properties, you will want to consider the following pros and cons.

Pros

- There is usually less competition from other homebuyers of all types.

- Abandoned and vacant properties are some of the least-expensive properties you will come across.

- Once you know where to search, you are likely to find a sizable supply of available abandoned and vacant properties.

Cons

- If you do not have available cash, it can be difficult to finance through traditional routes so have an alternative, like hard money, in place.

- If you purchase the home without a title search, you could end up with a property that comes with any number of liens. As deed holder, you are responsible.

- Repairs can be costly on abandoned or vacant properties, so be sure you have professional estimates as needed. It's not unusual for additional problems to arise during the renovation process.

Final Thoughts On How To Buy Abandoned Property

Abandoned properties offer a unique addition to your investment portfolio. Their below-market price and abundancy make them more attainable than some of the other options for investment. Determining ownership and a pathway to purchase is often more challenging than finding potential properties.

As with other investment properties, valuing the home at purchase and post-renovation are key to turning a profit. Be sure to include a cushion in your budget for unexpected repairs or problems that could be uncovered during the renovation process.

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.