Due Diligence For Wholesaling: The (ULTIMATE) Guide

Aug 02, 2022One of the most important concepts in acquiring and selling real estate is due diligence. Establishing a due diligence process that is catered to your business results from experience transacting with investors, real estate brokers, wholesalers, and other property professionals.

Whether you're utilizing the services of a real estate broker to complete a transaction, or are purchasing from a wholesaler, all parties must complete thorough due diligence in order to have successful outcomes.

In this article, you'll learn what due diligence is, why wholesaling due diligence is important, and how it applies to various parties in the transaction. Whether you're a wholesale buyer, seller, or a real estate wholesaler yourself, this article will help eliminate the common fears that arise from buying and selling properties without a complete due diligence checklist. Let's dive in.

- What Is Due Diligence In Real Estate?

- How Does Due Diligence Apply To Wholesaling Real Estate?

- What Are The Benefits Of Due Diligence In Wholesaling?

- What Are The Steps For Wholesaling Due Diligence?

- What Is A Due Diligence Fee In A Real Estate Contract?

- Why Is Wholesaling Due Diligence Important?

- Final Thoughts On Due Diligence For Wholesaling

What Is Due Diligence In Real Estate?

In its simplest form, due diligence in real estate is simply making sure that you are getting what you’re paying for. In every real estate deal or any business deal for that matter, every party is working to benefit themselves. In some cases, that can mean other parties misrepresent what they are selling or the terms of an agreement.

When a person “does their due diligence” they are ensuring that everything that they are agreeing to and accepting is actually what is being represented by the other parties involved in the transaction.

When it comes to wholesaling, this means that a real estate investor will ensure that the properties they are buying are accurately represented by the seller and that the agreements they sign are fully understood by all parties.

How Does Due Diligence Apply To Wholesaling Real Estate?

In real estate wholesaling, there are two parts of the transaction; the property and the contract. In order to properly conduct due diligence, every party involved in the transaction must be fully aware of all of the terms and conditions of both of these elements. Due diligence should be done on all sides of the transaction, including the seller, wholesaler, and the end buyer.

Let’s look at some examples of what due diligence can look like from the point of view of each party in this type of real estate transaction.

Buyer Due Diligence

The buyer who is purchasing the property from the wholesaler has the responsibility of ensuring the quality of what he or she is buying. This can be as simple as physically inspecting the property, but true due diligence will usually involve professional inspections. The buyer should review their contracts carefully and be aware of any parts of the property that are being sold “as-is” or that have potential future issues that have been disclosed.

When reviewing the contract, a buyer who is truly conducting his or her due diligence will also look for clauses that specify other liabilities involved with the property, such as liens, easements, or other issues. Buyers should also conduct a records search so that they can become aware of any other issues with the property that were not disclosed by other parties involved with the contract.

Seller Due Diligence

Sellers also have a responsibility to conduct due diligence. In most states, this due diligence is actually a legal obligation to disclose certain information about the property. Examples include knowledge about when large appliances were purchased, known issues with the property such as wood rot or termites, and legal matters such as property liens.

Wholesaling Due Diligence

Real estate investors who participate in wholesaling have to ensure that they are getting an accurate picture of a property and its contract. This means looking at all of the information submitted by the seller and ensuring that the buyer is paying the agreed-upon amount.

The role of a wholesaler is often misunderstood, especially by buyers and sellers who do not have a lot of experience in the industry. This can often mean that other members of a real estate transaction have not done their due diligence. Because of this, the argument can be made that part of the job of a wholesaler is to encourage everyone involved in a deal to do their due diligence.

Sharing the information collected as part of everyone’s discovery process will usually lead to a better transaction for everyone.

Read Also: Wholesaling Real Estate For Beginners | Real Estate Skills

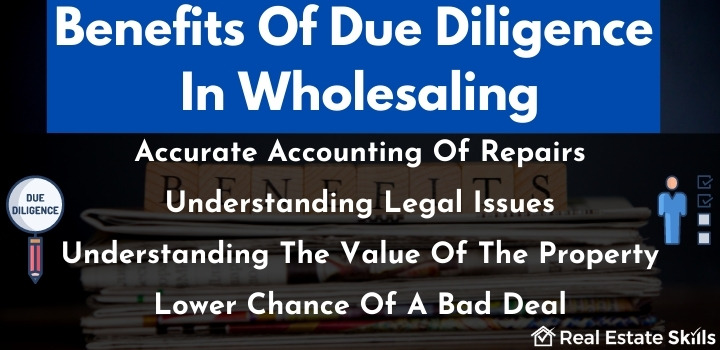

What Are The Benefits Of Due Diligence In Wholesaling?

There’s a saying that a good deal is any deal where all parties walk away believing that they got a good deal. That’s nearly always true in real estate, where good deals are often made when every party understands exactly what they are agreeing to.

While the process can be time-consuming and cost money, there are several advantages to wholesale real estate investors who take the time to go through this process step-by-step.

Getting An Accurate Accounting Of Repairs

The first step of doing due diligence is to get an accurate picture of the structural issues with a property. Even if your real estate investment strategy is to sell properties without doing any repairs, it’s still important to know exactly what you are buying in order to determine its true market value. In many states, a wholesaler is considered to be legally responsible for informing potential buyers of serious issues with the property.

If you are doing repairs, then it should be obvious why you want to know everything that could become an issue. Even if you plan on only doing some renovations, it’s important to know what potential problems need to be worked around.

Read Also: Estimating Rehab Costs: (Ultimate) Investor's Guide

Understanding Legal Issues

Often, the legal issues with a property can hold up a deal for months. Relying on the seller to disclose everything rarely works, many wholesale deals work with highly motivated sellers who don’t have the time or energy to research legal issues with the property. Often, a real estate agent will only be able to give the wholesaler a vague warning about potential problems, such as “the seller said her mom mentioned something about an easement once”.

These legal issues can have huge consequences on the resale value of the property. There are many potential buyers who won’t touch property with certain restrictions, greatly reducing your odds of selling the property in an area even if the local real estate market is hot.

A Better Understanding Of The Value Of The Property

Wholesalers rarely think about if a piece of real estate will become a good rental property, investment property, or even a short-term rental. They care about getting the property sold and making a profit. Part of selling the property, however, is to understand the motivations of your buyers.

If the due diligence process turns up issues that make the property unable to accept housing vouchers, or community restrictions prevent a property from becoming a vacation rental, that can severely limit the pool of potential buyers.

A Lower Chance Of A Bad Deal

No one wants to get into a deal only to discover huge problems that could potentially wipe them out. Bad real estate deals happen when the parties involved don’t take the time to verify all of the information about a property.

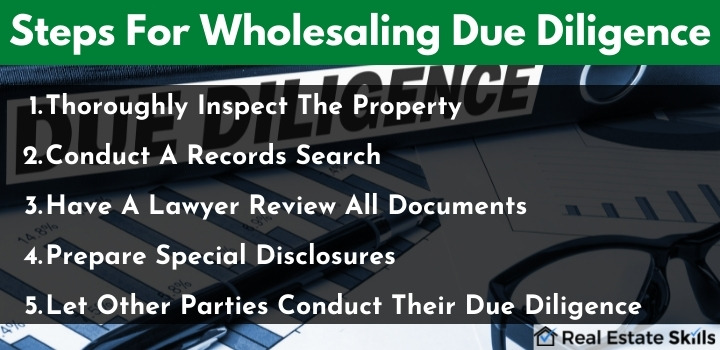

What Are The Steps For Wholesaling Due Diligence?

If you are a real estate investor who wants to ensure that they are getting a good deal, then it’s worth the time and effort to conduct due diligence on every property transaction. Be sure to follow these steps in order to ensure that everything is covered.

1. Thoroughly Inspect The Property

Hire a professional inspector if you don’t have the training to do this. Some wholesale investors go so far as to hire a general contractor to look at potential purchases.

2. Conduct A Records Search

In many states, a title company will offer this service. The officers will look for liens, community restrictions (such as HOA rules), easements, and historic problems such as boundary disputes or improperly transferred titles. This step can usually be done at the same time as the physical property inspection.

3. Hire A Lawyer To Review All Documents

While some parties may be able to trust the real estate agents and title company to prepare the “correct” documents, a wholesaler will want to make sure that their interests are protected. Ask a real estate lawyer to review the documentation which typically only costs a few hundred dollars, and it’s highly recommended to new investors.

4. Prepare Special Disclosures For The Buyer And Seller

If you discover adverse information that you are legally required to disclose, make sure that a disclosure statement is prepared. This will protect you in the event the other parties do not do their due diligence and discover the problems after the sale.

5. Allow Other Parties To Conduct Their Due Diligence

Insisting on rushing a deal will likely scare away experienced buyers, or at the very least cause the real estate agents on all sides of the deal to warn their clients to look at the deal more closely. Giving everyone a reasonable amount of time to review everything makes for a better deal overall.

If any of these steps turn up information that no longer makes the deal profitable, then make sure you have clearly defined exit strategies. Being able to get out of a "bad deal" is crucial to ensuring a wholesaler’s success in real estate.

What Is A Due Diligence Fee In A Real Estate Contract?

Due diligence fees or an earnest money deposit are commonly put up by all parties to ensure that if anything goes wrong during the due diligence period the other party can walk away from the deal. This money can be used as an exit strategy for any member of the real estate deal in the event that the due diligence process turns up information that no longer makes the deal advantageous.

How Long Is The Due Diligence Period In Real Estate?

While many real estate agents will claim that the standard due diligence time frame is ten days, the truth is that this period of time can be negotiated. If you need more time to thoroughly check out a property, ask for it.

How Much Is The Due Diligence Fee?

Due diligence fees are always negotiable, but there can sometimes be a strong local market culture that insists on a set amount. For example, in some areas, the due diligence fee is always a flat $1,000, while other places believe that 1% of the sales price in the purchase contract is the “standard” amount.

The truth is that there is no standard amount, especially when it comes to wholesale real estate. Carefully consider the amount that you will ask for. It should be low enough that the buyer feels comfortable risking that amount, but high enough that the buyer would not walk away from a deal over small issues.

Remember that the due diligence fee is meant to ensure that all parties are being honest and working towards a deal that will be good for everyone involved.

Can You Negotiate After The Due Diligence Period?

Absolutely! If your research during this time uncovers adverse information about the property, it’s entirely possible to negotiate ways to fix it. At this point in the process, the deal isn’t signed, but generally, all parties want it to go through. The due diligence fee that was put up by the buyer can also be a big encouragement to work together to come up with a solution for any problem that comes up.

Remember that the due diligence fee paid by the buyer at the beginning of this process is usually tied to certain outcomes. For example, if a seller states that the property has no liens, but a record search turns up this type of adverse information, the seller could choose to work with the buyer or wholesaler to clear the liens or either party could walk away from the deal altogether.

They could negotiate with the wholesaler to cover the cost of the liens in exchange for a lower selling price, assuming, of course, that the wholesaler was agreeable to this.

Can Due Diligence Fees Be Refunded?

If a sale goes through, due diligence fees are rarely refunded to the buyer. The exception to this is if there are obvious problems that occur during the discovery process, such as information coming out that goes against what the seller has already disclosed.

Be aware, however, that a total refund of these fees in these cases is rare; a significant portion of the fee has already been used to pay the title officers and inspectors who are doing the research.

Why Is Wholesaling Due Diligence Important?

One of the most common mistakes that many new real estate investors make is assuming that if they don’t look for problems, they can legally transfer an investment property to potential buyers and then claim ignorance if something goes wrong down the line. This is rarely true, and claiming willful ignorance of a property’s issues will not do the real estate investor any good in court.

While it’s very possible to find properties in which the seller actually knows very little about potential liabilities, it’s pretty rare to find buyers who will not perform at least some rudimentary checks before signing a purchase agreement. In fact, most states require title company officers to perform property history searches in order to look for liens and easements, and just about every real estate agent knows to encourage their clients to get an inspection done. In fact, failing to do so can often result in a real estate license being revoked.

Whether you've invested in commercial real estate or residential real estate, every real estate deal is different. Take your time and go through the process the right way for these reasons.

1. Distressed Properties

A lot of wholesale deals are for distressed properties since the motivated sellers of these properties rarely want to deal with the problems they come with. the homeowner in these situations rarely knows everything that is wrong with the property; they typically inherited the real estate or have other issues that have led them to be unable to deal with the issues.

In the case of foreclosures, it is entirely possible that no one what the true issues with the property are. Simply trusting that a property “looks alright so it must be ok” is a recipe for disaster.

2. Legal Issues

If potential sellers don’t know much about the structural issues of a property, they tend to know even less about its legal issues. When the due diligence process turns up information such as utility easements, restrictive covenants, or title liens, it usually comes as a surprise to both the seller and the wholesaler.

Unfortunately, these types of issues have the potential to sink a real estate deal. While some issues can be cleared up fairly quickly, others can become legal quagmires that can potentially take years to settle. Taking a few extra days or a few hundred dollars to run the proper checks is worth it to save the wholesaler potentially hundreds of thousands of dollars down the road.

3. Avoiding Problems With Potential Buyers

Investors who are hoping for a higher price by hiding the issues with a property by simply pretending they don’t exist are often surprised to learn that the old adage is true; the truth will come out.

Final Thoughts On Due Diligence For Wholesaling

It can be tempting to skip due diligence, especially when a wholesaler has cash buyers lined up or they suspect they already know everything that is wrong with the property. There can always be surprises, however. Plenty of investors have discovered too late that there are serious issues that could prevent the sale of a property.

The discovery process takes relatively little time, and it can mean the difference between an investor successfully completing a sale or going bankrupt.

If you are looking to improve your strategies in wholesaling real estate and make sure that you are doing your due diligence, then check out our brand-new training and be a part of a community of high-level wholesalers and real estate entrepreneurs and start scaling your real estate business today!